Chapter 10 Liabilities PowerPoint Authors: Brandy Mackintosh

Chapter 10 Liabilities PowerPoint Authors: Brandy Mackintosh Lindsay Heiser McGraw-Hill/Irwin Copyright © 2013 by The McGraw-Hill Companies, Inc. All rights reserved. Learning Objective 10-1 Explain the role of liabilities in financing a business. 10-2 The Role of Liabilities Liabilities are created when a company: Buys goods and services on credit Obtains short-term loans Issues long-term debt Current liabilities are short-term obligations that will be paid with current assets within the company’s current operating cycle or within one year of the balance sheet date, whichever is longer. 10-3 The Role of Liabilities The liability section of the General Mills 2010 and 2011 comparative balance sheets. 10-4 Learning Objective 10-2 Explain how to account for common types of current liabilities. 10-5 Measuring Liabilities Initial Amount of the Liability Cash Equivalent Additional Liability Amounts Increase Liability Payments Made 10-6 Decrease Liability Current Liabilities Accounts Payable Increases (Credited) Decreases (Debited) when a company receives goods or services on credit when a company pays on its account Accrued Liabilities Liabilities that have been incurred but not yet paid. 10-7 Accrued Payroll Payroll Deductions Payroll Liabilities Payroll deductions are either required by law or voluntarily requested by employees and create a current liability for the 1. Payroll Deductions company. Examples include: 1. Income tax 2. Employer FICA tax 2. Payroll Taxes 3. Other deductions (charitable donations, union dues, etc.) 10-8 Accrued Payroll Gross Pay $ 600.00 Payroll Deductions: Federal Income Taxes FICA Taxes 48.80 Other 10.00 Total Payroll Deductions Net Pay 10-9 $ 58.00 116.80 $ 483.20 Accrued Payroll Adam Palmer earned gross pay of $600 in the current payroll period. General Mills withheld $58 in Federal income taxes, $48.80 for FICA, and $10 for United Way, resulting in net pay of $483.20. Let’s assume that General Mills has 1,000 workers just like Adam. 1 Analyze Assets Cash (-A) -$483,200 2 Liabilities FIT Withheld (+L) +$58,000 FICA Payable (+L)+$48,800 United Way (+L) +$10,000 + Stockholders’ Equity Payroll Expense(+E, -SE) -$600,000 Record dr 10-10 = Wages and Salaries Expense (+E, -SE) cr Withheld Income Taxes Payable (+L) cr FICA Payable (+L) cr United Way Payable (+L) cr Cash (-A) 600,000 58,000 48,800 10,000 483,200 Accrued Payroll Employer Payroll Taxes Employers have other liabilities related to payroll. 1. FICA tax (a “matching” contribution) 2. Federal unemployment tax 3. State unemployment tax Assume General Mills was required to contribute $48,800 for FICA, $750 for federal unemployment tax, and $4,000 for state unemployment tax. 1 Analyze Assets = Liabilities + FICA Payable (+L) +48,800 FUTA Payable (+L) +750 SUTA Payable (+L) +4,000 2 Payroll Tax Expense (+E, -SE) -53,550 Record dr 10-11 Stockholders’ Equity Payroll Tax Expense (+E, -SE) cr FICA Tax Payable (+L) cr Federal Unemployment Tax Payable (+L) cr State Unemployment Tax Payable (+L) 53,550 48,800 750 4,000 Accrued Income Taxes Corporations calculate taxable income by subtracting tax-allowed expenses from revenues. This taxable income is then multiplied by a tax rate, which for most large corporations is about 35 percent. Let’s assume General Mills calculated taxable income to be $1,000,000, and is subject to a 35% tax rate, so income taxes owed are $350,000 ($1,000,000 × 35%) 1 Analyze Assets = Liabilities Income Tax Payable (+L) +350,000 2 Stockholders’ Equity Income Tax Expense (+E, -SE) -350,000 Record dr 10-12 + Income Tax Expense (+E, -SE) cr Income Tax Payable (+L) 350,000 350,000 Notes Payable Four key events occur with any note payable: 1. establishing the note, 2. accruing interest incurred but not paid, 3. recording interest paid, and 4. recording principal paid. 10-13 Notes Payable 1. Establish the note on November 1, 2012. Assume that on November 1, 2012, General Mills borrowed $100,000 cash on a one-year note that required General Mills to pay 6 percent interest and $100,000 principal, both on October 31, 2013. 1 Analyze Assets Cash (+A) +100,000 2 Notes Payable (+L) + Stockholders’ Equity +100,000 Record dr 10-14 Liabilities = Cash (+A) cr Notes Payable (+L) 100,000 100,000 Notes Payable 2. Accrue interest owed but not paid on December 31, 2012. 1 Analyze Assets Liabilities = Interest Payable (+L) 2 Stockholders’ Equity Interest Expense (+E, -SE) -1,000 Record dr Interest Expense (+E, -SE) cr Interest Payable (+L) 10-15 +1,000 + 1,000 1,000 Notes Payable 3. Record interest paid on October 31, 2013. 1 Analyze Assets Cash (-A) -6,000 2 Liabilities Interest Payable (-L) -1,000 + Stockholders’ Equity Interest Expense (+E, -SE) -5,000 Record dr dr 10-16 = Interest Expense (+E, -SE) Interest Payable (-L) cr Cash (-A) 5,000 1,000 6,000 Notes Payable 4. Record principal paid of $100,000 on October 31, 2013. 1 Analyze Assets = Cash (-A) -100,000 2 Note Payable (-L) + Stockholders’ Equity -100,000 Record dr 10-17 Liabilities Note Payable (-L) cr Cash (-A) 100,000 100,000 Current Portion of Long-Term Debt Long-Term Debt Current Portion of Long-term Debt Noncurrent Portion of Long-term Debt Borrowers must report in Current Liabilities the portion of long-term debt that is due to be paid within one year. 10-18 Additional Current Liabilities 10-19 Sales Tax Payable Payments collected from customers at time of sale create a liability that is due to the state government. Unearned Revenue Cash received in advance of providing services creates a liability of services due to the customer . Additional Current Liabilities Best Buy sells a television for $1,000 cash plus 5 percent sales tax. $1,000 × 5% = $50 sales tax collected 1 Analyze Assets Cash (+A) +1,050 2 = Liabilities Sales Tax Payable (+L) +50 + Stockholders’ Equity Sales Revenue (+R, +SE) Record dr Cash (+A) cr Sales Tax Payable (+L) cr Sales Revenue (+R, +SE) 1,050 50 1,000 When Best Buy pays the sales tax to the state government, its accountants will reduce Sales Tax Payable (with a debit) and reduce Cash (with a credit). 10-20 +1,000 Additional Liabilities On May 14th 2010, Live Nation Entertainment (the owner of Ticketmaster), received $8 million cash for advance ticket sales for two Lady Gaga concerts to be held on February 21 and 22, 2011. 1 Analyze Assets Cash (+A) +8 2 Liabilities + Stockholders’ Equity Unearned Revenue (+L) +8 Record dr 10-21 = Cash (+A) cr Unearned Revenue (+L) 8 8 Additional Liabilities When the February 21st concert is held, Live Nation Entertainment can recognize one half of the unearned revenue as earned revenue, as they have fulfilled part of the liability. 1 Analyze Assets = Liabilities Unearned Revenue (-L) -4 2 Stockholders’ Equity Concert Revenue (+R, +SE) +4 Record dr 10-22 + Unearned Revenue (-L) cr Concert Revenue (+R, +SE) 4 4 Learning Objective 10-3 Analyze and record bond liability transactions. 10-23 Long-Term Liabilities Common Long-Term Liabilities 1. Long-term notes payable 2. Deferred income taxes 3. Bonds payable Bonds are financial instruments that outline the future payments a company promises to make in exchange for receiving a sum of money now. 10-24 Bonds Key Elements of a Bond 1. Maturity date 2. Face value 3. Stated interest rate Interest Computation 12 $1,000 × 6% × 12 = $60 Bond Pricing The bond price involves present value computations and is the amount that investors are willing to pay on the issue date for the bonds. 10-25 Bonds Balance Sheet Reporting of Bond Liability Relationships between Interest Rates and Bond Pricing 10-26 Bonds Bonds Issued at Face Value General Mills receives $100,000 cash in exchange for issuing 100 bonds at their $1,000 face value, so the bonds are issued at total face value (100 × $1,000 = $100,000). 1 Analyze Assets Cash (+A) +100,000 2 + Stockholders’ Equity Bonds Payable (+L)+100,000 Record dr 10-27 Liabilities = Cash (+A) cr Bonds Payable (+L) 100,000 100,000 Bonds Bonds Issued at a Premium General Mills issues 100 of its $1,000 bonds at a price of 107.26 percent of face value, the company will receive $107,260 (100 × $1,000 × 1.0726). 1 Analyze Assets Cash (+A) +107,260 2 Liabilities + Stockholders’ Equity Bonds Payable (+L) +100,000 Premium on Bonds Payable (+L) +7,260 Record dr 10-28 = Cash (+A) cr Bonds Payable (+L) cr Premium on Bonds Payable (+L) 107,260 100,000 7,260 Bonds Bonds Issued at a Discount General Mills receives $93,376 for bonds with a total face value of $100,000, the cash-equivalent amount is $93,376, which represents the liability on that date. These bonds are issued at a discount because the cash received is less than the face value of the bonds. 1 Analyze Assets Cash (+A) +93,376 2 Liabilities + Stockholders’ Equity Bonds Payable (+L) +100,000 Discount on Bonds Payable (+xL,-L)-6,624 Record dr dr 10-29 = $100,000 - $93,376 = $6,624 discount Cash (+A) Discount on Bonds Payable (+xL, -L) cr Bonds Payable (+L) 93,376 6,624 100,000 Interest on Bonds Issued at Face Value General Mills issues bonds on January 1, 2013, at their total face value of $100,000. The bonds have an annual stated interest rate of 6 percent payable in cash on December 31 of each year, General Mills will need to accrue an expense and liability for interest at the end of each accounting period. The end of the first accounting period is January 31, 2013. 1 Analyze Assets $100,000 × 6% × 1/12 = $500 interest = Liabilities Interest Payable (+L) +500 2 Stockholders’ Equity Interest Expense (+E, -SE) -500 Record dr 10-30 + Interest Expense (+E, -SE) cr Interest Payable (+L) 500 500 Interest on Bonds Issued at a Premium Cash proceeds > Face value Cash proceeds – Face value = Premium Interest expense < Cash interest paid Interest expense = Cash interest paid – Premium amortization 10-31 Interest on Bonds Issued at a Discount Cash proceeds < Face value Face value – Cash proceeds = Discount Interest expense > Cash interest paid Interest expense = Cash interest paid+ Discount amortization 10-32 Bond Retirement General Mills’ bonds were retired with a payment equal to their $100,000 face value. Let’s analyze and record this transaction. 1 Analyze Assets = Cash (-A) -100,000 2 + Stockholders’ Equity Bonds Payable (-L) -100,000 Record dr 10-33 Liabilities Bonds Payable (-L) cr Cash (-A) 100,000 100,000 Bond Retirement The early retirement of bonds has three financial effects. The company 1. pays cash, 2. eliminates the bond liability, and 3. reports either a gain or a loss. Assume that in 2003, General Mills issued $100,000 of bonds at face value. Ten years later, in 2013, the company retired the bonds early. At the time, the bond price was 102, so General Mills made a payment of $102,000. 1 Analyze Assets Cash (-A) -102,000 2 + Stockholders’ Equity Loss on Bond Retirement(+E,-SE) -2,000 Record dr dr 10-34 Cash Payment $103,000 Liabilities = Carrying Value 100,000 Bonds Payable (-L) -100,000 Loss on Retirement $3,000 Bonds Payable (-L) Loss on Bond Retirement (+E, -SE) cr Cash (-A) 100,000 2,000 102,000 Learning Objective 10-4 Describe how to account for contingent liabilities. 10-35 Contingent Liabilities Contingent liabilities are potential liabilities that arise from past transactions or events, but their ultimate resolution depends (is contingent) on a future event. 10-36 Learning Objective 10-5 Calculate and interpret the quick ratio and the times interest earned ratio. 10-37 Evaluate the Results Two financial ratios are commonly used to assess a company’s ability to generate resources to pay future amounts owed: 1. Quick ratio 2. Times interest earned ratio Quick Ratio = (Cash + Short-term Investments + Accounts Receivable, Net) Current Liabilities Times Interest = Earned Ratio 10-38 (Net Income + Interest Expense + Income Tax Expense) Interest Expense Evaluate the Results At the end of its 2011 fiscal year, General Mills reported $620 million of cash and cash equivalents, no short-term investments, and $1,162 million of net accounts receivable. The company reported $3,659 million in total current liabilities. Quick Ratio = (Cash + Short-term Investments + Accounts Receivable, Net) Current Liabilities $620 + 0 + 1,162 3,659 = 0.487 A quick ratio of 0.487 implies that General Mills would be able to pay only 48.7 percent of its current liabilities, if forced to pay them immediately. However, not all current liabilities are to be paid immediately. 10-39 Evaluate the Results In 2011, General Mills reported net income of $1,798 million and interest expense of $346 million, and income tax expense of $721 million. Let’s calculate the times interest earned for 2011. Times Interest = Earned Ratio (Net Income + Interest Expense + Income Tax Expense) Interest Expense $1,798 + $346 + $721 $346 = 8.28 times The ratio means that General Mills generates $8.28 of income (before the costs of financing and taxes) for each dollar of interest expense. Reaching this level of interest coverage was important to General Mills because its long-term debt note reported that loan covenants required a minimum ratio of 2.5. 10-40 Chapter 10 Supplement 10A Straight-Line Method of Amortization McGraw-Hill/Irwin Copyright © 2013 by The McGraw-Hill Companies, Inc. All rights reserved. Bond Premium Bond premium or discount decreases each year, until it is completely eliminated on the bond’s maturity date. This process is called amortizing the bond premium or discount. The straight-line method of amortization reduces the premium or discount by an equal amount each period. Recall our example when General Mills received $107,260 on the issue date (January 1, 2013) but repays only $100,000 at maturity (December 31, 2016). Under the straight-line method, this $7,260 is spread evenly as a reduction in interest expense over the four years ($7,260 ÷ 4 = $1,815 per year). 1 Analyze Assets Cash (-A) -6,000 Cash Interest Amortization of Premium Liabilities = InterestPremium Expense on Bonds Payable 2 (-L) -1,815 Expense (+E, -SE) -4,185 Record dr dr 10-42 $6,000 (1,815) Stockholders’ Equity + $4,185 Interest Interest Expense (+E, -SE) Premium on Bonds Payable (-L) cr Cash (-A) 4,185 1,815 6,000 Bond Premium Amortization Schedule of Bonds Issued at a Premium $7,260 - $1,815 = $5,445 $7,260 ÷ 4 = $1,815 $100,000 × 6% × 12/12 = $6,000 $107,260 – $1,815 = $105,445 $6,000 - $1,815 = $4,185 Notice that each of these amounts would plot as a straight-line! 10-43 Bond Discount Recall our example where General Mills received $93,376 for four-year bonds with a total face value of $100,000, implying a discount of $6,624. The annual amortization of the discount is $1,656 ($6,624 ÷ 4). 1 Analyze Assets Cash (-A) -6,000 Cash Interest Liabilities = Amortization of Discount InterestDiscount Expense on $6,000 + 1,656 $7,656 Bonds Payable(-xL,+L)+1,656 2 Interest Expense (+E, -SE) -7,656 Record dr 10-44 Stockholders’ Equity Interest Expense (+E, -SE) cr Discount on Bonds Payable (-xL, +L) cr Cash (-A) 7,656 1,656 6,000 Bond Discount Amortization Schedule of Bonds Issued at a Discount $6,624 - $1,656 = $4,968 $6,624 ÷ 4 = $1,656 $100,000 × 6% × 12/12 = $6,000 $93,376 + $1,656 = $95,032 $6,000 + $1,656 = $7,656 10-45 Chapter 10 Supplement 10B Effective-Interest Method of Amortization McGraw-Hill/Irwin Copyright © 2013 by The McGraw-Hill Companies, Inc. All rights reserved. Effective Interest Amortization The effective-interest method of amortization is considered a conceptually superior method of accounting for bonds because it correctly calculates interest expense by multiplying the market interest rate times the carrying value of the bonds. When General Mills adds this $7,260 premium to the $100,000 face value, it reports a carrying value of $107,260 ($100,000 + $7,260) on January 1, 2013. The proceeds indicates that the market interest rte was 4 percent. Interest (I) = Principal (P) × Rate (R) × Time (T) Interest Expense = Carrying Value × Market Rate × n/12 $4,290 = $107,260 × 4% × 12/12 10-47 Effective Interest Amortization General Mills issued 6% stated rate bonds for $107,260. The market rate of interest on these bonds is 4%. The face amount of the bonds, $100,000, results in cash interest is $6,000 ($100,000 × 6%). Let’s amortize the premium on the bonds at the first interest payment date. 1 Analyze Interest (I) = Principal (P) × Rate (R) × Time (T) Liabilities Stockholders’ Equity = + Interest Expense = Carrying Value × Market Rate × n/12 -6,000 on $4,290Premium = $107,260 × 4% × 12/12 Interest Assets Cash (-A) Bonds Payable (-L) -1,710 2 Record dr dr 10-48 Cash Interest $ 6,000 Interest Expense (+E, -SE)Interest Effective 4,290 Premium on Bonds Payable (-L) Amortization of Premium $1,710 cr Cash (-A) Expense (+E, -SE) -4,290 4,290 1,710 6,000 Effective Interest Amortization $6,000 - $4,290 = $1,710 $7,260 - $1,710 = $5,550 Effective Interest Amortization of Bonds Issued at a Premium $107,260 × 4% × 12/12 = $4,290 $100,000 × 6% × 12/12 = $6,000 $107,260 - $1,710 = $105,550 Interest Expense decreases and Premium Amortization increases each period. Cash interest is unchanged. 10-49 Effective Interest Amortization General Mills issued $100,000 face value, 6%, 4-year bonds at a market price to yield investors 8%. The bonds were issued at a discount of $6,624. Let’s determine the effective interest for the first interest payment period. 1 Analyze Interest (I)= = Principal (P) × Rate (R) ×+ Time (T) Liabilities Stockholders’ Equity Interest ExpenseDiscount = Carrying Value × Market Rate × n/12 -6,000 on Interest $7,470 = $93,376 × 8% × 12/12 Expense (+E, -SE) -7,470 Bonds Payable(-xL,+L)+1,470 Assets Cash (-A) 2 Record dr Cash Interest $ 6,000 Interest ExpenseEffective (+E, -SE)Interest 7,470 cr Discount on Bonds Payable (-L) Amortization of Discount $ 1,470 cr 10-50 Cash (-A) 7,470 1,470 6,000 Effective Interest Amortization $7,470 - $6,000 = $1,470 $6,624 - $1,470 = $5,154 Effective Interest Amortization of Bonds Issued at a Discount $93,376 × 8% × 12/12 = $7,470 $100,000 × 6% × 12/12 = $6,000 $93,376 + $1,470 = $94,846 Both Interest Expense and Discount Amortization increase each period. Cash interest is unchanged. 10-51 Chapter 10 Supplement 10C Simplified Effective-Interest Amortization McGraw-Hill/Irwin Copyright © 2013 by The McGraw-Hill Companies, Inc. All rights reserved. Accounting for Bond Issue. The shortcut method records the bonds at issuance at Bonds Payable, Net. That is face amount less discount or face amount plus premium. The following journal entries demonstrate how the shortcut is applied to bonds issued at a premium, at face value, and at a discount. 10-53 Bond Premium Interest (I) = Principal (P) × Rate (R) × Time (T) Interest Expense = Bonds Payable, Net × Market Rate × n/12 Interest Expense $4,290 = $107,260 × 4% × 12/12 1 Analyze Assets Cash (-A) -6,000 2 Bonds Payable, Net (-L) -1,710 + Stockholders’ Equity Interest Expense (+E, -SE) -4,290 Record dr dr 10-54 Liabilities = Interest Expense (+E, -SE) Bonds Payable, Net (-L) cr Cash (-A) 4,290 1,710 6,000 Bond Discount Interest (I) = Principal (P) × Rate (R) × Time (T) Interest Expense = Bonds Payable, Net × Market Rate × n/12 Interest Expense $7,470 = $93,376 × 8% × 12/12 1 Analyze Assets Cash (-A) -6,000 2 Bonds Payable, Net (+L) + -1,470 Stockholders’ Equity Interest Expense (+E, -SE) -7,470 Record dr 10-55 Liabilities = Interest Expense (+E, -SE) cr Bonds Payable, Net (+L) cr Cash (-A) 7,470 1,470 6,000 Chapter 10 Solved Exercises M10-5, E10-2, E10-3, E10-8, E10-10, PA10-3 McGraw-Hill/Irwin Copyright © 2013 by The McGraw-Hill Companies, Inc. All rights reserved. M10-5 Reporting Current and Noncurrent Portions of Long-Term Debt Assume that on December 1, 2013, your company borrowed $15,000, a portion of which is to be repaid each year on November 30. Specifically, your company will make the following principal payments: 2014, $2,000; 2015, $3,000; 2016, $4,000; and 2017, $6,000. Show how this loan will be reported in the December 31, 2014 and 2013 balance sheets, assuming that principal payments will be made when required. As of December 31, 2014 2013 Current Liabilities: Current Portion of Long-term Debt Long-term Debt Total Liabilities 10-57 $ 3,000 $ 2,000 10,000 13,000 $ 13,000 $ 15,000 E10-2 Recording a Note Payable through Its Time to Maturity Many businesses borrow money during periods of increased business activity to finance inventory and accounts receivable. Target Corporation is one of America’s largest general merchandise retailers. Each Christmas, Target builds up its inventory to meet the needs of Christmas shoppers. A large portion of Christmas sales are on credit. As a result, Target often collects cash from the sales several months after Christmas. Assume that on November 1, 2013, Target borrowed $6 million cash from Metropolitan Bank and signed a promissory note that matures in six months. The interest rate was 8.0 percent payable at maturity. The accounting period ends December 31. Required: 1. Give the journal entry to record the note on November 1, 2013. 2. Give any adjusting entry required on December 31, 2013. 3. Give the journal entry to record payment of the note and interest on the maturity date, April 30, 2014, assuming that interest has not been recorded since December 31, 2013. 10-58 E10-2 Recording a Note Payable through Its Time to Maturity November 1, 2013: dr Cash (+A) cr Note Payable (+L) 6,000,000 6,000,000 Borrowed on 6-month, 8.0%, note payable. December 31, 2013 (end of the accounting period): dr Interest Expense (+E, -SE) cr Interest Payable (+L) 80,000 80,000 Adjusting entry for 2 months’ accrued interest ($6,000,000 x 8.0% x 2/12 = $80,000). April 30, 2014 (maturity date): dr dr dr 6,000,000 Note Payable (-L) 80,000 Interest Payable (per above) (-L) Interest Expense ($6,000,000 x 8.0% x 4/12) (+E, -SE) 160,000 cr Cash (-A) Paid note plus interest at maturity. 10-59 6,240,000 E10-3 Recording Payroll Costs McLoyd Company completed the salary and wage payroll for March 2013. The payroll provided the following details: Required: 1. Considering both employee and employer payroll taxes, use the preceding information to calculate the total labor cost for the company. 2. Prepare the journal entry to record the payroll for March, including employee deductions (but excluding employer payroll taxes). Employees were paid in March but amounts withheld were not yet remitted. 3. Prepare the journal entry to record the employer’s FICA taxes and unemployment taxes. 10-60 E10-3 Recording Payroll Costs with Discussion Req. 1 The total labor cost was $431,380, made up of the $400,000 in gross salaries and wages plus the $28,600 for Employer FICA taxes and $2,780 for unemployment taxes. Req. 2 March 31, 2013 dr Salaries and Wages Expense (+E, -SE) 400,000 cr Withheld Income Taxes Payable (+L) 37,000 cr FICA Taxes Payable—Employees (+L) 28,600 cr Cash (-A) 334,400 Payroll for March including employee deductions. Req. 3 March 31, 2013 dr Payroll Tax Expense (+E,-SE) cr FICA Taxes Payable—Employer (+L) cr Unemployment Taxes Payable (+L) Employer payroll taxes on March payroll. 10-61 31,380 28,600 2,780 E10-8 Preparing Journal Entries to Record Issuance of Bonds at Face Value, Payment of Interest, and Early Retirement On January 1, 2013, Innovative Solutions, Inc., issued $200,000 in bonds at face value. The bonds have a stated interest rate of 6 percent. The bonds mature in 10 years and pay interest once per year on December 31. Required: 1. Prepare the journal entry to record the bond issuance. 2. Prepare the journal entry to record the interest payment on December 31, 2013. Assume no interest has been accrued earlier in the year. 3. Assume the bonds were retired immediately after the first interest payment at a quoted price of 101. Prepare the journal entry to record the early retirement of the bonds. 10-62 E10-8 Preparing Journal Entries to Record Issuance of Bonds at Face Value, Payment of Interest, and Early Retirement Req. 1 dr Cash (+A) 200,000 cr Bonds Payable (+L) 200,000 Req. 2 dr Interest Expense (+E, -SE) cr Cash (-A) 12,000 12,000 ($200,000 x 6% x 12/12) = $12,000 Req. 3 dr Bonds Payable (-L) 200,000 dr Loss on Bonds Retired (+E, -SE) 2,000 cr Cash (-A) 202,000 ($200,000 x 101%) = $202,000 10-63 E10-10 Calculating and Interpreting the Quick Ratio and Times Interest Earned Ratio At December 31, 2010, Kraft Foods Inc. reported no short-term investments but did report the following amounts (in millions) in its financial statements: Required: 1. Compute the quick ratio and times interest earned ratio (to two decimal places) for 2010 and 2009. 2. Did Kraft appear to have increased or decreased its ability to pay current liabilities and future interest obligations as they become due? 10-64 E10-10 Calculating and Interpreting the Quick Ratio and Times Interest Earned Ratio Req. 1 2010 = $2,481 + $6,539 $15,660 = 0.58 2009 = $2,101 + $5,197 $11,491 = 0.64 2010 = ($4,114 + $ 2,024 + $1,147) ÷ $2,024 = 3.60 2009 = ($3,021 + $ 1,237 + $1,136) ÷ $1,237 = 4.36 Req. 2 10-65 PA10-3 Recording and Reporting Current Liabilities During 2013, Lakeview Company completed the following two transactions. The annual accounting period ends December 31. a. On December 31, 2013, calculated the payroll, which indicates gross earnings for wages ($80,000), payroll deductions for income tax ($8,000), payroll deductions for FICA ($6,000), payroll deductions for American Cancer Society ($3,000), employer contributions for FICA (matching), state unemployment taxes ($500), and federal unemployment taxes ($100). Employees were paid in cash, but these payments and the corresponding payroll deductions and employer taxes have not yet been recorded. b. Collected rent revenue of $6,000 on December 10, 2013, for office space that Lakeview rented to another business. The rent collected was for 30 days from December 11, 2013, to January 10, 2014, and was credited in full to Unearned Rent Revenue. Required: 1. Give the journal entries to record payroll on December 31, 2013. 2. Give ( a ) the journal entry for the collection of rent on December 10, 2013, and ( b ) the adjusting journal entry on December 31, 2013. 3. Show how any liabilities related to these items should be reported on the company’s balance sheet at December 31, 2013. 10-66 PA10-3 Recording and Reporting Current Liabilities Req. 1 dr Wage Expense (+E, -SE) 80,000 cr Withheld Income Tax Payable (+L) 8,000 cr FICA Payable (+L) 6,000 cr American Cancer Society Payable (+L) 3,000 cr Cash (-A) 63,000 dr Payroll Tax Expense (+E, -SE) 6,600 cr FICA Payable (+L) cr State Unemployment Tax Payable (+L) cr Federal Unemployment Tax Payable (+L) December 10, 2013: Req. 2 (a) dr Cash (+A) cr Unearned Rent Revenue (+L) 6,000 500 100 6,000 6,000 Collection of rent revenue for one month. (b) December 31, 2013: dr Unearned Rent Revenue (-L) cr Rent Revenue (+R, +SE) 4,000 4,000 Earned 20 days of rent and initially recorded all as unearned. Need to reduce unearned revenue for the 20 days and record it as earned revenue (20/30 x $6,000 = $4,000). 10-67 PA10-3 Recording and Reporting Current Liabilities Req. 3 Balance sheet at December 31, 2013: Current Liabilities: Withheld Income Taxes Payable FICA Payable American Cancer Society Payable State Unemployment Tax Payable Federal Unemployment Tax Payable Unearned Rent Revenue 10-68 8,000 12,000 3,000 500 100 2,000 End of Chapter 10 10-69

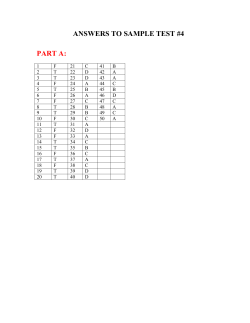

© Copyright 2026