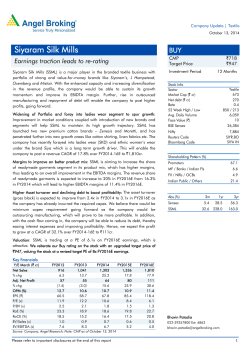

FY2014 Financial Results 15 October 2014

FY2014 Financial Results 15 October 2014 Group FY2014 financial highlights FY2014 S$’000 FY2013 S$’000 Change % 1,215,184 1,239,452 (2.0) Operating Profit# 348,963 369,288 (5.5) Fair value gain on investment properties 109,076 111,407 (2.1) Investment Income 48,215 13,971 NM Gain on partial divestment of 701Search* 52,863 - NM Profit after taxation 470,736 434,302 8.4 Net Profit attributable to shareholders 404,286 430,954 (6.2) Operating Revenue # This represents the recurring earnings of the media, property and other businesses. NM: Not meaningful * 701Search is the holding company for the Group’s regional online classified business. During the financial year, the Group entered into a strategic partnership agreement which provided for partial sale of stake in 701Search to Telenor. 2 Group FY2014 financial highlights Operating Revenue FY2014 S$’000 FY2013 S$’000 Change % Newspaper and Magazine 931,686 991,220 (6.0) Property 204,985 198,139 3.5 Others 78,513 50,093 56.7 1,215,184 1,239,452 (2.0) Newspaper and Magazine • Advertisement revenue fell S$51.3m (6.8%) • Circulation revenue fell S$9.7m (4.9%) Property • Higher rental income from Paragon and The Clementi Mall Others • Higher revenue boosted by contributions from exhibitions, sgCarMart (acquired in April 2013) and radio business. 3 Group FY2014 financial highlights Profit/(Loss) before taxation FY2014 S$’000 FY2013 S$’000 Change % Note Newspaper and Magazine 246,381 293,340 (16.0) (a) Property 239,397 222,417 7.6 (b) Treasury and Investment 30,419 11,385 NM (c) Others 12,194 (38,043) NM (d) 528,391 489,099 8.0 NM: Not meaningful (a) Decline in profit of the Newspaper and Magazine business was mainly attributable to lower advertisement revenue. (b) Operating profit, before finance costs and fair value gain on investment properties, rose S$7.0m (5.0%) to S$148.4m in line with higher revenue. (c) Treasury performance, before including financing cost previously allocated to the Property segment prior to REIT refinancing in July 2013, was lifted by increased dividend and interest income, higher profit on sale of investments and lower impairment charges on portfolio investments. (d) The Others segment turned into a profit with the gain on partial divestment of 701Search. In addition, the local online classified, radio and exhibitions businesses registered better performance in the financial year. 4 Group FY2014 highlights Operating Revenue Composition (S$1,215.2m) Newspaper and Magazine Advertisement Revenue Composition (S$705.9m) 9.7% 16.9% 14.8% 26.9% 15.3% 58.1% Advertisements (Newspaper & Magazine) 58.3% Display Circulation Classified * Rental & Services Others Magazines & Others * Classified includes Recruitment and Notices 5 Ad revenue slowed as property and transport sectors continued to face headwind Newspaper Ad Revenue Y-O-Y Growth (%) 5.0% 0.0% -1.7% -2.9% -5.0% -5.9% -7.0% -7.9% -10.0% -7.1% -7.3% -8.0% -7.8% -9.8% -9.1% -7.4% -10.3% -10.3% -10.2% -15.0% 1QFY14 2QFY14 Display 3QFY14 4QFY14 Classified* Total FY14 * Classified includes Recruitment and Notices 6 Growth in circulation copies led by robust digital sales 500 Daily Average Newspaper Circulation 450 400 350 Thousands 300 250 200 150 100 50 0 The Straits Times/ The Sunday Times The Business Times The New Paper/ The New Paper Sunday FY14 Lianhe Zaobao FY14 (Digital) Lianhe Wanbao FY13 Shin Min Daily News Berita Harian/ Berita Minggu Tamil Murasu/ Tamil Murasu Sunday FY13 (Digital) 7 Group FY2014 highlights Cost Composition (S$882.1m) 21.3% 42.5% 14.0% 6.2% 7.4% 8.6% Staff Cost Newsprint Premises Cost Depreciation Other Materials, Production & Distribution Costs Other Operating Expenses 8 A leaner workforce as the Group restructures and transforms Headcount as at end-August Staff Costs (S$'000) FY2014 FY2013 Change % 4,204 4,339 (3.1) 374,519 349,643 7.1 Staff costs were up S$24.9m mainly due to salary increments, higher bonus costs including a oneoff special bonus for prior year (S$10.4m) arising from REIT profit and incentive to drive growth. 9 Near-term newsprint prices expected to soften Average Newsprint Charge-Out Price & Monthly Consumption 700 12,000 650 11,000 611 611 607 598 600 10,000 550 9,057 9,000 8,416 500 8,147 7,856 8,000 450 400 7,000 1QFY14 2QFY14 LHS - Prices (US$) 3QFY14 4QFY14 RHS - Ave Mthly Consumption (MT) 10 Healthy operating margins S$'m Recurring Earnings# and Operating Margin^ 600 40.0% 35.0% 500 30.0% 400 25.0% 300 20.0% 15.0% 200 10.0% 100 5.0% 0 0.0% FY2010 FY2011 Profit before investment income (S$'m) # FY2012 FY2013 Sky@eleven profits (S$'m) FY2014 Operating Margin^ This represents the recurring earnings of the media, property and other businesses. ^ Computed based on recurring earnings excluding Sky@eleven. 11 Property segment maintains its steady growth Paragon The Clementi Mall The Seletar Mall • Will be the largest suburban lifestyle hub in • Rental reversions of 8.5% for SPH REIT portfolio the North-East • Healthy NPI margins for Paragon (76%) and The Clementi Mall • Targeted to open in (69%) November 2014 • Net Property Income (NPI) rose 5% to S$148.4m • Market value for Paragon (Freehold) and The Clementi Mall at S$2.7b and S$571m respectively • Unit price rose from IPO at S$0.90 to S$1.065 as at financial year end 12 Group investible fund Group Investible Fund (S$1.9b) 14.6% 28.4% 37.4% 19.6% Equities Bonds Investment Funds Cash and deposits (As at August 31, 2014) • Conservative stance maintained on investment allocation, focused on capital preservation • Returns are expected to be commensurate with low riskreturn profile to mitigate against volatility • About S$300m managed for final dividend payment and New Media fund 13 Strong growth in traffic for Online Classified business Top online classified website in Malaysia, with monthly page views exceeding 700 million1 No. 2 classified website in Indonesia, with monthly page views above 700 million1 Largest classified website in Vietnam, with monthly page views close to 500 million1 No. 2 classified website in the Philippines, with monthly page views of 270 million1 Data source: 1 Xiti , August 14 14 14 Declared dividend per share of 21cents 7 cents interim, 14 cents final (cents) 40 110% 94.4% 30 20 96.2% 90.2% 107.8% 100% 90% 80.4% 80% 10 27 24 24 22 21 0 70% 60% 2010# 2011 2012 Interim & Final Div (LHS) 2013^ 2014 Div Payout Ratio* (RHS) * Computed based on Group recurring earnings net of SPH REIT’s non-controlling interest (S$315m) # FY2010 included profits from the Group’s Sky@Eleven development ^ Excludes special dividend of 18 cents paid pursuant to the establishment of SPH REIT 15 15 Thank you Please visit www.sph.com.sg for more information.

© Copyright 2026