FRAC SAND ̶ a vital industrial ingredient in www.larongegold.com TSX.V: LAR

October 2014 FRAC SAND ̶ a vital industrial ingredient in the extraction of oil and natural gas www.larongegold.com TSX.V: LAR DISCLAIMER This corporate presentation (the “Presentation”) has been prepared by management of La Ronge Gold Corp. (the “Corporation”) based on public information and the Corporation’s confidential information. This Presentation is for information purposes only and is being made available on a confidential basis solely to enable the prospective investor to evaluate the securities of the Corporation (the “Securities”). This Presentation does not constitute an offer to sell to any person, or a general offer to the public of, or the general solicitation from the public of offers to subscribe or purchase, any of the Securities. Any unauthorized use of this Presentation is strictly prohibited. Distribution or copying of this Presentation, in whole or in part in any medium, to any person other than the prospective investor is prohibited without the prior written consent of the Corporation. The information contained in these slides, the Presentation made to you verbally and any other information provided to you (in writing or otherwise) in connection with the Corporation and its business (the “Presentation Materials”) is subject to updating, completion, revision, verification and amendment without notice which may result in material changes. The Presentation Materials are not intended to provide financial, tax, legal or accounting advice and do not purport to contain all the information that a prospective investor may require. Each prospective investor should perform and rely on its own investigation and analysis of the Corporation and the terms of any offering of the Securities, including the merits and risks involved, and are advised to seek their own professional advice on the legal, financial and taxation consequences of making an investment in the Corporation. No securities commission or similar regulatory authority in Canada has reviewed or in any way passed upon this presentation, and any representation to the contrary is an offence. Neither the Corporation nor the agent of the Corporation makes any representation or warranty, express or implied, and assumes no responsibility for the accuracy or completeness of the information contained in this Presentation or any other oral or written communication transmitted to prospective investors, and nothing contained in this summary is, or shall be relied upon as, a promise or representation by the Corporation or the agent of the Corporation as to the past or future performance of the Corporation. The Corporation does not undertake to provide any additional further information or to enter into negotiations regarding the investment opportunity to which these Presentation Materials relate. The Corporation retains the right, at any time, to terminate any discussions or negotiations with prospective investors. In the event of such termination the Corporation will not be under any obligation to disclose the reasons for such termination nor will they have any liability to any recipient hereof for any costs whatsoever incurred in the consideration of the information contained in these Presentation Materials. Certain statements contained in this Presentation are forward looking statements. These forward looking statements are not based on historical facts but rather on the expectations of management of the Corporation regarding the resulting company's future performance. All statements, other than statements of historical fact, may be forward looking statements. Forward looking statements are often, but not always, identified by the use of words such as “seek”, “anticipate”, “plan”, “continue”, “estimate”, “expect”, “may”, “will”, “project”, “predict”, “propose”, “potential”, “targeting”, “intend”, “could”, “might”, “should”, “believe” and similar expressions. Although the Corporation believes in light of the experience of its officers and directors, current conditions and expected future developments and other factors that have been considered appropriate that the expectations reflected in this forward-looking information are reasonable, undue reliance should not be placed on them because the Corporation can give no assurance that they will prove to be correct, and actual results, performance or achievement could differ materially from those expressed in, or implied by, these forward-looking statements. Forward-looking statements contained in this Presentation include, but are not limited to, statements with respect to the Corporation's business strategy, the market in which the Corporation operates; the ability of the Corporation to successfully integrate businesses; the timing and nature of equity offerings to be completed by the Corporation; the Corporation's potential revenue; the ability of the Corporation to successfully complete mergers and acquisitions; the ability of the Corporation to realize on the potential of target companies; and other expectations, beliefs, plans, objectives, assumptions, intentions or statements about future events or performance. Forward-looking statements contained in this Presentation reflect the current beliefs and assumptions of the Corporation's management based on information in its possession as of the date of this Presentation. Readers are cautioned that the foregoing list is not exhaustive. The forward-looking statements contained herein are expressly qualified in their entirety by this cautionary statement. The forward-looking statements included in this presentation are made as of the date of this presentation and the Corporation does not undertake and is not obligated to publicly update such forward-looking statements to reflect new information, subsequent events or otherwise unless so required by applicable securities laws. 2 SHARE STRUCTURE Capital Structure as of September 2nd, 2014 Shares Issued and Outstanding: 41,676,408 Warrants: 1,368,850 Options: 2,426,500 Fully Diluted: 44,471,758 3 BOARD OF DIRECTORS / SENIOR MANAGEMENT Rasool Mohammad President & CEO/ Director • 15 years experience in the mining and mineral exploration industry. • Mr. Mohammad has worked for companies such as BHP, Miramar Mining, Hunter Dickinson Inc., Cumberland Resources Ltd., and several other Vancouver-based junior exploration companies. Gord Davidson Vice President, Exploration • Has spent over 30 years exploring for and discovering mineral deposits. • He is credited with having a significant role in the discovery of Areva's Andrew Lake uranium deposit in the Kiggavik Trend of the North Thelon Basin, Canada. Director • Consulting geologist with over 20 years experience in diamond, precious and base metal exploration. • Holds an Honours Bachelor of Science degree in Geology and is a Qualified Professional Geoscientist. • President of Lakehead Geological Services Inc. • director on the boards of Oromin Explorations Ltd., Astur Gold Corporation, Grizzly Discoveries Inc. and La Ronge Gold Corp. Leonard D. Jaroszuk Director • Mr. Jaroszuk has been involved in and has managed a number of public companies engaged in real estate, construction, natural resources and exploration over the past 28 years. • Chairman of Enterprise Group, Inc. (TSX - E), a growing consolidator of profitable businesses providing services to the utility, energy, and infrastructure construction sectors. • Serves as a Director on several oil & gas service and manufacturing companies. Larry Johnson CFO, Corporate Secretary and Director • Mr. Johnson has worked with junior resource companies for over 30 years, many of them as the CFO. • His North American mineral exploration experience includes a focus on diamonds, gold and base metals. Douglass Turnbull 4 TRANSACTIONS OVERVIEW Transaction 1 • Completed acquisition of 22% ownership of frac sand mine and plant in Saskatchewan • Purchase price funding of capex of $1.0 million, completed Transaction 2 • Acquisition of Arkansas, US Tier 1 project • Consideration of 4,000,000 common shares of La Ronge issued to raise $1MM for project acquisition, Engineering, Permitting and G&A • Funding of capex potentially through a debt financing 5 US AND CANADA SHALE ENERGY BASINS- LOCATION ADVANTAGES 6 CANFRAC SANDS LTD. 7 EXECUTIVE SUMMARY- CANFRAC SANDS • La Ronge has a 22% equity stake in Canfrac Sands Corporation. • CanFrac produces superior quality, “Tier 2”, sand, used in unconventional fracturing of oil and natural gas wells, which meets ISO/API requirements. Operation is 100% owned. • Sand deposits and processing facilities are strategically located near Lloydminster, Saskatchewan, within the Western Canada Sedimentary Basin (WCSB). • Significant portion of deposit falls within a 20/40 and 40/70 mesh size – the most desired sizes for oil and gas industry applications. • Canfrac's audited financial year ended December 31, 2013, indicates gross sales of $3.28 million on the sale of 32,990 tonnes (t) of frac sand vs unaudited Q1-2014 total of 15,000 t sold. • September 2014 net income of $294,000 over revenue of $895,000. • Highly skilled workforce and existing operations team. • Current capacity is over 100,000 t/year of a wet gross product comprised of 16/30, 20/40, 40/70 and finer mesh products. • Existing customers include large Canadian oilfield services (OFS) and exploration and production (E&P) companies. 8 FRAC SAND PROJECT LOCATION MAP- VIKING OIL PLAY SK/AB (WCSB) CanFrac Sands 9 ARKANSAS, USA, LOCATION & FRAC SAND PRODUCERS KEY TIGHT OIL & SHALE GAS REGIONS Bluebird, AR Arkansas Project www.eia.gov/petroleum/drilling/pdf/dpr-full.pdf • Six regions account for 90% of oil growth & virtually all gas growth 2011-12 Unimin(Guion), AR Unimin, AR Unimin 10 ST PETER FORMATION, ARKANSAS, USA Arkansas Project 11 EXECUTIVE SUMMARY- ARKANSAS PROJECT • Premium “Tier 1” (highest quality), also known as “ Ottawa White”/”Northern White”, frac sand target. • 40/70 & 100 mesh (finer mesh) sand project of 99% pure quartz up to 14K PSI Crush. • About 600 miles closer than Wisconsin to the major Texas and Louisiana shale-plays, offering 25% savings per ton(T) in transportation costs. • Year-round operation forecasted. • Drilling and Permitting estimated completion by 1Q 2015. • Estimated frac sand costs of production at US$21.8/T; sales US$44.4/T, generating gross profit margin of US$22.6/T. “We expect a multi-year frac sand shortage (10% undersupply in 2016) as sand/well trends drive demand growth above long-lead time supply growth. We expect sand demand to nearly double (+96%) in 2016 vs. 2013, driven by 59% sand/well growth, vs. capacity growth of only 76%.” Source: Morgan Stanley 12 N. AMERICAN PROPPANT DEMAND (Built on Play-by-Play Analysis) Source: HPDI, Company Reports, Raymond James & Associates, Raymond James Ltd. 13 PROPPANT INTENSITY- LBS CONSUMED BY LATERAL FOOT Source: Drilling Info (HPDI), Raymond James & Associates, Raymond James Ltd. 14 OLD VS. NEW WELL COMPLETION SAND INTENSITY Source: Drilling Info (HPDI), Raymond James & Associates, Raymond James Ltd. 15 OLD VS. NEW WELL INITIAL PRODUCTION Source: Drilling Info (HPDI), Raymond James & Associates, Raymond James Ltd. 16 PROPPANT INTENSITY (EOG VS. PEERS; EAGLE FORD) Source: Drilling Info (HPDI), Raymond James & Associates, Raymond James Ltd. 17 WELL PERFORMANCE (EOG VS. PEERS; EAGLE FORD) Source: Drilling Info (HPDI), Raymond James & Associates, Raymond James Ltd. 18 ARKANSAS PROXIMITY ADVANTAGE TO MAJOR U.S. SHALE PLAYS CanFrac Sands Wisconsin Arkansas Project Source: University of Illinois, Minnesota Department of Natural Resources, Missouri Geological Survey, Raymond James Ltd. 19 FRAC SAND DELIVERED COST TO THE WELL SITE ($/ton)* 1. 2. 3. Assume Mining Costs of $40/ton and Site Equipment Costs of $20/ton (Per PacWest) Assumes 35 mile dray at $2.50/mile and 20 tons/Truck (RJ Estimates) Extrapolated from STB Data, also including railcar lease payment Source: PacWest, Raymond James Ltd. * Illustrative Purposes, Actuals could vary substantially! 20 ARKANSAS TIER 1 FRAC SAND PROJECT- ESTIMATED COSTS, SALES & MARGIN Cost US $/ton Sales US $/ton Mining (Drilling & Blasting) 4.0 100 Mesh* 36 Trucking 4.9 40/70 Mesh** 49 Wet Processing 4.6 20/40 Mesh** 70 Dry Processing 4.3 G&A 2.0 Royalty 2.0 21.8 * ** *** 44.4 Margin US $/ton 22.6*** Assuming an off-take agreement for 100 mesh @ US$ 36 / ton FOB of 500K t / year for 5 years Using spot price for 40 / 70 and 20 / 40 mesh (Aug 2014); assuming 6 % of 20/40, 57 % 40/70 & 34 % of 100 mesh in a ton of sand mined (3% waste) Gross Profit 21 PRO FORMA CAPITAL STRUCTURE & ENTERPRISE VALUE Share Structure Issue Price La Ronge- Current Shares Gross Proceeds Valuation @ $0.25 37,676,408 Ownership 82.5% Financing (completed) 1 $0.25 4,000,000 $1,000,000 8.8% Arkansas, US, Engineering/Permitting 2 $0.25 4,000,000 $1,000,000 8.8% 45,676,408 $2,000,000 Total Shares Out- Basic $11,419,102 100.0% Enterprise Value Market Capitalization $11,419,102 Commercial Loan (Major US Bank) 3 $30,000,000 TOTAL $41,419,102 1. 2. 3. 22 % Ownership of Canfrac Sand Ltd. Plant & Mine Design; Plant Permitting ( Private Placement to conclude in September, 2014) Assumes 100% Capex debt financing from major US Bank; Final Capex costs to come from an Economic Study 22 ARKANSAS TIER 1 FRAC SAND PROJECT- TIMELINE & KEY MILESTONES 2014 Q4 2015 Q1 Q2 2016 Q3 Q4 Q1 Q2 Drilling Financing *Debt Instrument P.E.A. Permitting Construction Production Key Milestones: 1. 2. 3. 4. 5. Q4 2014: NI 43-101 Resource Assessment, equity financing Q1 2015: Preliminary Economic Assessment commenced, quarry permit application, plant site engineering and permitting Q2 2015: Equity financing Q3-Q4 2015: Start of construction, Capex funding expected through a debt instrument Q1-Q2 2016: Production and delivery expected to commence Note: Milestones contingent on successful completion of previous milestone 23 PEER GROUP ANALYSIS PEER GROUP ANALYSIS Company CARBO Ceramics Inc. Hi-Crush Partners LP Emerge Energy Services LP U.S. Silica Holdings, Inc. Symbol NYSE:CRR NYSE:HCLP NYSE:EMES NYSE:SLCA Average 1. Share 1 Price $142.00 $49.24 $101.95 $51.31 Market Cap. Enterprise Value $mm $mm 3,281 1,631 2,409 2,758 3,194 1,749 2,515 2,971 Sales Gross EBITDA LTM Margin Margin $mm 668 178 948 604 LTM EV/ Sales 2014E 2015E 2016E LTM LTM 29.2% 40.5% 12.6% 33.6% 26.0% 36.9% 9.2% 25.7% 4.8x 9.8x 2.7x 4.9x 4.6x 5.5x 2.2x 3.8x 3.9x 4.1x 1.9x 3.3x 2 9 .0 % 2 4 .5 % 5 .5 x 4 .0 x 3 .3 x 3.5x 3.7x 1.7x 2.6x EV/ EBITDA LTM 2 0 1 4 E 2 0 1 5 E 2 0 1 6 E 18.4x 26.7x 28.9x 19.1x 16.3x 14.1x 20.8x 14.9x 12.6x 10.4x 14.1x 11.1x 11.4x 9.0x 10.5x 7.7x 2 .9 x 2 3 .3 x 1 6 .5 x 1 2 .1 x 9 .7 x Prices as at June 13, 2014 “North American frac sand demand over the next three to five years, with aggregate consumption expected to reach ~78 mln tons by 2016, representing a ~22% CAGR between 2013 and 2016 .Underpinning this outlook, we point to a secular (upward) shift in several key factors associated with new horizontal drilling and fracturing techniques, including: (i) the number of horizontal rigs deployed; (ii) the number of horizontal wells drilled per rig; (iii) the length of each lateral well; (iv) the number of fracturing stages per well; and (v) the amount of frac sand used per frac stage.” Source: Raymond James 24 U.S. PUBLICALLY LISTED FRAC SAND PRODUCERS Share Price Performance 25 GENERAL FRAC SAND INFO Two significant sources worldwide: Frac Sand is a naturally occurring silica (or quartz) sand used as a proppant to keep an induced hydraulic fracture open during the fracking process. • St. Peter Formation - Tier 1 (Wisconsin/Minnesota/Arkansas) • Winnipeg Formation - Tier 2 (Saskatchewan) These two areas contain the highest quality of quartz-rich accessible frac sand that meet ISO/API requirements. ISO/API Frac Sand Specifications: Alternative Proppants: Other alternatives to silica sand exist, including ceramic beads and resin-coated silica, but they are more costly to produce and the demand is less. must be greater than 98% quartz (Si02) round highly spherical high crush resistance consistent size or well sorted unconsolidated and friable 20/40, 40/70 and 100 are the three most commonly used mesh sizes in oil and gas production. A rare mineral in the required quality. 26 ADVANCES IN FRAC TECHNOLOGY • Plug & Perf results in higher production • Increase in volume of sand used per fracturing stage (previously 800 tons/well and currently 1,900 – 8,000 tons/well)* • increase in well space density * “The oil and gas industry can’t get enough fracking sand”, US Silica CEO says. Source: Whiting Petroleum Friday May 02,2014 :06:58 PM ET · SLCA U.S. Silica (SLCA) surged 9% in today's regular session on strong Q1 results which showed demand for fracking sand jumped 45% Y/Y, helping drive a 47% increase in revenue to $180M. SLCA forecasts full-year EBITDA in the upper end of the range of $180M-$200M, seeing demand for fracking sand outstripping supply for the rest of the year. More drillers are saying that fracking with more sand is the quickest, cheapest way to increase oil and gas output, CEO Bryan Shinn said in today's earnings call; a year ago, the average well used ~2,500 tons of sand, while today’s wells often use double that amount, and some wells have as much as 8K tons of sand pumped into them. Read more at Seeking Alpha: http://seekingalpha.com/currents/post/1711853?source=iphoneportfolioapp_email 27 Average Daily Oil Production OIL PRODUCTION INCREASES WITH PROPPANT USE (IP = Initial Production) Source: Whiting Petroleum 28 CONTACT INFORMATION ADDRESS: 701-675 West Hastings Street Vancouver, British Columbia Canada V6B 1N2 OFFICE: 604.639.4533 INVESTOR RELATIONS: Daniel Caamano Extension 305 [email protected] www.larongegold.com Canfrac Sands Ltd. – Dry Storage Facility 29

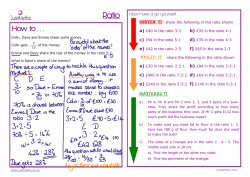

© Copyright 2026