Document 340656

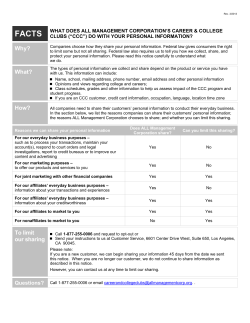

This translation of the original Japanese notice is provided solely for information purposes. discrepancy between this translation and the Japanese original, the latter shall prevail. Should there be any October 16, 2014 REIT Issuer: Daiwa Office Investment Corporation (Stock Code No.: 8976) Representative: Nobuaki Omura, Executive Director Asset Manager: Daiwa Real Estate Asset Management Co. Ltd. Representative: Akira Yamanouchi, President and Representative Director Inquiries to: Yuji Shinotsuka, Vice President and Representative Director (Tel: +81-3-6215-9649) Notice concerning Acquisition of Asset (Daiwa Ebisu 4-chome) We hereby announce that today Daiwa Office Investment Corporation (the “Investment Corporation”) has determined to acquire a trust beneficial interest in real estate (the “Acquisition”) as follows. 1. Summary of Asset to Be Acquired Type of Assets Trust beneficial interest in real estate Property Name Daiwa Ebisu 4-chome (Note 1) (the “Property”) Location 4-9-10 Ebisu, Shibuya-ku, Tokyo Acquisition Price 4,135.2 million yen ( excluding associated acquisition costs, consumption tax, etc.) Date of Conclusion of purchase agreement (the “Purchase Agreement”) October 16, 2014 Date of Delivery (scheduled) December 1, 2014 (Scheduled) Seller (the “Seller”) Not disclosed (Note 2) Funding for Acquisition Cash on hand or the loans (scheduled) to be announced in due course. Payment Method Lump-sum payment at the time of delivery Intermediary Not disclosed (Note 3) (Note 1) The new name of the Property is presented as its name is scheduled to be changed upon Investment Corporation’s purchasing of the Property. Seller has not agreed to disclose the current name of the Property. (Note 2) Seller is a domestic corporation which has not agreed to disclose its name. (Note 3) An Intermediary is a domestic corporation which has not agreed to disclose its name. 2. Reason for Acquisition We believe that the Property is appropriate pursuant to the basic policy for the asset management set forth in the Articles of Incorporation of the Investment Corporation and the management policy of the Investment Corporation. We decided to acquire the Property because we appreciate the rarity and profitability of the Property. (1) Location of the Property: The Property is located at 4 minutes on foot from JR Ebisu Station serving Yamanote, Saikyo and Note: This press release has been prepared as a public announcement regarding the Investment Corporation’s acquisition of asset and not prepared with the aim of soliciting investments. 1 Shonan-Shinjuku lines, and 6 minutes from Tokyo Metro Ebisu Station serving Hibiya Subway Line. The two stations conveniently connect to Shibuya and Shinjuku through JR lines and Roppongi, Kasumigaseki and Hibiya through the subway. The Ebisu area has been recognized as relatively a new office zone with potential since the opening of Ebisu Garden Place in 1994. The demand and supply condition for the area is stable as the area with the proximity to Shibuya is popular to international firms and software developers under the limited supply of the office buildings. (2) Building Facilities: The Property has 9 stories above ground and 1 below; the total floor area of 3,964.00 ㎡, about 110 tsubo with 2,600mm of ceiling height for standard floors (excluding 8th and 9th floors of 3,000mm) each with 100mm OA floor. Despite its age of 17 years since completion, the Property does not only look sophisticated with Glass Curtain Wall exterior but also constructed with quake-absorbing structure. As there is limited supply of younger office buildings in the area, we believe that the Property should maintain relative competitiveness in Ebisu. In terms of Investment Corporation’s portfolio performance, the Property with its functionality and favorable nearby location to the key train stations in the characteristic Ebisu area should contribute to the return. 3. Details of the Property to be Acquired Property Name Daiwa Ebisu 4-chome Type of Specified Assets Trust beneficial interest in real estate Trustee (scheduled) Mizuho Trust and Banking Co., Ltd. Trust Period From December 1, 2014 to November 30, 2024 Location (Lot Number) 4-72-3 Ebisu, Shibuya-ku, Tokyo and other 2 lots Use (Real Property Registry) Office, Parking Space Ownership Form (i) Land: Ownership 650.05 ㎡ Site Area (Real Property Registry) (ii) Building: Ownership Total Floor Area (Real Property Registry) 3,964.00 ㎡ Structure (Real Property Registry) Steel frame and steel framed reinforced concrete structure, flat roof ,9 stories above ground and 1 below Construction Date (Real Property Registry) December 3, 1997 Building Engineer Kume Sekkei Co., Ltd. Constructor Kajima Corporation Structural-design Engineer Kume Sekkei Co., Ltd. Floor Height/Ceiling Height 3,800 mm (for standard floor) / 2,600 mm (for standard floor) Air-conditioning System/OA Laying Each floor individual treatment air-conditioning OA-capable floor Building Inspection Agency Tokyo Metropolitan Government Engineering Due Diligence Company TOKIO MARINE & NICHIDO RISK CONSULTING Co., Ltd. Soil Contamination Risk Survey Earth-Appraisal Co., Ltd. Company Note: This press release has been prepared as a public announcement regarding the Investment Corporation’s acquisition of asset and not prepared with the aim of soliciting investments. 2 Probable Maximum Loss Level (Assessor) 2.44% (Sompo Japan Nipponkoa Risk Management Inc.) Acquisition Price 4,135.2 million yen (excluding acquisition costs and consumption tax, etc.) Appraisal Value (Appraisal Date) 4,330million yen (as of September 30, 2014) Appraiser DAIWA REAL ESTATE APPRAISAL CO.,LTD. Collateral None Summary of Tenants Total Number of Tenants 1 (As of scheduled delivery date) Rent Revenue Not disclosed (Note 1) Security Deposit and Guaranty Not disclosed (Note 1) Total Leased Floor Space Total Leasable Floor Space Trend in occupancy rates the last 5 years (Note2) Expected NOI (NOI Yield) Other Relevant Information 2,743.93 ㎡ (estimated as of the scheduled delivery date) (Note 2) 2,743.93 ㎡ (Note 2) March 31, 2012 - March 31, 2013 - March 31, 2014 - Scheduled delivery date 100.0% 173 million yen (4.2%) (Note 3) (1) After the completion of the building, northern part of the land of the Property was transferred to Tokyo Metropolitan Government for the city planning road. This caused the Property to become so to say noncompliant as it is in terms of the capacity volume ratio. (2) The road on the south of the Property is legislated by Building Standard Act article 42 clause 2. Site area of about 21.73 ㎡ has been spared for the road from the Property. (3) Regular inspection of the building facilities pursuant to article 12 clause 1 of Building Standard Act revealed certain things to be remedied. They are to be taken care of by delivery date by the Seller on its account. (4) Regular inspection of the private electrical facilities revealed certain things to be remedied. They are to be taken care of by delivery date by the Seller on its account. (5) Establishing the border between the northern road has yet to be completed. Conclusion of establishing the border will be taken care of by delivery date by the Seller on its account. (6) The investment Corporation will enter with the Seller into a periodical leasing agreement for the Property starting on the same day as the date of Execution of the Purchase Agreement (December 1, 2014)and ending on March 31, 2015. (Note1) The figures are not presented as no agreement has been obtained for the disclosure by the related parties. (Note2) The figures are based on the periodical leasing agreement for the Property with the Seller for the total leased floor space, total leasable floor space and trend in occupancy rates of the end tenants. Trend in occupancy rates of the end tenants is only available for the scheduled delivery date as the leasing had not taken place during previous periods. (Note4) The figure is forecasted for the period after the maturity of the periodical leasing agreement with the Seller. It is calculated with the assumption of the occupancy rate being 96% based on the expected terms of leasing agreements in consideration of the taxes and other costs that may incur. There is no leasing agreement outstanding as of today. Note: This press release has been prepared as a public announcement regarding the Investment Corporation’s acquisition of asset and not prepared with the aim of soliciting investments. 3 4. Details of the Seller Seller is a domestic corporation which has not agreed to disclose its name. The Seller does not fall under the Related Party of the Investment Corporation/Asset Manager. Also, the affiliated parties and the affiliated companies of the Seller do not fall under the Related Persons of the Investment Corporation/Asset Manager. 5. Status of Owners etc. of Properties The acquisition of the trust beneficial interest is not an acquisition from any persons having a special interest in the Investment Corporation or the Asset Manager. 6. Status of Intermediary (1) Summary of Intermediary A domestic corporation is the intermediary for the transaction of the Property. Since no permission, however, has been granted by it as to the disclosure of its name, etc., there presents no detail on it. There is no relationship required to be disclosed between the Investment Corporation/Asset Manager and the Intermediary in terms of capital, personnel and business. The Intermediary does not fall under the Related Party of the Investment Corporation/Asset Manager. Also, the Intermediary does not fall under the Interested Persons of the Investment Corporation/Asset Manager or under the Related Persons of the sponsor. (2) Fees for the Intermediary With no intermediary’s permission to disclosure of the fees and other details of the transaction, there is no presentation on the fees. Note: This press release has been prepared as a public announcement regarding the Investment Corporation’s acquisition of asset and not prepared with the aim of soliciting investments. 4 7. 8 Acquisition Schedule Date of Determination of the Acquisition October 16, 2014 Date of Execution of Purchase Agreement October 16, 2014 Scheduled Payment Date December 1, 2014 Scheduled Delivery Date December 1, 2014 Impact on the Investment Corporation’s Financial Standing if Forward Commitment is Not Executed The sale and purchase agreement with the Seller (the “Purchase Agreement”) falls under the Investment Corporation’s forward commitment* legislated by The Financial Services Agency’s “Guidelines for Financial Instruments Business Supervision”. (The final update: April 2014) For the purchase of the Property, the delivery date in the Purchase Agreement is scheduled to be on December 1, 2014. If there is a violation to any of the provisions of the Purchase Agreement by either the Investment Corporation or the Seller, the other party can cancel the Purchase Agreement and demand for a penalty charge equivalent to 10% of the purchasing price of the Property. As for the provision of the Purchase Agreement in relation to the funding for buyer’s purchasing of the Property, buyer’s obligation is to arise on condition that either the funding is completed or the certainty for the completion of funding is established. * Forward commitment is defined as “a sale and purchase agreement binding forward and future transactions, with respect to which the settlement and delivery take place one or more months after the signing of the date of agreement; or other similar agreements.” 9. Future Prospects As to the impact of the Acquisition on the Investment Corporation’s result and the distribution for the fiscal period ending May 2015 (19th fiscal period), it is not so significant that there is no amendment to the previously released forecast. - End - Note: This press release has been prepared as a public announcement regarding the Investment Corporation’s acquisition of asset and not prepared with the aim of soliciting investments. 5 【Reference Material 1】 Summary of Appraisal Report Appraiser DAIWA REAL ESTATE APPRAISAL CO.,LTD. Appraisal Date September 30, 2014 Appraised Value 4,330 million yen Items (million yen) (Note 1) Income Approach Value 4,330 Direct Capitalization Value 4,460 (1) Operating Revenue (a-b) 243 a. Potential Annual Rent Revenue 254 b. Amount of Loss due to Vacancy 10 (2) Operating Expenses (c+d+e+f) 55 c. Maintenance and Operation Cost (including cost of management, utility and PM fee) 35 d. Taxes and Public Charges 17 e. Non-life Insurance Premium 0 f. Other Expenses 2 (3) Net Operating Revenue 187 (4) Profit from deposits/guarantees, etc. 3 (5) Capital Expenditures 4 (6) Net Revenue ( (3)+(4)-(5)) 187 Capitalization Rate 4.2% Discounted Cash Flow Value 4,270 Discount Rate 3.9% Terminal Capitalization Rate 4.3% Integrated Value by Using Cost Method 3,140 Ratio of Land 80.4% Ratio of Building 19.6% (Note 1) The above revenue and expenses are based on the appraisal report and are not the figures forecasted by the Investment Corporation or the Asset Manager. Note: This press release has been prepared as a public announcement regarding the Investment Corporation’s acquisition of asset and not prepared with the aim of soliciting investments. 6 【Reference Material 2】 Photograph / Map < External View > Note: This press release has been prepared as a public announcement regarding the Investment Corporation’s acquisition of asset and not prepared with the aim of soliciting investments. 7 < Map > Note: This press release has been prepared as a public announcement regarding the Investment Corporation’s acquisition of asset and not prepared with the aim of soliciting investments. 8 【Reference Material 3】 Region Portfolio Overview after Acquisition of the Property Date of (Scheduled) Acquisition Name of Property Daiwa Ginza Daiwa Ginza Annex Daiwa Shibaura Daiwa Minami-Aoyama Oct 21, 2005 Oct 21, 2005 Oct 21, 2005 Oct 21, 2005 Oct 21, 2005/ Mar 30, 2012 Oct 21, 2005 Oct 21, 2005 Oct 21, 2005 Oct 21, 2005 Oct 21, 2005 Jan 27, 2006 Jan 27, 2006 Mar 24, 2006 Mar 24, 2006 May 1, 2006 May 1, 2006 Jul 31, 2006 Jul 31, 2006 Jul 31, 2006 Oct 6, 2006/ Mar 29/ May 29, 2013 Dec 1, 2006 Jul 13/ Nov 26, 2007 Jul 13, 2007 Aug 31, 2007 Mar 10, 2010 Aug 13, 2010 Sep 2, 2010 Mar 25, 2011 Mar 29, 2011 Jul 8, 2011 May 11, 2012 Dec 3, 2012/ Apr 12, 2013 Jul 3, 2013 August 9, 2013 September 27, 2013 July 4,2014 Daiwa Sarugakucho Five Central Wards of Tokyo (Note 1) Daiwa A Hamamatsucho Daiwa Jingumae Daiwa Shibadaimon Daiwa Misakicho Daiwa Shimbashi 510 Daiwa Tsukijiekimae Daiwa Tsukiji Daiwa Tsukiji 616 Daiwa Tsukishima Daiwa Nihombashi Horidomecho Daiwa Azabudai Daiwa Nihombashi Honcho Daiwa Ginza 1-chome Daiwa Kyobashi Daiwa Kojimachi 4 Chome Daiwa Onarimon Shinjuku Maynds Tower SHIBUYA EDGE Daiwa Kodenmacho Daiwa Jimbocho Daiwa Nishi-Shimbashi Daiwa Kudan Daiwa Kayabacho Building Daiwa Jimbocho 3 Chome E SPACE TOWER Daiwa Nihonbashi Hongokucho shinyon curumu Daiwa Shibuya Dougenzaka Akasaka Business Place Daiwa Shibuya Miyamasuzaka Azabu Green Terrace December 1,2014 (scheduled) Total Number of Properties located in Five Central Wards of Tokyo: 37 Daiwa Kinshicho Oct 21, 2005 Greater Tokyo Daiwa Higashi-Ikebukuro Oct 21, 2005 Daiwa Ebisu 4-chome Acquisition Price (million yen) Investment Ratio (Note 4) 14,100 3,050 8,265 4,550 3.6% 0.8% 2.1% 1.2% 3,190 0.8% 2,865 2,800 2,578 2,346 2,080 1,560 1,240 2,440 7,840 2,520 1,600 7,420 4,620 3,460 0.7% 0.7% 0.7% 0.6% 0.5% 0.4% 0.3% 0.6% 2.0% 0.6% 0.4% 1.9% 1.2% 0.9% 2,910 0.7% 13,860 133,800 5,900 2,460 4,150 5,000 4,000 5,600 3,550 24,000 1,721 3.5% 34.2% 1.5% 0.6% 1.1% 1.3% 1.0% 1.4% 0.9% 6.1% 0.4% 9,650 2.5% 4,500 9,200 7,000 1.1% 2.3% 1.8% 14,000 3.6% 4,135.2 1.1% 333,960 3,653 2,958 85.3% 0.9% 0.8% Note: This press release has been prepared as a public announcement regarding the Investment Corporation’s acquisition of asset and not prepared with the aim of soliciting investments. 9 (Note 2) Benex S-3 Daiwa Shinagawa North Daiwa Osaki 3 Chome Daiwa Kamiooka Integral Tower Total Number of Properties located in Greater Tokyo: 7 Daiwa Minami-Senba Regional Major Cities Daiwa Meieki (Note 3) May 1, 2006 Jul 13, 2007 Sep 18, 2012 Mar 1, 2013 May 29, 2014 4,950 7,710 1,650 2,000 15,220 38,141 4,810 5,300 1.3% 2.0% 0.4% 0.5% 3.9% 9.7% 1.2% 1.4% 9,481.5 2.4% 19,591.5 391,692.7 5.0% 100.0% Aug 31, 2007 Feb 1, 2013 August 1, 2014 (scheduled) Kitahama Grand Building Total Number of Properties located in Major Regional Cities: 3 Total Number of Properties: 46 (Note 1) “Five Central Wards of Tokyo” mean Chiyoda-ku, Chuo-ku, Minato-ku, Shinjuku-ku and Shibuya-ku. (Note 2) “Greater Tokyo” means Tokyo excluding the Five Central Wards of Tokyo, Kanagawa, Chiba and Saitama Prefectures. (Note 3) “Regional Major Cities” means Osaka area (i.e., Osaka, Kyoto and Hyogo Prefectures), Nagoya area (Aichi, Mie and Gifu Prefectures), ordinance-designated cities and core cities under Local Autonomy Act. (Note 4) Figures in the “Investment Ratio” columns represent the percentage of the (scheduled) acquisition price of each property to the aggregate amount of the (scheduled) acquisition price, and are rounded to the nearest first decimal place. Please note that adding up of the investment ratio of the properties may not exactly match the investment ratio for each investment regions or for the overall portfolio. * Website URL of the Investment Corporation: http://www.daiwa-office.co.jp/en/ Note: This press release has been prepared as a public announcement regarding the Investment Corporation’s acquisition of asset and not prepared with the aim of soliciting investments. 10

© Copyright 2026