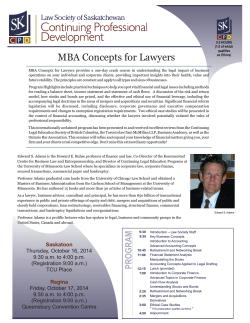

Fall Professional Development Calendar 2014/2015