Document 382708

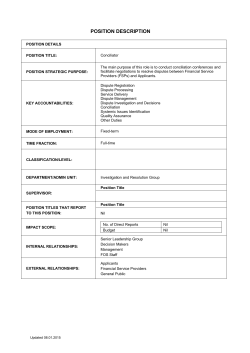

Introduction to the Financial Ombudsman Service Banking & Finance Bae Bastian Legal Counsel 29 July 2009 Outline The Financial Ombudsman Service Who are we? How we work New Terms of Reference The Banking & Finance team What we do How we work Maladministration Financial difficulty Financial Ombudsman Service FOS commenced operation on 1 July 2008 and brought together the dispute resolution services provided by: Banking and Financial Services Ombudsman Financial Industry Complaints Service Insurance Ombudsman Service As of 1 January 2009, it incorporated Credit Union Disputes Resolution Centre and Insurance Brokers Disputes Limited Provides independent dispute resolution services for up to 80% of banking, insurance and investment disputes in Australia Covers complaints about financial services including banking, credit, loans, general insurance, life insurance, financial planning, investments, stock broking, managed funds and pooled superannuation trusts. FOS – how it works FOS has five teams: Banking & Finance (BFSO) Investments, Life Insurance & Superannuation (FICS); and General Insurance (IOS) Mutuals (CUDRC) Insurance Brokers (IBD) FOS – how it works Colin Neave is the Chief Ombudsman of FOS Divisions are managed by individual industry Ombudsmen: Philip Field, Alison Maynard and Colin Neave. FOS Board is made up of financial services industry and consumer representatives with an independent chair (Prof The Honourable Michael Lavarch) FOS Board seeks advice from consumer and industry specific advisory committees New Terms of Reference by 2010 As part of ASIC’s approval of FOS, new Terms of Reference have been developed and submitted to ASIC for implementation on 1 January 2010. We will also develop a single process across the divisions Banking & Finance Role of Banking & Finance Referral service Dispute resolution – negotiation, mediation, conciliation, decision maker as an alternative to court. Power to award compensation – up to $280,000; Ombudsman’s determination is binding on financial services providers Educator; contributor to public policy NOT a regulator/consumer advocate/advisor Coverage of the Scheme We can only consider disputes about members Our members include - all retail banks operating in Australia and related entities - some non-banks including credit providers, mortgage brokers, financial planners and non cash payment facilitators Full list of members on web site If complaint relates to a member of another scheme, we will refer them to the appropriate scheme What we cannot consider Amount claimed above $280,000 (under new Terms of Reference can consider complaints up to $500,000 but only award $280,000) Commercial decisions (altered for financial difficulty claims under new Terms of Reference) Policy decisions No financial service received (not a customer) First complaint more than 6 years after the event Legal proceedings have commenced (under new Terms of Reference can consider dispute unless judgment entered) Who can lodge a dispute? A dispute can be lodged by an individual or small business, or a guarantor of an individual or small business For disputes about events arising after 11 March 2002 a small business is defined as one having: Less than 100 employees if it is a manufacturer Less than 20 employees if it is not Lodging a formal dispute Must be in writing Can be lodged on the web, by facsimile or mail (under new Terms of Reference, can lodge over phone as well) Translating service is available Can be lodged by an agent (family, friend, financial counsellor) – agent authority required In some cases representative must be the legal representative of the account holder e.g. a deceased estate - executor; a bankrupt trustee; a person under a guardianship order - legal guardian If dispute is not resolved we will require a general authority to exchange information between parties Dispute resolution process and outcomes Disputes closed as OTR or discontinued total: 2,390 OTR/DIS: 2,007 OTR: 985 DIS: 1,022 OTR/DIS: 333 OTR: 167 DIS: 166 Total cases closed: 6,349 Outcome determined Total: 3,959 BFSO reviews dispute Dispute referred to Member Resolved by Member 3,698 (93.4%) Finding OTR/DIS: 50 OTR: 10 DIS: 40 Unresolved Cases 110 (2.8%) BFSO investigation Negotiated Settlement 90 (2.3%) Conciliation Conference Appeal by member or consumer Ombudsman’s review 8 (0.2%) Recommendation 53 (1.3%) Appeal by member OTR: Outside Terms of Reference DIS: Discontinued Ombudsman’s review of member’s appeal Determination 0 (0.0%) The Dispute Resolution Process Terms of Reference: The Law – 5 legal counsel, legally trained case managers and case officers Applicable industry codes or guidelines – Code of Banking Practice, EFT Code, Centrelink Code Good industry practice – seconded banking adviser and financial services industry adviser Fairness Types of Disputes Calculation errors – wrong loan repayment figure; wrong payout figure Delay in settlement Decision to lend – lending when there was no capacity to repay the loan Conduct of bank if it sells property as mortgagee in possession Errors in charging fees (however, we cannot look at a bank’s policy decision to charge fees) Types of Disputes Breaches of bank’s duty of confidentiality or breaches of privacy Funds transfer problems – telegraphic transfers, internet banking Debt collection – disputes about the amount demanded; debt collection practices if conduct is by member or agent of member; credit listings with Veda Advantage Ltd (formerly Baycorp Advantage) Requests for a variation in the contract due to financial difficulty Maladministration in Lending What is Maladministration? Terms of Reference Clause 5.1 (a) cannot consider disputes solely about commercial judgment can consider disputes about maladministration in lending which involve: an act or omission contrary to or not in accordance with a duty owed at law or pursuant to the terms (express or implied) of the contract Maladministration in Lending The relevant principles are: Common law duty to act as a diligent and prudent banker Clause 25.1 of the Code of Banking Practice: “Before we offer you a credit facility (or increase an existing credit facility), we will exercise the care and skill of a diligent and prudent banker in selecting and applying our credit assessment methods and in forming our opinion about your ability to repay it.” Section 70(2)(l) of the UCCC – In determining if a term of a credit contract is unjust, the court may have regard to a number of factors including whether the credit provider “knew, or could have ascertained by reasonable enquiry of the debtor at the time, that the debtor could not pay…or not without substantial hardship” Maladministration in Secured Lending We examine the information obtained from the borrower and the assessment of that information. Was there proper assessment of the capacity to repay the loan having regard to the standard of a diligent and prudent lender? The application stage - What information is sought from the borrower? - What information is verified? The loan assessment stage - Is all relevant information taken into account? Maladministration in Secured lending If maladministration is established in relation to secured lending where a property was acquired, then the disputants would not have entered into the loan. In order to put them back into the position they would have been in, they would have had no loan, but no property. Maladministration in Secured lending Therefore their claim includes: 1. The disputants’ contribution to the purchase; 2. The purchase costs which were not included in the loan; 3. Payments made on the loan; 4. Other holding costs; 5. Sale costs. We would add back in any benefit obtained while being an owner of the properties, for example: not having to pay rent or interest on alternative accommodation; rent received from leasing the property and any tax deduction received for an investment property. Maladministration in Secured Lending The net amount is the disputants’ claim. The sale proceeds are used to repay the loan and these costs. If the sale proceeds are insufficient to repay the loan and these costs, then the bank must waive the balance of the loan (if any) and then pay to the disputants an amount sufficient to cover the costs incurred. If the sale proceeds are sufficient to repay the loan and the above costs, then notwithstanding any maladministration, the breach of the bank-customer contract has not caused the disputants any loss. Case Study Young couple borrowed $104,000 to purchase first home. Within a few months they were in arrears. Bank conceded lending was outside its guidelines. Bank to sell property and bear cost of shortfall, if any; Assessment of disputants’ financial loss: Funds put towards purchase and interest lost on funds put towards purchase; ($51,289) Establishment costs, legal costs, rates, mortgage discharge fee; ($1,697) Payments made; ($16,635) Take into account rental payments that would have been paid in the same period ($24,180) Bank incurred shortfall on sale and paid disputants $45,441 Maladministration and Credit Cards New Applications/Increase in limit We expect lender to obtain sufficient info about a customers financial position to assess capacity to repay In most cases, lender entitled to rely on info provided by customer We will consider whether info was clearly incorrect or nonsensical or ought to be regarded as questionable because of other information held by lender Unsolicited Offers to Increase the Credit Limit Behavioural scoring usually based on repayment history Generally no enquiry made Assumptions not necessarily accurate Capacity to repay old limit does not mean capacity to service new limit In cases we see there is often maladministration in lending Assessment of the decision to lend – information from the cardholder What was the financial position of the cardholder at the time the credit was advanced? Retrospective statement of position: gross income, financial commitments including mortgage payments or rent, other expenses, number of dependents Supporting documents Assessment of the decision to lend – information from the member Was the credit limit appropriate based on member’s credit assessment method? Members will be asked to apply relevant method (new application) to information from cardholder or to conduct a manual assessment by an experienced credit officer We then decide: what credit limit was appropriate at the time? Resolution of disputes Try to resolve by negotiation to take account of current circumstances, avoid hardship and to be commercially practical taking into account the commercial considerations of collecting a non-interest accruing debt In some cases resolution may be that repayments are based on minimum monthly payment on the appropriate credit limit payable for an agreed term – eg 5 to 7 years depending on age/circumstances of the card holder Our approach to cases From the time the appropriate credit limit was exceeded, add purchases & cash advances and then total repayments Apply repayments to appropriate credit limit (including interest and annual fee) Any balance of appropriate credit limit repayable with interest Our approach to cases Sum of purchases & cash advances above appropriate credit limit repayable without interest (“outstanding principal debt”) Any unused repayments (step 2 above) applied to outstanding principal debt Cardholder can sell or otherwise redeem purchases to assist in repayment Example in Bulletin 45 Mr X was a disability pensioner Given a $12,000 credit limit on his Visa card BFSO found: appropriate credit limit was $1,000 Purchases and cash advances over appropriate limit of $1,000 do not accrue interest Payments of $1,050 repaid appropriate credit limit with interest Payments of $890 applied to reduce outstanding principal debt of $12,210 Outstanding liability $11,300 Example in Bulletin 45 Date Purchases over limit of $1,000 Payments Nov 03 $5,100 $0 Dec 03 $3,000 $150 Jan 04 $3,450 $600 Feb 04 $200 $300 sub-total $1,050 Mar 04 $200 $250 Apr 04 $260 $350 May 04 $0 $140 June 04 $0 $150 sub-total $890 Totals: $12,210 $1,940 Example in Bulletin 45 Bank offered to reduce the debt to $8,369, interest free, payable at $30 per month Mr X accepted. Further Information Bulletin 45: New applications Applications by cardholders for a credit limit increase Unsolicited offers for credit limit increases Bulletin 50: Maladministration and Financial Difficulty Bulletin 60: Secured Lending Financial Difficulty The Uniform Consumer Credit Code (UCCC) provides that a debtor can request a variation to their credit contract if they are unable to meet their repayments due to: Illness; Unemployment; or Other reasonable cause Under the UCCC, a debtor can request that the contract is: Extended and payments are reduced Postponed for a limited period during which no payment are due A combination of both The debtor must reasonably be able to expect to repay the debt if the contract is changed in one of these three ways The financial institution does not have to agree to the proposed change If it refuses, the debtor can apply to the relevant court or tribunal for an order varying the contract Financial Difficulty Code of Banking Practice – Clause 25.2 “ With your agreement, we will try to help you overcome your financial difficulties with any credit facility you have with us. We could, for example, work with you to develop a repayment plan. If, at the time, the hardship provisions of the Uniform Consumer Credit Code could apply to your circumstances, we will inform you about them.” Our Expectations of Banks We expect a bank to: Give genuine consideration to any proposed repayment variation and any reasonable alternatives (this would involve an assessment of a customer’s financial position) If a bank rejects any proposal, it should give reasons and ensure they reflect legitimate considerations and are referable to the customer’s circumstances If a subscriber to Code, inform their customer if the UCCC could apply Comply with the ASIC/ACCC Debt Collection Guidelines If a subscriber, to act fairly and reasonably in a consistent and ethical manner taking into account the conduct of the parties and the contract (clause 2.2 CBP) Our Expectations of a Debtors We expect that a debtor: Be willing to work with their bank (for eg, by promptly responding to requests for information) Provide current and accurate details of their financial position when requested Propose a realistic repayment plan that will result in eventual repayment of the debt Make whatever payments they can while their application is being considered and/or dispute is being considered by FOS Consideration of a Repayment Proposal We review the process followed by a bank in making a decision to accept/reject a request for assistance We assist the parties to try and reach a negotiated outcome; but the actual decision to agree/reject a variation is a commercial decision we are unable to review This will change upon commencement of our new TOR on 1/1/2010. FOS will have the power to vary terms of credit contracts Non-subscribers Code of Banking Practice reflects good industry practice and is relevant to our assessment of a dispute under that criterion in our Terms of Reference Non-subscribing banks and other lenders should therefore consider implementing our guidelines We will review the credit contract and any internal policy for dealing with customers in financial difficulty Approach to Loss If there is a breach of clause 25.2: The financial loss may include unnecessary default charges or enforcement costs Non financial loss may include some compensation for unnecessary stress or inconvenience If there is no loss, the disputant will be advised that they could refer the matter to the Code Compliance Monitoring Committee See Bulletins on our website for more information. Financial Difficulty Mr and Mrs S were experiencing financial difficulty as a result of Mr S suffering a workplace injury and Mrs S having recently given birth to their child. Also, a delay in settlement of the sale of their home due to the impending approval of a subdivision and they had fallen behind in the repayment of their 3 home loans. Mr and Mrs S had kept the bank informed of any possible delays with settlement Financial Difficulty Mr and Mrs S made a number of calls to the bank and say they were given differing responses about how the matter should be handled. They said the bank officer appeared insensitive and would not consider any alternative solutions When the dispute was referred from FOS to the bank, reference was made to the bank’s obligation under section 25.2 of the Code of Banking Practice. Financial Difficulty To resolve the dispute, the bank offered a repayment moratorium on each of their loans on the basis that settlement would be finalised within two months. This provided the disputants with an opportunity to finalise the subdivision and sale of their property. On the sale of the property, two of the disputants’ loans would be cleared and the arrears position cleared on the third loan. This offer was accepted by the disputants in resolution of their dispute. How to contact us Telephone: 1300 780 808 Internet: www.fos.org.au Mail: GPO Box 3 Melbourne Victoria 3001

© Copyright 2026