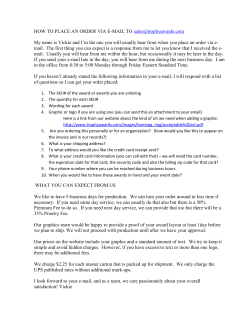

Financial Aid Office Policy and Procedures Manual