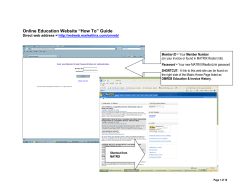

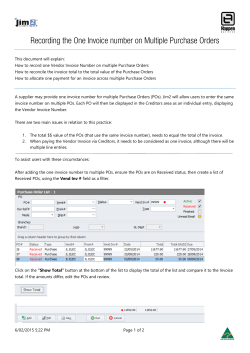

Technical specifications for fiscal verification of invoices