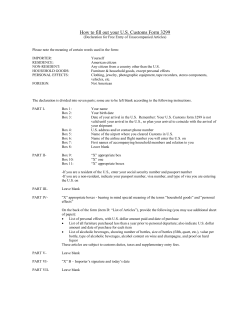

CUSTOMS EXTERNAL COMPLETION MANUAL