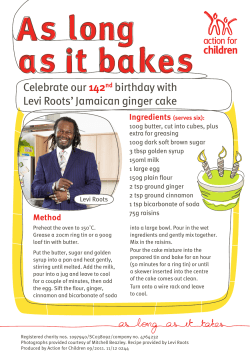

For personal use only 4 201 T