C u s to m e r P... D o c u m e n t a t...

www.danskebank.co.uk

Customer Package

Documentat ion

You should read this document w ith your:

• Customer Agreements; and

• Credit Card Agreements (if this applies).

Please keep this booklet to refer to in the future.

From 9 October 2014

Danske Bank

Welcome

At Danske Bank, we’re always keen to find ways to improve how we communicate with

our customers, using information that is easy to use and understand. As part of this

commitment, we have developed this booklet to provide information you need to know

about our customer packages in one document.

The packages in this booklet offer you many practical advantages to help you manage

your everyday finances.

Please take the time to read this booklet and keep it handy, as the information it contains

about your customer package is important.

We are committed to treating customers fairly and to providing you with important

information on your accounts. We value all our customers and look forward to continuing

to provide you with the highest levels of customer service.

We hope you find this booklet useful. If you have any questions, please call your local

branch.

Gerry Mallon

Chief Executive

2

Danske Bank

Danske Bank customer

package documentation

As at 9 October 2014

Section 1

Important information

1 to 15

Section 2

General terms and conditions

16 to 59

Special terms and conditions Personal Current Accounts

Special terms and conditions 24Hour Telephone Banking

Special terms and conditions - eBanking

Special terms and conditions Electronic Signature

Special terms and conditions - Danske 3D Secure

Special terms and conditions Danske Text Service

Section 3

Special terms and conditions for

Debit MasterCard Personal Card

60 to 66

Section 4

Personal Danske MasterCard

Credit Cards terms and conditions

67 to 75

Section 5

Danske Visa Credit Card

terms and conditions

76 to 84

Section 6

Important Information - London Branch

85 to 86

Section 7

Special terms and conditions for

Danske eSaver

87 to 89

Sect ion 1 - Important informat ion

What can I read about in this section?

How to read this booklet

Personal package features

Who your agreement is with

Explanation of personal package features

Services available for Our customers at the Post Of fice®

Basic bank account

Credit card summary boxes

How to use your accounts

Putting things right for you

How we use your personal and business information

A guide to how we and credit reference and

fraud prevention agencies use your personal information

18579

Plain English Campaign's Crystal Mark only applies to

section 1 of this publication.

Plain English Campaign's Crystal Mark does not apply to page 7 and

‘Services available for Our customers at the Post Office®’ on page 5

and 6.

Sect ion 1 - Important informat ion

How to read this booklet

This booklet covers our Danske Choice and Danske Freedom packages. It also covers our basic bank account Danske

Basic. Depending on which package you choose, different sections of this booklet will apply. We’ve tried to make reading

this booklet as easy as possible by dividing it into sections.

You’ll find a reminder at the start of each section telling you whether the section applies to your package.

If you are a customer of our London branch, you should also read section 6.

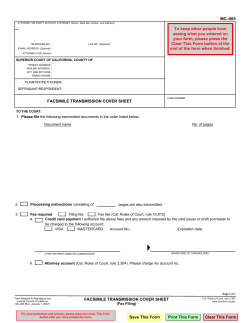

Please see the chart below, which identifies what coloured sections of the booklet you need to read.

Sections

1

2

3

4

5

6

7

Danske Choice

Danske Freedom

Danske Basic

Danske Visa credit card

London Branch Customers

Danske eSaver

Note: Customers of our London branch should read the sections relevant to the products they have chosen, as well

as section 6 of this booklet.

2

Sect ion 1 - Important informat ion

Personal package features

Danske Choice

Danske Freedom

18 and over

18 to 27

Current account

3

3

eBanking and 24 Hour Telephone Banking

3

3

Debit Card

- cash withdrawals at cash machines and at Post Office ® counters.

3

3

- lodgements at Post Office® counters

3

3

Age

- make a donation to a charity

(where the cash machine provider offers this service)

3

3

3

- point of sale (for example, shops (including contactless), over the

phone, through the internet)

Chequebook available

3

3

Arranged overdraft available

3

3

£7,500

£3,000

Standard

Standard

3

3

Maximum arranged overdraft available without

a fee for setting it up

MasterCard credit card

(see summary box on page 7)

Commission-free foreign currency

Ordered by eBanking

3

Ordered at a branch

3

Discounted arrangement fee for residential home loans

3

Favourable rates on standard fixed rate personal loans

3

Note:

If you are not eligible for one of our personal current account packages, you may be interested in our basic bank account,

Danske Basic. See page 6 for details.

Whether we grant you any of our credit facilities depends on your age and circumstances.

We may change or withdraw the products or benefits associated with Danske personal packages.

Details of our fees and service charges and interest rates are available in our ‘Fees and service charges explained’ and 'Interest

rates' leaf lets, (available at any Danske Bank branch in the UK and on our website at www.danskebank.co.uk/docs) and in the

document called ‘Customer Information on fees and service charges and interest - Personal Current Accounts’, which we have

given you.

In addition, with our personal packages you can register for Danske Text Service. The Special Terms and Conditions for Danske

Text Service are available in Section 2 of this booklet.

3

Sect ion 1 - Important informat ion

Who your agreement is with

When you open an account with us your account agreement

is with Northern Bank Limited, registered in Northern Ireland

(registered number R568). The terms and conditions which

we give you when you open an account with us will apply to

that agreement.

Danske Bank is a trading name of Northern Bank Limited

which is authorised by the Prudential Regulation Authority

and regulated by the Financial Conduct Authority and the

Prudential Regulation Authority (reference number 122261).

Explanation of personal package features

Arranged overdraft

All the personal packages in this booklet (except Danske

Basic) offer an arranged overdraft. Each package offers a

specific maximum amount, where we do not charge an

overdraft set up fee to set the arranged overdraft up. You can

apply separately, after we have opened the package, for any

amount over this specific limit. The overdraft set up fee for

any amount over this specific limit is currently 1% of the

extra amount. Whether we grant you an arranged overdraft

depends on your circumstances.

Chequebook

All the personal packages in this booklet (except Danske

Basic) offer a chequebook with your current account.

You can apply for a chequebook once you have opened your

account.

Current account

A current account is a safe and convenient way to manage

your day-to-day finances. You can use it to manage your

money, receive your money, pay bills and keep your money

secure. All our personal packages offer a current account

which you can use to set up direct debits and standing

orders, free of charge.

eBanking (including Mobile Banking) and

24 Hour Telephone Banking

eBanking is our internet banking service. Both eBanking and

24 Hour Telephone Banking offer an easy, quick and

inexpensive way to carry out your banking transactions at a

time that suits you best.

Statements

All our personal packages provide a statement every half

year. If you register for eBanking, you will automatically

receive your statements electronically.

We will also issue a statement at the end of any calendar

month where you have had a payment transaction on your

account.

4

Debit Card

If a debit card is available with your current account, you can

use this as a cash card and a debit card.

A cash card allows you to withdraw your money at cash

machines both in the UK and abroad or make a donation to a

charity (where the cash machine provider offers this

service). A debit card allows you to pay for goods and

services. This is sometimes known as using your card at a

‘point of sale’. You can do this in a number of ways.

• In places such as shops, supermarkets, petrol stations

and hotels

• Over the phone

• Through the internet

You will be able to shop anywhere you see the logo, both in

the UK and abroad.

If Your Card has the contactless indicator,

then you will be able to make contactless transactions.

Further information is available in section 3.

You can also use your debit card to withdraw cash and make

lodgements at a Post Office® counter.

The money for these transactions will be taken from your

current account. All transactions will appear on your

current-account statement, with details such as the date, the

place the transaction was made, and the amount you paid.

A daily spending limit is automatically set on your account to

limit the amount you can withdraw from a cash machine. If

you are under 16, you have to apply for a spending limit to be

set on your account for you to be able to use your card at

point of sale (you will need permission from your parent or

guardian). If you want to change either of these limits, please

speak to your branch.

MasterCard credit card

We may issue a MasterCard credit card as part of Our

personal packages referred to in this booklet (except Danske

Basic). Whether we issue a MasterCard credit card depends

on your age and circumstances.

A credit card allows the person named on the card to charge

purchases to the credit card account.

You will have a separate account for your credit card and we

will tell you what your credit limit is. We will send you a

statement each month, which will give you details of the

amount that you have spent and the minimum payment you

need to make. You can use your MasterCard credit card at

more than 24.6 million outlets worldwide.

Sect ion 1 - Important informat ion

You can make payments in any of the following ways.

• By direct debit

• Through our eBanking service or 24 Hour Telephone

Banking service

• By taking your statement to your bank and paying by cash

or cheque

• By sending a cheque to Danske Bank, Clearing Control

Unit, Donegall Square West, Belfast, BT1 6JS

When you make a payment you must make sure that you give

us the sort code and account number for your MasterCard

credit card account. You will find this information on your

credit card

statement.

You should read the summary box (in this section of the

booklet) which applies to the credit card for the package you

have chosen.

Visa credit card

You can apply for a Visa card when you apply for any of Our

personal packages. A Visa card is not part of the package.

Whether we issue a Visa card depends on your age and

circumstances.

Danske 3D Secure

Danske 3D Secure is provided by Us in association with

MasterCard Secure Code™ and Verified by Visa™. Danske

3D Secure is a secure way of using your debit card, your

MasterCard credit card or your Visa credit card to make

purchases on the internet with organisations who take part

in the scheme. Please refer to section 2 for full terms and

conditions or contact your branch for more information.

Danske eSaver

You can also apply for Danske eSaver, which is an instant

access savings account. You get access to your Danske

eSaver account through our eBanking or 24 Hour Telephone

Banking services.

Phone Calls

Call charges may vary. Please refer to your service provider.

Services available for Our customers

at the Post Office®

Cash Deposit Service

You can deposit sterling cash to your Danske Bank account

in the UK at any Post Office® branch in Northern Ireland or

in Great Britain. Details of this service are as follows:

• you must have a valid Danske Bank debit card for the

account into which the deposit is being made – we will use

the details from the card to identify the sort code and

account number of the account to be credited. If you do

not have a debit card you may request one. Debit cards

are not available with all accounts;

• you must present your Danske Bank debit card with the

cash you want to lodge. You will be required to either place

your card into the chip and PIN terminal or hand it to the

Post Office® teller. You will not be required to enter a

Personal Identification Number (PIN);

5

• you may deposit up to £20,000 sterling containing a

maximum of £250 sterling in coin in a single deposit at

over 400 Post Office® branches in Northern Ireland

although restrictions may apply in some branches where

lower single deposit levels may be in place;

• prior to deposit, notes must be sorted by denomination

amounts and coin must be sorted by denomination

amounts and presented in full bags;

• the Post Office ® teller will issue a printed

acknowledgement to you which you should keep for your

own records;

• the cash deposit will be credited to your Danske Bank

account on the next business day and that will be the

Entry Date which appears on your bank statement. Please

refer to the Payment Table on page 33 of this booklet for

details.

Further details of this service are available from any Danske

Bank branch in the UK or at www.postoffice.co.uk or

www.danskebank.co.uk .

Cheque Deposit Service

You can lodge sterling cheques to your Danske Bank account

at selected Post Offices® in Northern Ireland. Details of the

service are as follows:

• you must place the cheques and a completed pre-printed

Bank Giro Credit into a Danske Bank deposit envelope. You

can request a book of personalised Bank Giro Credits

from your branch. Deposit envelopes are available from

the Post Office® or from any Danske Bank branch in

Northern Ireland;

• the sort code and account number (taken from the Bank

Giro Credit) must be detailed on the envelope in the

spaces provided;

• the Bank Giro Credit must be completed with the total of

the cheques to be lodged;

• the envelope should be handed to a Post Office® teller,

who will issue you with a printed acknowledgement which

you should keep for your own records;

• cheque deposits made in this way and prior to the cut-off

time which applies in the Post Office® branch where the

deposit is being made, will be received by Us on the next

business day and that will be the Entry Date which

appears on your bank statement. Please refer to the

Payment Table on page 32 of this booklet for further

details.

Details of Post Office® branches offering the Cheque

Deposit service are available from the Post Office® or from

any Danske Bank branch in Northern Ireland. You can also

obtain details via the internet on www.postoffice.co.uk or

www.danskebank.co.uk .

Cash Withdrawal Service

You can withdraw cash from your Danske Bank account at

any Post Office® branch in Northern Ireland or in Great

Britain. Details of this service are as follows:

• you must have a valid Danske Bank debit card and PIN for

the account from which you wish to make the withdrawal;

• you may withdraw up to £500 if the balance available on

your account and the daily cash withdrawal limit

applicable to your card allows.

• you must advise the Post Office® teller of the amount

that you want to withdraw and place your card into the

chip and PIN terminal. The amount of the withdrawal will

Sect ion 1 - Important informat ion

appear on the chip and PIN terminal. When you enter your

PIN you will authorise the withdrawal;

• the Post Office® teller will hand you your cash along with

a printed acknowledgement for your own records.

• withdrawals made at the Post Office® branch will be

debited from your account on the next business day and

that is the Entry Date which will appear on your bank

statement. The available balance on your account will be

reduced immediately by the amount of the withdrawal.

Please refer to the Payment Table on page 33 of this

booklet for further details.

Further details are available from any of Our branches in

Northern Ireland or at www.postoffice.co.uk or

www.danskebank.co.uk.

Balance Enquiry Service

You can obtain a balance enquiry for your Danske Bank

account at any Post Office® branch in Northern Ireland or in

Great Britain. Details of this service are as follows:

• you must have a valid Danske Bank debit card and PIN for

the account on which you wish to make the balance

enquiry;

• you will be required to place your card into the chip and

PIN reader and when prompted, enter your PIN;

• the Post Office® teller will hand you a printout with your

balance detailed.

Further details are available from any of Our branches in

Northern Ireland, at www.postoffice.co.uk or at

www.danskebank.co.uk

Using your cards safely

We can monitor how you use your debit card and credit

card, and we may contact you or suspend your debit card

or credit card (without contacting you) if we think that it

could be misused. If you are travelling abroad, we

recommend that you contact your branch

to tell them that you may be using your debit card or

credit card outside the UK.

6

Basic bank account

The Danske Basic account is a basic bank

account. Features of this account are as follows.

• You can register for our eBanking and 24 Hour Telephone

Banking services, which give you a quick and easy way to

carry out your banking transactions at a time that suits

you best. (These services may be temporarily unavailable

during periods when we are carrying out routine

maintenance.)

• A debit card. As well as being able to make withdrawals at

cash machines both in the UK and abroad, or make a

donation to a charity (where the cash machine provider

offers this service), you can also use your debit card to

withdraw cash and make lodgements at a Post Office®

counter and pay for goods and services at shops, hotels,

petrol stations and so on, over the phone and through the

internet.

• You can set up direct debits and standing orders on your

account, free of charge.

• We will send you account statements half yearly. We will

also send you a statement at the end of any calendar

month where you have had a payment transaction on your

account.

You cannot get an arranged overdraft or a chequebook with

your Danske Basic account.

Refer to 'Explanation of personal package features' for

additional information on the features listed above.

Some fees and service charges may apply. Please see the

‘Fees and service charges explained’ leaf let or the document

called ‘Customer Information on fees and service charges

and interest - Personal Current Accounts’ we issued with

your customer agreement. By using 24 Hour Telephone

Banking, eBanking and cash machines, you could save money.

You can get more information about basic bank accounts on

the Money Advice Service's website at

www.moneyadviceservice.org.uk

Sect ion 1 - Important informat ion

SUMMARY BOX – Danske MasterCard Standard Credit Card

SUMMARY BOX – Danske Visa Credit Card

The information contained in this table summarises key product features and is not intended to replace any

terms and conditions

The information contained in this table summarises key product features and is not intended to replace any

terms and conditions

APR

• Representat ive 22.9% APR var iable

Monthly

Rate

Annual

Rate

0% (for 5 months from date of card issue) if we

tell you in writing that you are entitled to an

Introductory Rate

1.73%

20.76%

Purchases

Not applicable

1.73%

20.76%

Cash advances

Cash advances

Balance

transfers

Interestfree

per iod

Interest

charg ing

informat ion

0% (for 5 months from date of card issue) if we

tell you in writing that you are entitled to an

Introductory Rate

1.73%

Balance

transfers

20.76%

•

Maximum 59 days for purchases and balance transfers if you pay your balance in

full and on time.

•

In addition there is an interest free period on purchases and balance transfers

during the introductory period if we tell you in writing.

•

There is no interest free period on cash advances.

You will not pay interest on new purchases if you pay your balance in full and on time.

Otherwise, the period over which interest is charged will be as follows:

From

Until

Purchases

The date by which you must make your

minimum payment as shown in your statement

for the month in which the transaction is made.

Repaid in full

Cash advances

The date your account is debited (this appears

on your statement as the interest date).

Repaid in full**

Balance

transfers

The date by which you must make your

minimum payment as shown in your statement

for the month in which the transaction is made.

Repaid in full

If you do not pay off your balance in full, we will allocate payments we receive to your account

in the following order:

•

Towards balances on which interest is charged at the Standard Rate;

•

Towards balances on which interest is charged at any rate which is less than the

Standard Rate; and

•

Introductory Rate

Monthly

Rate

Annual

Rate

0% (for 5 months from date of card issue) if we

tell you in writing that you are entitled to an

Introductory Rate

1.73%

20.76%

Not applicable

1.73%

20.76%

0% (for 5 months from date of card issue) if we

tell you in writing that you are entitled to an

Introductory Rate

1.73%

20.76%

Interest

rates

Interestfree

per iod

Interest

charg ing

informat ion

** If you pay the balance in full, the interest charge for the period from the previous

statement to the date of full repayment will be debited the following month.

Allocat ion of

payments

• Representat ive 22.9% APR variable

Introductory Rate

Interest

rates

Purchases

APR

•

Maximum 59 days for purchases and balance transfers if you pay your balance in full

and on time.

•

In addition there is an interest free period on purchases and balance transfers during

the introductory period if we tell you in writing.

•

There is no interest free period on cash advances.

You will not pay interest on new purchases if you pay your balance in full and on time.

Otherwise, the period over which interest is charged will be as follows:

From

Until

Purchases

The date by which you must make your

minimum payment as shown in your statement

for the month in which the transaction is made.

Repaid in full

Cash advances

The date your account is debited (this appears

on your statement as the interest date).

Repaid in full**

Balance

transfers

The date by which you must make your

minimum payment as shown in your statement

for the month in which the transaction is made.

Repaid in full

** If you pay the balance in full, the interest charge for the period from the previous

statement to the date of full repayment will be debited the following month.

Allocat ion of

payments

If you do not pay off your balance in full, we will allocate payments we receive to your account

in the following order:

•

Towards balances on which interest is charged at the Standard Rate;

•

Towards balances on which interest is charged at any rate which is less than the

Standard Rate; and

•

Towards balances on which interest is charged at 0%.

Towards balances on which interest is charged at 0%.

See condition 3.5 of the terms and conditions that apply to your Agreement

See condition 3.5 of the terms and conditions that apply to your Agreement

Minimum

repayment

•

Greater of 3% of current balance, or the total of interest and default charges on the

statement plus 1% of the current balance (less interest and default charges), or £5,

each month.

•

If you only make the minimum payment it will take longer and cost more to clear your

balance.

Minimum credit limit

£250

Credit limit

Maximum credit limit

Fees

•

Charges

Cash advances^

Greater of 3% of current balance, or the total of interest and default charges on the

statement plus 1% of the current balance (less interest and default charges), or £5,

each month.

•

If you only make the minimum payment it will take longer and cost more to clear your

balance.

Minimum credit limit

£250

Maximum credit limit

Subject to status

Credit limit

2% with a £2 minimum

Fees

•

Charges

Cash advances^

2% with a £2 minimum

Copies of statements

£5 each

Copies of transaction vouchers

£5 each

£5 each

No annual fee

Copies of transaction vouchers

£5 each

Emergency cards and emergency cash

£20 (if you should ask us to issue an emergency

card or emergency cash to you)

Emergency cards and emergency cash

£20 (if you should ask us to issue an emergency

card or emergency cash to you)

Danske Bank Card Exchange Rate (UK)

Rates can be found at

www.danskebank.co.uk/travelmoney

Danske Bank Card Exchange Rate (UK)

Rates can be found at

www.danskebank.co.uk/travelmoney

Foreign Usage Non-Sterling Transaction Fee

Default

charges

•

Subject to status

No annual fee

Copies of statements

Minimum

repayment

2.75% (including purchases of foreign currency and

travellers’ cheques outside the UK)

Cash Fee*

2% with a minimum of £2

Late payment charge

£8

Foreign Usage Non-Sterling Transaction Fee

Default

charges

2.75% (including purchases of foreign currency and

travellers’ cheques outside the UK)

Cash Fee*

2% with a minimum of £2

Late payment charge

£8

*Payable in addition to the Non-Sterling Transaction Fee in certain

circumstances. See www.danskebank.co.uk/travelmoney for more

information.

*Payable in addition to the Non-Sterling Transaction Fee in certain

circumstances. See www.danskebank.co.uk/travelmoney for more

information.

^ Maximum daily withdrawal limit at cash machines is £500 per day.

^ Maximum daily withdrawal limit at cash machines is £500 per day.

APR stands for ‘annual percentage rate’. It aims to give people a more

accurate idea of how much they are being charged when they borrow money. It

allows people to compare the total cost of borrowing money for different types

of loan and lengths of time.

APR stands for ‘annual percentage rate’. It aims to give people a more

accurate idea of how much they are being charged when they borrow money. It

allows people to compare the total cost of borrowing money for different types

of loan and lengths of time.

Credit card pricing

An explanation of credit card pricing can be found on our website at www.danskebank.co.uk in the Personal cards section under

'Tips and Information'.

7

Sect ion 1 - Important informat ion

Important information

Using your current account

Your bank account details

Each account you open will have a sort code and account

number. The sort code and account number are used when

you make payments to or from your account in the UK.

The sort code is a six-digit number which is used to

identify your branch. Your account number is an

eight-digit number which is used to identify your account at

that branch. You will find your sort code and account number

printed on your paying-in slips, on the footer of each of the

cheques in your chequebook (if we have issued one for your

account) and bank statements. On your bank statement the

sort code and account number are combined (in that order)

into a fourteen digit Account Number for Your Account. The

first six digits are your sort code and the last eight digits are

the account number. The name of your account is

usually your own name. The name of your account will also

appear on your paying-in slips, cheques, cards and

statements.

When you make payments to your account from an account

which is outside the UK, or you make payments from your

account to an account which is outside the UK, you will need

to use the Bank Identifier Code(BIC) and the International

Bank Account Number (IBAN). The BIC for all of your

accounts is DABAGB2B.

The IBAN for each of your accounts is unique. You can find

the IBAN for your account on your bank statement or by

asking your branch. If money is sent to your account from

abroad the correct

IBAN (International Bank Account Number) must be used to

make sure the payment is received. If you are sending money

to an account abroad then you must take care to quote the

correct BIC and IBAN for the payee's account. It is important

that you use the correct BIC and IBAN when making a

payment to another bank account abroad.

When you are making payments into or out or your account it

is important that you use the correct sort code and account

number (for payments within the UK) or the correct BIC and

IBAN (for payments outside of the UK). If you use the wrong

details, your payment may be delayed or not paid. We are

not liable for any payment that is delayed, not paid or paid

incorrectly because you have given us the wrong details.

However, we will make reasonable efforts to try to recover

any money paid incorrectly.

Your statements

We will regularly send you account statements. You will also

get extra information with your statement. This will tell you

more about the service charges and interest rates which

could apply to your account. You can also get ministatements on your account at a Danske Bank cash machine

in the UK, on eBanking or through our 24 Hour Telephone

Banking service. You should use your statements to keep

track of your money. You should always check your statement

carefully and tell your branch straight away if there are any

mistakes. For more information on 'How to read your

statement' visit our website at www.danske.co.uk

Security

You should keep information about your bank account in a

secure place at all times. This includes your chequebook,

cards and PIN (personal identification number). You should

keep your card separate from your chequebook. Always

remember to keep your PIN secret and do not let anyone

know what it is – not even bank staff. If you find it hard to

remember your PIN, you can change it to a number which is

easier to memorise. You can do this at any Danske Bank

cash machine in the UK.

If you throw away bank correspondence (such as cash

machine receipts, mini-statements, old chequebooks and

8

expired cards), you should first shred any paper.

You should cut through the chip and any magnetic stripe on

any card you destroy.

If your cheque book, card, PIN or personal password has

been lost or stolen or if you suspect that anyone else has this

information, you should contact us immediately. You can do

this in any of the ways set out on our website and in your

terms and conditions.

Terms and conditions

You should read the terms and conditions for your accounts

carefully. If there is anything you do not understand, please

ask us for help. To make our terms and conditions easy for

you to understand we have divided them into 'General Terms

and Conditions' which apply to all our personal current and

savings accounts, and 'Special Terms and Conditions'. The

General Terms and Conditions are set out in section 2. The

Special Terms and Conditions are set out in the later parts of

this booklet. Once you sign the customer agreement, you will

be bound by these terms and conditions.

We can change the terms and conditions for your accounts –

the times when we can do this are set out in the General

Terms and Conditions. Nothing in the terms and conditions

will take away your legal rights relating to goods or services

which are faulty or which we have misdescribed. For more

information about your statutory rights, contact your local

trading standards department or Citizens Advice Bureau.

Fees and service charges

You may have to pay fees and service charges for some of

the services we provide. You can find details of these in the

‘Customer information on fees and service charges and

interest - Personal Current Accounts’ document attached to

your customer agreement. You can also get a copy of our

‘Fees and service charges explained’ leaf let from any branch

and on our website at www.danskebank.co.uk.

Interest rates

We have already given you details of the interest rates that

will apply to the accounts. If we reduce the credit interest

rates then we will give you two months' written notice. The

debit interest rates are based on the Bank of England Base

Rate. When Bank of England announce a change to its official

Base Rate, we will apply the change from the start of the

Business Day following the rate change. We will display

notices in our branches, on our website at

www.danskebank.co.uk and in the Belfast Telegraph, the

News Letter or Irish News (or all of them) within three

business days of the change coming into force.

Payments to and from your account

It's easy to make payments both to and from your account.

You can do this in a number of ways

• Direct payments into or from your account

• Cash payment into or from your account

• Cheque payment into or from your account

For full details about payments to and from your account,

please read clauses 3, 4, 5, 6, 7 and 10 of the General Terms

and Conditions in section 2.

The Payment Table on pages 32 to 36 sets out the timings

for payments into and out of your account.

Sect ion 1 - Important informat ion

Changing your mind

Financial difficulties

You can cancel the customer agreement if you change your

mind about the package you have chosen within:

If you are having financial difficulties, you should let us know

as soon as possible. We will do all we can to help you

overcome your difficulties. With your co-operation, we will

develop a plan with you for dealing with your financial

difficulties and we will tell you in writing what we have

agreed. If you want to arrange an appointment, you can call

us on 0845 600 2882 (or 0044 2890 049221 if you are

outside the UK) between 8am and 8pm Monday to Friday and

between 9am and 4.30pm on Saturdays (except for bank

holidays or other holidays in Northern Ireland when the bank

is not open for business). For more information, visit our

website at www.danskebank.co.uk

• 14 days of the date after the date you signed the

customer agreement; or

• 14 days of the date after the date you received this

booklet and any other information relating to the

products and benefits in the package you have chosen

(whichever date is later).

You must give us written notice that you are cancelling the

agreement.

If you are liable (legally responsible) for repaying any

amounts in relation to any of the products or services in the

package you have chosen, you must repay those amounts

before we can cancel the agreement.

Joint accounts

A joint account is an account that is opened in the names of

two or more people. Opening a joint account is

straightforward but you should only open a joint account if

you and the other joint account holders understand the

commitments you are entering into. You also need to think

about what would happen if you split up or if one of you died.

If you are worried about how the other joint account holders

may use the joint account, you should carefully consider

whether a joint account is suitable for you.

When you open a joint package with Us, you will have to

agree to use the current account (or current accounts)

within the package on the basis that any one of the account

holders can authorise transactions without having to get

permission from the other account holders (this is called an

‘Either to sign’ or ‘Anyone to sign’ mandate). If you want to

open a joint account with a ‘Both to sign’ or ‘All to sign’

mandate, please speak to your adviser.

For further details about joint accounts, please read clause 2

of the General Terms and Conditions in section 2.

Additional information on Joint Accounts is also available on

the British Bankers' Association (BBA) website

www.bba.org.uk

"You and your joint account".

9

We may record or monitor calls for your protection, to train

our staff and to maintain the quality of our ongoing service.

Call charges may vary. Please refer to Your service provider.

Sect ion 1 - Important informat ion

Putting things right for you

We are committed to providing a high standard of customer

service. If you are not satisfied with any part of our service,

we have procedures in place to deal with your concerns

effectively and in the correct way. If you want to make a

complaint, please follow the steps below. Please provide as

much relevant information as possible, including your

account details, the branch or part of the business involved,

a summary of your complaint and any action already taken to

deal with the issue.

Step 1

You can contact us as follows:

In person

Visit any of our branches and talk to one of our team. You

can find your nearest branch and its opening hours at

www.danskebank.co.uk

Online

Visit www.danskebank.co.uk and click on the ‘Contact us’ link

on the homepage. Click on ‘Make a complaint’ and you’ll then

be able to write to us using our online form.

In writing

You can write to Us at:

Danske Bank

PO Box 2111

Belfast

BT10 9EG

Step 2

We always aim to deal with complaints in a way you are

satisfied with. However, if you are not satisfied with the final

or written response you receive from us you may be able to

refer your complaint to the Financial Ombudsman Service

('FOS').

You should send your complaint to:

Financial Ombudsman Service

South Quay Plaza

183 Marsh Wall

London

E14 9SR

Phone: 0845 080 1800

Email: [email protected]

You must normally refer the complaint to them within six

months of the date of our final response.

The Financial Ombudsman Service can help with complaints

about most financial problems involving products and

services provided in, or from, the UK. However, some

restrictions apply.

You will also be able to contact the Financial Conduct

Authority if you think that we may have broken the Payment

Services Regulations 2009.

By phone

You can call us on 0845 600 2882. When you call you’ll

need to have your account information handy.

You can contact the FCA by writing to:

(Lines are open between 8am and 8pm Monday to Friday and

between 9am and 4.30pm on Saturdays except for bank

holidays or other holidays in Northern Ireland when the bank

is not open for business. We may record or monitor calls for

your protection, to train our staff and to maintain the quality

of our ongoing service).

Financial Conduct Authority

25 The North Colonnade

Canary Wharf

London

E14 5HS

One of our complaint handlers will make sure that your

complaint is fully investigated and try to deal with the matter

in a way you are satisfied with. We will deal with all

complaints promptly and impartially (that is, in a fair and

unbiased way). If we have not dealt with your complaint by

the close of business on the business day after we receive

your complaint, we will send you a letter acknowledging your

complaint. This letter may also include our final response to

your complaint. If we need more time to investigate your

complaint, we will keep you informed of the steps we are

taking to deal with it.

The FCA will use this information to inform its

regulatory activities.

In all cases, within eight weeks of receiving your complaint

we will send you a letter explaining:

•

•

10

our final response; or

why we cannot provide a final response yet, and when

we expect to be able to do this.

If any part of your complaint relates to a product another

company has provided (for example, an insurance product),

we will send that part of your complaint to that company. We

will do so promptly. We will also give you a final response to

explain why we have sent that part of your complaint to the

other company, and that company’s contact details.

Sect ion 1 - Important informat ion

How we use your personal and business information

Danske Bank is a trading name of Northern Bank Limited.

Northern Bank Limited is a member of the Danske Bank

Group (the Group).

At Northern Bank Limited, we store your information to

manage your accounts and to provide services which suit

your needs. We have explained below what information we

hold and how we use it.

What information do we hold?

As one of our customers, you give us certain information,

such as your name and address. We may currently hold

other personal and financial information about you and we

may get or receive more information about you in the future.

This information may include:

•

•

•

•

details you give us on application forms;

information we get from how you use your accounts;

details of who supplies goods and services to you;

information from other organisations, such as credit

reference and fraud prevention agencies; and

• information from people who know you, such as joint

account holders and people you are financially linked

to.

There may be times when the information we hold about you

includes sensitive personal data, such as information

relating to your health, racial or ethnic background, sexual

life, criminal convictions or proceedings. We will only hold

this data when we need to for the purposes of the product or

services we provide to you or when we normally do so in the

course of our business.

If you are a business customer, the information we hold will

also include details you or other people (such as your

advisers) give us during financial reviews and interviews, as

well as information we get from analysing the banking

transactions of the business.

How we use your information

As well as using your information to manage the products

and services we provide to you, we may need to use your

data for a number of other reasons. These include the

following.

• When you ask for a service or product from us, we will

use the details you provided and other details (such as

how you manage your accounts with us) to help us in

our assessment process.

• We will use your information to assess whether our

products and services are suitable for you, including

making credit decisions about you. This may involve

credit scoring.

• We may use your information for research purposes

and regular statistical analysis (including risk and

credit analysis) to develop, improve and market our

products and services, to understand your buying

preferences and to produce management information

relating to risk.

• We may use your information to prevent fraud and

recover debts.

If you are financially linked to another account holder within

the Group, we may look at your information when deciding

whether to approve an application for credit by the person

you are linked to, including when that person applies on

11

behalf of a business that he or she owns. (For a full list of

companies in the Group, please contact your branch or write

to the Data Protection Officer, Danske Bank, Donegall

Square West, Belfast, BT1 6JS.)

We may link information about your accounts with us to

information about other products and services we provide to

you. We may also link your information to the information

relating to other people you are financially linked to, if you

make a joint application or if you tell us that you have a

husband, wife, civil partner or partner.

Confidentiality

We appreciate that it is important for you to know that we

will not give your personal and business information to

anyone else. We will treat all your information as confidential

at all times, even when you are no longer a customer. This

means that we will not pass on information about you,

unless:

• we have your permission to do so;

• we must provide this information by law;

• we have a duty to the public to share the information;

or

• it is in our own interests to do so (for example, to

prevent fraud or recover money you owe us).

There are other circumstances where we need to provide

information to other people to help us and you to run your

accounts. We do so when it is in your interests as well as

ours. We have set out these circumstances below.

We subscribe to the Lending Code which sets minimum

standards of good practice in the UK. To meet our duties to

regulators, we may allow authorised people to see our

records (which may include information about you) for

reporting, compliance and auditing purposes. For the same

reason, we will also hold the information about you when you

are no longer a customer.

We may also share information with certain statutory

bodies, eg the Financial Services Compensation Scheme

(FSCS) if required by law.

We may provide information about you to someone you

nominate or authorise to act on your behalf.

If we provide you with products and services involving

insurance, we must pass your details to insurers. Insurers

may keep a record, on a register of claims, of information you

provide in connection with any claims made under the

insurance. Insurers may use this register to prevent

fraudulent claims. You can get a list of companies who use

the register, and details of the register operator, from the

insurers.

We may exchange information about you with other

companies in the Group to assess credit risk, to prevent

fraud or manage risk, or to help us run your accounts. We

may also share your information within the group to prepare

research and analyse statistics (including analysing risk and

credit) so that we can improve our services. We may

exchange information about you with other companies in the

group for marketing purposes if you give us your permission.

Sect ion 1 - Important informat ion

Service providers

We will sometimes arrange for service providers, agents

and subcontractors sometimes from outside the EEA, to

provide services and process your information on our behalf.

We will make sure that these service providers, agents and

subcontractors have a duty to keep your information

confidential and secure, and that they only process your

information as set out in a written contract.

Protecting you

We may use your information to protect you in the following

ways.

• We may record or monitor phone calls for your

protection, to train our staff and to maintain the quality

of our service.

• We use CCTV to record images in and around our

premises to prevent and detect crime.

• Before we provide any service, we will carry out antimoney-laundering checks, which may include searches

to confirm your identity.

Credit reference and fraud prevention agencies

We may use credit reference and fraud prevention agencies

to help us make decisions when you apply for a credit

product or for a product which allows you to get credit.

If you provide false or inaccurate information and we find

that you have committed fraud, we will pass your details to

fraud prevention agencies.

Law enforcement agencies may access and use this

information.

We and other organisations may also access and use this

information to prevent fraud and money laundering, for

example, when:

• checking details on applications for credit and creditrelated or other facilities;

• managing credit and credit-related accounts or

facilities;

• recovering debt;

• checking details on proposals and claims for all types

of insurance; and

• checking details of job applicants and employees.

Please contact your branch or write to the Data Protection

Officer, Danske Bank, Donegall Square West, Belfast, BT1

6JS if you want to receive details of the relevant fraud

prevention agencies.

We and other organisations may access and use from other

countries the information the fraud prevention agencies

record.

What we do and how both we and credit reference and fraud

prevention agencies use your information is explained in the

section called ‘A guide to how we and credit reference and

fraud prevention agencies use your personal information’ (on

pages 13 to 15 of this booklet).

12

Please help us – We want our service to meet your

expectations at all times. For it to do so, we need the

information we hold about you to be accurate and up to date.

Please help us by telling us straight away if there are any

changes to your personal circumstances.

You can check the contact details that we have for you

through eBanking or by contacting your branch. It is

important that you tell us about any changes to your contact

details, including your email address or mobile number.

You are entitled to a copy of the personal information we hold

about you. We charge a small administration fee for

providing this information. You can also ask us to correct any

mistakes in the information we hold about you. You must

write to us if you want to see this information.

Keeping you up to date with e-mail and text messages

We are keen to keep you up to date with changes to the

service we provide (for example, if we extend our opening

hours at your local branch) or interruptions to our service,

and also to remind you to activate and use the online

services you have registered for.

If we have your email address or mobile number, we will use

these to send you messages. All our emails and text

messages will not be encrypted but they will not contain any

personal information. You should never give personal

information such as your name, address, date of birth, PIN or

account number in an email or text message unless you have

subscribed to a service where this information is part of the

log-in process. If you want to email us, do so through

eBanking.

If you do not want us to contact you by text message or email,

please contact us and we will delete these details from our

records. Or you can delete the details yourself through

eBanking (under the heading ‘Are your details correct?’).

Keeping you up to date about our products and offers

Through our marketing programme, we will identify and tell

you about products and services supplied by the group or

other chosen organisations that we consider may be of

interest to you. We may contact you by post, phone or other

reasonable methods (unless you have asked us not to) and

we will give you enough details so that you can make an

informed choice. We may also contact you by e-mail, text

message and fax if you ask us to.

You do not have to accept the products or services we offer.

You can tell us in writing at any time if you do not want to

receive marketing information. We will remind you of this

right at least once every three years.

Sect ion 1 - Important informat ion

Important data protection

A guide to how we and credit reference and fraud

prevention agencies use your personal information

What is a credit reference agency?

Credit reference agencies collect and maintain information

on consumers’ and businesses’ credit behaviour, on behalf of

organisations in the UK.

What is a fraud prevention agency?

Fraud prevention agencies collect, maintain and share

information on known and suspected fraud. Some credit

reference agencies also act as fraud prevention agencies.

Why do you use them when I have applied to your

organisation?

Although you have applied to us, we will not only check our

own records but will also contact credit reference agencies

to get information on your credit behaviour with other

organisations. This will help us make the best possible

assessment of your overall situation before we make a

decision.

Where do they get the information?

They get information from the following sources.

• Information that is available to the public, such as:

– the electoral register from local authorities;

– county court judgments from Registry Trust; and

– bankruptcy orders (and other similar orders) from

the Insolvency Service.

• Fraud information may also come from fraud

prevention agencies.

• Credit information comes from information on

applications to banks, building societies, credit card

companies and so on, and also from how those

accounts have been managed.

How will I know if you are sending my information to a credit

reference agency or fraud prevention agency?

We will tell you when you apply for an account if we are going

to give your information to a credit reference agency or a

fraud prevention agency. The next section of this document

will tell you how, when and why we will search at credit

reference agencies and fraud prevention agencies and what

we will do with the information we get from them. We will

also tell you if we plan to send information about your or your

business’s payment history to credit reference agencies. You

can ask us, at any time, which credit reference agencies and

fraud prevention agencies we use.

Why do you use my information in this way?

We and other organisations want to make the best possible

decisions we can, to make sure that you or your business will

be able to repay us. Some organisations may also use the

information to check your identity. In this way, we can make

sure that we all make responsible decisions. At the same

time, we also want to make decisions quickly and easily and,

by using up-to-date information, we can make the most

reliable and fair decisions possible.

13

Who controls what these agencies are allowed to do with

my data?

All organisations that collect and process personal data are

regulated by the Data Protection Act 1998, overseen by the

Information Commissioner’s Office. All credit reference

agencies regularly consult the Commissioner. How the

agencies use the electoral register is controlled by the

Representation of the People Act 2000.

Can just anyone look at the information the credit reference

agencies hold about me?

No. Access to your information is very strictly controlled and

only the people that are entitled to see it can do so. Usually

that will only be with your permission or, in rare cases, if

there is a legal duty.

Please read this section very carefully, as it will vary

from lender to lender.

What we do

1 When you apply to us to open an account, we will do the

following.

1a Check our own records for information on:

1a1 your personal accounts;

1a2 your financial associates’ personal accounts (if

this applies); and

1a3 your business accounts, if you are an owner,

director or partner in a small business.

•

A financial associate will be someone you have a

personal relationship with that creates a joint financial

unit in a similar way to a married couple. You will have

been living at the same address at the time. It does not

include temporary arrangements such as those between

students, people who share a rented f lat, or business

relationships.

•

A small business is an organisation (a sole trader,

partnership or a limited company) that has three or

fewer partners or directors.

1b Search at credit reference agencies for information on:

•

your personal accounts;

•

your financial associates’ personal accounts, if

you are making a joint application now or you have

previously made joint applications, had joint

accounts or been financial linked to other people;

•

other members of your family, if we do not have

enough information to help you (we will only do

this in rare cases); and

•

your business accounts, if you are a director or

partner in a small business.

1c Search at fraud prevention agencies for information on

you and any addresses you have lived at, and your

business (if you have one).

2

What we do with the information you give us as part of

the application

2a We will send your information to the credit reference

agencies.

Sect ion 1 - Important informat ion

2b If you are making a joint application or you tell us that

you have a husband, wife, civil partner or financial

associate, we will:

•

search, link and record information at credit

reference agencies about you both;

•

link your records with the records of any person

you identify as your financial associate;

•

take both your and their information into account

in applications you or they or both of you make in

the future; and

•

continue this linking until the account is closed or

is changed to a sole account and one of you tells

us that you are no longer linked.

So, you must be sure that you have their permission to

give us information about them.

2c If you give us false or inaccurate information and we

suspect or identify fraud, we will record this and may

also pass this information to fraud prevention agencies

and other organisations involved in preventing crime and

fraud.

2d We may also use your information to offer you other

products, but only if you have given your permission.

3 With the information we gather, we will:

3a assess your application for credit (sometimes using

scoring methods);

3b check details on applications for credit and

credit-related facilities or other facilities;

3c confirm your identity and the identity of your husband,

wife, civil partner, partner or other directors and

partners (sometimes using scoring methods);

3d carry out checks to prevent and detect crime, fraud and

money laundering;

3e manage your personal and business accounts (if you

have one) with us; and

3f from time to time, analyse statistics or carry out testing

to make sure existing and future products and services

we provide are accurate.

Any or all of these processes may be carried out as part of

an automated system.

4 What we do when you have an account

4a If you borrow or may borrow from us, we will give credit

reference agencies details of your personal and business

accounts (if you have one), including account names,

details of the people who hold those accounts with you,

and information on how you manage the accounts.

4b If you borrow money and do not repay it in full and on

time, we will tell the credit reference agencies.

4c We may regularly search our own group records and the

records of credit reference agencies to manage your

account with us, including whether to make credit

available or to continue or extend existing credit. We

may also carry out checks at fraud prevention agencies

to prevent or detect fraud.

4d If you have borrowed from us and do not make payments

that you owe us, we will trace where you are and recover

the money from you.

14

What credit reference and fraud prevention agencies do

5

When credit reference agencies receive a search from

us, they will do the following.

5a Place a search ‘footprint’ on your credit file, whether or

not you or we go ahead with your application. If the

search was for a credit application, other organisations

may see the record of that search (but not the name of

the organisation that carried it out) when you apply for

credit in the future.

5b Link the records of you and anyone you have identified as

your financial associate, including the names (and later

or previous names) of other people who hold those

accounts with you. Links between financial associates

will stay on your and their files until you or they

successfully file for a disassociation (to break the link)

with the credit reference agencies.

•

Financial associates can ‘break the link’ between them if

their circumstances change and they are no longer a

financial unit. They should apply for their credit file from

a credit reference agency and file for a ‘disassociation’.

6 The credit reference agencies will give us:

6a credit information, such as previous applications you

have made and how you and your financial associates (if

this applies) have managed your and their accounts

(including business accounts);

6b public information, such as county court judgments

(CCJs) and bankruptcies;

6c electoral register information; and

6d information to help prevent fraud.

7

When we give the credit reference agencies

information about your personal and business accounts

(if this applies to you), the credit reference agencies

will:

7a record these details, including any previous and later

names that have been used by the account holders and

how you or they manage your account (accounts); and

7b make a record of the debts you still have left to pay, if

you borrow money and do not repay it in full and on time.

The records we share with credit reference agencies will

stay on file for six years after the accounts are closed,

whether settled by you or defaulted (not paid in full by you).

8

Credit reference agencies will not use your information

to:

8a create a blacklist; or

8b to make a decision.

Sect ion 1 - Important informat ion

9

9a

9b

9c

9d

9e

9f

9g

The information that we and other organisations

provide to the credit reference agencies about you, your

financial associates and your business (if you have one)

may be supplied by credit reference agencies to other

organisations and used by them to:

prevent crime, fraud and money laundering (for example,

by checking the details you have provided on

applications for credit and credit-related facilities or

other facilities);

check how you have managed your credit and

credit-related accounts;

check your identity, if you or your financial associate

applies for other facilities;

make decisions on credit and credit-related services

about you, your partner, other members of your

household or your business;

manage your personal, your partner’s and your business

(if you have one) credit or credit-related account or other

facilities;

trace where you are and recover debts that you owe; and

carry out statistical analysis and system testing.

10 The information that we provide to the fraud prevention

agencies about you, your financial associates and your

business (if you have one) may be supplied by fraud

prevention agencies to other organisations and used by

them and us to:

10a prevent crime, fraud and money laundering by, for

example:

•

checking details provided on applications for credit and

credit-related facilities or other facilities;

•

managing credit and credit-related accounts or facilities;

•

cross-checking details provided on proposals and claims

for all types of insurance; or

•

checking details on applications for jobs or when

checked as part of employment;

10b check your identity if you or your financial associate

applies for other facilities, including all types of

insurance proposals and claims;

10c trace where you are and recover debts that you owe;

10d carry out other checks to prevent or detect fraud; and

10e carry out statistical analysis and system testing.

Law enforcement agencies may access and use this

information.

We and other organisations may access and use from

other countries the information recorded by fraud

prevention agencies.

11 We may also use your information for other purposes

you have given your specific permission for or, in very

limited circumstances, when we must do so by law or if

we are allowed to under the terms of the Data Protection

Act 1998.

12 We may use your information to offer you other

products, but only if we are allowed to do so.

15

How to f ind out more

You can contact the CRAs currently in business in the UK by

using the following details. The information they hold may not

be the same so it is worth contacting them all. They will

charge you a small fee, as set out in the Data Protection Act

1998, for providing the information.

• CallCredit, Consumer Services Team,

PO Box 491, Leeds, LS3 1WZ

Phone: 0870 0601414

Website: www.callcredit.co.uk

• Equifax PLC, Credit File Advice Centre,

PO Box 3001, Bradford, BD1 5US

Phone: 0870 010 0583

Website: www.myequifax.co.uk

• Experian, Consumer Help Service,

PO Box 8000, Nottingham NG80 7WF

Phone: 0844 481 8000

Website: www.experian.co.uk

We subscribe to the CAIS credit account information

sharing scheme operated by Experian relating to

creditworthiness and fraud.

If you want to receive details of those fraud prevention

agencies from whom we obtain and with whom we record

information about you, contact/write to us at Danske Bank,

Donegall Square West, Belfast, BT1 6LT. You have a legal

right to these details.

Northern Bank Limited is owned by Danske Bank A/S. You

can ask for a complete list of the companies in the Danske

Bank Group at any time by writing to us at the address

above.

Sect ion 2 - Terms and Condit ions

If you have a

Danske Choice or

Danske Freedom Package or

Danske Basic Account

read this section.

Sect ion 2 - Terms and Condit ions

General Terms and Conditions - Personal Accounts

Part 1: General informat ion

These General Terms and Conditions are also available in

Braille, in large print, on tape and on disk. Please speak to

a member of staf f for details.

These General Terms and Conditions are written and

available only in English and We undertake to communicate

with You in English.

Make sure You read and understand these General Terms

and Conditions and any Special Terms and Conditions for

Your Account or Service before opening an Account.

Good Banking

We comply with the FCA's requirements to pay due regard

to customers’ interests and to treat customers fairly.

We also subscribe to the Lending Code which sets

minimum standards of good practice in the UK.

A copy of the Lending Code "A guide to the Lending Code

For consumers" is available from a link on Our Website

www.danskebank.co.uk

How You can contact Us

Our head of f ice is at

Donegall Square West, Belfast BT1 6JS.

You can contact Us by:

•

Visit ing any of Our Branches;

•

Wr it ing to Us at Danske Bank PO Box 2111,

Belfast BT10 9EG;

•

Telephoning Us on 0845 600 2882, or any of the

telephone numbers stated on Our Website. You

can call bet ween 8am and 8pm Monday to Fr iday

and bet ween 9am and 4.30pm on Saturdays,

except for bank holidays or other holidays in

Northern Ireland when the bank is not open for

business. We may record or monitor calls for your

protect ion, to train our staf f and to maintain the

qualit y of our ser v ice. Call charges may var y.

Please refer to Your ser v ice prov ider.

•

Using the secure mail funct ion on eBanking; or

•

Complet ing the general enquir y form on Our

Website

Details of the ways that You can contact Us are also

available on Our Website.

What should You do if You have a dispute relat ing to

Your Account?

If You are not happy with any part of Our service, please

ask your branch for a copy of Our leaf let ‘Putting things

right for you’ or visit Our website. We aim to deal with

complaints in away Our customers are satisf ied with.

If You have followed Our published complaint procedures

and you disagree with the f inal response We have given,

You can refer the matter to the Financial Ombudsman

Service. Details are available from Us or from

www.f inancial-ombudsman.org.uk.

17

You will also be able to contact the Financial Conduct

Authority (FCA) if You think that We have broken the

Payment Services Regulations 2009.

The FCA will use this information to inform its regulatory

activities.

Important informat ion about compensat ion

arrangements

We are covered by the Financial Services Compensation

Scheme (FSCS). The FSCS can pay compensation to

depositors if a bank is unable to meet its f inancial

obligations. Most depositors – including most individuals

and small businesses – are covered by the scheme.

In respect of deposits, an eligible depositor is entitled to

claim up to £85,000. For joint accounts each account

holder is treated as having a claim in respect of their

share. So for a joint account held by two eligible depositors,

the maximum amount that could be claimed would be

£85,000 each (making a total of £170,000). The £85,000

limit relates to the combined amount in all the eligible

depositor's accounts with the bank, including their share of

any joint account, and not to each separate account.

For further information about the compensation provided by

the FSCS (including the amounts covered and eligibility to

claim) please ask at Your local branch, refer to the FSCS

website www.FSCS.org.uk or call the FSCS on 0800

6781100 or 020 7741 4100. Please note only

compensation related queries should be directed to FSCS.

Things You should know

When you open an account with us, your account agreement

is with Northern Bank Limited, registered in Northern Ireland

(registered number R568). The terms and conditions which

we give you when you open an account with us will apply to

that agreement.

Danske Bank is a trading name of Northern Bank Limited

which is authorised by the Prudential Regulation Authority

and regulated by the Financial Conduct Authority and the

Prudential Regulation Authority (reference number

122261). We comply with the FCA's requirements to pay

due regard to customers’ interests and to treat customers

fairly. Details of our registration can be found at

www.fca.org.uk/register, or by contacting the FCA on

0800 1116768.

Northern Bank Limited is a member of the Danske Bank

Group

Our main business is to provide financial services in the

form of a bank and to provide associated products and

services, including Payment Services.

Copies of these General Terms and Conditions – Personal

Accounts and any Special Terms and Conditions which apply

to an Account or Service may be accessed and viewed via

Our Website and can be printed out by clicking on the PRINT

button on the appropriate page on Our Website.

Alternatively, You can obtain a copy at any time from Your

Branch.

Our VAT Number is GB853759092.

Sect ion 2 - Terms and Condit ions

Part 2: Def init ions

“Account” means any personal current or savings account

which You hold with Us and to which We have told You

these General Terms and Conditions will apply;

“Account Number” means the combination of your six digit

Sort Code and eight digit account number which are used

to identif y Your Account. The combined fourteen digits

appear on your bank statements and are referred to as

Your Account Number;

“Addit ional Cardholder” means any person You have

asked Us to give a Card to so that they can use the

Account;

“Agreement” means the agreement between Us and You

relating to an Account which is covered by these General

Terms and Conditions and any Special Terms and

Conditions for the Account. These General Terms and

Conditions and any Special Terms and Conditions may be

altered from time to time in accordance with Clause 27;

“Arranged Overdraf t Interest" means interest You pay

when You have an arranged overdraft or an arranged

excess in accordance with Clause 14;

“Bacs” means the Bacs payment scheme used by UK banks

for the electronic processing of f inancial transactions,

principally direct debits and Bacs direct credits. The Bacs

payment scheme operates on a 3 day processing cycle so

that the payee's account is credited 2 days after the

process commences;

“BIC” means the Bank Identif ier Code, sometimes known as

a SWIFT Code. The BIC for Your Account with Us is

DABAGB2B;

“Business Day” means a Monday, Tuesday Wednesday,

Thursday or Friday (excluding Bank and other holidays in