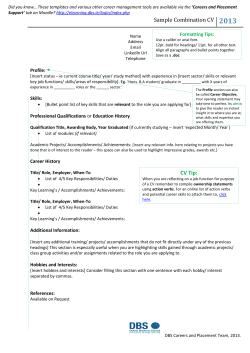

Brochure Sample Text