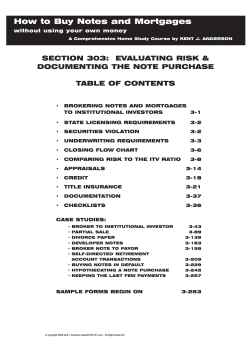

Document 313315