험난했던 주말, 조용했던 월요일…

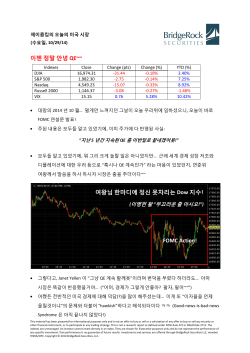

제이콥킴의 오늘의 미국 시장 (월요일, 10/27/14) 험난했던 주말, 조용했던 월요일… Indexes DJIA S&P 500 Nasdaq Russell 2000 VIX Close 16,817.94 1,961.63 4,485.93 1,117.48 16.04 Change (pts) 12.53 ‐2.95 2.22 ‐1.35 ‐0.07 Change (%) 0.07% ‐0.15% 0.05% ‐0.12% ‐0.43% YTD (%) 1.46% 6.13% 7.41% ‐3.97% 16.91% 지난 주말은 참으로 험악(?)했수다~~ 1) 오리지날 Emerging Markets 의 일원인 ‘브라질’의 대선… 경제 개혁의 희망을 찢어발기신 현직 대통령 Dilma Rousseff 가 재선에 성공: o iShares MSCI Brazil Capped (EWZ) ‐5.39% (오늘 SPY 만큼이나 거래량 많았슴~) o iShares Latin America 40 (ILF) ‐2.90% (브라질이 50% weight~) o WisdomTree Brazilian Real Strategy ETF (BZF) ‐2.66% (Brazilian real 을 엉성하게 따라가는 ETF~) 2) 유럽에서는 ‘유럽중앙은행’이 실시한 스트래스 테스트에서 25 개 은행들이 낙방! 낙제생들은 주로… 언제나 그랬듯이… 이탈리아와 그리스쪽 애덜이었기에… (참조: 어제 시황에 25 개 낙제 은행 리스트 첨부했슴): o o o iShares MSCI Italy Capped (EWI) ‐2.56% Global X FTSE Greece 20 ETF (GREK) ‐3.06% iShares MSCI Europe Financials (EUFN) ‐1.56% 3) “후강퉁” 또다시 연기! (듕궈, 널 믿은 우리가 잘못인거야? 제발 말해줘~~ ㅜㅜ) o iShares China Large‐Cap (FXI) ‐1.14% 4) 그리고 그 무엇보다도… 어제부로 NY Jets 가 7 연패에 빠졌다는 사실! (아… 어릴때는 OB Bears 가 그렇게 맨날 지더니… 뉴욕 와서는 NY Mets 에 NY Knicks… 이번에는 NY Jets 까지… 전 언제나 winning team 을 응원해 볼 수 있을까요? ㅜㅜ) 하지만… 오늘 월요일 미국장은 비교적 조용했슴. (뭐, 위 리스트를 보고 월요일도 험난할거라 겁먹기는 했지만 ㅋㅋ) 하지만… 에너지 섹터는 완존 “안습”입니다! (누구 바닥을 아시는 분~~?) This material has been prepared for informational purposes only and is not an offer to buy or sell or a solicitation of any offer to buy or sell any security or other financial instrument, or to participate in any trading strategy. This is not a research report as defined under NYSE Rule 472 or NASD Rule 2711. The indexes are unmanaged. An investor cannot invest directly in an index. They are shown for illustrative purposes only and do not represent the performance of any specific investment. Past performance is no guarantee of future results. Investments and services are offered through BridgeRock Securiteis LLC, member FINRA/SIPC. Copyright © 2014 BridgeRock Securities, LLC. 국제 유가 지난 주말 “험악 리스트”에 국제 유가도 들어갔어야 해. 오늘 오전 한때, WTI 12 월 선물가가 $79 이하로 다이빙 했었쥐~~ 그동안 유가 하락에 대해서는 갖가지 이유가 존재했지만… 오늘은 지엄하신 골드만삭스 님의 한마디가 주요 원인이라고 볼수 있어. 꼴드만 가라사대: “WTI 가 $75 까지 내려가고… 2016 년까지는 거기서 한발짜국도 움직이지 않을 것이니라~~” (언제는 또 $90 이 적정선이라매~~?) 당삼, Energy Sector 가 바로 반응을 보였쥐~~ (뉘시라고 버틸수 있겠어요?) o Energy Select Sector SPDR ETF (XLE) ‐2.10% 하지만, 국제 유가는 의외로 오후에 반등했어… (아마도 그동안 너무 short 을 쳐놓았기에 더이상은 무서워서 다들 커버하지 않았을까?) USO 의 어제와 오늘 아침부터 확 빠졌다 올라가기 쌩쇼~~ 미국 기업 실적 이제 험악한 이야기 그만하고~ 아름다운 이야기 좀 해봅시다! 이름하여 Earnings Season~~ 지난주까지 S&P 500 지수내 약 213 개 기업이 3/4 분기 실적 발표를 마쳤지… 좀 걱정 했었는데, 생각보다 괜찮은 편이라네~~ 지난해보다 수익이 약 5.6% 상승했다고… 반면, 기대치는 4.5%! 자… 그럼 내일은 어떤 회사들이 실적을 발표하는지 살펴봅시다 (뒷장을 보시오): This material has been prepared for informational purposes only and is not an offer to buy or sell or a solicitation of any offer to buy or sell any security or other financial instrument, or to participate in any trading strategy. This is not a research report as defined under NYSE Rule 472 or NASD Rule 2711. The indexes are unmanaged. An investor cannot invest directly in an index. They are shown for illustrative purposes only and do not represent the performance of any specific investment. Past performance is no guarantee of future results. Investments and services are offered through BridgeRock Securiteis LLC, member FINRA/SIPC. Copyright © 2014 BridgeRock Securities, LLC. 내일(10/28)의 실적 발표 예정 리스트 (Market cap 이 $10 이상되거나, 아니면 좀 유명한것으로 추려보았소~~) Ticker AET WHR AME AMTD CMI DD ECL FCX GLW HCA HOT LVLT MMC NBL PCAR PCG PFE PH SHW SIRI COH GILD AFL AMP APC BXP CHRW EA EIX EQR ESRX FISV MAR MCK VRSK VRTX WDC WGP WYNN FB Company Aetna Inc. Whirlpool Corp. Ametek Inc. TD Ameritrade Cummins Inc. du Pont Ecolab Inc. Freeport‐McMoRan Corning Inc. HCA Holdings, Inc. Starwood Worldwide Level 3 Marsh & McLennan Noble Energy, Inc. PACCAR Inc. PG&E Corporation Pfizer Inc. Parker‐Hannifin Sherwin‐Williams Sirius XM Holdings Inc. Coach, Inc. Gilead Sciences Inc. AFLAC Inc. Ameriprise Anadarko Petroleum Boston Properties Inc. CH Robinson Electronic Arts Inc. Edison International Equity Residential Express Scripts Fiserv, Inc. Marriott McKesson Corporation Verisk Analytics, Inc. Vertex Pharm. Western Digital Western Gas Wynn Resorts Ltd. Facebook, Inc. Sector Healthcare Consumer Goods Industrial Goods Financial Industrial Goods Basic Materials Consumer Goods Basic Materials Technology Healthcare Services Technology Financial Basic Materials Consumer Goods Utilities Electric Healthcare Industrial Goods Basic Materials Services Consumer Goods Healthcare Financial Financial Basic Materials Financial Services Technology Utilities Electric Financial Healthcare Services Services Services Services Healthcare Technology Basic Materials Services Technology Industry Health Care Plans Appliances Diversified Machinery Investment Brokerage ‐ National Diversified Machinery Agricultural Chemicals Cleaning Products Copper Diversified Electronics Hospitals Lodging Diversified Communication Services Insurance Brokers Independent Oil & Gas Trucks & Other Vehicles Utilities Drug Manufacturers ‐ Major Industrial Equipment & Components Specialty Chemicals Broadcasting ‐ Radio Textile ‐ Apparel Footwear & Accessories Biotechnology Accident & Health Insurance Asset Management Independent Oil & Gas REIT ‐ Office Air Delivery & Freight Services Multimedia & Graphics Software Utilities REIT ‐ Residential Health Care Plans Business Services Lodging Drugs Wholesale Business Services Biotechnology Data Storage Devices Oil & Gas Pipelines Resorts & Casinos Internet Information Providers This material has been prepared for informational purposes only and is not an offer to buy or sell or a solicitation of any offer to buy or sell any security or other financial instrument, or to participate in any trading strategy. This is not a research report as defined under NYSE Rule 472 or NASD Rule 2711. The indexes are unmanaged. An investor cannot invest directly in an index. They are shown for illustrative purposes only and do not represent the performance of any specific investment. Past performance is no guarantee of future results. Investments and services are offered through BridgeRock Securiteis LLC, member FINRA/SIPC. Copyright © 2014 BridgeRock Securities, LLC.

© Copyright 2026