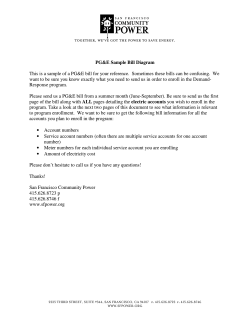

Renew On-Line 111 Technology for a Sustainable Future Contents