Document 26624

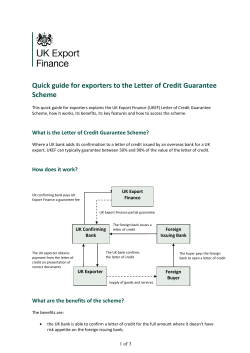

Import Letters of Credit Product Description Sheet AIB Customer Treasury Services An import Letter of Credit is one of the most secure methods of importing goods and it allows you to control shipping dates or facilitates a shipment schedule. Product Description TradeAccess Many Exporters will not provide goods unless they receive payments in advance or are guaranteed payment by a bank. A Letter of Credit is a conditional payment guarantee provided by an Importer's bank to the Exporter. The payment guarantee is conditional upon the Exporter providing documentary evidence of the shipment of goods in accordance with the terms of the Letter of Credit (L/C). The Importer's bank will guarantee the payment to the Exporter either immediately upon receipt of the correct documents or at some future determinable date e.g. 60 days from sight (by the bank) of the shipping documents or 90 days from Bill of Lading date. Letters of Credit are issued subject to the Uniform Customs and Practice for Documentary Credits issued by the International Chamber of Commerce. (See over for Product Diagrams). High volume users can benefit from TradeAccess, AIB Global Treasury Services’ online Trade Finance portal, which is designed to assist Importers in the convenient, efficient and secure online management of their Letters of Credits. It has been developed to assist in the streamlining and automation of International Trade activities, ultimately delivering greater control over country, commercial or performance risks. Product Benefits • The Importer's bank takes on the responsibility of paying the Exporter, reducing the administration of the accounts payable function in the Importer's office. • The Importer's bank is only authorised to effect payment for documents that comply with the terms and conditions of the L/C. In the event that documents do not comply with the terms and conditions the bank must refer to the Importer before payment is effected. • The provision of a bank guarantee of payment may enable the Importer to negotiate extended trade credit terms. • Using Letters of Credit with extended credit terms may be a relatively cheap source of credit when compared to overdrafts. • Multiple payments can be effected under one Letter of Credit. T TradeAccess delivers the following:• Significant time savings in the preparation and submission of L/C and Guarantee applications through user-friendly templates. • Online access to details of Import and Export L/Cs, including the actual scanned image of both incoming and outgoing L/Cs. • Immediate notification by email of all new activity, for example, receipt of new L/Cs, amendments and payments and collections activity. • A comprehensive suite of standard management reports covering all aspects of transaction activity. These reports may also be customised to meet specific requirements. • As a web based service transactions can be reviewed and approved from any location. Import Letters of Credit, Standby Letters of Credit and Guarantees are subject to credit approval. FOR FURTHER INFORMATION PLEASE CONTACT YOUR RELATIONSHIP MANAGER OR OUR TRADE FINANCE TEAM ON 01-6093868 Ref. No. 04-12 T Steps 1 – 4 Issuance Restrictions / Disadvantages It is necessary for the Importer to have a line of credit with a bank before the bank is able to issue a Letter of Credit. The amount outstanding under each Letter of Credit issued is applied against this line of credit from the date of issuance until final payment. The Importer cannot cancel a Letter of Credit or change it without everyone involved agreeing. The decision to pay is in the hands of the issuing bank, not the buyer. Letters of Credit do not guarantee the quality or quantity of the goods. Steps 5 – 10 Negotiation This product may not be suitable for your particular circumstances; therefore it is strongly recommended that if you have not already done so you should consult an independent professional financial advisor. This publication is for illustration purposes only. This publication is not to be reproduced in whole or part without prior permission. AIB Customer Treasury Services is a registered business name of Allied Irish Banks, p.l.c. Allied Irish Banks, p.l.c. is regulated by the Central Bank of Ireland. Ref. No. 04-12

© Copyright 2026