Cardiff School of Management LLM International Business (Finance)

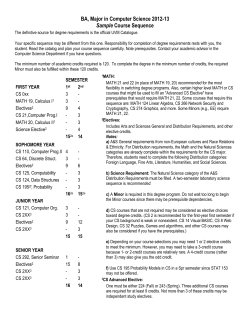

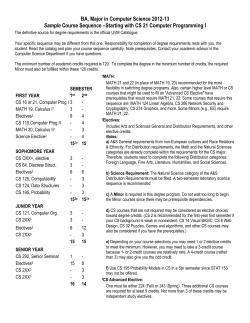

Cardiff School of Management Department of Business and Management Studies LLM International Business (Finance) Joining Pack for 2014-2015 Academic Year To understand global interconnectedness of economies, markets and industries within which transnational corporations compete, an individual would require a high degree of knowledge and understanding of the municipal, regional and international customs, practices and laws. Such an individual would also require a certain set of communication skills to draft, present, negotiate, moot and write in a disciplined way. LLM International Business programme therefore aims to provide such knowledge and understanding as well as the skills to the students through an advanced study and assessment of laws within subject areas and issues that are rooted in the international business and management environment. Key Dates (Academic Year 2014 – 2015) Autumn Term (Michaelmas) Intensive academic law induction programme (October 2014 cohort) Formal Teaching Start Monday 22 September 2014 End Friday 26 September 2014 Monday 29 September 2014 Friday 19 December 2014 Spring Term (Hilary) Intensive academic law induction programme (January 2014 cohort) Formal Teaching Start Monday 12 January 2015 End Friday 16 January 2015 Monday 19 January 2015 Friday 27 March 2015 Summer Term (Trinity) Formal Teaching (January 2015 cohort) Start Monday 27 April 2015 End Friday 19 June 2015 Dissertations Workshops and supervision period October 2014 cohort January 2015 cohort Start End Monday 20 April 2015 Monday 15 June 2015 Friday 10 July 2015 Possible Examination Board date Monday 1 September 2015 Dissertation submission deadline Tuesday 14 July 2015 Friday 4 September 2015 1st or 2nd week of September 2015 In addition to these dates you will need to be aware of other important events and deadlines throughout the year; such as coursework/ assessment submission dates, publication of results, mitigating circumstances deadlines, and programme and assessment planning deadlines established from time to time. The above dates are a guide subject to change. Do please bear in mind that depending on the nature of work and availability of resources, the October 2014 cohort may well finish at the same time as the January 2015 cohort. Key contacts Programme Director Mr Mayo Win-Pe LLB (Buckingham) LLM (Leicester) PGCLTHE (UCL) FHEA barrister Senior Lecturer in Law 02920 417164 [email protected] Academic Administrator Katerina Ciura (Team Leader) 02920 417147 [email protected] The Administrators offices are located on the ground floor of the Cardiff School of Management building near to the front reception desk. Teaching location Cardiff School of Management (Ogmore Building) Cardiff Metropolitan University Llandaff Campus Western Avenue Cardiff CF5 2YB The School endeavours to make every effort to ensure that all formal teaching sessions are conducted within the building although there may be circumstances where formal scheduled classes are timetabled in another building within the Llandaff campus. Welcome to your programme This is the Joining Pack for the LLM International Business for the academic year 20142015. The staff of the Cardiff School of Management warmly welcomes you to Cardiff Metropolitan University Llandaff Campus. Detailed information about the programme is contained in the Programme Handbook which you will receive during your induction after enrolment and registration has taken place. Using your Joining Pack This document contains information to assist you in preparing for your studies. Some of it will be of more relevance to you later in the course than at the start of your studies. We recommend that you read the information contained herein thoroughly and carefully, as it covers many of the questions you will have about your Programme. This Joining Pack should be read in conjunction with the University Student Handbook and Student Charter available electronically via the Student Portal and by following this link – http://www3.cardiffmet.ac.uk/english/registry/academic_handbook/pages/home.aspx It is absolutely vital that you also understand the University Academic Handbook which contains all the up to date Regulations, rules and procedures applicable to you as the student. It is an open access publication made available here – http://www3.cardiffmet.ac.uk/english/registry/academic_handbook/pages/home.aspx While the information contained in this Joining Pack is correct as of 23 June 2014, it is important to note that the information in this document may, from time to time, be changed. You should always check with the Programme Director via email to ensure that you make important decisions in accordance with the most up-to-date information. With best wishes for the coming year, Mr Mayo Win-Pe LLM International Business Programme The Administration The Programme Director is responsible for the administration of the programme supported by the Administrator Katerina Ciura. The conduct of the programme is subject to the control of the Law Field Group and the Director of Learning and Teaching and Associate Dean Dr Kelvin Hughes who is also the Chair of the School Learning and Teaching Committee. Programme Outline for 2013-2014 academic year To graduate with the Master of Laws degree in this programme, you are required to successfully complete 180 ‘M’ level credits. Save for the dissertation module (40 credits) all modules in the LLM are weighted 20 credits each. LLM programme is designed to operate over 3 terms plus dissertation sessions and supervision over the summer months. Please note that the term dates for the LLM programme neither follow the pattern of other Masters programmes nor the University timetables. The LLM term dates are as detailed above under ‘Key Dates’ table. Modules Do please note that for the 2014-2015 Academic Year, the School will only be able to offer the following modules under FINANCE pathway specialisation. There will not be any other choices available. You will therefore be required to undertake the following modules: Term 1 (October 2014 entry cohort) 1. 2. 3. 4. Introduction to International Business (LLM7001) (20 credits) Legal Research Skills and Reasoning (LLM7005) (20 credits) Business and Crime (LLM7006) (20 credits) Transnational Commercial Law (LLM7003) (20 credits) Term 2 (Both October 2014 and January 2015 entry cohorts) 1. Role of Business in Society (LLM7002) (20 credits) 2. Legal Issues in Mergers and Acquisitions (LLM7011) (20 credits) 3. Legal Aspects of International Finance (LLM7010) (20 credits) Term 3 (Repeat of Term 1 modules for the January 2015 entry cohort) 1. 2. 3. 4. Introduction to International Business (20 credits) Legal Research Skills and Reasoning (20 credits) Business and Crime (20 credits) Transnational Commercial Law (20 credits) Do please note that students may only progress into the dissertation phase upon successful completion of their diet of taught modules and assessments. Due to the intensive nature of reading and assessments involved in the programme, it is recommended that the quicker the permission is received upon successful completion of the assessments, the longer the timeframe is available to commence the dissertation phase. The rules and processes applicable to dissertation supervision will be provided to the students closer to the time. Schedule of formal group sessions and singulares/tutorials/ smaller classes The School endeavour to ensure that the programme is delivered over two full days (9am – 6pm) of the week. Whilst every effort is made to provide two connected days in a given week (Monday to Friday) for all formal sessions as well as ad hoc sessions, the practicalities of appropriate room availability as well as lecturers timetables may mean that it may not always be possible. Further agreed sessions either on a one to one basis or those consisting of collective meetings which may take the form of singulares/ tutorials/ smaller classes are arranged on an ad hoc basis by individual lecturers within a given week (Monday – Friday) which is also subject to availability of appropriate rooms and lecturers timetables. Weekly group sessions are normally timetabled for 2 hours blocks for each module. There may be circumstances where these blocks may run consecutively in any given day. Depending on the progress made, it may well be that smaller sessions are continued elsewhere outside of timetabled teaching classes/rooms either in the same day or at a mutually agreed time and date. There will of course be short breaks provided throughout the day but being fore warned is fore armed as to the intensive nature of the programme schedule. Timetables The University publishes timetables at the beginning of each term. You are advised to check the timetable periodically for the first week or two of the term in question as they are likely to change overnight. You will be notified by the Programme Director of the changes as and when advised by the University timetabling unit. Required Reading To familiarise yourself with the nature and content of the modules, although you are not required to purchase the books, it is nevertheless recommended that you peruse them. The list is subject to change and you will be notified of your reading requirements once you have joined the programme. Do note that you will be ‘reading’ for a specialist postgraduate master of laws programme and as such the requisite degree of commitment and ability needed cannot be underestimated. Introduction to international Business August, R., Mayer, D., and Bixby, M (2008) International Business Law: Text, Cases, and Readings, 5th ed., Pearson Education Goode, R., Kronke, H., McKendrick, E., and Wool, J (2010) Transnational Commercial Law: Text, Cases and Materials, OUP Oxford The Role of Business in Society Cato, M. S. (2008), Environment and Economy (London: Routledge). Schaltenegger, S. and Wagner, M. (2006), Managing the Business Case for Sustainability: The Integration of Social, Environmental and Economic Performance (Sheffield: Greenleaf). Transnational Commercial Law Dalhuisen, J. (2007), Dalhuisen on Transnational and Comparative Commercial, Financial and Trade Law, 3d ed., Hart Publishing Penn, G. and Haynes, A. (2009), The Law and Practice of International Banking, 2nd edn., Sweet & Maxwell Legal Research Skills and Reasoning Hanson, S (2009). Legal Method, Skills and Reasoning: 3rd Edition. Routledge Cavendish Publishing Limited. Volokh, E (2010) Academic Legal Writing: Law Review Articles, Student Notes, Seminar Papers, and Getting on Law Review, 4th edn. Foundation Press. Business and Crime Zagaris, B. (2010) International White Collar Crime: Cases and Materials, Cambridge University Press Zerk, J. A. (2011) Multinationals and Corporate Social Responsibility: Limitations and Opportunities in International Law (Cambridge Studies in International and Comparative Law), 1st ed., Cambridge University Press Dissertation Lyons, E and Doueck, H (2010) The Dissertation: From Beginning to End. Oxford University Press Salter and Mason (2007) Writing Law Dissertations. Pearson Longman Legal Aspects of International Finance Buckley, R. (2008) International Financial System: Policy and Regulation (International Banking and Finance Law Series), Kluwer Law International Warde, L. (2010) Islamic Finance in the Global Economy, 2nd revised ed., Edinburgh University Press Legal Issues in Mergers and Acquisitions De Pamphilis, D. (2009) Mergers, Acquisitions and Other Restructuring Activities: An Integrated Approach to Process, Tools, Cases and Solutions, 5th ed., Academic Press Inc. Dirk van Gerven (2010) Cross-Border Mergers in Europe, Cambridge University Press Gaughan, P. A. (2010) Mergers, Acquisitions and Corporate Restructurings, 5th ed., John Wiley and Sons Goyder, J. and Albors-Llorens, A. (2009) Goyder’s EC Competition Law, 5th ed., OUP Oxford Sudarsanam, S. (2010) Creating Value from Mergers and Acquisitions, Pearson Education Limited, Financial Times, Prentice Hall Previous years’ examples of type, mode and content of Assessments for individual Modules NOTE: LLM International Business (Finance) Assessments – So far as is possible, all assessments are based on LIVE international business related issues: LLM 7005 Legal Research Skills and Reasoning – Doctrinal legal research essay (50%) and a full 3,000 word dissertation proposal (50%) LLM7002 Role of Business in Society (non-law module) – group writing of report on an aspect of business such as ethics and sustainability and individual project presentation (100%) LLM7001 Introduction to International Business – Tesco joint venture agreement with China Resources Enterprise essay (40%) and JP Morgan Chase investigation into ‘London Whale’ trades by Financial Conduct Authority essay (60%) LLM7003 Transnational Commercial Law – Co-operative Bank exchange offer to bondholders (40%) and Bank of England special resolution regime under the Banking Act 2009 (60%) LLM7006 Business and Crime – skeleton, trial bundle and moot court on GlaxoSmithKline operations in China and consideration under Bribery Act 2010 (100%) LLM7011 Legal Issues in Mergers and Acquisitions – case analysis on Blackberry and Fairfax take-over (20%) and Negotiation on dispute resolution between Rio Tinto and the Mongolian government over Oyu Tolgoi mine (80%) LLM7010 Legal Aspects of International Finance – Presentation on Kusile power plant finance in South Africa (20%) and recognition of Sharia law under the Rome Convention essay (80%) Previous years’ dissertations 2012-2013 dissertations were on: • Indemnity clauses in upstream petroleum agreements in the oil and gas sector • Transfer pricing and arm’s length principle in the European Union • • • • Tax avoidance and multinational corporations’ directors’ duties Observance of human rights by the multinational operating in Nigerian oil and gas sector Comparative analysis of operation of the universal declaration of human rights in India and Europe Piracy and ransom claims under English law 2013-2014 dissertation are on: • Corporate Governance following the global financial crisis • Comparative analysis between FOB and CIF incoterms • Doctrine of legal personality in company law context - End of document -

© Copyright 2026