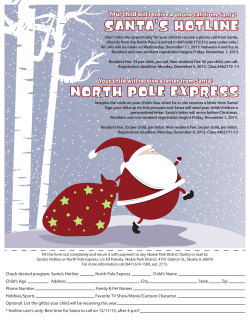

BUSINESS RESOURCE SMALL SANTA ANA