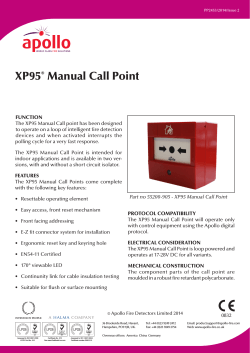

042056/EU XXV. GP Eingelangt am 16/10/14