Lazard US Mid Cap Equity Portfolio 3Q 2014

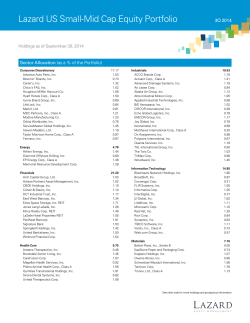

Lazard US Mid Cap Equity Portfolio 3Q 2014 Holdings as of September 30, 2014 Sector Allocation (as a % of the Portfolio) Consumer Discretionary Advance Auto Parts, Inc. Dick's Sporting Goods, Inc. Houghton Mifflin Harcourt Co. Kohl's Corp. Macy's, Inc. MDC Partners, Inc., Class A ServiceMaster Global Holdings, Inc. 31.62 6.96 4.00 3.12 5.00 4.74 3.63 4.17 Consumer Staples Molson Coors Brewing Co., Class B Sysco Corp. 9.49 5.11 4.37 Energy Transocean, Ltd. 3.36 3.36 Financials IntercontinentalExchange, Inc. Janus Capital Group, Inc. The Hartford Financial Services Group, Inc. 10.25 4.37 2.97 2.91 Health Care CareFusion Corp. Magellan Health Services, Inc. Zoetis, Inc. 16.35 5.04 4.61 6.70 Industrials American Airlines Group, Inc. Joy Global, Inc. TAL International Group, Inc. XPO Logistics, Inc. 9.83 1.89 4.26 1.95 1.73 Information Technology Blackhawk Network Holdings, Inc. Convergys Corp. NeuStar, Inc., Class A NXP Semiconductor NV Xerox Corp. 10.84 2.48 0.56 0.78 4.00 3.02 Materials Better Place, Inc., Series B Eastman Chemical Co. 2.25 0.00 2.25 Cash & Equivalents 6.02 TOTAL 100.00 See other side for prospectus information Lazard US Mid Cap Equity Portfolio 3Q 2014 Published on October 15, 2014. Equity securities will fluctuate in price; the value of your investment will thus fluctuate, and this may result in a loss. Mid-cap securities carry additional risks, their earnings may be less predictable, their share prices more volatile, and their securities less liquid than large-cap securities. The Portfolio invests in stocks believed by Lazard to be undervalued, but that may not realize their perceived value for extended periods of time or may never realize their perceived value. The stocks in which the Portfolio invests may respond differently to market and other developments than other types of stocks. The securities mentioned are not necessarily held by Lazard for all client portfolios, and their mention should not be considered a recommendation or solicitation to purchase or sell these securities. It should not be assumed that any investment in these securities was, or will prove to be, profitable, or that the investment decisions we make in the future will be profitable or equal to the investment performance of securities referenced herein. There is no assurance that any securities referenced herein are currently held in the portfolio or that securities sold have not been repurchased. The securities mentioned may not represent the entire portfolio. Not a deposit. May lose value. Not guaranteed by any bank. Not FDIC insured. Not insured by any government agency. Please consider a fund’s investment objectives, risks, charges, and expenses carefully before investing. For more complete information about The Lazard Funds, Inc. and current performance, you may obtain a prospectus or summary prospectus by calling 800-823-6300 or going to www.LazardNet.com. Read the prospectus or summary prospectus carefully before you invest. The prospectus and summary prospectus contain investment objectives, risks, charges, expenses, and other information about the Portfolio and The Lazard Funds that may not be detailed in this document. The Lazard Funds are distributed by Lazard Asset Management Securities LLC. Lazard Asset Management LLC • 30 Rockefeller Plaza • New York, NY 10112 • www.lazardnet.com MF12390

© Copyright 2026