Document 352659

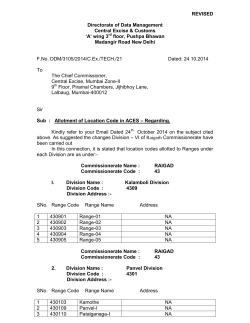

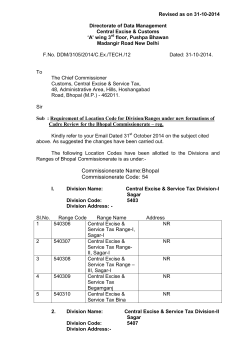

Oct 20, 2014 Gudang Garam Sebastian Tobing Company Focus ([email protected]) Minor impact from higher excise tax Higher excise tax has been announced Ministry of Finance has announced excise tax for: 1) SKM cigs with production more than 2bn sticks to be Rp415/stick, up 10.7% from Rp375/stick in 2013-14. 2) SKT cigs with production more than 2bn sticks to be Rp290/stick, up 5.5% from Rp275/stick. Minor downside to Gudang Garam The excise tax on SKM is higher than our expectation by c1%, while the impact on SKT is below our expectation by 11%. However, as SKM still contribute more than 90% of GGRM’s total revenue, the net impact is still a downgrade on 2015 EBIT and net profit by 1.4% and 1.6% respectively. We are also downgrading our FY15 EBIT margin by 20bps from 12.3% to 12.5%. Historically GGRM will pass-on the price increase in stages, perhaps as early as next year. We are assuming ASP growth of 7.9% for SKM and 9% for SKT in 2015, along with 6.6% volume growth. Downgrade to Hold on rising risk-free rate; but higher PT We downgrade our rating from Buy to Hold as share price have rallied almost 30% in the past three months. However, we are still upgrading our price target to Rp66,300/share from Rp62,600 on the back of lower cost of debt assumption that more than offset the rising risk-free rate. We revised our risk-free rate from 7.5% to 8.1% and the cost of debt from 11% to 7.5%. The changes in price target mostly come from the changes in WACC relative to changes in our excise tax estimates. Valuation: Hold, PT of Rp66,300/sh We apply DCF methodology to derive our price target. We apply riskfree rate of 8.1% and WACC of 10.1%. Our new price target implies 23x 2015 PE and 19x 2016 PE. GGRM currently trades at 23x 2015 PE and 19x 2016 PE respectively. Founded in 1958, Gudang Garam grew into one of the biggest and most wellknown cigarette company in Indonesia, providing both the choice and quality associated with Gudang Garam. HOLD Rp66,300 Company Update Share Price Sector Price Target Rp60,500 Consumer Rp66,300 (9%) Stock Data Reuters Code Bloomberg Code Issued Shares (m) Mkt Cap (Rpbn) Avg. Value Daily 6 month (Rpm) 52-Wk range GGRM.JK GGRM.IJ 1,924 116,407 Rp49.6 Rp61,500/Rp33,850 Major Shareholders PT. Suryaduta Investama Others Public 69.3% 7.2% 23.5% Consensus EPS Consensus (Rp) TRIM vs Cons. (%) Companies Data 14F 2,763 (8.0) 15F 3,232 (10.4) 2012 2013 2014F 2015F 2016F 49,029 55,437 63,113 71,742 81,713 Net Profit (Rpbn) 4,014 4,329 4,921 5,633 6,597 7 0 ,0 0 0 7 , 0 0 0 ,0 0 0 EPS (Rp) 2,086 2,250 2,558 2,928 3,429 6 0 ,0 0 0 6 , 0 0 0 ,0 0 0 -18.0% 7.8% 13.7% 14.5% 17.1% 5 0 ,0 0 0 5 , 0 0 0 ,0 0 0 4 0 ,0 0 0 4 , 0 0 0 ,0 0 0 3 0 ,0 0 0 3 , 0 0 0 ,0 0 0 Year end Dec Sales (Rpbn) EPS Growth (%) DPS (Rp) BVPS (Rp) P/E (x) Div Yield (%) 1,000 800 900 1,100 1,300 Stock Price V o lu m e P r ic e 13,760 15,209 16,867 18,743 20,937 2 0 ,0 0 0 2 , 0 0 0 ,0 0 0 25 24 24 21 18 1 0 ,0 0 0 1 , 0 0 0 ,0 0 0 1.9% 1.5% 1.7% 2.1% 2.5% PT Trimegah Securities Tbk - www.trimegah.com O c t- 1 3 D e c-1 3 Fe b-1 4 A p r- 1 4 J u n -1 4 Aug-14 O c t- 1 4 COMPANY FOCUS 1 Impact of higher excise tax Indonesian Government has increased the cigarette excise tax: 1) For SKM (machine-rolled) cigarette with production above 2bn sticks, the excise tax is raised to Rp415/stick (up 10.7% yoy) from Rp375/stick. 2) For SKT (hand-rolled) cigarette with production above 2bn sticks, the exciset tax is raised to Rp290/stick (up 5.5%) from Rp275/stick. We have previously estimated our SKM excise tax to be Rp410 (1.2% below realized) and our SKT excise tax to be Rp327/stick (11% higher than realized). SKM cigarettes currently contribute up to 93% of GGRM’s total revenue. Figure 1. SKM excise cost Net revenue margin / stick (LHS) Excise tax (Rp/stick) (RHS) 450 42.0% 40.0% 400 38.0% 350 36.0% 300 34.0% 250 32.0% 200 30.0% 2009 2010 2011 2012 2013 2014 2015 Source: TRIM Research, Company Figure 2. SKT excise cost Tota l excise tax (Rp) Net Revenue Margin 300 60.0% 280 55.0% 260 240 50.0% 220 45.0% 200 180 40.0% 160 140 35.0% 120 30.0% 100 2009 2010 2011 2012 2013 2014 2015 Source: TRIM Research, Company PT Trimegah Securities Tbk - www.trimegah.com COMPANY FOCUS 2 Figure 3. Impact to our earning estimate 2014E 2015E 2016E Before After % Chg Before After % Chg Before After Sales 63,113 63,113 0.0% 71,742 Gross profit 12,161 12,161 0.0% 13,724 EBIT 7,769 7,769 0.0% Net profit 4,921 4,921 EPS 2,558 2,558 Gross 19.3% EBIT % Chg 71,742 0% 81,713 81,713 0.0% 13,596 -0.9% 15,502 15,331 -1.1% 8,965 8,838 -1.4% 10,234 10,063 -1.7% 0.0% 5,726 5,633 -1.6% 6,722 6,597 -1.9% 0.0% 2,976 2,928 -1.6% 3,494 3,429 -1.9% 19.3% 19.1% 19.0% 19.0% 18.8% 12.3% 12.3% 12.5% 12.3% 12.5% 12.3% 7.8% 7.8% 8.0% 7.9% 8.2% 8.1% SKM 8.6% 8.6% 7.9% 7.9% 7.8% 7.8% SKT 8.6% 8.6% 9.0% 9.0% 9.0% 9.0% SKM 71.7 71.7 0% 76.4 76.4 0% 81.5 81.5 0% SKT 8.3 8.3 0% 7.5 7.5 0% 6.8 6.8 0% Margin Net Price increase, % Sales volume, bn stick Source:TRIM Research, Company The impact to our earning estimate is modest, as the downgrade in EBIT was offset by our higher expectation for SKT cigs. The impact to our EBIT estimate in 2015 is a 1.4% downgrade and to net profit a 1.6% downgrade. However, this will also impact our 2016 estimates by roughly the same amount and subsequent years as the excise tax becomes the new floor for subsequent hike. We view that GGRM, may increase its ASP in stages to allow margin recovery. Thanks to the excise tax the net revenue margin per stick have fallen to around 36%, a level not seen in the past five years. Historically GGRM is able to pass-on the excise tax, though in periods. Given the higher than expected tax hike this year, the ASP appreciation might take a while. PT Trimegah Securities Tbk - www.trimegah.com COMPANY FOCUS 3 Valuation Figure 4. WACC and DFC calculations 2016F 2017F 2018F 2019F 2020F 2021F 2022F 2023F 2024F 2025F 2016F 7,547 (1,509) (3,195) 1,351 2017F 8,600 (1,567) (3,670) 1,441 2018F 9,761 (1,628) (4,090) 1,537 2019F 10,999 (1,691) (4,727) 1,638 2020F 12,361 (1,757) (5,252) 1,744 2021F 13,852 (1,827) (5,979) 1,856 2022F 15,460 (1,900) (6,639) 1,975 2023F 17,180 (1,977) (7,504) 2,100 2024F 19,031 (2,057) (8,319) 2,232 2025F 21,011 (2,142) (9,370) 2,372 4,194 4,804 5,580 6,218 7,096 7,903 8,896 9,799 10,887 11,870 221,828 Discount factor Discounted FCFF Total discounted FCFF Net debt / (Net cash) Minority Interest NAV 1.00 4,194 140,947 13,310 73 127,564 1.10 4,364 1.21 4,604 1.33 4,660 1.47 4,830 1.62 4,887 1.78 4,996 1.96 4,999 2.16 5,045 2.38 98,368 # of shares (bn) NAV / share Market price Upside/(downside) 1.92 66,300 61,000 9% Risk free rate Market premium Beta Debt proportion Tax rate Equity cost of capital Debt cost of capital WACC LT growth rate 8.1% 5.0% 0.99 40% 25% 13.1% 7.5% 10.1% 4.5% EBIT x (1 - tax) Less: Capital Expenditure Changes in Working Capital Add: Depreciation & Amortization FCFF LT Growth 2013 2014 2015 2016 Rp/sh 2,250 2,558 2,928 3,429 Growth YoY % 7.8% 13.7% 14.5% 17.1% P/E - Current x 27.1 23.8 20.8 17.8 P/E - TP x 29.5 25.9 22.6 19.3 EPS Source:TRIM Research, Company Downgrade to HOLD We are downgrading our recommendation to HOLD following GGRM’s stellar performance in the past three months. Share price have performed 30% during this period, outperforming JCI. Combined with the rising riskfree rate and negative headline from higher than expected excise tax, we are downgrading our recommendation to Hold. We are still upgrading our price target Ro66,300/share on the back of lower WACC from our downward revision of company’s cost of debt assumption (from 11% to 7.5%) that more than offset our rising risk-free rate assumption (from 7.5% to 8.1%), We apply DCF methodology to value GGRM, the stock currently trades at 21x 2015 PE and 18x 2016 PE post our earnings revision. PT Trimegah Securities Tbk - www.trimegah.com COMPANY FOCUS 4 Risk Raw materials supply and price may affect profitability Gudang Garam, as with other cigarette companies, are dependent on local supply of clove and tobacco to meet its production needs. This is especially relevant for clove since the government has imposed restriction on clove import (in recent years the only time clove is allowed to be imported was in Jan ’12, when clove price hit historical high Rp240,000/kg). The harvests of clove (in March) and tobacco (in Aug/Sep) will affect the supply of raw materials. While the harvests for 2014 are within expectation, there is a risk future harvest unable to meet industry’s demand, causing the price to soar. Without alternative supply source, Company’s profitability margin will take negatively affected. Advertising and packaging requirement The promotional activities of cigarettes in Indonesia are restricted. Currently when advertising tobacco the packaging is not allowed to be shown, as well as the broadcast of tobacco advertising is limited to 9.30 pm to 5.00 am. Health warnings are also shown at the end of every advertisement. As of June 2014, a new restriction was imposed, requiring cigarette companies to print graphic image of tobacco-related diseases that occupy 40% of the packaging, in hope to raise health warnings and curb cigarette demand. While we believe the current advertising restrictions will not significantly affect the sales and profitability of the Company, further restrictions may be implemented. Potential increase of excise tax Price is the most significant driver in cigarette sales. With the poor spending 12% of their income on cigarettes (second only to rice at 18%), the growth of the cigarette sales depend on its affordability. The price of cigarette in Indonesia at USD0.75-1.65 for a pack of 20 is far less than those in neighbouring countries. In Malaysia or Thailand, the same pack can go for USD3-5 and in Australia, it can cost up to USD17. For Gudang Garam, excise tax made up 67% of its cost of sales. Hence the potential increase of excise tax will significantly affect the demand for cigarettes as well as the profitability of the Company. The average excise tax is 46% of the base price, compared with the 57% potential excise tax regulated in the law. Furthermore a regional excise tax on cigarettes of 10% has been implemented in Jan ’14. With the possibility of a further 11% increase in excise tax and future additional regulation, this represents a risk for the Company. Decrease of purchasing power Cigarette companies, Gudang Garam included, may face the risk of decreasing purchasing power in Indonesia. The issue of cutting back or removing subsidized fuel will cause inflation PT Trimegah Securities Tbk - www.trimegah.com COMPANY FOCUS 5 Income Statement (Rpbn) Year end Dec Revenue Balance Sheet (Rpbn) 2012 2013 2014F 2015F 2016F Year end Dec 2012 2013 2014F 2015F 2016F 49,029 55,437 63,113 71,742 81,713 Cash and equivalents 1,286 1,404 1,300 1,345 1,808 13.8% 13.7% 13.9% 12,161 13,724 15,502 Other curr asset 28,668 33,200 37,938 41,885 46,382 Net fixed asset 10,389 14,789 16,418 16,607 16,765 2,452 2,781 2,822 2,884 3,361 41,509 50,770 57,178 61,376 66,508 ST debt 8,164 12,979 14,979 14,479 13,979 Other curr liab 5,638 7,116 8,270 9,283 10,609 0 0 0 0 0 1,101 1,259 1,259 1,259 1,259 131 152 217 291 376 15,035 21,506 24,725 25,313 26,223 36,064 40,285 Revenue Growth (%) 17.1% Gross Profit 9,185 13.1% 10,874 Opr. Profit 6,007 6,650 7,769 8,965 10,234 EBITDA 7,031 7,758 8,952 10,230 11,585 Other asset EBITDA Growth (%) -8.9% 10.3% 15.4% 14.3% 13.2% Total asset Net Int Inc/(Exp) (495) (756) (1,035) (1,092) (1,032) Gain/(loss) Forex (18) (13) 17 (18) 16 Other Inc/(Exp) (988) (1,053) (1,184) (1,265) (1,351) Pre-tax Profit 5,531 5,936 6,751 7,855 9,218 Tax 1,462 1,552 1,765 2,054 2,410 Minority Int. (55) (55) (64) (74) (85) Extra. Items 0 0 0 0 0 Reported Net Profit 4,014 4,329 4,921 5,726 6,722 Core Net Profit 4,031 4,342 4,904 5,745 6,707 13.0% 17.1% 16.7% 900 1,100 1,300 Growth (%) Dividend per share growth (%) -17.8% 7.7% 1,000 800 13.6% -20.0% 12.5% 22.2% 18.2% 0.4 0.4 0.4 0.4 0.4 Dividend payout ratio Cash Flow (Rpbn) LT debt Other LT Liab Minority interest Total Liabilities Total Equity 26,475 29,264 32,454 Net (debt) / cash (6,879) (11,575) (13,679) Total cap employed 27,707 30,676 33,930 37,614 41,920 Net Working capital 23,030 26,085 29,669 32,602 35,773 8,164 12,979 14,979 14,479 13,979 Debt Key Ratio Analysis Year end Dec 2012 2013 2014F 2015F 2016F Core Net Profit 4,031 4,342 4,904 5,745 6,707 Profitability Depr / Amort 1,024 1,108 1,184 1,265 1,351 (848) Chg in non-cash Working Cap Others 2,572 (13,134) (12,171) (1,149) (1,113) (952) Year end Dec 2012 2013 2014F 2015F 2016F Gross Margin (%) 18.7% 19.6% 19.3% 19.1% 19.0% Opr Margin (%) 12.3% 12.0% 12.3% 12.5% 12.5% EBITDA Margin (%) 14.3% 14.0% 14.2% 14.3% 14.2% 8.2% 7.8% 7.8% 8.0% 8.2% ROAE (%) 15.8% 15.5% 15.9% 16.7% 17.6% ROAA (%) 10.0% 9.4% 9.1% 9.7% 10.5% (4,015) (1,997) (2,454) (2,000) (2,307) 3,612 2,304 2,521 4,058 4,902 Capex (2,911) (5,429) (2,813) (1,454) (1,509) Others (649) (211) (145) (17) (14) CF's from investing (3,560) (5,640) (2,958) (1,471) (1,523) Current ratio (x) 2.2 1.7 1.7 1.8 2.0 Net change in debt 2,000 4,814 2,000 (500) (500) Net Debt to Equity (x) 0.3 0.4 0.4 0.4 0.3 Net Debt to EBITDA (x) Interest Coverage (x) 1.0 1.5 1.5 1.3 1.1 11.3 8.4 7.4 8.1 9.6 CF's from oprs Others (1,861) (1,360) CF's from financing 139 Net cash flow 191 Cash at BoY Cash at EoY Free Cashflow Stability (1,667) (2,042) (2,416) 3,454 333 (2,542) (2,916) 118 (104) 45 463 1,095 1,286 1,404 1,300 1,345 A/P (days) 4 6 6 6 6 1,286 1,404 1,300 1,345 1,808 A/R (days) 10 14 14 14 14 5,667 (1,049) 2,170 4,604 5,632 Inventory (days) 241 244 244 236 229 Interim Result (Rpbn) Efficiency Capital History 4Q12 1Q13 2Q13 3Q13 4Q13 13,999 13,379 15,420 15,670 16,997 Gross Profit 2,859 2,627 2,947 3,255 3,219 Opr. Profit 1,686 1,611 1,847 2,201 2,021 Net profit 1,155 1,034 1,093 1,417 1,318 Gross Margins (%) 20.4% 19.6% 19.1% 20.8% 18.9% Opr Margins (%) 12.0% 12.0% 12.0% 14.0% 11.9% Net Margins (%) 8.3% 7.7% 7.1% 9.0% 7.8% Sales Core Net Margin (%) PT Trimegah Securities Tbk - www.trimegah.com Date 27-Aug-90 IPO@Rp10,250 COMPANY FOCUS 6 PT Trimegah Securities Tbk Gedung Artha Graha 18th Floor Jl. Jend. Sudirman Kav. 52-53 Jakarta 12190, Indonesia t. +62-21 2924 9088 f. +62-21 2924 9150 www.trimegah.com DISCLAIMER This report has been prepared by PT Trimegah Securities Tbk on behalf of itself and its affiliated companies and is provided for information purposes only. Under no circumstances is it to be used or considered as an offer to sell, or a solicitation of any offer to buy. This report has been produced independently and the forecasts, opinions and expectations contained herein are entirely those of Trimegah Securities. While all reasonable care has been taken to ensure that information contained herein is not untrue or misleading at the time of publication, Trimegah Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. This report is provided solely for the information of clients of Trimegah Securities who are expected to make their own investment decisions without reliance on this report. Neither Trimegah Securities nor any officer or employee of Trimegah Securities accept any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents. Trimegah Securities and/or persons connected with it may have acted upon or used the information herein contained, or the research or analysis on which it is based, before publication. Trimegah Securities may in future participate in an offering of the company’s equity securities.

© Copyright 2026