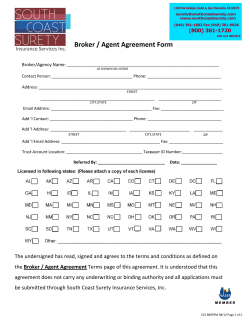

Document 287587