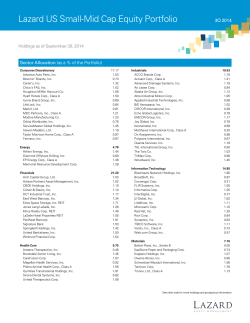

FORM N-Q SECURITIES AND EXCHANGE COMMISSION