CS – 15 Risk Premium for Insurance Product Pricing Steve Mildenhall, AON Re

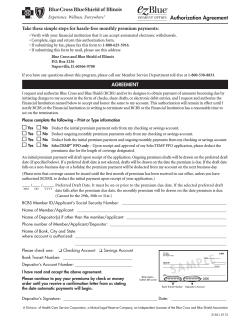

CS – 15 Risk Premium for Insurance Product Pricing Steve Mildenhall, AON Re Dave Ingram, Milliman USA Don Mango, AM Re Risk Premium for Insurance Product Pricing Stephen Mildenhall CAS/SOA ERM Symposium Washington DC, July 2003 Why a Risk Premium? • Need to make a profit • Need to be reasonably confident of making a profit • Risk Premium is an all encompassing term – Covers frictional costs – Covers pure risk (toss of fair coin) – Compensation for bearing risk under uncertainty • Philosophical distractions should be resisted Risk Premium: 2000BC-today State of the world w Policy Payout E ( L) g ( L(w )) Pr(w ) L w E ( L) L(w ) Pr(w ) w E ( L) L(w ) Pr* (w ) w E ( L) h L(w ) Pr(w ) w All of the above Probabilities Financial Consequences of policy Risk Premium • • • • • • • • Standard deviation Variance Semi-Variance Percentile/VaR Tail-VaR Wang Transform Esscher Transform Utility-based • Micro-view of single risk • SD, Variance,… of what? • Which measure is appropriate? Measures of Risk • Problem: collapse distribution to a number – All moments may not be enough to determine distribution! • No consensus methodology • Rothschild-Stiglitz offer four possible definitions of when X is “more risky” than Y 1. 2. 3. 4. X = Y + noise Every risk averter prefers Y to X (utility) X has more weight in the tails Var(X) > Var(Y) 1, 2, and 3 are equivalent and are different from 4 Parameter Risk: don’t delude yourself • Variance of losses in your model is not the same thing as variance of losses! – Hayne’s Loss Reserving Example (CLRS) • Leverage, Excess Policies and Jensen’s inequality E( f ( X )) f (E( X )) – Need to compute the mean correctly – Risk load should not be used to compensate for miscellaneous actuarial inadequacies Don’t believe a risk load formula that says a new small line is a good thing! Size: what is a large risk? • Parameter risk is all that matters…almost • Process risk matters for large risks • Large? – – – – – 100M households in US $1M loss = 1¢ per household $100M loss = $1 per household $1B loss = $10 per household $10B loss = $100 per household Large Size: what is a large risk? • Heterogeneous distribution of wealth • Demographics – Ultimate risk bearers are individual insureds – Population concentrations correlated to risk loads • Frequency of losses, size of market Don’t believe a risk load formula that does not account for population demographics Big Picture: moving beyond individual policy risk All states of the world States of the world relevant for one policy w Multiple states yielding same loss L for one policy Projection with loss of information Policy Payout L Big Picture: moving beyond individual policy risk Sim# 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 A 77,490 58,089 78,255 8,934 45,939 37,614 5,379 16,600 36,492 53,382 6,911 42,304 4,114 31,730 15,796 19,180 6,756 3,967 9,401 11,352 B 123,643 44,276 41,085 115,909 66,417 34,151 50,342 19,034 10,658 16,521 43,635 12,079 26,544 16,976 33,017 17,466 18,021 14,584 16,660 3,810 C 12,301 54,757 18,167 1,317 2,677 31,340 24,204 40,084 27,340 3,671 17,632 6,515 29,910 10,725 7,587 13,622 22,012 12,489 3,956 8,277 Total 213,435 157,122 137,507 126,160 115,033 103,105 79,925 75,717 74,490 73,574 68,179 60,898 60,568 59,431 56,401 50,268 46,789 31,040 30,017 23,439 Mean Loaded Load 28,484 40,416 42% 36,241 53,667 48% 17,429 19,733 13% 82,155 113,815 39% SD CV 23,584 82.8% 31,804 87.8% 13,564 77.8% 46,310 56.4% Transf Probs 0.160 0.104 0.086 0.074 0.066 0.060 0.054 0.050 0.046 0.042 0.039 0.036 0.033 0.030 0.027 0.025 0.022 0.019 0.016 0.011 Big Picture: moving beyond individual policy risk • Rodney Kreps, co-measures Eg ( X i ) condition on X i • P/C: Catastrophe (re-)insurance – Cat models explicitly quantify correlation • Life: Hedging interest rate and investment risk Three Points to Remember • Parameter Risk • Size • Think Big-Picture Pricing for Risk David Ingram ERM Symposium Washington DC, July 2003 Pricing for Risk 1. RMTF Survey of current Practices 2. Methods for Setting Risk Margins a. b. c. d. Charge for Risk Capital Risk Adjusted Hurdle Rates Adjusted Target Calculation Replication How Do you Price for Risk? Capital Risk-adjusted allocation profit target ROI IRR ROE CTS Premium Margin 25% 26% 30% 21% 16% 18% 18% 16% 27% 23% Stochastic scenario analysis 19% 17% 21% 17% 13% Assumption PADS 13% 12% 11% 15% 18% Assumption stress testing 25% 26% 20% 19% 28% What is the basis for Risk Adjustment? 3. If you use capital allocations for reflecting risk, how are these allocations determined? Regulatory formula multiple 147 55.26% Internal formula 69 25.94% Economic capital 44 16.54% Other 6 2.26% Total: 266 What is the basis for Risk Adjustment? 4. If you use assumption PADS, how are these PADS determined? Analysis of recent experience 66 50.00% Industry standard 36 27.27% Other 5 3.79% Stochastic scenario analysis 25 18.94% Total: 132 What is the basis for Risk Adjustment? 5. If you risk-adjusted profit objective, how is it determined? Judgment 81 Formula 44 Other 6 Total: 131 61.83% 33.59% 4.58% What is the basis for Risk Adjustment? 6. If you use assumption stress testing, how are the parameters determined? Judgment 137 59.05% Confidence limits 48 20.69% Worst case historical experience 42 18.10% Other 5 2.16% Total: 232 What is the basis for Risk Adjustment? 7. If you use stochastic scenario analysis, how is the distribution of results analyzed? Percentiles 83 30.51% Mean-variance analysis 44 16.18% Conditional tail expectation (CTE) 44 16.18% Problem scenario analysis 38 13.97% Value at risk 24 8.82% Efficient frontier 23 8.46% Earnings at risk 14 5.15% Other 2 0.74% Total: 272 Methods for Setting Risk Charge • Judgment Methods • Quantitative Methods Judgment Methods • Risk Premium based on – – – – Prior products Market prices Comfort with particular risks Relative perceived risk of company products Quantitative Methods 1. 2. 3. 4. Charge for Risk Capital Risk Adjusted Hurdle Rates Adjusted Target Calculation Replication Charge for Risk Capital • Most common quantitative risk adjustment to pricing • Charge is: – (HR – is) * RCt • Where HR is Hurdle Rate • is is the after tax earnings rate on surplus assets • RCt is the risk capital in year t Charge for Risk Capital • Is it actually a charge for risk? – Or just a cost of doing business? • It is a charge that is proportionate to risk • If there are other risk charges or adjustments, need to be careful not to double charge for risk Risk Adjusted Hurdle Rates • Efficient Frontier Analysis • Market Analysis Efficient Frontier Analysis Process A.Brainstorming B.Modeling C.Display / Identify Frontier D.Determine Risk/Reward Trade-off Parameters Efficient Frontier Premier III Efficient Frontier 35.00 30.00 Return 25.00 20.00 15.00 10.00 5.00 - 2.00 4.00 6.00 Risk 8.00 10.00 12.00 14.00 Market Analysis • Study Relationship between Return and – Product Concentration – Income/ ROE volatility For a group of successful companies. • Develop Target returns – Based on Products – Based on volatility Market Analysis Product Concentration ROE Volatility • Product A – 12% • Product B – 15% • Product C – 10% Target ROE = • Risk-free rate + 3.7 • 22.83% +1.83% ln() • 7.5% + Market Analysis While this is “quantitative”… Data is so thin that much judgment is needed to develop targets Study of Insurance Company ROE ROE Std Dev Ratio Group I 13.96% 6.71% 48% Group II 10.52% 11.32% 107% Group III 10.12% 16.02% 158% Group IV 4.86% 25.96% 534% Group V (3.69%) 21.13% NM Adjusted Target • Instead of concentrating on 50th Percentile results (or average results) – In a stochastic pricing model • Pricing Target adjusted to 60th, 70th or 80th Percentile Adjusting Target Monthly Returns 20% 50th Percentile 0.86% 15% 10% 80th Percentile (2.35%) Average 0.72% 5% 0% 100% 95% -5% -10% -15% -20% -25% 90% 85% 80% 75% 70% 65% 60% 55% 50% 45% 40% 35% 30% 25% 20% 15% 10% 5% 0% Replication • Finance – Law of One Price – Two sets of securities that have the same cashflows under all situations will have the same price • Replication – if you can replicate the cashflows of an insurance product with marketable securities then market price of securities is the correct price for product Risk & Return • Bonds – Volatility of Bond Prices 8.6% – Average Return on Bonds – 5.8% compound Average, 6.1% Arithmetic Average – Risk/Reward = 139% to 148% • Stocks – Volatility of Stock Returns 20.5% – Average Return – 10.5%, 12.2% – Risk Reward = 168% to 194% Insurance Products • Cannot easily hedge with 100% efficiency • But can compare… VA Product vs. Common Stocks • Insurance Product – VA – $10 B AV – Std Dev = 200, CTE 90=429 Compare to • Common Stock Fund A – $300 M Fund – Std Dev= 200, CTE 90= 390 • Common Stock Fund B – $330 M Fund – Std Dev= 220, CTE 90= 429 Returns • Insurance Product – VA – 75 Expected Return • Common Stock Fund A – 100 Expected Return • Common Stock Fund B – 110 Expected Return Recommendations 1. Work on evolving from Judgment to Quantitative 2. Quantitative methods need to be based on Pricing Risk Metric 3. Ultimately should tie to market pricing for risks Risk Premiums Don Mango AM Re Where Are We Going? • • • • • Commonalities Simulation Modeling Explicit Valuation Aggregate Risk Modeling Interaction Effects Commonalities • Valuation of Contingent Obligations (“VALCON”) • Levered investment trusts • Strong dependencies on economic and capital market conditions Commonalities • Long time horizons and held-to-maturity (“HTM”) portfolios • We sell “long-dated, illiquid, OTC derivatives” • We have an incomplete, inefficient secondary market • We retain magnitudes of risk that bankers would never dream of Commonalities • IMPLICATIONS: • This seminar should be the norm, not the exception. • There may be hybrid products in our future. • We may not be able to simply borrow capital market techniques. Simulation Modeling • Aka “Monte Carlo valuation” • Financial engineers use it to price longdated, illiquid, OTC derivatives • Devil is in the parameters and dependence structure Simulation Modeling • IMPLICATIONS: • We are heading the same direction. • We need transparency or at least explicitness of assumptions. Explicit Valuation • Complete, efficient market affords participants the luxury of not having to think or care or have any opinion of the fundamental value of a product • Counting on the continued presence of counterparties to limit downside • Bloomberg gives you “the price” Explicit Valuation • Incomplete, inefficient market requires some explicit valuation by its participants • True, you could be a “delta” off a content provider – 10% below Swiss Re or Met Life Explicit Valuation • IMPLICATION: If you want to be a leader, formulate a risk appetite and apply it. – Read Karl Borch, 1961 • What are your desired payoff profiles, and please be specific and use quantities! Aggregate Risk Modeling • Valuation develop indicated price based on the impact of the product on your portfolio – a “MARKET OF ONE” • “One Price” does not mean One Value • Value is idiosyncratic and in the eye, mind, interpretive filter, and model of the beholder Aggregate Risk Modeling • • • • Requires aggregate portfolio risk modeling Integration of disparate risks A critical goal of our ERM efforts Sounds like it might require actuaries of all kinds … Aggregate Risk Modeling • IMPLICATIONS: • Get information content into the indicated prices and (hopefully) the quotes. • Risk Management is that Content Provider. Interaction Effects • Indicated price meets market strategy, premium goals, expense ratios, relationships, history, culture, decision process, … • Multiple participants selling promises with indistinguishably small probabilities of nonperformance Interaction Effects • Throw in some “momentum sellers” going delta off the content providers • Result is an unstable system dynamic = “the insurance market” • Mutually reinforcing behaviors, for good or bad Interaction Effects • IMPLICATIONS: • Theory aside, the attainable risk premium will rarely be where it “should be.” • Market Price represents somebody’s quote (usually the LCD – winner’s curse) – no “exogenous” source • No more isolated strategy development – we have seen the enemy, and it is us.

© Copyright 2026