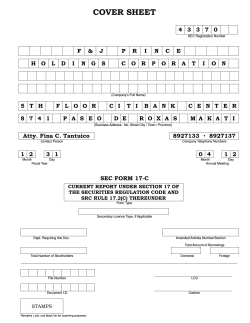

Document 260224