SHANGHAI DALONG ZHIHENG TECHNOLOGY DEVELOPMENT CO., LTD. 上海大隆智恒科技发展有限公司 Business Credit Report SAMPLE

Business Credit Report SAMPLE

SHANGHAI DALONG ZHIHENG TECHNOLOGY DEVELOPMENT CO., LTD.

上海大隆智恒科技发展有限公司

Your Enquiry:

Shanghai Dalong Zhiheng Technology

Development Co., Ltd.

Date of Enquiry: May 10, 2012

Report Type:

Business Credit Report

Type of Enquiry: Normal

Date of Delivery: May 16, 2012

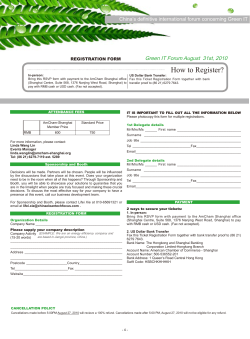

INVESTIGATION NOTES

The given contact person SUN Lili is the Director of Subject’s Sales Department.

1 / 12

PROFILE

Subject Name:

Sinotrust No.:

AIC No.:

N.O.C.:

Address:

Zip Code:

Telephone:

Facsimile:

Website:

SUMMARY

SHANGHAI DALONG

ZHIHENG TECHNOLOGY

DEVELOPMENT CO., LTD.

(Given by Official Sources)

Establishment Date:

May 18, 1997

Legal Status:

Limited liability company

Listed or Not:

No

Legal Rep.:

WANG Tao

Registered Capital:

1,000,000

0243320517

Sales:

11,915,000 (2011)

310000101234567

Net Profit:

193,000 (2011)

222222222

Total Assets:

6,053,000 (Dec. 31, 2011)

Suite B, 24/F, 88 Hengshan Rd. Net Worth:

3,299,000 (Dec. 31, 2011)

Xuhui District

Employees:

56

Shanghai City

I/E License:

Yes

Litigation Records:

Yes

Credit Records:

Yes

Public Records:

Yes

200000

(+86 21) 61238888

Currency in this report is Chinese Yuan (RMB) unless

(+86 21) 61238800

otherwise stated. "--" in this report indicates

http://www.dlzh.com.cn

"unavailable" or "no comment" due to insufficient

information.

CREDIT ASSESSMENT

Major Indicators

Business Size:

Company Background:

Financial Position:

Industry Outlook:

Credit Rating:

Base Credit Limit:

RATING DISTRIBUTION IN SINOTRUST DATABASE

Score

40

68

74

73

72

Rating

Fairly Small

Fairly Strong

Fairly Strong

Fairly Strong

CR3

200,000

MAIN BUSINESS & INDUSTRY CLASSIFICATION

Main Business:

Chinese SIC:

ISIC:

NACE:

Wholesale and retail of computer equipment

5170,Wholesale of mechanical equipment, hardware, electrical and electronic

products

4650,Wholesale of machinery, equipment and supplies

46.5,Wholesale of information and communication equipment

More information about Subject's lines of business can be found in the section “OPERATIONS.”

2 / 12

FINANCIAL SUMMARY

2011

11,915,000

285,000

193,000

6,053,000

2,754,000

3,299,000

5.85

1.62

1.97

45.50

8.81

9.36

Sales

Total profit

Net profit

Total assets

Total liabilities

Total shareholders' equity

Return on net assets (%)

Net profit margin (%)

Turnover of total assets

Liabilities/assets ratio (%)

Sales growth (%)

Total assets growth (%)

2010

10,950,000

-567,000

-489,000

5,535,000

2,418,000

3,117,000

-15.69

-4.47

1.98

43.69

---

IMPORTANT EVENTS

Subject changed its name from Shanghai Zhiheng Technology Development Co., Ltd. to the present one in Apr.

2005.

GENERAL COMMENTS

With a history of 15 years, Subject has established rather sound sales channels in East China and proves certain

market competitiveness. Its shareholders boast strong competencies and its management level is also well

experienced in respect to industry and management expertise, which lays a solid foundation for its stable

development.

Due partly to the impact of the global financial crisis and partly to the intensified market competition, the market

share of the products it sells on a commission basis dropped, causing Subject to experience certain fluctuations

in operating revenue over the past three years and to post a loss in 2009. However, Subject adjusted its sales

strategies in a timely manner, swung from deficit to surplus in 2010, and its solvency also remained strong.

REGISTRATION

Establishment Date:

Registered Address:

Zip Code:

Registry:

Legal Rep.:

AIC No.:

Legal Status:

Registered Capital:

Business Scope:

Duration of Operation:

Latest Yearly Inspection:

May 18, 1997

1688 Huqingping Highway, Shanghai

200001

Shanghai Municipal Administration for Industry and Commerce

WANG Tao

310000101234567

Limited liability company

1,000,000.00

Computer system equipment, office automation equipment, communications

equipment, mechanical and electrical equipment (wholesale and retail, and

purchasing and marketing on a commission basis)

From May 18, 1997 To May 17, 2016

2011

CHANGES IN REGISTRATION

Date of Change

Apr. 2006

Aug. 2010

Change(s)

Registered Capital

AIC No.

From

RMB 100,000

3100001234567

3 / 12

To

RMB 1,000,000

310000101234567

SHAREHOLDERS AND SHARES

Shareholders

Shanghai Dalong (Group) Co., Ltd.

LI Jun

FU Bin

Total

Capital Subscribed

510,000

400,000

90,000

----------1,000,000

% of Total

51.00

40.00

9.00

-------100.00

Shareholders

Shanghai Dalong (Group) Co., Ltd.

LI Jun

FU Bin

Way of Investment

Cash

Cash

Cash

Paid-up %

100.00

100.00

100.00

BACKGROUND OF MAJOR SHAREHOLDERS

Shanghai Dalong (Group) Co., Ltd.

0243321552

May 18, 1997

WANG Tao

310000101234567

Joint stock limited company (listed)

1,000,000.00

300 Dalian Rd., Shanghai

(+86 21) 67891234

(+86 21) 67894321

www.dalong.com.cn

Investment in industries and real estate development

638,467,200,000 (2011)

As one of Shanghai's most renowned real estate companies, Shanghai Dalong

(Group) Co., Ltd. was listed on the Shanghai Stock Exchange in 2000 (stock code:

666666).

Note: Information provided above comes directly from Sinotrust database and may contain obsolete information.

Name:

Sinotrust No.:

Establishment Date:

Legal Rep.:

AIC No.:

Legal Status:

Registered Capital:

Address:

Telephone:

Facsimile:

Website:

Main Business:

Sales:

Other Information:

HISTORY

May 1997

Apr. 2005

Apr. 2006

May 2010

Shanghai Zhiheng Technology Development Co., Ltd. was incorporated.

Shanghai Zhiheng Technology Development Co., Ltd. was acquired by Shanghai

Dalong (Group) Co., Ltd. and accordingly was renamed Shanghai Dalong Zhiheng

Technology Development Co., Ltd.

Subject increased its registered capital from RMB 100,000 to RMB 1,000,000.

Subject became the general agent of Nanjing Hwuary Display Co., Ltd. in East China.

MAIN EXECUTIVE(S)

Name:

Post:

Gender:

Date of Birth:

Education:

Work Experience:

WANG Tao

Chairman of the Board

Male

1969

Master's degree

Previously, with the Chinese Academy of Sciences;

currently, with Shanghai Dalong (Group) Co., Ltd. as General Manager;

since Apr. 2005, concurrently with Subject as Chairman of the Board.

4 / 12

Name:

Post:

Gender:

Date of Birth:

Education:

Work Experience:

LI Jun

General Manager

Male

1965

Master's degree

1983-1985: with Shanghai Chemical Fiber Research Institute as a research fellow;

1985-1989: with Shanghai Foreign Trade Corporation as Dept. Manager;

1989-1990: with Shanghai Honglong Electronic Co., Ltd. as Manager;

1990-1997: with Shanghai Data Industry Co., Ltd. as General Manager;

since 1997: with Subject as General Manager.

AFFILIATE(S)

Name:

Address:

Website:

Main Business:

Sales:

Shares held by Subject:

Shanghai Dalong Zhiyu Technology Development Co., Ltd. (literal translation)

218 Dongfang Rd., Pudong New Area, Shanghai

www.dalong.com.cn

Selling electronic products

550,000 (2010)

95%

Name:

Address:

Website:

Main Business:

Sales:

Shares held by Subject:

Shanghai Dalong Zhichuang Technology Development Co., Ltd. (literal translation)

1/F, 2000 Quyang Rd., Shanghai

www.dalong.com.cn

Producing and selling electronic products

650,000 (2010)

90%

BANKING RELATIONSHIP

Account Bank:

Account No.:

Account No.:

Interviewee:

Telephone:

Interviewee's Remarks:

Date of Interview:

Bank of Shanghai, Xuhui District Sub-branch

XXXXXXXXX8090333 (RMB)

XXXXXXXXX8090334 (FC)

Miss XU, Service Counter

(+86 21) 56786666

Subject does hold accounts with the Bank, and its day-to-day transaction records are

normal.

May 16, 2012

NUMBER OF EMPLOYEES

Total Employees:

Head office:

56

18

The information above was confirmed by Subject's managerial staff in May 2012.

OFFICE FACILITIES

Location:

Area:

Property Ownership:

Traffic Convenience:

Suite B, 24F, 88 Hengshan Road, Shanghai

300 square meters

Rented

Situated in Xujiahui Business Circle, Subject enjoys favorable transport facilities.

5 / 12

OPERATIONS

Main Business:

Chinese SIC:

Wholesale and retail of computer equipment

5170,Wholesale of mechanical equipment, hardware, electrical and electronic

products

7210,Corporate management

ISIC:

4650,Wholesale of machinery, equipment and supplies

7010,Activities of head offices

NACE:

46.5,Wholesale of information and communication equipment

70.1,Activities of head offices

Subject is the general agent of Hwuary brand displays in East China and also distributes Hongda brand

computer memory sticks, Kunpeng brand hard drives, Quanshun brand CD-ROMs, keyboards, mice, etc. on a

commission basis.

TRADEMARKS & PATENTS

Total No. of Trademarks

Registration No.

Registration Date

Trademark Design

2

2345678

Mar. 28, 2010

Patent Type

Total Patents

Patents Applied in 2011

Patents Applied in 2010

Patents Applied in 2009

Patents Applied in 2008

Patents Applied in 2007

Invention Patent

0

------

Utility Model Patent

5

2

1

1

-1

Design Patent

5

1

-2

2

--

2123456

Dec. 7, 2009

Total

10

3

1

3

2

1

Note: Information on only the patent application records since 2007 is provided herein.

PURCHASING INFORMATION

Main Purchases:

No. of Major Suppliers:

Major Suppliers:

Main Payment Terms:

Displays, computer memory, hard drives, CD-ROMs, etc.

Around 10

Nanjing Hwuary Liquid Crystal Display Technical Co., Ltd., Suzhou Zhongji Electronic

Co., Ltd. and other producers of computer fittings

30-day credit or immediate payment

Subject is the general agent of Hwuary brand displays and purchases displays from Nanjing Hwuary Liquid

Crystal Display Technical Co., Ltd. directly on 30-day open account.

The information above was provided by Subject's managerial staff in May 2012.

SELLING INFORMATION

Domestic:

Regions:

About 95%

Shanghai and major cities in Jiangsu Province

6 / 12

Customers:

Sales Terms:

Retailers and individual users

30-day credit or immediate payment

Overseas:

Regions:

Customers:

Sales Terms:

About 5%

Hong Kong

ABC Ltd.

L/C

Subject is planning to reinforce its sales efforts in medium- and small-sized cities since its gross sales profit

margin in medium- and small-sized cities is relatively high. For the time being, competition in the large cities of

East China is heating up, leading to a declining gross sales profit margin of relevant products, especially the

displays Subject currently sells.

The information above was provided by Subject's managerial staff in May 2012.

IMPORT & EXPORT

I/E License:

Customs' Rating:

Total Imports:

Yes

A (May 16, 2012)

0 (Unit: USD 10,000)(2011)

Total Exports:

0-10 (Unit: USD 10,000)(2011)

Definitions of Ratings of General Customs:

AA:

Excellent;

A:

Good

B:

Average

C:

Fairly Poor

D:

Very Poor

Please order our Business I/E Records Report for more detailed import and export information on Subject.

CREDIT RECORD

Supplier:

Commodities Supplied:

Interviewee:

Post:

Telephone:

Amount:

Cooperation Duration:

Cooperation Terms:

Payment Punctuality:

Date of Interview:

Nanjing Hwuary Liquid Crystal Display Technical Co., Ltd

Computer displays

Miss YAN

Financial Dept.

025-84556567

Approx 3.5 million Yuan per month

Long-term

Monthly settlement

Prompt

May 16, 2012

Supplier:

Commodities Supplied:

Interviewee:

Post:

Telephone:

Amount:

Cooperation Duration:

Cooperation Terms:

Payment Punctuality:

Date of Interview:

Suzhou Zhongji Electronic Co., Ltd.

Computer mice and hard drives

Mr. WANG

Sales Manager

0551-63415399

Approx 1 million Yuan per month

Long-term

45-day credit

Prompt

May 16, 2012

7 / 12

MAJOR RANKS

Year

2010

2009

Major Rank

Top 100 Private Enterprises of Shanghai

Top 100 Private Enterprises of Shanghai

Place

89

97

LITIGATION RECORDS

Source:

Hearing Court:

Case Number:

Plaintiff:

Date of Hearing:

Case Brief:

Date of Acquisition:

www.hshfy.sh.cn

Pudong New Area People's Court, Shanghai

(2010) PMY(M)CZ No. 15487

SONG Sanxiong

Sep. 28, 2010

Dispute over the sales contract between SONG Sanxiong and Subject

May 16, 2012

PUBLIC RECORDS

Source:

Date of Issue:

Issue Title:

http://www.creditlink.cn/crdopen/findOneBill/1152922840606525712.html

May 1, 2012

List of Companies with Abnormal Operations (2012) No.5 Issue of Shanghai Xuhui District

Office, SAT

Note: This report only provides litigation records, public rankings as well as other public records from the latest

3 years.

FINANCES

Balance Sheet ('000):

TOTAL ASSETS

TOTAL LIABILITIES

TOTAL SHLDRS’ EQUITY

TOTAL LIABILITIES & SHLDRS’ EQUITY

Dec. 31, 2011

(Consolidated)

6,053

Dec. 31, 2010

(Consolidated)

5,535

2,754

3,299

6,053

2,418

3,117

5,535

2011

11,915

285

193

2010

10,950

-567

-489

Income Statement ('000)

Sales

Total profit

Net profit

NOTES TO FINANCES

Due to the lack of a clear government policy regarding the transparency of enterprise financial information,

many financial items might be missing in the above financial statements, causing possible inequality between

the sum of the provided items and the provided Total Number.

Change of Key Financials ('000)

2011

11,915

193

Sales

Net profit

8 / 12

Growth Rate (%)

8.81

--

2010

10,950

-489

Total assets

Total liabilities

Total shareholders’ equity

6,053

2,754

3,299

9.36

13.90

5.84

5,535

2,418

3,117

Profitability

Return on net assets (%)

Return on total assets (%)

Net profit margin (%)

2011

5.85

3.19

1.62

2010

-15.69

-8.83

-4.47

Efficiency

Turnover of total assets

2011

1.97

2010

1.98

Solvency

Liabilities/assets ratio (%)

2011

45.50

2010

43.69

Growth

Sales growth (%)

Total assets growth (%)

2011

8.81

9.36

2010

---

Important Ratios:

INDUSTRY PROFILE

5170,Wholesale of mechanical equipment, hardware, electrical and electronic products

Industry Definition:

This industry involves the wholesale and import & export of general machinery, special equipment, traffic &

transport equipment, electric machinery, hardware & electric products, household appliances, computer

equipment, communications equipment, electronic products, meters & instruments and office machinery. This

industry is composed of such sub-industries as the wholesale of agricultural machinery; wholesale of

automobiles, motorcycles and components thereof; wholesale of hardware & electric products; wholesale of

household appliances; wholesale of computer, software & auxiliary equipment; wholesale of communications,

broadcasting, & television equipment, and the wholesale of other machinery & equipment and electronic

products n.e.s.o.i.

Industry Status & Trend:

The machinery industry reported production value and sales value of 7.88 trillion Yuan and 7.69 trillion Yuan

respectively in 2011, up 27.08% and 26.73% year-on-year. The growth of production and sales slowed for five

consecutive months and rallied in June when the production value and sales value stood at 1.56 trillion Yuan

and 1.52 trillion Yuan respectively, both of which achieved new record highs. However, import growth outpaced

export growth for the past two years and the machinery industry continued to incur a trade surplus in 2011;

judging from the current situation, a trade deficit will reappear in six years.

Industry production and sales are expected to maintain 2-digit growth in 2012 and the estimate is 20% or so, but

the profit margin will be markedly lower as compared with 2011 and a trade deficit will reoccur. To

accommodate new challenges imposed by international and domestic economic circumstances, this industry

must accelerate its structural adjustment and upgrade to experience continuous and healthy development.

INDUSTRY BENCHMARK

5170,Wholesale of mechanical equipment, hardware, electrical and electronic products

2011

Return on net assets (%)

Return on total assets (%)

Gross profit margin (%)

Turnover of total assets

Best

22.30

13.60

18.30

3.30

9 / 12

Average

8.60

5.50

10.20

1.80

Worst

-5.00

-1.40

-0.10

0.30

Turnover of current assets

Turnover of accounts receivable (days)

Liabilities/assets ratio (%)

Current ratio

Quick ratio

Sales growth (%)

Gross profit growth (%)

Total assets growth (%)

4.50

17.65

41.90

4.06

1.61

30.30

23.80

26.30

2.40

38.71

64.40

1.34

1.06

11.90

12.30

13.00

0.40

240.00

85.10

0.63

0.52

-19.30

-26.50

-15.30

2010

Return on net assets (%)

Return on total assets (%)

Gross profit margin (%)

Turnover of total assets

Turnover of current assets

Turnover of accounts receivable (days)

Liabilities/assets ratio (%)

Current ratio

Quick ratio

Sales growth (%)

Gross profit growth (%)

Total assets growth (%)

Best

23.60

13.80

18.70

3.30

4.50

17.73

49.00

4.06

1.66

28.30

21.70

23.60

Average

9.10

5.60

10.40

1.80

2.40

39.13

71.50

1.34

1.11

9.90

11.20

9.90

Worst

-4.70

-1.40

-0.10

0.30

0.40

257.14

92.20

0.63

0.57

-21.30

-29.40

-19.00

* The above indicators come from industry statistics regularly published by the government.

TREND CHART OF KEY INDICATORS

5170,Wholesale of mechanical equipment, hardware, electrical and electronic products

Trend of Gross Profit Margin (Average)

Trend of Turnover of Accounts Receivable (Days) (Average)

10 / 12

Trend of Liabilities/assets Ratio (Average)

Trend of Sales Growth (Average)

CREDIT RATING

CR3

In assessing credit status of a business, SINOTRUST takes into consideration its size, history and background,

financials and operations against industry average, credit history, etc. Indications of SINOTRUST credit ratings

are as follows.

11 / 12

Rating

CR1

CR2

CR3

CR4

CR5

CR6

CR7

Risk Level

Very low

Low

Below average

Average

Above average

High

Very high

Indications

Credit can be extended on very loose terms.

Credit can be extended on fairly loose terms.

Credit can be extended on normal terms.

Credit should be on a closely monitored basis.

Credit should be avoided as much as possible.

Credit should be on secured basis.

Transaction should be on COD basis.

BASE CREDIT LIMIT

200,000

When calculating base credit limit, SINOTRUST presupposes that Subject purchases main

commodities/services equally from many suppliers. Main factors considered include Net Assets, Total Assets,

Total Sales, Profit, Credit Rating, etc. No consideration is given to the specific situation of your transaction with

Subject. You may refer to the following recommendations when making credit decisions, but it is advisable that

necessary adjustments be made in accordance with your sales strategies and credit policies.

Annual Supply/Subject's Sales

Above 40%

30%~40%

Recommended Credit Limit

Above 4 times the base credit limit

3 to 4 times the base credit limit

20%~30%

2 to 3 times the base credit limit

10%~20%

Below 10%

1 to 2 times the base credit limit

Within base credit limit

--------- End of the Report --------This report is furnished at your request for your exclusive use in making business decisions and shall not be used in legal proceedings.

Information contained herein shall not be released to the person or firm reported on, nor to any third party, unless otherwise agreed upon by

SINOTRUST and GLOBIS. Neither SINOTRUST nor GLOBIS shall be held liable for any loss or damage arising out of use of any of the

information contained in this report.

12 / 12

© Copyright 2026