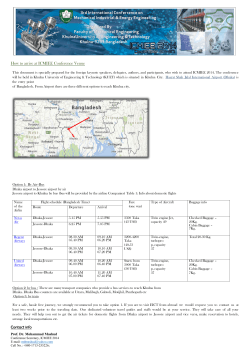

Manual on the Control and Examination of Baggage