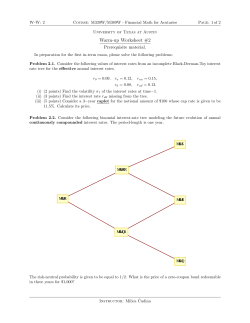

American Options with Stochastic Dividends and Volatility: A