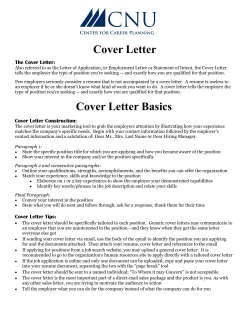

Document 38149