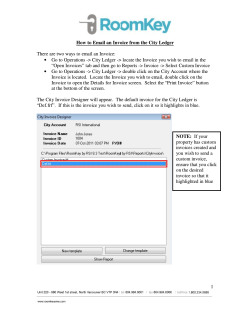

Accounts Receivable User Manual