CPD COURSE PROGRAMME 2014/15 icaew.com/eastengland BUSINESS WITH CONFIDENCE

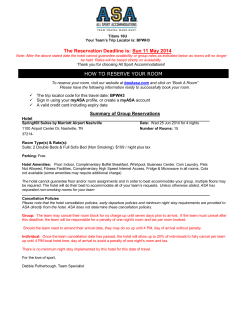

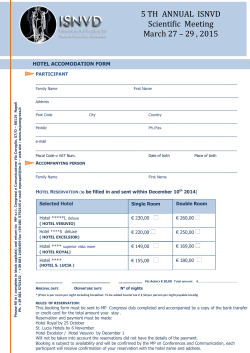

CPD COURSE PROGRAMME 2014/15 BUSINESS WITH CONFIDENCE icaew.com/eastengland WELCOME TO OUR NEW CPD COURSE PROGRAMME BOOKING PROCEDURE AND COSTS The South Essex Society’s Courses Committee meets annually to discuss the topics our courses should cover to be of the most help to you and your business. This season’s programme covers a wide range of topics, which we hope will help add value to your business and your clients’ businesses too. (Personal Discount Scheme) We hope you find the courses you need within our programme. If not, do please let us know by contacting our Regional Executive, Linda Howard on +44 (0)1223 654 684 or [email protected] You can be assured that any comments will be carefully considered by £500 for 10 courses or 50% discount for all staff on any course with an annual subscription of £500 (Firms’ Discount Scheme) or £100 for Individual courses the committee. Duncan Sheekey Chairman, Programme, Conferences and Courses Committee COURSE PROGRAMME Please send your payment with the appropriate booking form at the back of the brochure, or book online at icaew.com/southessex We reserve the right to vary the published programme Date Time Course Speaker Venue Thursday 16 October 2014 09.15 12.45 FINANCE ACT 2014 (CP 243) Mark Morton, Mercia Group Ltd Ivy Hill Hotel Margaretting Thursday 16 October 2014 14.00 17.15 REMUNERATION PACKAGE PLANNING (CP 244) Mark Morton, Mercia Group Ltd Ivy Hill Hotel Margaretting Thursday 13 November 2014 09.15 12.45 OBTAINING, ASSESSING AND DOCUMENTING AUDIT EVIDENCE (CP 245) Chris Elliott, Mercia Group Ltd Ivy Hill Hotel Margaretting Thursday 13 November 2014 14.00 17.15 AUDIT AND ASSURANCE UPDATE (CP 246) Chris Elliott, Mercia Group Ltd Ivy Hill Hotel Margaretting Monday 24 November 2014 14.00 17.15 IMPLEMENTING THE NEW FRS (CP 247) Phil Frost, Mercia Group Ltd Ivy Hill Hotel Margaretting Wednesday 3 December 2014 14.00 17.15 AUTO ENROLMENT: WHAT YOU NEED TO KNOW (CP 248) Pat Nown, Mercia Group Ltd Stock Brook Country Club, Billericay Wednesday 25 February 2015 09.15 12.45 EMPLOYMENT TAXES UPDATE (CP 249) Mark Ward, The Professional Training Partnership Ivy Hill Hotel Margaretting Wednesday 25 February 2015 14.00 17.15 VAT UPDATE AND SPECIFIC BUSINESS SECTOR ISSUES (CP 250) Simone Hurst, VATease Ivy Hill Hotel Margaretting Monday 23 March 2015 14.00 17.15 CHARITIES: CURRENT ISSUES (CP 251) Bill Telford, Telford Financial Training Ivy Hill Hotel Margaretting Thursday 16 April 2015 14.00 17.15 BUSINESS STRUCTURES TAX ISSUES (CP 252) Martyn Ingles, Ingles Tax & Tax Training Ltd Ivy Hill Hotel Margaretting Monday 11 May 2015 14.00 17.15 TAX PLANNING FOR RETIREMENT (CP 253) Tony Jenkins, Dragon Training Ivy Hill Hotel Margaretting Wednesday 3 June 2015 09.15 12.45 ACCOUNTANCY UPDATE AND CURRENT ISSUES (CP 254) Jeremy Williams, Mercia Group Ltd Ivy Hill Hotel Margaretting Wednesday 3 June 2015 14.00 17.15 TOP TIPS FOR DELIVERING THE PROFITABLE ASSIGNMENT (CP 255) Jeremy Williams, Mercia Group Ltd Ivy Hill Hotel Margaretting Tuesday 30 June 2015 14.00 17.15 TAX IN THE CONSTRUCTION INDUSTRY: A REFRESHER AND PLANNING (CP 256) Tim Palmer, Palmer Training Ltd Hylands House Chelmsford Cancellations, Refunds and Transfers – Transfer of bookings to another course may be made up to seven working days before the course booked on. No refund will be due for cancellations received within seven working days of a course. Replacement delegates may be sent. 2 Finance Act 2014 Thursday 16 October 2014 Ivy Hill Hotel, Margaretting 09.15 – 12.45 SPEAKER Mark Morton, Mercia Group Ltd OBJECTIVES CONTENT This course will cover all of the major clauses in the Finance Act and will concentrate on the practical implications for accountants and their clients. • Personal tax, including changes to pensions and the transferable MCA CPD HOURS 3 • Business and corporate tax changes including the new rules for partnerships and LLPs and AIA • Changes for charities and CASCs, including the new Social Investment Relief • Employee tax, including changes to share schemes and the rules for company cars and vans • Capital taxes changes, including restrictions to PPR • VAT and SDLT, including the changes to the enveloped dwellings charge • Other legislative changes CP243 Remuneration Package Planning Thursday 16 October 2014 Ivy Hill Hotel, Margaretting 14.00 – 17.15 SPEAKER Mark Morton, Mercia Group Ltd OBJECTIVES CONTENT With each successive Finance Act, previously tax-efficient remuneration packages lose their appeal and new opportunities are created. The perils associated with the provision of benefits continue to require great attention (especially with the new-style P11D and its attendant penalties). • Efficient remuneration planning for the owner/manager This course will update participants on the latest developments in employee taxation and suggest ways of minimising the burden for both employee and employer. CPD HOURS • Extraction as capital, including Entrepreneurs' Relief • Transferring income to other members of the family • The most popular benefits • National Insurance efficiency • Non-taxable payments and benefits • Problem areas 3 CP244 3 Obtaining, Assessing and Documenting Audit Evidence Thursday 13 November 2014 Ivy Hill Hotel, Margaretting 09.15 – 12.45 SPEAKER Chris Elliott, Mercia Group Ltd OBJECTIVES CONTENT Developments in auditing standards in the last few years have increased the significance (and in some cases the risk!) of using audit evidence from clients, experts and third parties. Regulators and file reviewers regularly mention weaknesses in the approach to such evidence and indeed in the actual evidence obtained. The ISAs include a number of specific requirements together with guidance intended to strengthen audit practice, and auditors need to be reasonably familiar with these requirements. • Directors’ and auditors’ responsibilities: - directors’ responsibilities and pre-conditions for an audit - audit evidence and recording evidence The course examines these areas and provides practical guidance concerning regular problems arising in the audit of owner managed companies. The course includes a number of worked examples and case studies. CPD HOURS 3 (AUDIT RELATED: 3) • Dealing with third parties: - management experts and auditors’ experts - service organisations and outsourcing - external confirmations - using internal auditors • Common problem areas: - groups and working with component auditors - using non-audit services effectively - evidencing fraud considerations - accounting estimates including impairment of fixed assets - related parties - going concern - subsequent events - management representations and communication with those charged with governance CP245 Audit and Assurance Update Thursday 13 November 2014 Ivy Hill Hotel, Margaretting 14.00 – 17.15 SPEAKER Chris Elliott, Mercia Group Ltd OBJECTIVES CONTENT We are now into the fourth year of conducting audits under the clarified ISA regime. It is therefore imperative that audit files demonstrate an understanding of, and compliance with, the requirements of the clarified ISAs. • Feedback from the main Regulators (QAD/ACCA/AQR) and the FRC annual report This course will look at the most recent changes affecting auditing in the UK and their practical implications for the planning and execution of audits. • Effective use of sampling - factors to consider Changes in the audit exemption rules mean that more companies will not require a statutory audit and so the course will also cover developments in the guidance in relation to the provision of assurance services, in particular assurance review engagements. The course is aimed at partners, managers and senior staff involved in audit. CPD HOURS • Preparing for FRS 102 - Audit implications • What does an assurance review engagement involve? • A practical look at substantive analytical procedures • Continuing problem areas - a reminder (including scepticism, estimates and fraud) • A summary of the Auditing Standards, Practice Notes, Technical Releases and other audit pronouncements issued since the previous audit update course • Latest guidance on owner managed business audits • Recent and likely future developments affecting auditing in the UK (including EU and BIS proposals) Short examples and exercises will be used to illustrate common problems identified during file reviews and how to prevent them occurring on your files. 3 (AUDIT RELATED: 3) Note: The course will focus on the audits of individual entities rather than group issues. CP246 4 Implementing the New FRS Monday 24 November 2014 Ivy Hill Hotel, Margaretting 14.00 – 17.15 SPEAKER Phil Frost, Mercia Group Ltd OBJECTIVES CONTENT UK GAAP is undergoing a radical overhaul. Companies will be required to adopt the new accounting standards for periods commencing on or after 1st January 2015, restating their comparatives as appropriate. • An overview of how the new standards were developed • FRS 100 – Application of Financial Reporting Requirements – what entities are required or can choose to do The FRSSE will remain though with consequential changes. Entities which are currently required to or chose to adopt IFRS will continue to be able to do so. However, there is a reduced disclosure framework for parent entities and subsidiaries set out in FRS 101. Entities which are not required to or chose not to adopt to IFRS, or which are not allowed to prepare accounts under the FRSSE will be required to adopt “The FRS” – embodied in FRS 102. This course will explore the new standards in detail – detailing the key areas which will require different treatment. • FRS 101 – Reduced Disclosure Framework – for those adopting IFRS • FRS 102 – What the new requirements are and the key differences from current UK GAAP • The impact on FRSSE entities • The transition process and the importance of the opening comparative balance sheet CPD HOURS 3 (AUDIT RELATED: 3) CP247 Auto Enrolment: What You Need to Know Wednesday 3 December 2014 Stock Brook Country Club, Billericay 14.00 – 17.15 SPEAKER Pat Nown, Mercia Group Ltd OBJECTIVES CONTENT The Pensions Act 2008 and 2011 introduced a series of measures referred to as 'automatic enrolment' whereby employers are required to put qualifying individuals into a workplace pension scheme. Specifically the content will include: Many large employers have already commenced auto enrolment as there is a planned timetable for implementation depending on the number of employees. However, research suggests that many smaller employers and their employees are still very much in the dark about what it all means. This is partly because many businesses employ fewer than 50 individuals and this size of business is not required to compulsorily start until 1 June 2015 at the earliest. • Types of worker and their relevance These changes to pensions law affect every employer in the UK. The policy aim is to help people save for retirement as millions of people in the UK are not saving enough for retirement yet are living longer lives. Planning for this key change earlier rather than later is essential to ensuring that SME businesses are prepared as there are a wide range of issues to understand and consider. • Communication processes This course has been designed to outline the essential framework of what you need to know to get started and how the process works. • Staging dates • Identification of workers for auto enrolment • Financial contributions • Choosing a pension scheme and the role of NEST • Opting in/out • Administering the auto enrolment process • Compliance and penalties CPD HOURS 3 CP248 5 Employment Taxes Update Wednesday 25 February 2015 Ivy Hill Hotel, Margaretting 09.15 – 12.45 SPEAKER Mark Ward, The Professional Training Partnership OBJECTIVES CONTENT To review the current practice and procedures relating to the taxation of employees and the national insurance implications, with particular focus on recent and impending developments, and potential problem areas • Classes 1 & 1A national insurance contributions CPD HOURS • Disguised remuneration issues and EBTs 3 • Emoluments and benefits in kind • Car benefits • IR35 and status issues • Share schemes • Termination and other ex-gratia payments • Expenses payments, including travel • Administration CP249 VAT Update and Specific Business Sector Issues Wednesday 25 February 2015 Ivy Hill Hotel, Margaretting 14.00 – 17.15 SPEAKER Simone Hurst, VATease OBJECTIVES CONTENT In addition to reviewing general VAT changes in the last 12 months, this course will also give you an overview of some of the key VAT issues relating to certain business sectors. The first half of the course will concentrate on a general VAT update and the second half of the course will focus on specific business sector VAT issues. • Review of VAT changes in the previous 12 months including a summary of case law CPD HOURS 3 (AUDIT RELATED: 1) • Charities • Health and Welfare • Construction Industry • Property Development • Retail • Other areas such as motor, solicitors, education depending on available time CP250 6 Charities: Current Issues Monday 23 March 2015 Ivy Hill Hotel, Margaretting 14.00 – 17.15 SPEAKER Bill Telford, Telford Financial Training OBJECTIVES CONTENT Accounting for charities is subject to continual change. Recent developments include legislative changes as well as regulatory developments. In particular the Charities SORP has been updated to reflect the changes introduced by FRS 102 and consequent changes to the FRSSE (which may well have been withdrawn by the date of the course!) • Recent legal and regulatory developments and Charity Commission consultations and publications. This course will consider the practical impact in charity accounts that arise from these changes. It will also address key auditing issues together with issues for reporting accountants. • Planning for the new Charities SORP • The impact of changes in charity funding and public sector involvement on trustees’ reports and accounts • Charitable structures including Charitable Incorporated Organisations • Audit and assurance issues including independent examinations, whistle blowing and clarified ISAs CPD HOURS 3 (AUDIT RELATED: 3) CP251 Business Structures - Tax Issues Thursday 16 April 2015 Ivy Hill Hotel, Margaretting 14.00 – 17.15 SPEAKER Martyn Ingles, Ingles Tax and Training Limited OBJECTIVES CONTENT The best structure for start-up businesses is not necessarily appropriate as the business grows and it will often be necessary to review and possibly revise the structure in the future. The business structure chosen will also have an impact on the tax treatment of the eventual sale or exit from the business. The course will include: You should gain an understanding of the most appropriate tax structure at various times in the life cycle of a business and the need for a periodic review of the most appropriate structure. • “Hybrid” structures involving corporate members and service companies The course will consider in particular the antiavoidance measures targeting partnerships and LLPs with non-individual members that were introduced in Finance Act 2014. CPD HOURS • Tax advantages of limited companies • Tax treatment of partnerships and LLPs • Incorporation of the partnership - comparison of company with LLP • Anti-avoidance targeting the use of corporate partners by partnerships and LLP • The extension of the loans to participators rules to LLPs • Tax consequences of forming a group or joint venture • Tax implications of demerging the business • Selling the business - tax implications of different structures 3 CP252 7 Tax Planning for Retirement Monday 11 May 2015 Ivy Hill Hotel, Margaretting 14.00 – 17.15 SPEAKER Tony Jenkins, Dragon Training OBJECTIVES CONTENT Retirement is a time that hopefully comes to all of us, some sooner others later. As time passes opportunities must be taken advantage of to maximise the ability and the tax efficiency of accumulating wealth towards retirement. Changes in the pension regime both in terms of what can be saved and withdrawn are important and must be fully understood. Access to pension schemes has been made more flexible from 27 March 2014 and will become more flexible from April 2015. • The approved pension provisions (including state pension provisions) When considering that planning in relation to retirement it is not only the pension provisions that need to be considered but all the income and capital tax provisions both before retirement and also during retirement. • Unapproved pensions provisions • The use of other assets for pension provision including property • Exit routes from a family company or OMB • CGT planning on retirement • Considering relevant aspects across each age group • Extracting funds from pensions arrangements • Income and capital taxes during retirement This course will give delegates a thorough and wide knowledge on all tax aspects of pension matters. CPD HOURS 3 CP253 Accountancy Update and Current Issues Wednesday 3 June 2015 Ivy Hill Hotel, Margaretting 09.15 – 12.45 SPEAKER Jeremy Williams, Mercia Group Ltd OBJECTIVES CONTENT On completion of the course, participants will: Content may change as a result of developments but is likely to include: • Understand the practical impact of the FRC’s Future of UK GAAP project on all sizes of companies • The implementation of the FRC’s proposal for the Future of Financial Reporting in the UK and Republic of Ireland specifically FRSs 100, 101 and 102 and of their proposals for small entities, together with a review of the practical impact of the revised EU Accounting Directive, and an overview of the requirements of FRS 102 including the transitional provisions • Be aware of all FRC Accounting Standards and FREDs issued since the last update course • Understand which pronouncements affect them and the action that should be taken • Understand other pronouncements, discussion documents and developments arising during the period which affect accounting, reporting, practical legal issues, and the related work of practitioners CPD HOURS 3 (AUDIT RELATED: 3) • Current developments and issues in International GAAP • Other current developments and issues in UK GAAP, including the changes to accounting and reporting by incorporated micro-entities and the introduction of the “cash accounting” option for smaller unincorporated entities, together with the impact of, and opportunities arising from, changes in audit exemption • Developments in money laundering including feedback on the ICAEW’s AML benchmarking exercise • Accounting and reporting areas where frequent mistakes are discovered • Developments in specialist areas including the revised SORPs • Regulatory changes and QAD feedback on Practice Assurance CP254 8 Top Tips for Delivering the Profitable Assignment Wednesday 3 June 2015 Ivy Hill Hotel, Margaretting 14.00 – 17.15 SPEAKER Jeremy Williams, Mercia Group Ltd OBJECTIVES CONTENT The course is an opportunity for the practitioner to focus on the ways in which assignments can be made more profitable. Most courses concentrate on technical aspects and neglect other essential aspects. This course will address some technical issues but in the context of other areas the practice needs to consider. • Objectives for the assignment - What do your clients need? - What do you need? The outcome should be that delegates identify clear actions which would improve profitability on individual assignments. CPD HOURS 3 (AUDIT RELATED: 3) • Efficiency and effectiveness of the work - Gaining benefit from time spent planning - Using technology better - Going for minimum not maximum compliance with the rules • Finalisation procedures - What goes wrong? - Improving review procedures • Administrative procedures - Budgeting, ensuring this plans for profit - Timetabling key elements of all assignments - Billing the right amount at the right time - Measuring performance indicators that matter • Managing people and work - Planning with the resources you have, not those you dream of! - Managing and motivating your team. CP255 Tax in the Construction Industry: A Refresher and Planning Tuesday 30 June 2015 Hylands House, Chelmsford 14.00 – 17.15 SPEAKER Tim Palmer, Palmer Training Ltd OBJECTIVES CONTENT The course will provide a detailed insight into how the Construction Industry Scheme works in practice and explains the tax responsibilities and roles of both the contractor and subcontractor. This course will cover: • The CIS tax responsibilities of both the contractor and subcontractor under the current CIS regime Participants will gain an understanding of the current CIS tax rules and administration requirements. The full practical impact of tax and CIS will be considered, together with an update on recent developments. • The dealings the contractor will have with HMRC CPD HOURS 3 • Verification and the steps contractors have to take • The monthly CIS return: its completion and filing • The impact on the subcontractor • Is the subcontractor really self-employed? • Current problems facing contractors and subcontractors • What really are construction operations • Who are within the scheme and who are not • CIS penalties • Current IR35 issues facing the construction industry • Practical CIS planning • General overview CP256 9 BOOKING FORM PLEASE PHOTOCOPY THIS FORM Please complete the form and send with payment to the address below. Book online at icaew.com/southessex DETAILS BOOKING QUERIES Name: (BLOCK CAPITALS please) Email Address Course Code (eg CP 100) Address Course Title Postcode/Zipcode Date Country Venue Telephone No Company/Firm Fax number FDS Membership No. *(if applicable) Email address DELEGATE NAMES (First Name and Surname in BLOCK CAPITALS please) Email Address ICAEW Membership No. PLACES REQUIRED COURSE FEES FEE (excluding VAT) Adult £100.00 £ . Student £50.00 £ . £ . Sub Total £ . VAT (20%) £ . Total remittance enclosed (payable to SES Chartac) £ . Less 50% discount for Firms’ Discount Members* EVENTS BOOKING TEAM ICAEW PO Box 6083 Milton Keynes MK10 1PG T +44 (0)1908 248 159 / +44 (0)1223 654 684 F +44 (0)1908 248 053 E [email protected] 10 NO. PEOPLE TOTAL COST Firms’ Discount Scheme Application Tailored for the larger practice Annual subscription fee of £500 plus VAT 50% discount on all course fees for any member of staff Please enrol/renew my firm/organisation as a member of the Firms’ Discount Scheme. I understand that my subscription entitles me and any of my staff to 50% discount per place on any of the courses shown on this leaflet. Please use the booking form on page 10 to inform us of the places you would like to book on each course. Or, once your annual subscription has been paid, bookings may be made online using the 50% discount code we will send with your scheme payment confirmation letter. Book online at icaew.com/southessex I enclose a cheque for £500 + VAT (£600) made payable to SES Chartac to cover the annual subscription fee. Name of Firm/Organisation No. of Partners No. of Qualified Staff Unqualified Staff Contact Address Telephone No. Postcode/Zipcode Email Signature Date DD MM YY Personal Discount Scheme Membership Tailored for the sole practitioner/smaller practice Your subscription entitles you to one place on any 10 of the 14 courses listed. You may send any one individual from your office on each of the ten courses chosen. All 10 places must be used by the end of July 2015. 10 half day courses for £500 plus VAT Sole practitioners – should you wish to attend more than ten courses, one extra place on any of the remaining four courses may be booked at £50 plus VAT per place. Smaller practices – may also book up to four extra places, either on the courses already chosen, or on the remaining four courses, at £50 plus VAT per place, but no more than two delegates per course from any one firm may attend using this scheme. For multiple course bookings you should use the Firms’ Discount Scheme. Please use the booking form overleaf to indicate the courses you wish to attend. You may join the personal discount scheme online at icaew.com/sespersonaldiscountscheme You will be issued a unique code which will allow you to select and book your 10 half day courses. I enclose a cheque for £500 + VAT (£600) made payable to SES Chartac. Name Address Company/Firm ICAEW Membership No. Postcode/Zipcode Telephone No. Email Date DD MM YY 11 PERSONAL DISCOUNT SCHEME ADVANCE BOOKING FORM PLAN AHEAD – make your course selection now Course Date Venue FINANCE ACT 2014 (CP 243) Thursday 16 October 2014 Ivy Hill Hotel Margaretting REMUNERATION PACKAGE PLANNING (CP 244) Thursday 16 October 2014 Ivy Hill Hotel Margaretting OBTAINING, ASSESSING AND DOCUMENTING AUDIT EVIDENCE (CP 245) Thursday 13 November 2014 Ivy Hill Hotel Margaretting AUDIT AND ASSURANCE UPDATE (CP 246) Thursday 13 November 2014 Ivy Hill Hotel Margaretting IMPLEMENTING THE NEW FRS (CP 247) Monday 24 November 2014 Ivy Hill Hotel Margaretting AUTO ENROLMENT: WHAT YOU NEED TO KNOW (CP 248) Wednesday 3 December 2014 Stock Brook Country Club Billericay EMPLOYMENT TAXES UPDATE (CP 249) Wednesday 25 February 2015 Ivy Hill Hotel Margaretting VAT UPDATE AND SPECIFIC BUSINESS SECTOR ISSUES (CP 250) Wednesday 25 February 2015 Ivy Hill Hotel Margaretting CHARITIES: CURRENT ISSUES (CP 251) Monday 23 March 2015 Ivy Hill Hotel Margaretting BUSINESS STRUCTURES - TAX ISSUES (CP 252) Thursday 16 April 2015 Ivy Hill Hotel Margaretting TAX PLANNING FOR RETIREMENT (CP 253) Monday 11 May 2015 Ivy Hill Hotel Margaretting ACCOUNTANCY UPDATE AND CURRENT ISSUES (CP 254) Wednesday 3 June 2015 Ivy Hill Hotel Margaretting TOP TIPS FOR DELIVERING THE PROFITABLE ASSIGNMENT (CP 255) Wednesday 3 June 2015 Ivy Hill Hotel Margaretting TAX IN THE CONSTRUCTION INDUSTRY: A REFRESHER AND PLANNING (CP 256) Tuesday 30 June 2015 Hylands House Chelmsford Changes can be made at a later date but must be notified in writing EVENTS BOOKING TEAM ICAEW PO Box 6083 Milton Keynes MK10 1PG T +44 (0)1908 248 159 / +44 (0)1223 654 684 F +44 (0)1908 248 053 E [email protected] No of places Delegate name(s)

© Copyright 2026