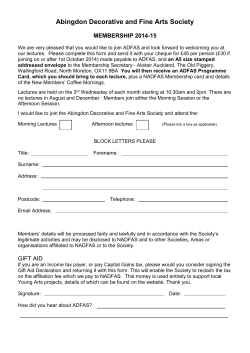

Abingdon Decorative and Fine Arts Society MEMBERSHIP

Abingdon Decorative and Fine Arts Society MEMBERSHIP We are very pleased that you would like to join ADFAS and look forward to welcoming you at our lectures. Please complete this form and send it with your cheque for £39 per person (£20 if joining in or after September 2013 and £10 in or after January 2014) made payable to ADFAS, and an A5 size stamped addressed envelope to the Membership Secretary:- Mrs Sandy King, 17 Park Crescent, Abingdon OX14 1DF. You will then receive an ADFAS Programme Card, which should bring to each lecture, a NADFAS Membership card and details of the New Members’ Coffee Mornings. Lectures are held on the 3rd Wednesday of each month (the 2nd Wednesday in December) starting at 10.30am and 2pm. There is no lecture in August. Members join either the Morning Session or the Afternoon Session. I would like to join the Abingdon Decorative and Fine Arts Society and attend the: Morning Lectures Afternoon lectures (Please tick a box as applicable) BLOCK LETTERS PLEASE Title: Forename: Surname: Address: Postcode: Telephone: Email Address: Members’ details will be processed fairly and lawfully and in accordance with the Society’s legitimate activities and may be disclosed to NADFAS and to other Societies, Areas or organisations affiliated to NADFAS or to the Society. GIFT AID If you are an Income tax payer, or pay Capital Gains tax, please would you consider signing the Gift Aid Declaration and returning it with this form. This will enable the Society to reclaim the tax on the affiliation fee which we pay to NADFAS. This money is used entirely to support local Young Arts projects, details of which can be found on the website. Thank you. Signature: How did you hear about ADFAS?: Date: Gift Aid Declaration THE NATIONAL ASSOCIATION OF DECORATIVE & FINE ARTS SOCIETIES (NADFAS) Details of donor Title…………..Forename(s)……………………Surname………………………………………… Address………………………………………………………………………………………………... ………………………………………………………………………………………………………….. …………………………………………………Post Code…………………………………………… I want the Charity to treat * all donations I have made for the 4 years prior to this year, and all donations I make from the date of this declaration until I notify you otherwise * all donations I make from the date of this declaration until I notify you otherwise as Gift Aid donations. * delete as appropriate The amount of donation is that part of my total annual subscription attributed to the NADFAS affiliation fee. *(2012: £11.40). Date: ……./……/……. Notes 1. 2. 3. 4. 5. 6. You must pay an amount of Income tax and/or capital gains tax at least equal to the tax that the charity (and any other charity or Community Amateur Sports Club to which you have made a Gift Aid declaration) reclaims on your donations in the tax year (currently 25p for each £1 you give). You can cancel this Declaration at any time by notifying the charity. If in the future your circumstances change and you no longer pay tax on your income and capital gains equal to the tax that the charity reclaims, you can cancel your declaration (see note 1) If you pay tax at a higher rate you can claim further tax relief in your Self Assessment tax return. If you are unsure whether your donations qualify for Gift Aid tax relief, ask your local tax office. Please notify the charity (via your society) if you change your name or address. Gift Aid Declaration – guidance notes for completion Your Society is a member of the National Association of Decorative and Fine Art Societies (NADFAS), which is a registered charity. NADFAS is able to claim Gift Aid on the affiliation fee (donation) paid by you as part of your total annual subscription. If you complete the Gift Aid Declaration and return it to your society we can claim Gift Aid of £2.85 on £11.40 of the subscription paid by you for 2012. Your subscription including the affiliation fee will be collected by your society in the usual way. If you are a higher rate taxpayer, you can also claim back the difference between the standard and higher rates of tax in your self-assessment tax return. The claim can be back dated to cover donations from 6 April 2008 . If you wish for your previous donations via the affiliation fee to be included, please ensure that you leave that option on the form open. For your information previous years’ affiliation fees have been: 2009: 2010: 2011: 2012: £10.75(Covers subscriptions paid in the tax year to 5 April 2009) £10.90(Covers subscriptions paid in the tax year to 5 April 2010) £11.15(Covers subscriptions paid in the tax year to 5 April 2011) £11.40(Covers subscriptions paid in the tax year to 5 April 2012) The completed Gift Aid declaration should be returned to your local society for processing. Please DO NOT send the declaration, related correspondence or payment to NADFAS.

© Copyright 2026