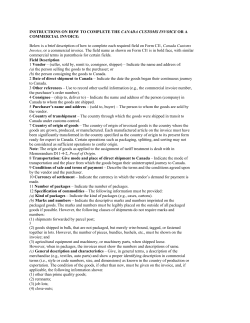

Technical specifications for fiscal verification of invoices