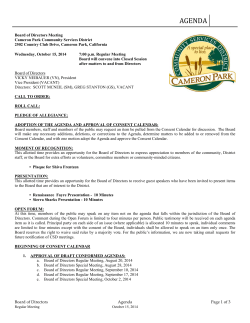

Document 347949