Document 395191

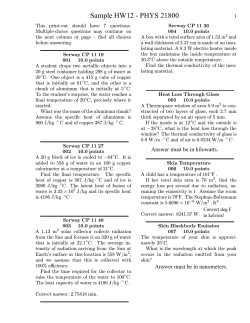

Th u r s d ay 3 0 , O c to b e r 2 0 1 4 News & Report Analysis Currency Market Precious Metal Base Metal Energy Market Global Supply Electrosteel moves SC over coal block cancellation Tata Steel’s Canadian partner to cut jobs Anrak Aluminium optimistic of govt nod for bauxite project Sesa Sterlite posts Rs 1,619-cr profit in 2Q Indiabulls plans to bid for coal blocks 2 Thursday 30, October 2014 Daily MMR Landed Prices London Metal Exchange : Wednesday 29, October 2014 Pr. Sell (1) Morning Session Buy Sell * (2) Afternoon Session Buy Sell Kerb Change (2) - (1) Value Stk(tns) change $/ton Rs/ton Copper Grade A Spot 6859.50 6854.00 6855.00 6904.00 6905.00 6869.50 -4.5 1,62,675 MMR LP 4,54,396 3-mth 6800.00 6785.00 6785.50 6826.00 6827.00 6795.00 -14.5 1625 14-D MA 4,46,431 PP (HCL) 4,56,624 Average 10-days - 6725.80 20-days - 6731.30 30-days - 6750.20 Tin High Grade Spot 19755.00 20145.00 20150.00 20169.00 20170.00 19866.00 395.0 9,115 -- -- 3-mth 19760.00 20165.00 20170.00 20174.00 20175.00 19875.00 410.0 -25 -- -- -- -- Average 10-days - 19550 20-days - 19882.80 30-days - 20197.80 Lead Spot 2019.00 2019.00 2020.00 2029.00 2030.00 2022.75 1.0 2,24,475 MMR LP 1,38,764 3-mth 2030.00 2034.00 2035.00 2040.00 2041.00 2034.00 5.0 -75 14-D MA 1,37,890 PP (HZL) 1,46,300 Average 10-days - 2004.60 20-days - 2039.30 30-days - 2049.20 Zinc Special High Grade Spot 2252.50 2264.50 2265.00 2303.00 2304.00 2258.00 12.5 7,05,525 MMR LP 1,59,806 3-mth 2252.00 2260.50 2261.00 2297.00 2298.00 2256.00 9.0 -2700 14-D MA 1,57,997 PP (HZL) 1,69,200 Average 10-days - 2234.90 20-days - 2269.80 30-days - 2264.50 Aluminium Spot 1990.50 2011.50 2012.00 2037.00 2038.00 1995.25 21.5 44,27,975 MMR LP 1,54,433 3-mth 1996.50 2013.50 2014.00 2033.00 2034.00 1996.00 17.5 -8475 14-D MA 1,51,263 PP (Nalco) 1,59,400 Average 10-days - 1961 20-days - 1930.40 30-days - 1929.80 Aluminium Alloy Spot 2075.00 2075.00 2085.00 2083.00 2084.00 2074.00 10.0 26800 3-mth 2080.00 2080.00 2090.00 2089.00 2090.00 2080.00 10.0 0 Average 10-days - 2069 20-days - 2087 30-days - 2085.80 Nickel Spot 15055.00 15575.00 15585.00 15689.00 15690.00 15484.00 530.0 3,80,946 -- -- 3-mth 15135.00 15615.00 15625.00 15749.00 15750.00 15545.00 490.0 2082 -- -- -Copper Aluminium -01-Oct 25-Oct Zinc Lead 20-Oct 20-Oct Average 10-days - 1512.50 20-days - 15786.30 30-days - 16204.50 Note: 1. MMR LP = MMR Landed Prices, excluding excise duty. 2. PP = Producer Prices ex-smelter, excl. excise Minor Metals ($/LB) Antimony 99.65% 9,600 Cadmium 99.80% 90.00 Cobalt HG Moly.oxide 99.80% 14.00 14.25 Tantalite 30% Ta2O5 92.00 Titanium Ferro-vana Con. Ti02 650.00 24.90 Silicon 2,050 Week ended Avg of Steel Prices: 25/10/2014 (Incl. Excise duty) Sponge Iron Pig Iron Mandi 29,600 HMS 33,400 CRP(LSLP) Mumbai 30,000 33,000 Kolkata 29,600 - Indicative Domestic Market Rates (Rs./kg) Mumbai 29-Oct Chennai 29,600 32,000 MS Ingots Bhiwandi 38,200 Comex Copper (cents/lb) Prev Delhi 29-Oct Prev -510.0 -508.0 430.0 - 428.0 - Alum Ingot Zinc Slab Lead Ingot Tin Slab Nickel (4x4) Scrap Copper Heavy Copper Uten. 168.0 185.0 137.0 1,485.0 1,100.0 167.0 186.0 138.0 1,480.0 1,085.0 172.0 192.0 132.0 1,480.0 1,087.0 172.0 192.0 132.0 1,480.0 1,087.0 473.0 432.0 472.0 431.0 --- --- Copper Mixed Brass Utensil Brass Huny Brass Sheet Alum Utensil -328.0 -343.0 137.0 -329.0 -341.0 134.0 415.0 -322.0 142.0 415.0 -319.0 142.0 Virgin Metals Copper Pat Copper W/Bar Delhi 29,800 - Oct'14 Nov'14 Dec'14 Rate 311.20 311.15 310.45 Change 0.1 0.4 0.4 Kanpur 38,000 Durgapur 34,200 Comex Al (cents/lb) Rate - Change - Precious Metals : Indicative Rates Metal Gold Std Silver Gold Silver Gold Silver Market Mumbai Mumbai London London Comex Comex Unit Rs./10g Rs./kg $/tr.oz. $/tr.oz. $/tr.oz. $/tr.oz. 29-Oct 27,400 38,500 1,223.5 17.20 1,224.3 17.21 Prev 27,520 38,700 1,229.3 17.18 1,227.8 17.19 orex: Oct 29, 2014 (Rs/Unit Currency) Buy USD 61.41 61.32 EURO 78.18 GBP 98.95 98.84 SGD 48.32 — — AUD 54.57 YEN 0.5681 0.5671 SFR 64.85 Sell 78.08 48.21 54.50 64.73 Buy Sell Customs Notified Rates: Oct 02, 2014 [Rs.(Imp/Exp)]: US$ 62.30/61.30;Pound Sterling 101.25/99.00;Euro 79.00/77.10 3 Thursday 30, October 2014 Daily U.S. stocks closed with slight losses on a significantly weaker yen and as participants Wednesday, finishing off their lows of the focused on the potential positives of the Fed's session, after the Federal Reserve ended its stance. "The market is relieved as the rates would stimulative monthly bond-buying program remain low for some time while seeing a recovery and expressed confidence in U.S. economic in the U.S. economy," said Nobuhiko Kuramochi, a prospects. Major indexes were volatile following strategist at Mizuho Securities in Tokyo. the central bank's statement, with the S&P 500 Currency Market down as much as 0.8 percent before pulling back. Material shares were lower throughout The dollar stayed on the front foot on the session, a decline in Facebook pressured the Thursday, hovering near 3-1/2 week highs Nasdaq, but strength in energy and financial against a basket of currencies after the Federal shares helped the market recover. The Dow Reserve surprised markets with a more hawkish Jones industrial average fell 31.44 points, or policy tone and signaled its confidence in the 0.18 percent, to 16,974.31, the S&P 500 lost U.S. economic recovery. The dollar index, which 2.75 points, or 0.14 percent, to 1,982.3 and the measures the U.S. currency against a basket of Nasdaq Composite dropped 15.07 points, or six major rivals, rose to 86.083, after touching 0.33 percent, to 4,549.23. 86.143, its highest level since October 6, in the As a result, Asian stock prices declined on wake of the Fed's announcement. The Fed Thursday while US dollar currency surged to a released a statement that underscored the three-week high versus the yen after the U.S. improving U.S. labour market, dismissing recent Federal Reserve ended its massive quantitative financial market volatility, European growth easing MSCI's challenges and largely weak inflation outlook. broadest index of Asia-Pacific shares outside The dollar hovered near a three-week peak of Japan .MIAPJ0000PUS was down 0.6 percent. 109.12 yen JPY= after surging nearly 0.7 percent In a statement on Wednesday after a two-day in light of the Fed's statements, while the meeting, the Fed ended its quantitative easing euro fetched $1.2624 EUR= after shedding 0.8 programme of bond purchases. At its peak, the percent overnight. programme, as expected. programme pumped $85 billion a month into the USD/INR - 29/10/14 financial system. "The Fed was widely expected 61.27 61.29 and looking ahead, we anticipate further gains in the greenback," she said. Tokyo's Nikkei .N225 bucked the trend in Asia and rose 0.5 percent, taking heart from USD/INR Overnight VAR Data releases today 17:00 16:00 statement breathed new life into the U.S. dollar 15:00 61.37 14:00 New York, said in a note to clients. "The FOMC 13:00 61.35 9:00 61.33 managing director at BK Asset Management in 12:00 61.31 to their labour market assessment," Kathy Lien, 11:00 anyone anticipated such a significant upgrade 10:00 to end quantitative easing (QE) but barely 0.3443 Forecast Previous USD Advance GDP q/q 3.1% 4.6% USD Unemployment Claims 277K 283K Source : Mecklai Financial 4 Thursday 30, October 2014 Daily 6 mth LIBOR Major Currencies Today’s Crosses Spot Cash v/s INR 0.32 USD / INR - ATM Options (put/call) 0.15 Forward Rates v/s INR (Export/ Import) October November December March June September 61.45/ 46 61.39/ 41 61.80/ 83 62.24/ 27 62.64/ 68 63.86/ 90 65.00/ 04 66.08/ 12 - - - 0.00/0.46 0.00/0.68 0.00/0.84 0.00/1.31 0.00/1.70 0.00/2.07 EUR / USD 1.2620 77.54/ 56 77.46/ 50 78.01/ 05 78.57/ 61 79.09/ 14 80.68/ 73 82.19/ 23 83.67/ 70 0.16 USD / JPY(100) 109.06 56.34/ 35 56.28/ 30 56.68/ 71 57.06/ 14 57.48/ 53 58.66/ 70 59.77/ 82 60.87/ 92 0.69 GBP / USD 1.5980 98.19/ 21 98.09/ 13 98.77/ 74 99.41/ 26 100.02/ 71 101.89/ 95 103.62/ 01 105.25/ 92 0.06 USD / CHF 0.9557 64.29/ 30 64.23/ 25 64.66/ 69 65.16/ 18 65.60/ 64 66.95/ 98 68.24/ 27 69.51/ 53 3.06 AUD / USD 0.8771 53.89/ 90 53.84/ 86 54.21/ 23 54.60/ 61 54.94/ 97 56.01/ 04 57.01/ 04 57.96/ 99 Source : Mecklai Financial considerable time. The central bank has held its Precious Metal key rate at zero to 0.25 percent since 2008. Gold traded near a three-week low as the dollar strengthened after the Federal Reserve ended its asset-purchase program. Holdings in the largest exchange-traded product extended declines to the lowest in six years. Bullion for immediate delivery was at $1,213.07 an ounce by 11:57 a.m. in Singapore from $1,212.15 yesterday, according to Bloomberg generic pricing. The metal dropped to $1,208.50 yesterday, the lowest price since Oct. 8, as the Bloomberg Dollar Spot Index rose the most in four weeks. to end monthly bond-buying, dismissed recent turmoil in global financial markets and focused on employment gains. Policy makers at the end of a two-day meeting yesterday maintained a commitment to keep borrowing costs low for a Market Highlights - Gold (% change) Gold (Spot) Gold (Spot -Mumbai) Comex Gold (Oct’14) MCX Gold (Oct’14)** FOMC appearing more positive on the economic outlook,” Daniel Hynes, senior commodity strategist at Australia & New Zealand Banking Group Ltd., wrote in a note today. “This elicited a strong rally in the U.S. dollar and selling in gold. Movement in the U.S. dollar over the next few days could set the tone for commodities into the year end.” Gold for December delivery fell as much as 1.2 percent to $1,210.60 an ounce on the Comex in New York before trading at $1,212.80. Futures Fed officials, voting to proceed with plans Gold “Quantitative easing ends in the U.S., with the Unit Last Prev. day as on October 29, 2014 WoW MoM YoY yesterday dropped to $1,208.20, the lowest since Oct. 8. Assets in the SPDR Gold Trust, the biggest bullion-backed ETP, shrank for a second day to 742.40 metric tons yesterday, the least since October 2008. In China, the largest consumer, lower prices have spurred physical demand as volumes for the Shanghai Gold Exchange’s benchmark bullion spot contract rose to a three- $/oz 1211.5 -1.32 -2.3 -0.9 -9.8 Rs/10 gms 26995.0 3.45 #N/A 1.9 -9.4 $/oz 1214.3 -0.82 -1.2 1.9 -9.7 Rs /10 gms 27079.0 -0.21 -1.5 0.5 -10.2 Source: Angel Broking week high yesterday. Base Metal A price index of the six main LME metals is heading for a second annual loss, the first Daily Thursday 30, October 2014 time that’s happened since the recession in open interest is the lowest in 19 months for zinc 2007-2008. Evidence of a slowdown in China, futures and down 10 percent for aluminum this the world’s top metals user, is fueling concern year. that demand for raw materials will weaken. A stronger US dollar kept the raw materials This month, the International Monetary Fund of base metals more expensive for buyers using reduced its 2015 forecast of global growth. other currencies. Besides, possible strikes at the Investors are pulling out of industrial-metals Grasberg mine in Indonesia and at the Antamina funds at the fastest pace in 15 months, signaling mine in Peru may disrupt 3.1 percent of world increased concern that a faltering global copper production. As a result, all base metals economy will slow demand for everything from at the LME declined. Copper dropped for the cars to appliances. first time in four days as the Federal Reserve’s The withdrawals from industrial-metals decision to end its bond-purchase program ETPs this month were equal to 12 percent of strengthened the dollar, reducing the appeal of their market capitalization, more than any commodities as an alternative investment. The commodity group, after $22.2 million was pulled metal retreated as much as 0.6 percent after in September. The price index of the six main closing yesterday at the highest in almost six metals on the LME has fallen 4 percent since the weeks end of July, leaving the gauge down 0.3 percent Copper for delivery in three months on this year. The ETP outflow halts a seven-month the London Metal Exchange fell 0.5 percent to period through July when investors poured $6,778.25 a metric ton at 10:44 a.m. in Tokyo $101.3 million into industrial metals, a bigger after closing at $6,815 yesterday, the highest percentage increase than any other commodity since Sept. 19. In New York, copper futures for group, data compiled by Bloomberg show. December delivery slid 0.7 percent to $3.084 a Indonesia’s ban on exports of unrefined ore pound, while the January contract in Shanghai from mines drove concern that supplies of was little changed at 47,740 yuan ($7,807) per tin and nickel would be squeezed, while an tonne. improving U.S. housing market brightened demand prospects for copper wire and pipe. Nickel tumbled 16 percent since the end of July to $15,527 a metric ton on the LME today, The outlook shifted after the IMF cut its and copper fell 4.9 percent to $6,770 a ton. growth forecast to 3.8 percent on Oct. 6, from The Bloomberg Commodity Index of 22 raw a July estimate of 4 percent. Supplies of copper, materials slid 7.1 percent over the same period, lead, tin and nickel will be in surplus this year, while MSCI All-Country World Index of equities Macquarie Group Ltd. said in an Oct 14. report. dropped 2.5 percent. The Bloomberg Treasury U.S. exchange-traded products backed by Bond Index gained 1.8 percent. the metals saw an outflow of $55 million this Energy Market month, the most since July 2013, data compiled by Bloomberg show. Hedge funds have bet on West Texas Intermediate retreated from a lower copper prices for five weeks, the longest one-week high after government data showed stretch since April. London Metal Exchange crude stockpiles rose as output surged to a 5 Thursday 30, October 2014 Daily Market Highlights - Crude Oil (% change) as on October 29, 2014 Crude Oil Unit Last Prev. day Brent (Spot) $/bbl 87.3 1.6 0.6 -8.1 -19.4 Nymex Crude (Sep ’14) $/bbl 82.2 1.0 2.1 -9.7 -16.3 ICE Brent Crude (Oct’14) $/bbl 87.1 1.3 2.8 -10.2 -20.1 5083.0 2.0 1.6 -11.0 -16.1 MCX Crude (Oct ’14) WoW MoM YoY yesterday. The European benchmark crude traded at a premium of $5.10 to WTI, compared with $4.92 yesterday. Global Supply OPEC's oil production is unlikely to change much in 2015 and there is no need to panic at Rs/ bbl the crude price drop, OPEC's secretary general Source: Angel Broking said on Wednesday, adding to indications the record high in the U.S., the world’s biggest oil exporter group is in no hurry to cut output. consumer. Brent slid in London. Futures fell Abdullah al-Badri also said output of higher- as much as 0.6 percent in New York. Crude cost oil supplies such as shale would be curbed stockpiles gained for a fourth week as production if oil remained at around $85 a barrel, while increased to 8.97 million barrels a day, the the Organization of the Petroleum Exporting fastest rate since January 1983, according to the Countries enjoys lower costs and will see higher Energy Information Administration. Supply and demand for its crude in the longer term. demand will return to equilibrium and OPEC Oil's drop below the $100-mark, the level members aren’t waging a price war, Secretary- many OPEC members had endorsed, has raised General Abdalla El-Badri said yesterday. the question of whether OPEC will cut supply “Expanding stockpiles are putting downward when it meets in November. Badri said OPEC's pressure on oil,” Kang Yoo Jin, a commodities output was unlikely to change much next year, analyst at Woori Investment & Securities Co. adding to signs a decision to cut in November in Seoul, said by phone today. “Oversupply is unlikely. concerns in the market are not easing because News & Report Analysis OPEC isn’t making any comments so far on a possible production cut.” WTI for December delivery dropped as much as 45 cents to $81.75 a barrel in electronic trading on the New York Mercantile Exchange, Electrosteel moves SC over coal block cancellation and was at $81.91 at 2:10 p.m. Seoul time. The Electrosteel Castings Ltd has said that it has contract climbed 78 cents to $82.20 yesterday, filed a petition before the Supreme Court on the highest close since Oct. 21. The volume of the cancellation of allotment of a coal block. all futures traded was about 31 percent below The North Dhadhu coal block, situated in the 100-day average. Prices have decreased 17 Jharkhand, was earlier allotted to Electrosteel percent this year. Castings as well as a few other investors for Brent for December settlement declined shared operations. as much as 32 cents, or 0.4 percent, to $86.80 The company also said it was examining the a barrel on the London-based ICE Futures implication of the Ordinance, promulgated by Europe exchange. The contract rose 1.3 percent the Centre this month paving way for e-auction 6 7 Thursday 30, October 2014 Daily in a statement to the Toronto Stock Exchange. The restructuring will take place in the fourth (October-December) quarter, it added. NML has already begun trial shipping of ores to Tata Steel’s European operations. of coal blocks, on the company’s investment so far made in the joint coal mining project. Anrak Aluminium optimistic of govt nod for bauxite project India's Anrak Aluminium is optimistic of It had stated in a note that it did not make securing government approval to mine bauxite any fresh investments apart from the initial in three to four months, a company official said investments made on the coal block, which is on Wednesday, possibly ending a three-year yet to be made operational. wait. The ductile iron pipe maker reported net "We are hopeful of getting approval in profit of Rs. 12.78 crore in the July-September three to four months," Hariharan Mahadevan, quarter against Rs. 19.76 crore in the president of projects at Anrak, told an industry corresponding quarter last financial year. conference in Singapore. Tata Steel’s Canadian partner to cut jobs Canadian miner New Millennium Iron Corporation (NML) has decided to downsize its workforce by around 30 per cent. company. to produce 1.5 million tonne of bauxite, used to make alumina which then goes into producing aluminium. April 2015, while the second phase will include a smelter, Mahadevan said. Amrak is a joint The company said it would implement the “human resource restructuring plan”, which included a workforce reduction of 12 fulltime employees, or around 30 per cent of the company’s total strength of 38 people. Through the job cuts, NML expects to save C$1.52 million ($1.35 million) annually. However, the severance packages would entail a one-time cost, which is now being worked out. company of Andhra Pradesh, will have an annual capacity Its alumina refinery should be in place by Tata Steel has a 26.2 per cent stake in the The The mine, located in the southeastern state said the restructuring exercise was in response to the present difficult commodity market. “One-time charges associated with the restructuring are currently being finalised,” it said venture between Penna group of industries and Ras Al Khaimah Investment Authority, according to the company's Facebook page. Vedanta Ved Ve dant da d ntaa nt Aluminium, Alum Al umiiniu um ium m, m, which w hich hi hich ch has h as been b ee en Daily Thursday 30, October 2014 struggling to source sufficient bauxite to feed quarter were copper, aluminium and zinc its 1 million tonne per year alumina refinery in India businesses; while oil & gas production Odisha state, is also hopeful of an improvement in Rajasthan has normalised after completion in the supply of bauxite. of maintenance shutdown at the Mangala Billionaire Anil Agarwal, the founder of processing terminal," said Group CEO Tom London-listed Vedanta Resources that controls Albanese in a statement. Vedanta Aluminium, said on Tuesday that Indiabulls plans to bid for coal blocks the government of Odisha has assured him of adequate supplies in the next three to four months. Indiabulls Power plans to bid for coal blocks being auctioned and has no plans to bring in a Sesa Sterlite posts Rs 1,619-cr profit in 2Q strategic partner or to sell stake as it hopes to grow organically, CEO Rajiv Rattan said. "We are Sesa Sterlite on Wednesday reported Rs keen to bid in the new coal auctions as unlike 1,619 crore consolidated net profit in July- before, we are now certain of a transparent and September quarter this fiscal on the back of Rs fair process of allotment," Rattan said. He further 19,448.14 crore net sales. said the company had not taken a coal block but ensured proper fuel supply, making it perhaps the only listed power entity that was not hit by the Supreme Court's order cancelling allocation of coal blocks. Rattan said speculation about selling stake was baseless. "There is no truth to these talks, I have put in Rs 360 crore of my own money into the company, which is a clear signal that we are not planning to sell or bring in any strategic The metal, mining and oil and gas major investor right now, I am clearly not looking had reported Rs 2,394 crore net profit after tax, at exiting this company or feel the need for a minority interest and consolidated share in currently," said Rattan. strategic gic investor currently, Ratta profit of associates in the same quarter last fiscal while net sales were at Rs 25,170.66 crore, it said in a BSE filing. The NRI billionaire Anil Agarwal-led firm, however, said the results are not comparable as Sesa Sterlite was created in August last year following a merger of Sterlite Industries and several other entities of Vedanta group into Sesa Goa last year in August. "Main performance drivers during the 8 Thursday 30, October 2014 Daily Workers plan strike at US miner Freeport's Indonesia site Workers at Freeport-McMoRan's giant Indonesian copper mine plan to go on strike for a month from next week, a union official said on Monday, after the company failed to make changes to local management following a fatal accident. Earlier this month, hundreds of angry protesters blocked access for two days to the openpit area of the Grasberg complex, where production was temporarily suspended following the death of four workers on September 27. The remote copper mine is one of the largest in the world and any prolonged disruption could support prices of the metal , which have fallen almost 10 percent this year.Three Freeport unions have agreed to take strike action from Nov. 6 until Dec. 6 to pursue demands including the appointment of new managers, Albar Sabang, a senior official at a Freeport union, told Reuters. Sabang's union has about 9,100 members. "The purpose of the strike is of course to stop production so there will be pressure for the Freeport Indonesia management to answer to our demands," Sabang told Reuters by text message. Freeport, which employs around 24,000 workers, declined to comment on Monday. About three-quarters of the workforce belong to a union. Relations between Freeport and the unions have been strained in recent years following a three-month strike in late 2011 as well as a series of minor disputes. In addition to the four workers killed in the collision involving a truck last month, 28 people were killed after a tunnel collapsed in May last year. Indonesia's mine ministry investigated the Sept. 27 accident and asked the company to introduce changes to safety procedures and policies before allowing open-pit mining to resume.Three weeks ago, the Freeport Indonesia union warned of fresh protests, blockades or strike action if workers' safety concerns and other demands were ignored. A union letter detailing the planned strike was sent on Oct. 23 to Freeport's local CEO, Rozik Soetjipto, the chief executive and chairman of the Arizona-based firm and various government officials. 9

© Copyright 2026