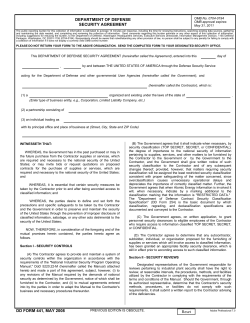

Best Practices in Drafting Independent Contractor Agreements Vol. 2013, No. 5