Indemnity > PROVIDER MANUAL An indemnity information resource for

Indemnity PROVIDER MANUAL An indemnity information resource for our Provider community. > Contents Welcome............................................................3 Administrative Functions.................................14 Important Phone Numbers and Addresses........4 Inquiry Process........................................................... 14 Claims Submissions.................................................... 14 Claims Overpayment............................................. 14 Timely Filing of Claims......................................... 14 Paper Claims Submission...................................... 15 Electronic Claim Submission................................ 15 Effective Follow-Up on Outstanding CareFirst BlueCross BlueShield Indemnity Claims.................. 15 Step-By-Step Instructions for Effective Follow-Up.............................................................. 15 Other Party Liability................................................... 16 Coordination of Benefits (COB).......................... 16 Subrogation........................................................... 17 Personal Injury Protection (PIP).......................... 17 Workers’ Compensation........................................ 17 Clinical Appeal Process.............................................. 17 Clinical Appeals and Analysis Unit....................... 17 Clinical Appeals Checklist..................................... 17 Expedited or Emergency Appeals Process................. 18 Appeal (or Grievance) Resolution............................. 18 Administrative or Technical Appeals......................... 18 Carefirst.com Resources........................................ 18 HIPAA Compliant Codes........................................... 18 In-Office Injectable Drugs Standard Reimbursement Methodology................................... 19 Participating Provider Agreement (PAR).................. 19 Eligibility................................................................ 19 Physician Assistants............................................... 19 Reimbursement Allowances.................................. 19 Preferred Provider Agreements (PPN)...................... 20 Eligibility................................................................ 20 Reimbursement..................................................... 20 Collection of Retroactively Denied Claims............... 20 Changes in Provider Information.............................. 20 Termination of Agreement......................................... 20 Membership and Product Information...............8 Membership Identification Cards................................ 8 Traditional Products..................................................... 9 Preferred Provider Products........................................ 9 PPN.......................................................................... 9 PPO.......................................................................... 9 Medicare Supplemental Products................................ 9 TEFRA...................................................................... 9 Network Claims Product............................................ 10 Patient information............................................... 10 Claims Submission Process........................................ 10 Maryland Point of Service.......................................... 10 Primary Care Provider.......................................... 10 Specialist/Referral.................................................. 10 Direct Access.......................................................... 11 Claims/Benefits...................................................... 11 BlueCard® Program............................................... 11 Where to Direct Inquiries..................................... 12 Policy Statements............................................13 Care Management...................................................... 13 Mandatory Second Surgical Opinion (MSSOP) .13 Utilization Control Program (UCP)/Utilization Control Program Plus (UCP+) ............................ 13 Coordinated Home Care and Home Hospice Care ......................................................... 13 Individual Case Management (ICM) .................. 13 Outpatient Pre-Treatment Authorization Plan (OPAP) .................................................................. 13 Magellan Health Services ..................................... 13 2 indemnity INFORMATION PROVIDER MANUAL > > Welcome Welcome to CareFirst BlueCross BlueShield (CareFirst) and CareFirst BlueChoice, Inc. (CareFirst BlueChoice). Your participation in one or all of our networks means that you have access to thousands of local and national employers and their employees. Our members have access to state-of-the-art facilities, some of the best physician and provider care in the country and medically proven advanced technology. This manual provides the information you need to service CareFirst BlueCross BlueShield Indemnity members and to do business with us. If you have questions, please call Provider Services. Visit www.carefirst.com/providers and click on Phone Numbers and Claim Addresses to obtain the correct phone number. Note: For ease of communication, all references to “CareFirst” will refer to both CareFirst BlueCross BlueShield and CareFirst BlueChoice, Inc., unless specified otherwise. Per the terms of the Participating Agreement, all providers are required to adhere to the policies and procedures contained in this manual, as applicable to each type of provider. Specific requirements of a member’s health benefits are varied and may differ from and supersede the general procedures outlined in this manual. If we make any procedural changes in our ongoing efforts to improve our service to you, we will update the information in this manual and notify you via BlueLink, our administrative newsletter. 3 indemnity INFORMATION PROVIDER MANUAL > > Important Phone Numbers and Addresses Provider Services Maryland Indemnity XW Prefix and BlueCard® Claims Mental Health for Level III and Key Groups only NCA Indemnity – XIA, XIJ and XWY Prefixes & BlueCard® Claims CareFirst BlueChoice – XIC, XIK and XWR Prefixes BluePreferred – XIP, XIL and XWV Prefixes What Number to Call Where to Send Claims or Correspondence 410-581-3581 800-437-2332 Claims: Mail Administrator P.O. Box 14115 Lexington, Ky 40512-4115 410-581-3581 Claims: Mail Administrator P.O. Box 14117 Lexington, Ky 40512-4117 202-479-6560 800-842-5975 Claims: Mail Administrator P.O. Box 14116 Lexington, Ky 40512-4116 Correspondence: Mail Administrator P.O. Box 14114 Lexington, Ky 40512-4114 202-479-6560 800-842-5975 Claims: Mail Administrator P.O. Box 14116 Lexington, Ky 40512-4116 Correspondence: Mail Administrator P.O. Box 14114 Lexington, Ky 40512-4114 202-479-6560 800-842-5975 Claims: Mail Administrator P.O. Box 14116 Lexington, Ky 40512-4116 Correspondence: Mail Administrator P.O. Box 14114 Lexington, Ky 40512-4114 202-479-6560 800-842-5975 Claims: Mail Administrator P.O. Box 14116 Lexington, Ky 40512-4116 Correspondence: Mail Administrator P.O. Box 14114 Lexington, Ky 40512-4114 202-479-6560 800-842-5975 Claims: Mail Administrator P.O. Box 14116 Lexington, Ky 40512-4116 Correspondence: Mail Administrator P.O. Box 14114 Lexington, Ky 40512-4114 202-479-6560 800-842-5975 Claims: Mail Administrator P.O. Box 14116 Lexington, Ky 40512-4116 Correspondence: Mail Administrator P.O. Box 14114 Lexington, Ky 40512-4114 BlueChoice Advantage – XIR Prefix BluePrecision – Blue Precision logo on ID Card Maryland Hospital Insurance Plan (MHIP) – MHIP logo on ID Card Dental HMO (The Dental Network) Indicator – DH Use 4 digit TDN site number Discount Dental Indicator – CareFirst BlueChoice logo on ID Card with no dental indicator 4 410-847-9060 888-833-8464 indemnity INFORMATION PROVIDER MANUAL Correspondence: Mail Administrator P.O. Box 14114 Lexington, Ky 40512-4114 Claims: Mail Administrator P.O. Box 14118 Lexington, Ky 40512-4118 > > Important Phone Numbers and Addresses (continued) State of Md Provider Services What Number to Call Where to Send Claims or Correspondence State of Maryland – POS and PPO 877-228-7268 State of Maryland – HMO 877-228-7268 Claims & Correspondence: CareFirst BlueCross Mail Administrator BlueShield P.O. Box 14115 P.O. Box 9885 Lexington, Ky 40512-4115 Baltimore, Md 21284-9885 Claims: Mail Administrator P.O. Box 14116 Lexington, Ky 40512-4116 Correspondence & Appeals: CareFirst BlueChoice Mailstop RR230 Owings Mills, Md 21117-4208 or CareFirst BlueChoice P.O. Box 804 Owings Mills, Md 21117-9998 NASCO Provider Services (NASCO - National Accounts Service & Claims Operations) What Number to Call Where to Send Claims or Correspondence Northrop Grumman – NRG Prefix Northrop Grumman – ESS or NGC Prefix 877-228-7268 800-972-8088 Claims: Mail Administrator P.O. Box 14115 Lexington, Ky 40512-4115 Correspondence: Mail Administrator P.O. Box 14114 Lexington, Ky 40512-4114 800-516-1269 Claims: Mail Administrator P.O. Box 14115 Lexington, Ky 40512-4115 Correspondence: Mail Administrator P.O. Box 14114 Lexington, Ky 40512-4114 877-228-7268 Claims: Mail Administrator P.O. Box 14115 Lexington, Ky 40512-4115 Correspondence: Mail Administrator P.O. Box 14114 Lexington, Ky 40512-4114 All other NASCO Accounts FEP Provider Services (FEP – Federal Employee Program) What Number to Call Where to Send Claims or Correspondence Federal Employee Program – R Prefix Professional & Institutional Providers in Montgomery & Prince George’s counties, Washington, D.C. & Northern Virginia (east of Rte. 123*) All other Md FEP Providers 202-488-4900 Professional & Institutional Inquiries: 410-581-3568 800-854-5256 Claims: Mail Administrator P.O. Box 14113 Lexington, Ky 40512-4113 Correspondence: Mail Administrator P.O. Box 14112 Lexington, Ky 40512-4112 Claims: Mail Administrator P.O. Box 14113 Lexington, Ky 40512-4113 Correspondence: Mail Administrator P.O. Box 14111 Lexington, Ky 40512-4111 *For Providers west of Rte. 123, send all claims and correspondence to local plan. 5 indemnity INFORMATION PROVIDER MANUAL > > Important Phone Numbers and Addresses (continued) Provider Contacts What Number to Call Where to Send Claims or Correspondence BlueCard® BlueCard® Eligibility Provider Information and Credentialing 800-676-BLUE (2583) 410-872-3500 877-269-9593 Fax 410-872-4107 866-452-2304 Provider Relations and Professional Contracting 410-872-3500 877-269-9593 Fax 410-505-6900 866-452-2306 Institutional and Vendor Contracting 410-872-3500 877-269-9593 Fax 410-872-4106 866-452-2305 Care Management 866-PRE-AUTH (733-2884) Fax 410-720-3058 Authorization Claims: Mail Administrator P.O. Box 14115 Lexington, Ky 40512-4115 Correspondence: Mail Administrator P.O. Box 14115 Lexington, Ky 40512-4115 Correspondence: CareFirst BlueCross BlueShield 10455 Mill Run Circle P.O. Box 825 Mailstop CG-41 Owings Mills, Md 21117-0825 Correspondence: CareFirst BlueCross BlueShield 10455 Mill Run Circle P.O. Box 825 Mailstop CG-52 Owings Mills, Md 21117-0825 Correspondence: CareFirst BlueCross BlueShield 10455 Mill Run Circle P.O. Box 825 Mailstop CG-51 Owings Mills, Md 21117-0825 Correspondence: Mail Administrator P.O. Box 14114 Lexington, Ky 40512-4114 866-PRE-AUTH (733-2884) - Option 1 Fax 410-761-7661 Provider Seminar Registration 6 877-269-2219 indemnity INFORMATION PROVIDER MANUAL Register online www.carefirst.com > Providers and Physicians > Register for a seminar > > Important Phone Numbers and Addresses (continued) Automated Voice Response Units What Number to Call BlueLine 410-581-3535 800-248-8410 Maryland Region — Authorizations, Eligibility and Claim and Benefit Inquiry for PPO, MPOS, PPN and Md Indemnity 410-581-3535 800-248-8410 FirstLine 202-479-6560 800-842-5975 NCA Region — Eligibility, Claim and Benefit Inquiry for CareFirst BlueChoice, BluePreferred and NCA Indemnity 202-479-6560 800-842-5975 Maryland Point of Service (MPOS) Referral Line Vendor Contacts Argus — Pharmacy benefits manager Fax for referrals: 410-998-5741 What Number to Call Prior authorization requests: 800-314-2872 Fax 800-315-4025 Emdeon — Enrollment for electronic claims submission 866-369-8805 Icore Healthcare — Supplier of injectable drugs 866-522-2470 Laboratory Corporation of America (LABCORP) — Provides laboratory services for CareFirst BlueChoice members 800-322-3629 Magellan Behavioral Health — Mental Health and Substance Abuse services 800-245-7013 Allscripts (Payerpath) — Enrollment for electronic claims submission 877-623-5706 ext. 1 - new clients ext. 2 - existing clients Direct number for Md. providers: Travis Bacile 804-327-5085 RealMed — Enrollment for electronic claims submission 877-927-8000 ext. 1201 RelayHealth — Enrollment for electronic claims submission 800-527-8133 - Option 2 Walgreens Specialty Pharmacy (formerly McKession Specialty) — Supplier of injectable drugs 7 indemnity INFORMATION PROVIDER MANUAL 888-456-7274 > > Membership and Product Information Membership Identification Cards Maryland Point of Service (MPOS) Member Name JOHN DOE Member ID XWM999999999 MARYLAND POINT OF SERVICE PCP John Smith, MD BCBS Plan 190/690 Member Name JOHN DOE Member ID XWV999999999 Group GG99 Eff Date 09/01/07 Coverage Type FAM Plan Benefits Group 0000000-0000 MPOS PR/SP 10/15 B E F $35 OP VISION 3110 (Bin #011834 PCN #0300-0000) BCBS Plan 080/580 Member Name JOHN DOE Member ID XWG999999999 Group 1900000-OA00 Eff Date 01/01/08 Coverage Type BCBS Plan 190/690 Plan Benefits BC-365 BS-C DIAG4 MM ND P907 CITY BALTO/BFG Maryland PPO/PPN Member Name JOHN DOE Member ID XWM999999999 Group 1900000-OA00 Eff Date 01/01/08 Coverage Type P10 S20 ER25 DC Indemnity Traditional Maryland Indemnity 8 DC Indemnity Member Name JOHN DOE Member ID XIJ999999999 PCP Dr. Smith Group 0HM0 BCBS Plan 080/580 Copay P30 S40 DO ER100 National BCBS Plan 190/690 Plan Benefits P10 S20 ER25 indemnity INFORMATION PROVIDER MANUAL Member Name JOHN DOE Member ID USB999 99 9999 NATIONAL ACCOUNT Group 1900000-OA00 PPO 80% $25 OV COPAY SPECIALIST $35 OV COPAY Eff Date 02/01/09 BCBS Plan 690/190 Coverage H&W > > Membership and Product Information (continued) Federal Employee Program (FEP) – Standard Option Government-Wide Service Benefit Plan Member Name JOHN DOE Member ID R30048852 www.fepblue.org Enrollment Code 105 Effective Date 01/01/2008 RxBIN RxPCN RxGrp Government-Wide Service Benefit Plan PPO 610415 PCS 65006500 Traditional Products Participating providers are required to accept the allowed benefit as payment in full. Subscribers can only be billed for deductibles, copayments and non-covered services. Subscribers may carry Major Medical coverage in addition to Plan C. Types of benefits provided under this plan include but are not limited to: n Inpatient medical care n Surgical coverage n iagnostic services, as part of the diagnostic D endorsement Types of benefits provided under Major Medical include but are not limited to: n Office visits n Outpatient mental health n Physical therapy n Durable medical equipment (DME) Preferred Provider Products Under the terms of preferred provider products, members have less out-of-pocket expense when a preferred provider renders care. When care is rendered by a non-preferred or out-of-network provider, benefits will be provided, in most cases, but the member will be responsible for deductibles and coinsurance. CareFirst offers two preferred provider products: Preferred Provider Network (PPN) and Preferred Provider Organization (PPO). 9 Federal Employee Program (FEP) – Basic Option indemnity INFORMATION PROVIDER MANUAL Member Name JOHN DOE Member ID R30048852 www.fepblue.org Enrollment Code 112 Effective Date 01/01/2008 RxBIN RxPCN RxGrp Basic 610415 PCS 65006500 PPN A PPN is a provider-driven product. This means that in addition to the terms of the participating agreement, the provider agrees to: n nsure that all managed care provisions of the E contract are met n Direct care to other PPN providers n ontact CareFirst if an out-of-network referral C is medically indicated (contact the referral unit) PPO A PPO is a subscriber driven product. This means that the subscriber agrees to: n Stay within the Preferred Provider Network n dhere to the managed care provisions of the A contract Medicare Supplemental Products CareFirst offers a variety of Medicare supplemental products to compliment Medicare benefits. These products are offered through group contracts as well as directly to individual subscribers. TEFRA The Tax Equity and Fiscal Responsibility Act (TEFRA) is legislation enacted by the federal government which specifically states that an active employee age 65 and over, or the spouse (the Deficit Reduction Act – or DEFRA – is an amendment to TEFRA which stipulates that spouses fall under TEFRA) age 65 and over of an active employee, may enroll in the same group coverage offered to younger > > Membership and Product Information (continued) employees and their spouses. In instances where the employee or spouse has elected the group coverage, CareFirst is the primary carrier to whom the claim should be submitted first, Medicare is the secondary carrier. After CareFirst has processed the claim, it will be necessary to forward the claim to Medicare because claims are not automatically forwarded to Medicare. Network Claims Product CareFirst jointly administers the Network Claims product with third-party administrators (TPAs), selfinsured employers, and health and welfare funds. Because CareFirst shares administrative tasks with these entities, employers are able to access CareFirst’s provider networks, design health benefits, and share financial responsibilities. CareFirst is responsible for training and maintenance of the provider network and collecting and pricing claims. Patient information Patients enrolled in this program can be identified in several ways: n unique identification card bears the CareFirst A logo and the logo of the account or TPA n he prefix on the identification card begins T with ‘A’ followed by two numeric characters n Identification cards, Explanation of Benefits (EOB), checks and vouchers will usually have CareFirst’s and the account’s logo Claims Submission Process Providers should submit claims following the instructions that appear on the reverse side of the patient’s identification card. The patient’s alpha/numeric prefix and the CareFirst provider number must be submitted on all claims to ensure timely processing. Claims can be submitted electronically or on paper, as identified in the CareFirst participating agreement. Participating providers agree to accept the CareFirst allowed benefit as payment in full for services rendered to these patients, less any deductibles and coinsurance amounts. To obtain information about benefits, claim status, claim adjudication, deductibles, or coinsurance, please call the provider service number on the back of the patient’s identification card. Maryland Point of Service Primary Care Provider Internists, family practitioners, nurse practitioners and pediatricians are eligible to contract with CareFirst to become primary care providers under the Maryland Point of Service (MPOS) product. Members 13 years of age and older may select an internist as a PCP as long as the PCP has no self-imposed age restrictions. Members up to age 21 may select a pediatrician as a PCP as long as the PCP has no self-imposed age restrictions. The member chooses a PCP during open enrollment and may change PCPs at any time during the year. If a PCP is not selected, one will be automatically assigned. The PCP is responsible for managing and coordinating all of the member’s health care needs. Specialist/Referral When specialty care is required, the PCP writes a referral using the Maryland Uniform Consultation Referral form to a specialist within the preferred provider network. The referral must be completed by the PCP for the member to receive maximum benefits. The specialist cannot refer the member to another provider, as this would raise the out-of-pocket expense for the member. If additional care is required, the specialist should confer with the PCP, and the PCP will determine what course of action to take. PCPs should mail, phone, or fax the referral to CareFirst as soon as possible to avoid out-of-network processing of the specialist’s claim. 10 indemnity INFORMATION PROVIDER MANUAL > > Membership and Product Information (continued) Referrals are valid for a minimum of 120 days, unless otherwise stated. Specialists should verify the validity of a referral prior to rendering services. Referrals for inpatient services must be called in by the PCP to Utilization Management (866-773-2884). Direct Access Generally certain services can be obtained without a referral from the PCP and still be processed as in-network services. These services are referred to as direct access services. Please keep in mind that benefits for these services would still need to be verified by the appropriate provider service area. They are: n Accidental care n Ambulance services n rtificial insemination/in-vitro fertilization A performed by PPN specialist n Hospice care n Human organ transplant n Emergency n ost outpatient diagnostic, machine and M laboratory testing and radiological service (except MRI, CAT scan, Holter Monitor, and interventional radiology) Most psychiatric and substance abuse care should be referred through Magellan Behavioral Health. BlueCard® Program CareFirst along with the Blue Cross Association in Chicago implemented the BlueCard® Program. Providers who participate with CareFirst’s Maryland provider network should accept all BlueCross BlueShield (BCBS) members. Claims/Benefits Claims may be submitted electronically or on paper. Paper claims are to be submitted to the normal CareFirst address. National account paper claims should be submitted to the CareFirst NASCO address. Programs that are not affected by BlueCard® include: Federal Employee Program, Medicare Secondary, Maryland Dental Program, Vision Program, Pharmacy Program and CareFirst’s HMOs including the HMO OptOut policies. For benefit information, contact BlueLine, FirstLine, CareFirst Direct or Provider Services (see “Important Phone Numbers and Addresses”). Providers located in Maryland should file claims based on the following: n B/GYN services rendered by a PPN OB/GYN O or Nurse Midwife in his or her office Some of your patients may have the Triple Choice product. Level one of this product provides the highest level of benefits and the services are provided or referred by the PCP. Level two services are performed by a PPN provider without a referral. Level three services are rendered by 11 a CareFirst participating provider or non-participating provider and offers the lowest level of benefits. indemnity INFORMATION PROVIDER MANUAL n rovider is participating with CareFirst’s P Maryland network only. Claims for all BCBS subscribers, regardless of the BCBS plan that they are enrolled through, must be submitted to CareFirst. > > Membership and Product Information (continued) n rovider is a preferred provider with CareFirst’s P Maryland network and the National Capital network and the member has a PPO/PPN contract. Claims should be submitted to the plan where the subscriber has membership. n rovider is a preferred provider with CareFirst’s P Maryland network only, or the National Capital network only, and the member has a PPO/PPN contract. Claims should be submitted to the plan where the practitioner holds a PPO/PPN contract. n laims for CareFirst subscribers who hold a C Maryland membership card and subscribers of BCBS plans that the provider does not participate with must be submitted to CareFirst. The BlueCard® program also requires that participating providers bill the patient only for their share of covered services (deductibles, copayments, and coinsurance amounts) based on CareFirst’s allowed benefit. All BCBS plans have issued their subscribers membership identification cards that contain a 3-letter membership number prefix (excluding Federal Employee Program, Medicare Secondary, Maryland Dental Program, and CareFirst’s HMOs). BlueCross BlueShield (BCBS) assigns the first two positions (or letters) of the prefix and each BCBS plan assigns the third. Most plans take advantage of the ability to assign the third letter and use it to assist with claims direction and contract identification. 12 indemnity INFORMATION PROVIDER MANUAL CareFirst’s Maryland membership numbers begin with the letters XW, CareFirst of DCs prefixes begin with XI. It is critical to claims processing for out-of-state subscribers that the prefix appears on the claim form. The prefix should be obtained from the subscriber’s identification card, when possible. Include the prefix for both paper and electronic claims. If you are not certain where to indicate the prefix when filing electronically, please contact your Electronic Data Interchange (EDI) vendor. Where to Direct Inquiries n Benefits and eligibility can be verified by contacting the plan through which the patient is enrolled. To do this, call toll free 800-676-2583 and you will be directed to the appropriate BCBS plan. It is important to obtain the 3-letter prefix from the subscriber’s ID card prior to using this number. n laim status inquiries can be directed to C CareFirst. You can contact: n BlueLine: 410-581-3535 or 800-248-8410 n FirstLine: 202-479-6560 or 800-842-5975 n CareFirst Direct n P rovider Services 202-479-6560 or 800-842-5975. > > Policy Statements Care Management Mandatory Second Surgical Opinion (MSSOP) MSSOP is aimed at containing costs by reducing unnecessary diagnostic and surgical procedures. It also provides reassurance to patients having elective surgery by either confirming the need for the surgery or advising them of other forms of treatment. Some employer groups elect Voluntary Second Surgical Opinion (VSSOP), while others choose MSSOP for certain procedures. If a subscriber’s contract requires MSSOP, a penalty is applied if the VSSOP is not obtained. A practitioner who is qualified to perform the surgery must perform the VSSOP. The program applies to a specific list of diagnostic and surgical procedures when they are performed on an elective, non-emergency basis. The procedures on the MSSOP list vary from account to account. To verify procedures, check BlueLine. Utilization Control Program (UCP)/Utilization Control Program Plus (UCP+) These are inpatient admission review programs designed to contain hospital costs by reviewing admissions for appropriateness and number of inpatient days. These programs feature pre-admission review, admission review, continued stay review, retrospective review, and discharge planning. Notification of admissions to the CareFirst Utilization Management department are required (see Important Telephone Numbers). Coordinated Home Care and Home Hospice Care The Coordinated Home Care and Home Hospice Care programs allow recovering and terminally ill patients to stay at home and receive care in the most comfortable and cost-effective setting. In order to qualify for program benefits, the patient’s physician, hospital or home care coordinator must submit a treatment plan to CareFirst. A licensed home health agency or approved hospice facility must render eligible services. Once approved, the home health agency or hospice is responsible for coordinating all services. Individual Case Management (ICM) ICM is a voluntary program available to those members who have acute illnesses in a variety of specialty areas including Aquired Immune Deficiency Syndrome (AIDS), oncology, neonatology, pediatrics, high-risk obstetrics, head injury, spinal cord injury as well as medicine and surgery. Case management serves to coordinate and support services that are aimed at assisting the member’s attainment of short-term health objectives and long-term goals. Health care providers, patients, family members, employers or anyone familiar with the case may refer candidates for ICM (see Important Telephone Numbers). Outpatient Pre-Treatment Authorization Plan (OPAP) OPAP is a pre-treatment program that applies to outpatient physical, speech and occupational therapy. This program requires that CareFirst review and approve the Initial Authorization Request Form prior to a given visit (e.g., before the tenth visit) or prior to the first visit depending on the subscriber’s contract. The provider of care must complete a form that includes the patient’s diagnosis and expected length of treatment. The form will then be reviewed, and the provider and subscriber will receive written notification of the decision. Magellan Health Services Magellan offers a full array of managed mental health, substance abuse, and Employee Assistance Programs (EAP) services, including utilization management, PPO, HMO and point-of-service networks. Magellan offers programs designed with a patient-advocacy focus such as Care Management and enhanced utilization management. Care Management is Magellan’s network-based clinical service program. It combines the best attributes of utilization management with the clinical skills and experience of a care management team that guides referrals and serves as a patient’s advocate through the entire episode of care. Enhanced Utilization Management is a utilization review process that works with each member’s provider to ensure medically-necessary treatment in the most appropriate setting. 13 indemnity INFORMATION PROVIDER MANUAL > > Administrative Functions Inquiry Process Providers should use CareFirst Direct or call Provider Services regarding claim inquiries. Many inquiries can be handled to the providers’ satisfaction in the appropriate Provider Services area. If the inquiry cannot be satisfied in the Service area, the provider will be instructed to submit a written inquiry on a Provider Inquiry Resolution Form (PIRF) to document the reason for the request along with pertinent or supportive records, literature or claims documentation to CareFirst Provider Services.* To review the CareFirst claims adjudication and payment policies, please refer to the Contents section in this manual. These sections are especially helpful in describing multiple claims billing guidelines, including but not limited to Modifier Reimbursement Guidelines, Bilateral Procedures Reimbursement Guidelines, Team Surgery and Preventive Services. *Please request reviews of processed claims within 6 months or 180 days (whichever is greater) of the determination. Claims Submissions In accordance with Maryland law addressing uniform claim form submission, all health care practitioners licensed or certified under the Health Occupation Article, Annotated Codes of Maryland must use the Centers for Medicare and Medicaid Services (CMS) 1500 as the standard claim form. In addition, providers should use the CMS instructions for completing the 1500 form when filing for professional services. To obtain the CMS 1500 form, please refer the CMS Web site, www.cms.gov. Claims Overpayment If a claims overpayment is discovered and you wish to return the payment to CareFirst, please mail it to: CareFirst BlueCross BlueShield P.O. Box 791021 Baltimore, Md 21279 Please include the membership number, patient name, claim number and the reason for the refund with your check. The check should be made payable to CareFirst BlueCross BlueShield. Timely Filing of Claims To be considered for payment, claims must be submitted within 365 days from the date of service. 14 indemnity INFORMATION PROVIDER MANUAL Reconsideration: Claims submitted beyond the timely filing limits generally are rejected as not meeting these guidelines. If your claim is rejected, but you have proof that the claim was submitted to CareFirst within the guidelines, you may request processing reconsideration. Documentation is required for this process. Timely filing reconsideration requests must be received within six months of the provider receiving the original rejection notification on the provider voucher or notice of payment. Requests received after six months will not be accepted and the charges may not be billed to the member. For electronic claims: A confirmation from the vendor or clearinghouse that CareFirst successfully accepted the claim. Error records are not acceptable documentation. For paper claims: A screen print from the provider’s computer indicating the original bill creation date along with a duplicate of the clean claim or a duplicate of the originally submitted clean claim with the signature date in field 12, indicating the bill creation date. > > Administrative Functions (continued) Paper Claims Submission Paper claims are scanned and a digitized version of the claim that is produced is stored electronically. Successful imaging of the claim depends on print darkness. Light print produces unacceptable imaging and your claim may be returned to you. Please make sure to change typewriter ribbons or printer cartridges regularly so that the print is dark. Incomplete claims create unnecessary processing and payment delays for all providers. The fields listed below must be completed on all claims submitted to CareFirst. Claims missing information in any of the following fields will be returned: n n n n n n n n n n n n lock 1a: Insured’s ID Number* B Block 2: Patient’s Name Block 3: Patient’s Birth Date Block 21: Diagnosis Block 24a: Dates of Service Block 24b: Place of Service Block 24d: Procedures, Services or Supplies Block 24f: Charges Block 24g: Days or Units Block 25: Federal Tax ID Number Block 31: Signature of Provider (including degree or credentials) Block 33: Physician Billing Information (enter your CareFirst Maryland region provider number** in the ‘Grp#’ area) Effective Follow-Up on Outstanding CareFirst BlueCross BlueShield Indemnity Claims To follow-up on claims submitted over 30-days ago, you can check BlueLine to determine the claim status. Do not resubmit claims without checking BlueLine, FirstLine or CareFirst Direct first. Submitting a duplicate of a claim already in process will generate a rejection, which will cause a backlog of unnecessary claims to be processed. Step-By-Step Instructions for Effective Follow-Up Claim Status The most effective way to accomplish follow-up on submitted claims is to: n n n ccess BlueLine, FirstLine, or CareFirst A Direct (for local accounts & Federal Employee Program) or the appropriate dedicated national accounts (NASCO) unit to determine the status of the claim If there is no record of the claim, the claim must be resubmitted If the claim has been pending in the system for less than 30 days, wait until 30 days have elapsed from the processing date given on BlueLine, FirstLine, or CareFirst Direct. If processing has not been completed after 30 days, contact the appropriate provider customer service area *The 3-digit prefix must be included if present on the subscriber’s identification card. FEP membership numbers do not have a 3-digit prefix, but begin with an “R” and have 8 numeric digits. **Use your 4-digit provider number with alpha characters (9999XX). Claims must be submitted on an original (red/white) CMS 1500 form. Claims that are submitted on photocopies or forms other than an original CMS 1500 require manual input, which may result in processing delay. All information must fit properly in the blocks provided. Electronic Claim Submission Electronic claims submission is the automated filing of claims utilizing a computer software package and transmitting the claims electronically. See page 7 for a list of electronic claims submission vendors. 15 indemnity INFORMATION PROVIDER MANUAL > > Administrative Functions (continued) Large Volume of Unpaid Claims n Please be sure that all vouchers and/or remittance tapes have been posted n Use BlueLine to verify receipt and status of claims n If you still have questions, please contact the appropriate provider customer service unit for assistance n Submit a copy of the Medicare Remittance Notice attached to a copy of the HCFA 1500 form. Be sure that the CareFirst provider numbers are indicated on the HCFA 1500 form appropriately n Mail to the appropriate claims address Medicare Supplemental/Complementary Please allow approximately 30 days for the claim to be processed through the spin-off system after you receive the Medicare Remittance Notice. If processing from CareFirst does not occur in 30 days, please follow these steps: Other Party Liability n heck BlueLine, FirstLine, or CareFirst Direct C to verify that the claim has not been received by CareFirst. You do not need to wait 30 days from Medicare’s processing date to check BlueLine, FirstLine, or CareFirst Direct. You may check any time after the receipt of a Medicare Remittance Notice I f there is no record of the supplemental claim, please follow these steps: 16 indemnity INFORMATION PROVIDER MANUAL I f the claim has been pending for more than 30 days, please contact the appropriate provider customer service unit for assistance. Coordination of Benefits (COB) COB is a cost-containment provision included in most group and member contracts that is designed to avoid duplicate payment for covered services. COB is applied whenever a member covered under a CareFirst contract is also eligible for health insurance benefits through another insurance company or Medicare. If CareFirst is the primary carrier, full benefits are provided as stipulated in the member’s contract. However, the member may be billed for any deductible, coinsurance, non-covered services or services for which benefits have been exhausted. These charges may then be submitted to the secondary carrier for consideration. > > Administrative Functions (continued) Group contracts may stipulate different methods of benefits coordination. However, generally CareFirst’s standard method of providing secondary benefits for covered services is the difference between the higher allowed benefit and the amount paid by the primary carrier as long as the difference does not exceed CareFirst’s allowed benefit, except when Medicare is primary. Claims for secondary benefits must be accompanied by the explanation of benefits (EOB) from the primary carrier. Subrogation Subrogation refers to the right of CareFirst to recover payments made on behalf of a member/subscriber whose illness, condition, or injury was caused by the negligence or wrong-doing of another party. Such action will not affect the submission and processing of claims, and all provisions of the participating provider agreement apply. Personal Injury Protection (PIP) PIP is an automobile insurance provision that covers medical expenses and lost wages experienced by the insured or passengers as a result of an automobile accident. The minimum coverage is $2,500. While Maryland law was amended in 1989 to require this coverage for passengers and family members under the age of sixteen, most insureds choose to continue to cover other passengers under this provision in their automobile insurance contracts. Workers’ Compensation This program is designed to provide reimbursement for workers who sustain injuries or illnesses arising out of or in the course of employment. The Maryland Workers’ Compensation Act excludes sole proprietors, partners and officers of closed corporations from mandatory coverage under the act, giving them instead the option to elect coverage. Verification from the subscriber of this waiver is required by CareFirst in order to process claims. Workers’ compensation replaces health insurance. A participating provider cannot balance-bill CareFirst or the subscriber for any amount not covered under workers’ compensation. Claims for workers’ compensation should be filed to the workers’ compensation carrier first and to CareFirst only after the workers’ compensation carrier has determined that the charges are non-compensable under workers’ compensation. If workers’ compensation determines that the charges are non-compensable, attach a copy of the denial from the workers’ compensation carrier to the claim. 17 indemnity INFORMATION PROVIDER MANUAL Clinical Appeal Process Clinical Appeals and Analysis Unit The Clinical Appeals and Analysis Unit (CAU) is responsible for review, preparation, reconciliation and communication, reporting and analysis of clinical appeals for CareFirst. The CAU is the primary contact for appeals for internal and external auditing agencies. Clinical Appeal Checklist CAU reviews and responds to clinical appeals. CareFirst has one internal level for the appeals process. Appeals must be submitted within 180 calendar days or six (6) months, whichever is longer, from the date the adverse decision was received. A letter describing the reason(s) for the appeal and the clinical justification or rationale is required including the following information, if possible: n Patient’s name and identification number n Provider number or tax identification number n dmission and discharge date, if applicable or A the date(s) of service n The treating physician’s name n The complete inpatient medical record n Relevant outpatient records n letter of medical necessity addressing specific A related clinical information. Supporting clinical notes or medical records includes pertinent lab reports, x-rays, treatment plans and progress notes. n If the appeal includes a request for review of ancillary services, the letter of medical necessity should specifically state the medical necessity of the ancillary services on the denied days. n I f the appeal involves inpatient days, a licensed physician who is a member of the hospital’s staff or a nurse working in conjunction with the physician should write the letter of medical necessity. n I f a nurse writes the letter of medical necessity, it should indicate the physician(s) involvement in the appeal > > Administrative Functions (continued) Expedited or Emergency Appeals Process Administrative or Technical Appeals You may request an expedited or emergency appeal after an adverse decision for preauthorization of a service, admission, continued length of stay or awaiting service or treatment. An expedited or emergency appeal is defined as one where a delay in receiving the health care service could seriously jeopardize the life or health of the member or the member’s ability to function or cause the member to be a danger to self or others. Expedited appeals may be faxed to 410-528-7053. CAU does not review or respond to administrative or technical appeals. For direct questions about claims that deny because of enrollment, co-pay/deductible, lack of preauthorization and claims payment should contact Provider Services at 800-842-5975 or 202-479-6560. Any hospital representative may submit these appeals. An expedited appeal may include, but is not limited to, a physician to physician or peer to peer review, when an adverse decision has been rendered regarding a concurrent inpatient length of stay. An emergency includes a service not yet provided (i.e., a prospective service that is not yet a claim.) We will answer an expedited or emergency appeal within 24 hours from the date the appeal is received. The grievance will be reviewed by a physician not involved in the initial denial determination. There is a full and fair review process for all grievance decisions. Appeal (or Grievance) Resolution n hen a claim is denied for “no authorization W obtained,” this indicates there is not a contractually required pre-certification on file. n o submit a payment dispute for “no T authorization,” give a specific reason why precertification could not be obtained and include the complete medical record n e will return requests for reconsideration W without the above information citing “denial of payment upheld,” until the request is submitted with the information needed to complete the review. Carefirst.com Resources The following information is available on our Web site: Once the internal appeal process is complete, you will receive a written decision that will include the following information: n areFirst Drug Information includes information C about prior authorization requirements, quantity limits and the CareFirst formulary n areFirst Medical Policy Manual has the most C up-to-date medical policy information and guidelines n laims Adjudication and Associated C Reimbursement Policy information, including details on Billing and Reimbursement Guidelines n The specific reason for the appeal decision. n reference to the specific benefit provision, A guideline protocol or other criteria on which the decision was based. 18 n n statement regarding the availability of all A documents, records or other information relevant to the appeal decision, free of charge including copies of the benefit provision, guideline, protocol or other similar criterion on which the appeal decision was based. otification that the diagnosis code and its N corresponding meaning, and the treatment code and its corresponding meaning will be provided free of charge upon request. n ontact information regarding a State C consumer assistance program. n I nformation regarding the next level of appeal, as appropriate. indemnity INFORMATION PROVIDER MANUAL Written appeals should be mailed to: Mail Administrator P.O. Box 14114 Lexington, KY 40512-4114 HIPAA Compliant Codes To comply with the requirements of the Health Insurance Portability and Accountability Act (HIPAA), CareFirst and CareFirst BlueChoice will add the HIPAA-compliant codes and corresponding reimbursement rates to your fee schedule when they are released from AMA or CMS. These updates are made on a quarterly basis through the calendar year. > > Administrative Functions (continued) In-Office Injectable Drugs Standard Reimbursement Methodology submitted under the supervising physician’s name and provider number. In-Office Injectable drugs are reimbursed at a percentage of the Average Sales Price (ASP). In-Office Injectable drugs without an ASP are reimbursed at a percentage of the lowest Average Wholesale Price (AWP). The ASP is calculated by the Centers for Medicare & Medicaid Services (CMS) and available at CMS.gov. The AWP is based on the most cost effective product and package size as referenced in Thomson’s Red Book. Reimbursement Allowances Participating providers agree to accept the Allowed Benefit or ‘AB’ as determined by CareFirst. This means that participating providers cannot bill the subscriber/ patient for the difference between their charge and the allowed benefit for covered services. Participating prov iders may bill subscribers for deductibles, coinsurance and copayments up to the Allowed Benefit at the time of service. The subscriber/patient may be billed in full for non-covered services. Reimbursement for all in-office injectable drugs is updated quarterly on the first of February, May, August and November. The rates are in effect for the entire quarter but are subject to change each quarter. P4 Oncology and P4 Rheumatology fee schedules are not included in this reimbursement methodology. Participating Provider Agreement (PAR) The major terms of the PAR agreement require that the provider: n n n ile claims on behalf of the member F Only request deductibles and copayments at the time of the service Accept the allowed benefit as payment in full The provider will receive reimbursement directly from CareFirst on their remittance. Eligibility Most licensed health care professionals are eligible to participate. Please contact the Networks Development Department with eligibility questions (see “Important Phone Numbers and Addresses”). Physician Assistants Covered services rendered by Physician Assistants (PA) are eligible for reimbursement under the following circumstances: n A is under the supervision of a physician as P required by local licensing agencies n Services rendered by the PA are submitted under the supervising physician’s name and provider number CareFirst BlueChoice does not contract with Physician Assistants. Physician Assistants’ services are to be 19 indemnity INFORMATION PROVIDER MANUAL Providers cannot require the payment of charges above and beyond coinsurance, copayments and deductibles. To help you evaluate your office’s current practices, our policy is below. articipating providers shall not charge, collect P from, seek remuneration or reimbursement from or have recourse against subscribers or members for Covered Services, including those that are inherent in the delivery of Covered Services. The practice of charging for office administration and expense is not in accordance with the Participation Agreement and Participating Provider Manual. Such charges for administrative services would include, by way of example, annual or per visit fees to offset the increase of office administrative duties and/or overhead expenses, malpractice coverage increases, writing prescriptions, copying and faxing, completing referral forms or other expenses related to the overall management of patients and compliance with government laws and regulations, required of health care providers. However, the provider may look to the subscriber or member for payment of deductibles, co-payments or coinsurance, or for providing specific health care services not covered under the member’s Health Benefit Plan as well as fees for some administrative services. Such fees for administrative services may include, by way of example, fees for completion of certain forms not connected with the providing of Covered Services, missed appointment fees, and charges for copies of medical records when the records are being processed for the subscriber or member directly. > > Administrative Functions (continued) Fees or charges for administrative tasks, such as those enumerated above, may not be assessed against all members in the form of an office administrative fee, but rather to only those members who utilize the administrative service. Preferred Provider Agreements (PPN) Participating providers are also eligible to become Preferred Providers. Major provisions of the Preferred Provider Agreement include: n Submit all claims directly to CareFirst n ccept the Preferred Provider Allowed Benefit A as payment in full n ill CareFirst members only for deductibles, B copayment, coinsurance, and non-covered services n irect care of PPN patients to other PPN D providers n otify CareFirst if an out of network referral N is required n nsure that the managed care provisions of E the contract are met Eligibility Preferred providers must meet CareFirst’s credentialing standards. Reimbursement Preferred providers agree to accept a Preferred Provider Allowed Benefit (PPAB) as payment in full. Preferred providers may not bill the patient for amounts that exceed the PPAB for covered services. Subscribers are liable for non-covered services, deductibles, copayments and coinsurance. 20 indemnity INFORMATION PROVIDER MANUAL Collection of Retroactively Denied Claims A provider reimbursement may be offset against a retroactively denied claim by an affiliated company of CareFirst, Inc. Changes in Provider Information CareFirst health care providers who need to change their provider information should use a Change in Provider Information Form found on our website www.carefirst. com/providers/forms. Print the form and complete the applicable information, including the information regarding accepting new patients (open/close panel). Be sure to include your office letterhead when returning the completed form to: CareFirst BlueCross BlueShield Provider Information and Credentialing Mailstop CG-41 10455 Mill Run Circle Owings Mills, Md. 21117-0825 You may also fax the completed form to: 410-872-4107. Remember if you change your Tax Identification number you will be issued a new CareFirst provider number, and a new provider packet. We realize that you are not a new provider, but you must use the new CareFirst provider number when required. Termination of Agreement Under the terms of the current provider agreements, prov iders must prov ide w ritten notif ication of termination with 90 days notice. > > CareFirst BlueCross BlueShield is the shared business name of CareFirst of Maryland, Inc. and Group Hospitalization and Medical Services, Inc. CareFirst BlueCross BlueShield and CareFirst BlueChoice, Inc. are both independent licensees of the Blue Cross and Blue Shield Association. ® Registered trademark of the Blue Cross and Blue Shield Association. ®’ Registered trademark of CareFirst of Maryland, Inc. BOK5366-1N (7/12) > >

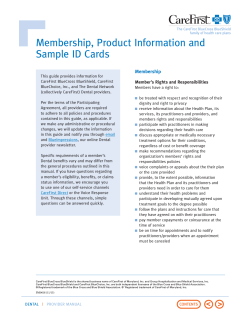

© Copyright 2026