Base Metals Monthly Report

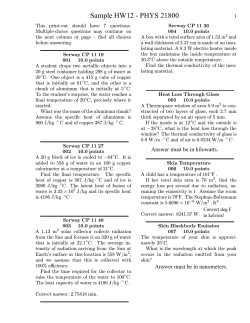

Base Metals Monthly Report Thursday| October 9, 2014 Base Metals Monthly Report Prathamesh Mallya Senior Research Analyst Non-Agri Commodities [email protected] (022) 3935 8134 Kaynat Chainwala Research Associate Non-Agri Commodities and Currencies [email protected] (022) 3935 8136 Angel Commodities Broking Pvt. Ltd. Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093. Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 2921 2000 CX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX: Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302 Disclaimer: The information and opinions contained in the document have been compiled from sources believed to be reliable. The company does not warrant its accuracy, completeness and correctness. The document is not, and should not be construed as an offer to sell or solicitation to buy any commodities. This document may not be reproduced, distributed or published, in whole or in part, by any recipient hereof for any purpose without prior permission from “Angel Commodities Broking (P) Ltd”. Your feedback is appreciated on [email protected] www.angelcommodities.com Base Metals Monthly Report Thursday| October 9, 2014 Major News and Developments Refined Copper market for June shows deficit of 27k mt Global zinc deficit at 248 kt in Jan-Jul 2014 - ILZSG In the first half of 2014, world usage is estimated to have increased by around 14.5% compared with that in the same period of 2013, supported by strong apparent demand in China. The International Lead and Zinc Study Group (ILZSG) indicate that the global zinc production has grown by almost 2% year-on-year during January to July this year. According to ILZSG, the world market for refined zinc was in deficit by 248 kt during the first seven months of the year. Higher mine output from China, Mexico and the US contributed to the 3% year-on-year growth in global Zinc mine supply. On the other hand, the mine supply from Canada, Ireland and Peru declined during the quarter. The global refined zinc metal production has increased by 4.1% during the period. This was primarily on account of increased production in China, Italy, the Republic of Korea, Norway and Poland. The global demand for refined zinc metal rose 7.7% during the seven-month period. The apparent usage of refined metal by China and the US increased 13.8% and 8.7% respectively. The refined zinc metal usage remained flat in the Europe. ILZSG statistics indicate that the zinc mine production during January to July this year totaled 7,713,000 tonnes as against 7,538,000 tonnes during the same period in 2013. The global refined zinc metal production during the period totaled 7,684,000 tonnes during Jan-Jul ’14 as against 7,383,000 tonnes in 2013. The apparent zinc usage totaled 7,932,000 tonnes during the initial seven-month period in 2014, higher from 7,368,000 tonnes during corresponding period in 2013. According to preliminary ICSG data, the refined copper market balance for June 2014 showed an apparent production deficit of 27,000 metric tonnes. Chinese apparent demand increased by 27% (1.1 Mt) based on a 47% increase in net imports of refined copper from the low net import level in the first half of 2013. World mine production is estimated to have increased by around 5% (410,000 t) in the first half of 2014 compared with mine production in the same period of 2013. World refined production is estimated to have increased by almost 8% (800,000 t) in the first half of 2014 compared with refined production in the same period of 2013: primary production was up by 7.5% and secondary production (from scrap) was up by 8%. Norilsk shares sank to a six-month low as nickel prices plunge OAO GMK Norilsk Nickel (NILSY), the best performer earlier this year among Russian shares traded in the U.S., sank to a six-month low on concern demand will weaken amid expectations for a slowdown in global economic growth. The stock has lost 20 percent since July, reversing a fivemonth rally that made it stand out as the benchmark Micex Index tumbled after President Vladimir Putin’s annexation of Crimea in March. Nickel entered a bear market last month amid a slowdown in China, the largest metals consumer, and as stockpiles ballooned to a record. www.angelcommodities.com Base Metals Monthly Report Thursday| October 9, 2014 Price Performance Economic growth may never return to pre-crisis levels IMF World economic outlook expects global growth to be 3.3% in 2014, down from its April forecasts as countries fail to recover strongly from recession. The International Monetary Fund (IMF) has cut its global growth forecasts for 2014 and 2015 and warned that the world economy may never return to the pace of expansion seen before the financial crisis. Base Metals Dismal base metals performance in Sep'14 0.0% -2.0% -4.0% -3.6% -6.0% -4.4% -8.0% -6.8% -7.1% Aluminium Lead -10.0% -12.0% -14.0% In its flagship half-yearly world economic outlook (WEO), the IMF said the failure of countries to recover strongly from the worst recession of the postwar era meant there was a risk of stagnation or persistently weak activity. The IMF’s economic counsellor, Olivier Blanchard, said the three main short-term risks were that financial markets were too complacent about the future; tensions between Russia and Ukraine and in the Middle East; and that a triple-dip recession in the eurozone could lead to deflation. The IMF said the outlook was brighter in the US and the UK, which were “leaving the crisis behind and achieving decent growth”. Zinc Copper -13.5% Nickel Base metals on the LME traded on a negative note in September as China's factory output grew at the weakest pace in nearly six years in August while growth in other key sectors also cooled, raising fears of slowdown in the world's second-largest economy and demand concerns in the biggest consumer. Also, weak housing, construction and manufacturing data from the US indicated declining activity in the sector which significantly accounts for base metal consumption dragged prices lower. Further, LME stocks of all base metals rose except Aluminium. In addition, dollar strength which jumped to 4-year high after the Federal Reserve raised interest-rate estimates to 1.375 percent, compared with 1.125 percent in June for end 2015 in its September meeting added to downside. However, prices were supported as the Fed maintained the “considerable time” language in its forward guidance, suggesting the 1st rate hike remains somewhat distant. On the MCX, base metals took cues from international markets and traded lower but Rupee depreciation restricted sharp negative movement. www.angelcommodities.com Base Metals Monthly Report Thursday| October 9, 2014 Adding to excess supply, Newmont Mining Corp sent out its first copper concentrate shipment from Indonesia in late September, while the country's largest producer Freeport-McMoRan resume shipments in early August, to end a multi-month hiatus after Indonesia imposed a hefty export tax earlier this year. According to Japan's largest copper producer Pan Pacific Copper (PPC), global copper cathode supply growth is expected to outpace demand in 2015, resulting in a surplus of 193,000 mt. With 4 new mines started in Chile and Peru in 2014 producing around 190,000 mt in 2014 and 508,000 mt in 2015, global supply increase will outgrow consumption. PPC forecasts global copper production in 2015 to be at 22.9 million mt, up 4.6% from 21.9 million mt produced in 2014 and global consumption in 2015 to reach 22.7 million mt, up 3.9% from 21.9 million mt in 2014. Demand in China, which consumes around 45 percent of the world's copper, seems to be waning. China's economy got off to a weak start this year as first-quarter growth cooled to a sixquarter low of 7.4 percent. Beijing responded with a flurry of stimulus measures that pushed the pace up slightly to 7.5 percent in the second quarter, but could not sustain the positive momentum. Cautious investors increase short positions in copper Source:Reuters, Angel Commodity 9/30/2014 8/26/2014 7/22/2014 6/17/2014 5/13/2014 4/8/2014 3/4/2014 1/28/2014 12/24/2013 11/19/2013 10/15/2013 60000 50000 40000 30000 20000 10000 0 -10000 -20000 -30000 -40000 9/10/2013 National Bureau of Statistics data showed refined copper production rose 7.4 percent to 680,128 tonnes in August from July, beating the record 654,803 tonnes in November 2013. Output in August was 20.16 percent higher than a year before. In the first eight months, output rose 11.17 percent from the same period last year to 4.93 million tonnes. Imports of copper ores and concentrate rose 6.7 percent in August from July to 960,000 tonnes. In the first eight months, imports rose 14.3 percent year on year. 8/6/2013 Copper prices on the LME continued its negative stride in September losing 4.4 percent of its value on account of record high production of refined copper in China in August. Besides, the world's top producer is continuing to build new capacity. Strong output in the world's top refined copper producer and consumer could mean end users may cut their demand for imports from the biggest consumer. In an attempt to boost growth, China's central bank provided the country's biggest banks with fresh loans of 500 billion yuan ($81.35 billion) in the earlier part of September. Additional boost was given by People's Bank of China (PBoC) by cutting the 14-day repo rate by 20 basis points to 3.5 percent in its bi-weekly open market operations, its second such move in two months after a 10 basis point reduction in July. These efforts provided temporary respite to prices and restricted them from falling further. 7/2/2013 Copper Managed Net Copper Nickel Nickel turned out to be the worst performer in Sep’14 with losses of more than 13 percent as concerns regarding supply tightening were eased after news that a ban of ore exports won’t be enacted anytime soon by the Philippines, the largest supplier to China.The Philippines last month proposed a bill to require ore minerals to be processed before shipment. Congressman Erlpe John Amante said the prohibition may not be implemented for seven years, thereby putting an end to speculation of extreme supply deficit. Also, Philippines replaced Indonesia as the largest nickel ore supplier to the country this year, with shipments climbing 6.4 percent to a record 5.33 million tons in August as per Chinese customs data. China’s total nickel ore imports last month advanced for the first time since Indonesia’s ban, climbing 6.8 percent to 5.42 million tons. Moreover, China’s output of nickel pig iron, a cheaper alternative to traditionally refined metal, is estimated to be about 450,000 tons this year, more than previously forecast, as ore prices fall amid higher supplies. www.angelcommodities.com Base Metals Monthly Report Thursday| October 9, 2014 In addition, Chinese nickel exports jumped to more than 50,000 tons over June to August, almost double its exports in the first five months of the year, helping drive LME stocks up by about a quarter since mid-June to a record 359,166 tons. This has overshadowed expectations of a deficit as soon as next year that drove a spike in nickel prices after Indonesia enforced a ban on ore exports in January. Data from the International Nickel Study Group showed global nickel market was in a 5,200 tonne surplus in July, compared with a 12,600 tonne surplus in the same period a year ago. Inventories jumped 16 percent since June 30 and are heading for an 11th straight quarterly gain, the longest streak since the data begins in 1979. Owing to all these factors, the nickel market looks well supplied despite ban by the biggest producer. Aluminium Aluminium which is the second most produced metal in the world and used in a wide range of applications, from construction and cars to packaging has seen a revival in prices in 2014. The light weight metal industry has been suffering from oversupply since 2007, mainly due to large capacity increases in China and the Middle East. Prices have been falling since 2011, leading to shutdown of smelters. After gaining for 6 consecutive months, Aluminum prices declined 8 percent in Sep’14 as economic indicators for August showed decelerating industrial production, slowing investment growth, contracting imports, subdued CPI inflation, and widening PPI deflation, fueling concerns of slowing growth in China, the world’s biggest consumer. Construction sector concerns were further fuelled by data from the National Bureau of Statistics that showed the average price of new homes in 70 Chinese cities fell at a faster pace in August, with the average price of new homes falling for the fourth straight month in August. rose 8.8 percent year-on-year to 2.027 million tonnes in August (despite dismal demand), first time it has broken above the 2 million mark, thereby dragging price lower. Further losses were avoided as the world's biggest aluminium producer Rusal forecasts a global market deficit of 1.2 million to 1.3 million tonnes next year, down from a deficit of 1.5 million this year. However, the company stated that about 40 percent of mothballed capacity could be restarted if prices remained buoyant. Also, news that the People’s Bank of China provided China’s five largest banks with CNY 100 billion each of lending facility gave base metals prices a short spike, but surge in prices soon faded as the market digest the inadequacy of the measure to boost the economy. Another attempt to boost lending and aid growth was in the money markets, with the central bank lowering the interest rate on the 14-day repurchase agreements, a short-term loan to commercial lenders, by 20 basis points to 3.50%. While the cash injection was considered a form of targeted easing measures, which Beijing has deployed in recent months to support select areas such as public housing and small business, latest cut in the money market rates suggests authorities may be tempted to use more potent weapons to loosen credit. Another factor supporting prices is falling stocks on the LME. Stocks at LME warehouses have fallen 16% this year, to two-year lows. However, at 4.6m tonnes, they are still high by historical standards. However, there is opacity regarding the underlying physical supply and demand in the market owing to speculation that this reduction was partly triggered by high storage costs in LME warehouses, and some of the metal leaving LME warehouses has been moving into cheaper nonbonded storage. As per figures from the China Nonferrous Metals Industry Association, Chinese primary aluminium output www.angelcommodities.com Base Metals Monthly Report Thursday| October 9, 2014 Outlook For Oct’14, we expect base metal prices to trade lower as Chinese demand concerns along with trimming of global growth forecast by the IMF will act as a negative factor. FOMC minutes indicating accommodative monetary policy for a longer period of time will cushion prices. Copper prices are likely to trade lower owing to escalating supply glut concerns as Newmont Mining Corp sent out its first copper concentrate shipment from Indonesia in Sep’14. In addition, Japanese copper production is expected to rise about 3 percent in the six months between Oct’14-Mar’15 from a year earlier. We expect Aluminium prices to trade lower as concerns regarding demand outlook in China, the top consumer of the metal will push prices in the negative territory. Besides, Norsk Hydro (one of the largest aluminium supplier companies) is expected to increase its aluminium output at its Sunndal plant in Norway by 30 percent by the end of the year and wants to further increase its output by an additional 35,000 mt by mid-2015. We expect Nickel prices to trade lower as supply concerns have started to ease with rising output from China and delayed ban from Philippines. Technical Levels (30 Days) Commodity LME Copper ($/tonne) MCX Copper (Rs./kg) LME Aluminium ($/tonne) MCX Aluminium (Rs./kg) LME Nickel ($/tonne) MCX Nickel (Rs./kg) LME Lead ($/tonne) MCX Lead (Rs./kg) LME Zinc ($/tonne) MCX Zinc (Rs./kg) Support 1 6506 407 1883 116 14957 930 1999 124.4 2174 135 Support 2 6362 398 1818 112 13831 860 1912 119 2077 129 CMP 6698 413 1953 119.2 16658 1024 2095 128.85 2341 143.45 Resistance 1 6874 430 2061 127 17369 1080 2186 136 2367 147 Resistance 2 7098 444 2159 133 18656 1160 2282 142 2447 152 www.angelcommodities.com

© Copyright 2026