Base Metals Monthly Report

Base Metals Monthly Report Friday| November 7, 2014 Base Metals Monthly Report Prathamesh Mallya Senior Research Analyst Non-Agri Commodities [email protected] (022) 3935 8134 Kaynat Chainwala Research Associate Non-Agri Commodities and Currencies [email protected] (022) 3935 8136 Angel Commodities Broking Pvt. Ltd. Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093. Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 2921 2000 CX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX: Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302 Disclaimer: The information and opinions contained in the document have been compiled from sources believed to be reliable. The company does not warrant its accuracy, completeness and correctness. The document is not, and should not be construed as an offer to sell or solicitation to buy any commodities. This document may not be reproduced, distributed or published, in whole or in part, by any recipient hereof for any purpose without prior permission from “Angel Commodities Broking (P) Ltd”. Your feedback is appreciated on [email protected] www.angelcommodities.com Base Metals Monthly Report Friday| November 7, 2014 Major News and Developments Global LME zinc stocks markedly decline in July - USGS Chile copper boom begins to slow owing to rising production headaches. According to the U.S. Geological Survey (USGS), U.S. mine and smelter production of zinc totalled 478,000 metric tons for the period from January to July of this year. Chile is expected to produce a record 5.83 million tonnes of copper this year, rising to 6.23 million next year, state copper commission Cochilco forecast. Combined zinc output for July of this year was 66,900 metric tons, up from 63,000 metric tons in July 2013. Many in the industry are confident new mines will keep boosting supply, and are worried more by falling demand in the key buyer, China. Domestic mine production of zinc in July 2014 was 64,400 metric tons, up from 61,000 metric tons in July 2013. Average daily mined zinc output in July was 2,080 t, up 6% from a year ago. The official estimate for production in 2014 has been downgraded twice, cut from 6.07 million tonnes - a drop equivalent to the output of a medium-sized mine. IMF sees Euro zone slipping in to deflation Markets have been roiled by the diverging growth prospects in the United States versus the ailing euro zone and a Japan that has dipped back into contraction. The value of the dollar had surged by the end of last week for 12 successive weeks, the longest rally in 40 years. The IMF now sees a 30 percent chance of the euro zone slipping into deflation over the next year, and nearly a 40 percent probability the currency bloc could enter recession. China expected to face Bauxite Gap on Indonesian Ban China may face a shortage of bauxite, the raw material that feeds the world’s largest aluminum industry, should a ban on ore exports from Indonesia last into next year. There’s potential for a so-called bauxite gap of between 10 million to 15 million metric tons as stockpiles in the country run out. Indonesia banned raw ore exports in January, seeking to spur investments in processing facilities in Southeast Asia’s largest economy. U.S. consumption of refined zinc totalled 583,000 metric tons from January to July 2014. Zinc ore and concentrate exports were reported to be 254,000 metric tons during the same period. Nickel Asia says ore shipment value jumps 165% in Jan.Sept. Nickel Asia Corp. shipped P20.6 billion worth of nickel ore in the first nine months of the year, up 165 percent from P7.8 billion year-on-year, the company reported to the Philippine to the Philippine Stock Exchange on Monday. In a statement attached to a disclosure, Nickel Asia said its four operating mines sold 14.26 million wet metric tons (WMT) of nickel ore in January to September, compared with 10.32 million WMT in the same comparable period. The effect of the Indonesian ore export ban has led to a rapid surge in ore prices to Chinese customers, significantly higher than the increase experienced in LME (London Metal Exchange) prices. As a result, ore sales to Japanese customers, whose selling price has been traditionally linked to LME prices, are now benchmarked to China prices on the basis of a negotiated price per WMT of ore starting April of this year. Before the curb was imposed, the country accounted for about 18 percent of global bauxite production in 2013 and was China’s largest supplier. www.angelcommodities.com Base Metals Monthly Report Friday| November 7, 2014 Price Performance Copper market in 77,000 tonnes surplus in Jul 2014 - ICSG The global world refined copper market showed a 77,000 tonnes surplus in July, compared with a 63,000 tonnes deficit in June, the International Copper Study Group (ICSG) said in its latest monthly bulletin. Base Metals Slight recovery in Oct'14 6.00% 4.46% 4.00% 1.79% 2.00% For the first 7 months of the year, the market was in a 589,000 tonnes deficit compared with a 22,000 tonnes surplus in the same period a year earlier, the ICSG said World refined copper output in July was 1.91 million tonnes, while consumption was 1.84 million tonnes. Bonded stocks of copper in China showed a 57,000 tonnes surplus in July compared with a 106,000 tonnes deficit in June. Alcoa sees smaller aluminum market deficit on China smelter restarts. Alcoa Inc has decreased its estimate for the global aluminum market deficit this year due to smelter restarts in China, the world's No. 1 producer. The U.S. aluminum producer expects demand to outpace supply by 671,000 tonnes this year, down from a previous estimate of 930,000 tonnes. Aluminum prices which surged 27 percent in the first seven months of the year to an 18-month peak have prompted some Chinese smelters to abandon production cutbacks and are seen leading to restarts of other plants, chipping away at what was expected to be the first global deficit after years of oversupply. 0.92% 0.00% -2.00% -4.00% -3.25% -3.69% -6.00% LME Alu LME Zinc LMECopper LME Nickel LME Lead Base metals on the LME traded on a mixed note in October as the Federal Reserve ended its QE3 as stated despite global turmoil and expressed optimism regarding the growth in the US economy. The scheduled end of quantitative easing comes as the US economy adds jobs at the fastest pace since the Great Recession began in December 2008. The FOMC also said, as expected, that it will continue waiting a considerable time after the end of its assetpurchasing program to raise interest rates, especially if projected inflation continues to run below the Committee's 2 percent longer-run goal. In addition, China’s economy grew 7.3% in the third quarter, its slowest pace in five years, dragged down by a faltering real-estate market and waning consumer demand. This is a grave matter of concern for industrial metals that have been sucked into China to feed its construction boom. On the MCX, base metals traded mixed in line with trend in the international markets. www.angelcommodities.com Base Metals Monthly Report Friday| November 7, 2014 Copper world mine production. Copper prices on the LME returned to the positive territory in October and around 0.9 percent as the US economy showed robust recovery which can be seen in third quarter GDP and favorable employment numbers, thereby boosting demand outlook from the second biggest consumer. The ICSG forecasts a deficit of refined copper this year of about 270,000 tonnes, before swinging to a surplus next year of an estimated 390,000 tonnes. In April the ICSG had forecast a surplus in 2014 of 400,000 tonnes. But operational failures combined with delays in ramp-up production and start-up of new mines, are leading to lower than anticipated growth. After a growth rate of 8% in 2013, world mine production of the metal is expected to grow by about 3% year-on-year in 2014 to 18.6 million tonnes and by about 7% in 2015. It expects strong growth in world mine production next year owing to additional output from expansions and new mine projects and says most of the new production is expected to be in the form of copper in concentrate. Also, supply disruption concerns came to the fore as Indonesia’s Grasberg copper mine, one of the world’s largest, is running at two-thirds of capacity due to a strike, while a union leader said the workers had been suspended and a Freeport-McMoRan Inc. union official said that workers at the Grasberg mine will hold a onemonth strike, starting November 6th, due to management issues related to a fatal accident. In addition, workers at the biggest copper mine in Peru, Antamina, which is owned by BHP Billiton, Glencore Xstrata, Mitsubishi and Teck, said that they will walk out indefinitely as of November 10th, thereby bringing offline a total capacity of 30000 tons per month. On the flip side, China's copper imports surged 14.7% from the previous month in September, hitting a 5 month high after importers increased term shipments on an expected rise in seasonal demand. The record shipments come as smelters in the world’s largest metals consumer ramp up production capacity. Data from the General Administration of Customs showed that arrivals of anode, refined copper, alloy and semi finished copper products reached 390,000 tonnes in September, up from a 16 month low at 340,000 tonnes in August. The monthly imports were down 14.8% from a year earlier but in the first nine months, inflows rose 10.5% on year to 3.59 million tonnes. The data showed that imports of raw material copper ores and concentrate surged 34.4% from the previous month in September, hitting a record 1.29 million tonnes up from the previous record of 1.02 million tonnes in September 2013. Chinese copper smelters have increased purchases of concentrate in the international market to take advantage of strong processing fees. In addition, China's copper smelters may be paid between 9 percent and 20 percent more in fees for processing raw material concentrate next year by global miners, reflecting higher Overall, A strong dollar, boosted by Fed’s action, coupled with persisting expectations for a bubbling global surplus next year, pressured the red metal. Also fanning negative sentiment, two of China’s largest banks reported a sharp jump in bad loans in the third quarter, with one warning that a credit crunch in the eastern provinces may be spreading to the west. Nickel For the second month in a row, Nickel turned out to be amongst the worst performers, second only to lead owing to demand that has been limp due to a drag from China's property market, and because of Beijing's moves to curb pollution ahead of next month's Asia-Pacific Economic Cooperation (APEC) forum. Also, Supplies from the Southeast Asian nation in September fell 15 percent to 4.52 million metric tons, down from 5.33 million the previous month, data released today by China’s General Administration of Customs showed. However, sharp losses were cushioned as China's nickel pig iron producers were drawing down their stockpiles faster in the past month due to disruptions in Philippine ore exports, refuelling supply worries and fanning a nickel rally. Also, prices rebounded after reports that top stainless steel maker China may run down its ore supplies as soon as next April. www.angelcommodities.com Base Metals Monthly Report Friday| November 7, 2014 Further, seasonal rains are expected to disrupt nickel mining in the Philippines out to February, crimping exports to top buyer China and stoking a shortfall in the global supply of ore. With a ban on raw metal shipments by former top exporter Indonesia in place, the seasonal decline in the Philippines' output could force China's vast stainless steel industry to run down its stocks of nickel ore, reigniting a rally in nickel prices. However, Miners in the Philippines say they will be able to fulfil their 2014 contracts as they have factored in the impact of the annual monsoon. In addition, Nickel ore stocks at five major ports Tianjin, Rizhao, Lanshan, Lianyungang and Jingtang which account for 70% of the total stood at 15.3 million tonnes in October, down 17% since the start of the year. According to data from the International Nickel Study Group, Indonesian mine production of nickel in 2013 was 834,200 tonnes nearly a third of the global total. Nickel mines in the Philippines produced 315,600 tonnes last year. For the time being, there is little sign that the Indonesian government will ease the ban. And in spite of losing nearly a quarter of its price over recent months, nickel is still the best-performing base metal of 2014 so far, up 17 per cent. Aluminium Aluminium returned to the positive territory with prices surging by around 4.5 percent in October 2014 to become the biggest gainer in the base metals space. This can be largely attributed to concerns should Indonesia’s ban on ore exports last into next year, China may face a shortage of bauxite as there’s potential for a so-called bauxite gap of 10 million to 15 million metric tons as stockpiles in the country run out. China mines bauxite domestically and supplements local supplies with shipments from overseas. Before the Indonesian ban came into effect, users in China stockpiled the raw material to ensure supplies. The holdings may last a further six months. Hydro, one of Norway's biggest industrial companies with operations from Brazil to Qatar, said it expected any aluminium production start-ups around the globe to be offset by curtailments elsewhere, keeping the market tight after years of surpluses. In addition, data from the International Aluminium Institute (IAI) showed global unwrought aluminum inventories at the end of September were down 4,000 mt from August and up 276,000 mt from September 2013. Unwrought inventories totaled 1.375 million mt at the end of September, down from an August total of 1.379 million mt and up from 1.099 million mt at the end of September 2013. Total aluminum inventories at the end of August were down 17,000 mt at 2.466 million mt, and up 333,000 mt from 2.133 million mt at the end of September 2013, the IAI said. However, Alcoa Inc has decreased its estimate for the global aluminum market deficit this year due to smelter restarts in China, the world's No. 1 producer. The U.S. aluminum producer expects demand to outpace supply by 671,000 tonnes this year, down from a previous estimate of 930,000 tonnes. In July, Alcoa increased its market deficit estimate to 930,000 tonnes due to capacity cuts in China. Higher aluminum prices have prompted some Chinese smelters to abandon production cutbacks and are seen leading to restarts of other plants, chipping away at what was expected to be the first global deficit after years of oversupply. Also, Japan Aluminium Association stated that the country’s aluminum product output increased by 5.1% to 149,441 tonnes in August YoY increasing for the twelfth consecutive month. Among them, the output of aluminum plates used for aluminum cans, electronic equipment, automobile parts increased by 13.4% to 91,522 tonnes; the output of extrusion products mainly used for building and automobile sectors decreased by 5.8% to 57,919 tonnes. Further, Aluminium stocks held at three major Japanese ports were 313,400 tonnes at the end of September, up 6.3 percent from 294,800 tonnes a month. www.angelcommodities.com Base Metals Monthly Report Friday| November 7, 2014 Outlook For Nov’14, we expect base metal prices to trade higher as the ECB left interest rates unchanged at an all-time low but Draghi underlined the bank's readiness to take more steps to stimulate growth. Also, surprise easing by the Bank of Japan will support gains. However, concerns over interest rate hike by the FOMC have risen after robust economic data from the US will cap sharp gains. Further, demand concerns from China will be a drag on prices. Copper prices are likely to trade higher owing to expectation of lower surplus in 2015 after a number of mine suspensions in Peru and Indonesia. Further, China's consumption of refined copper is expected to rise at least 6 percent in 2015, roughly in line with this year, supported by new investment in power networks and demand from rail projects. We expect Aluminium prices to trade higher as reluctance by the Indonesian government to pull off the ban on Bauxite exports has raised supply concerns and will boost gains in the light metal. However, expected slowdown in new residential and commercial building projects in China will lead to easing of consumption growth for aluminium in the world's top metals consumer and restrict sharp gains. We expect Nickel prices to trade higher as supply concerns have reignited as most producers in the Philippines' main nickel mining region of Caraga are expected to close operations as normal from October or November until early next year in anticipation of heavy rains. Technical Levels (30 Days) Commodity LME Copper ($/tonne) MCX Copper (Rs./kg) LME Aluminium ($/tonne) MCX Aluminium (Rs./kg) LME Nickel ($/tonne) MCX Nickel (Rs./kg) LME Lead ($/tonne) MCX Lead (Rs./kg) LME Zinc ($/tonne) MCX Zinc (Rs./kg) Support 1 6475 400 1863 116 14160 870 1926 119 2190 135 Support 2 6280 388 1790 112 13350 820 1812 112 2101 120 CMP 6643 410.35 2061 127.75 15490 958.60 2004.5 124.75 2235.25 138.25 Resistance 1 6959 430 2136 133 16280 1000 2201 136 2394 147 Resistance 2 7185 444 2264 141 17910 1100 2298 142 2476 152 www.angelcommodities.com

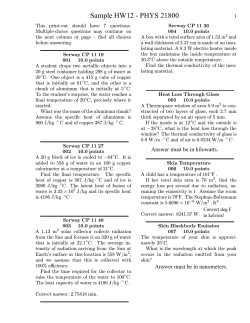

© Copyright 2026