Bellatrix Exploration Ltd. BUY Equity Research

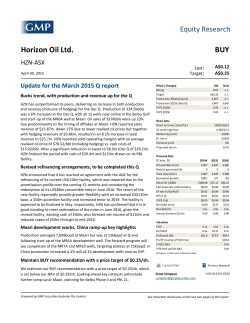

Equity Research Bellatrix Exploration Ltd.1 BUY BXE-TSX/NYSE ▼ November 4, 2014 Q3 results light What's Changed Rating Production pre-released; cash flow behind on higher gas weighting and lower realized oil prices Bellatrix released Q3 results that were below expectations. In a market concerned about commodity prices and any associated risk, our forecast of rising debt to cash flow causes some concern (note: GMP continues to have a generous price deck when compared to the current futures strip). When combined with continued expected infrastructure challenges and a year where capital spending was guided higher while production was guided lower, we are lowering our target price to $7.00 from $10.00. While Bellatrix should continue to appeal to value investors with a long term investment horizon, we would not be surprised to see short term challenges to the share price as risk adverse investors look for lower risk energy investments. Key highlights from the quarter • Production was pre-released and was as expected although cash flow was 19% lower than expected on higher gas weighting and lower realized oil prices. • Bellatrix has maintained its full year 2014 capital plans of $530 million with much of that in Q3 as spending was 70% higher than we anticipated. • Our forecasts now call for net debt of $505 million at YE’14 rising to $653 million and 2.0 times at YE’15. • Preliminary 2015 guidance was released with $450 million in capital spending delivering 48,000 – 49,000 boe/d of average production, up from 38,500 boe/d in 2014. • On the infrastructure side look for the compression booster expansion as well as the Twin Rivers pipeline build in 2014 along with new pipelines and the BXE owned plant being completed mid-2015. C$4.77 C$7.00 Last: Target: Target Production 2014E (boe/d) 6:1 Production 2015E (boe/d) 6:1 CFPS 2014E (f.d.) CFPS 2015E (f.d.) Old New BUY $10.00 38,493 48,997 $1.58 $1.91 n.c. $7.00 38,353 47,670 $1.45 $1.59 Share Data Shares o/s (mm, basic/f.d) 191.5/202.7 52-week high/low $11.27/$4.55 Market Cap (mm) $922 EV (mm) Dividend Yield Projected Return $1,428 0.0% 54% Financial Data YE Dec. 31 Oil and NGLs (b/d) Natural Gas (mmcf/d) Total (boe/d) 6:1 Equivalent growth WTI (US$/b) HHUB (US$/mmbtu) FX rate (USD/CAD) EPS (f.d.) CFPS (f.d.) Net debt (mm) Net Debt/CF Annual Dividend ($/share) Dividend Payout (%) Corporate Payout (%) 2013A 6,489 92.0 21,829 31% $97.99 $3.73 $0.97 $0.58 $1.12 $397.3 2.9x $0.00 0% 263% 2014E 12,688 154.0 38,353 76% $95.80 $4.41 $0.91 $0.64 $1.45 $505.3 1.8x $0.00 0% 135% 2015E 15,124 195.3 47,670 24% $90.00 $4.00 $0.90 $0.35 $1.59 $653.0 2.0x $0.00 0% 146% 5.8x 10.6x $72,028 3.1x 4.8x $37,223 2.9x 4.5x $33,046 $6.75 0.6x 0.3x Valuation P/CF EV/DACF EV/boe/d EV/2P reserves (YE13) P/(2P) NAV P/Risked Upside NAV All figures in CAD$ unless otherwise noted Grant Daunheimer, CFA (403) 543-3039 Graham Smith, CFA (403) 543-3032 [email protected] [email protected] Maintaining BUY recommendation, lowering target to $7.00 We calculate our $7.00 target price based on a combination of our 2015E EV/DACF multiple of 4.5 times (down from 5) and our risked development NAV of $14.08. We have moved our Risked NAV weighting to 30% from equal weight as a result of infrastructure constraints continuing to impact Bellatrix’s ability to crystalize value in a more timely fashion. Prepared by GMP Securities L.P. See important disclosures on the last two pages of this report Equity Research Operational highlights • A $450 million capital budget was approved for 2015 whereby Bellatrix will aim to average 48,000 to 49,000 boe/d in the year, implying 26% y-o-y growth using guidance mid-points. • Infrastructure will remain a priority for the company in the upcoming year as July 1, 2015 remains the target date to get phase 1 of the 110 mmcf/d plant at Alder Flats online. • Near term, additional booster compression and completion of the Twin Rivers pipeline are expected to increase gross processing capability by 30 – 40 mmcf/d, which could bolster Bellatix’s net volumes by 3,000 – 4,000 boe/d. • In Q2 2015, an additional 60 mmcf/d of gross processing capacity is expected to come online with the construction and tie-in of new pipelines, along with expansion of liquids handling capability at a third party plant. Figure 1. Actuals versus estimates Forecast Q3'14 Actual Q3'14 % Difference Q3'13 Year/Year % Change Production Crude Oil and NGL's (bbl/d) Natural Gas (mmcf/d) boe/d % Gas 12,964 150.2 37,995 66% 11,631 157.2 37,838 69% (10%) 5% (0%) 5% 5,993 94.0 21,852 72% 94% 67% 73% (3%) Wellhead Prices Crude Oil and NGL's ($/bbl) Natural Gas ($/mcf) $98.71 $4.34 $90.39 $4.44 (8%) 2% $102.71 $2.68 (12%) 66% Financial Gross Revenue ($/boe) Royalties ($/boe) $40.62 $7.63 $37.57 $7.00 (8%) (8%) $32.27 $4.04 16% 73% Operating Costs ($/boe) $8.03 $8.85 10% $8.98 (1%) Transport ($/boe) $1.00 $1.25 25% $0.82 53% Bellatrix Exploration Ltd. G&A ($/boe) $1.75 $1.75 0% $2.26 (23%) Cash Flow ($/boe) Cash Flow per Share (fd) Debt / Cash Flow Development Capex ($mm) $21.05 $0.36 1.3x $65.0 $17.08 $0.29 2.0x $110.5 (19%) (19%) 52% 70% $14.67 $0.25 1.9x $49.5 16% 17% 8% 123% Weighted Avg Basic Shares (mm) Net Debt ($mm) 191.1 $388.7 191.4 $477.3 0% 23% 108.3 $219.7 77% 117% Source: Company reports, GMP 2 Equity Research We have revised our forecasts down for Bellatrix as a result of greater spending on gas focused production as well as lower realized oil prices. As a result we have 2015 debt to cash flow rising to 2.0 times from 1.4 times. It should be noted our 2015 capital spending numbers remain slightly above guidance with our production forecasts on the low end of guidance. Figure 2. Revised forecasts 2014E 2015E Pre Revised % Change Pre Revised % Change Crude Oil&NGL's (bbl) 13,441 12,688 -6% 17,376 15,124 -13% Natural Gas (mmcf/d) 150.3 154.0 2% 189.7 195.3 3% boe/d 38,493 38,353 0% 48,997 47,670 -3% % Gas 65% 67% 3% 65% 68% 6% -8% Production Financial Revenue ($/boe) $33.59 $32.38 -4% $33.59 $30.84 Operating Costs ($/boe) ($8.00) ($8.25) 3% ($8.00) ($8.00) 0% Cash Flow ($/boe) $21.83 $20.06 -8% $21.59 $18.52 -14% CFPS (FD) $1.58 $1.45 -8% $1.91 $1.59 -17% D/CF 1.5x 1.8x 24% 1.4x 2.0x 48% E&D Capex ($mm) $514 $545 6% $470 $470 0% Net Debt ($mm) $445 $505 14% $529 $653 23% W. Avg Basis Shares (mm) 191.1 191.5 0% 191.1 191.5 0% Source: Company reports, GMP Bellatrix trades at a discount to its peers, we believe this is a result of an operationally challenged 2014 as well as higher debt levels. Figure 3. Valuation 2014E P/NAV* EV/DACF % times P/CF EV/boe/d D/CF Capex/CF times $/boe/d times times 2015E BXE 61% 4.8x Mid Inter. AVG 107% 6.7x BXE Mid Inter. AVG 4.5x 5.4x 3.1x $37,223 1.8x 1.7x 5.2x $79,976 1.5x 1.3x 2.9x $33,046 2.0x 1.3x 4.2x $64,316 1.5x 1.1x *NAV is based on 2013YE reserves Source: Company reports, FactSet, GMP Our target price is a combination Risked NAV and forward EV/DACF multiple. Given what we expect will be continued infrastructure challenges in Bellatrix’s core operating areas, we have moved our Risked NAV weighting down to 30%, from equal weight. We have done this to account for what we believe will be ongoing challenges in crystalizing value in the short term. 3 Equity Research Figure 4. GMP Risked NAV breakdown 2013 YE Assigned Reserves Reserves (mmboe) 124.2 87.4 211.6 Proven Probable 2P Reserves Other Assets/Liabilities Land Value (417,000 acres @ $400 per acre) Net Debt Option Proceeds & Other Total 2013YE 2P Net Asset Value Net Unbooked Upside Potential Locations Rich Gas Ferrier Cardium (Hz) Low GOR Pembina Cardium (Hz) High GOR Cardium (Hz) Cardium (JV) Notikewin (Hz) Notikewin (JV) Rich Gas Ferrier Cardium (JV) NGL Ferrier Cardium Oil (Hz) NGL Harmattan Cardium Oil (Hz) NGLHarmattan Mannville Gas(Hz) Total 2P NAV + Risked Upside Value Source: Company reports, GMP 15 70 125 32 50 25 20 25 90 45 497 4 Net Risked Resource (mmboe) 6.8 14.6 33.8 8.7 30.4 15.2 9.0 6.1 13.4 26.3 164.4 BT PV@10% ($mm) $1,050.8 $494.8 $1,545.6 Value ($mm) $167.0 ($397.3) $53.0 ($177.3) $1,368.3 $NAV/ Share $5.77 $2.72 $8.49 $NAV/ Share $0.91 ($2.18) $0.29 ($0.98) $7.51 BT PV@10% ($mm) $51.3 $192.2 $385.9 $97.5 $145.6 $69.2 $73.0 $37.5 $192.0 $87.3 $1,331.4 $2,699.7 $NAV/ Share $0.25 $0.95 $1.90 $0.48 $0.72 $0.34 $0.36 $0.18 $0.95 $0.43 $6.57 $14.08 Equity Research Disclosures The information contained in this report is drawn from sources believed to be reliable but the accuracy or completeness of the information is not guaranteed, nor in providing it do GMP Securities L.P., GMP Securities Europe LLP or GMP Securities Australia Pty Limited (collectively referred to as “GMP”) assume any responsibility or liability whatsoever. Information on which this report is based is available upon request. This report is not to be construed as a solicitation of an offer to buy or sell any securities. GMP and/or affiliated companies or persons may as principal or agent, buy and sell securities mentioned herein, including options, futures or other derivative instruments thereon. Griffiths McBurney Corp. (“GM Corp.”), an affiliate of GMP accepts responsibility for the contents of this research subject to the foregoing. U.S. clients wishing to effect transactions in any security referred to herein should do so through GM Corp. GMP Securities L.P. will provide upon request a statement of its financial condition and a list of the names of its Directors and senior officers. Company-Specific Disclosures: 1 GMP has, within the previous 12 months, provided paid investment banking services or acted as underwriter to the issuer. 2 GMP is a market maker for the securities of the subject issuer. 3 GMP owns 1% or more of this issuer’s securities. 4 GMP Securities, LLC, an affiliate of GMP, discloses the following in relation to this issuer as required by the Financial Industry Regulatory Authority (“FINRA”) Rule 2711: as applicable. 5 The analyst is related to an officer, director or advisory board member of the issuer, but that individual has no influence in the preparation of this report. 6 The analyst has visited the operations of this issuer. The issuer and/or GMP clients paid all or a portion of the travel expenses associated with the analyst’s site visit to its operations. 7 The analyst who prepared this report has viewed the operations of this issuer. 8 The analyst who prepared this research report owns this issuer's securities. 9 RESERVED 10 RESERVED Each research analyst and associate research analyst who authored this document and whose name appears herein certifies that: (1) the recommendations and opinions expressed in the research report accurately reflect their personal views about any and all of the securities or issuers discussed herein that are within their coverage universe; and (2) no part of their compensation was, is or will be, directly or indirectly, related to the provision of specific recommendations or views expressed herein. GMP Analysts are not registered and/or qualified as research analysts with the FINRA and/or the New York Stock Exchange and may not be associated persons of GMP Securities, LLC and therefore may not be subject to FINRA Rule 2711 restrictions on communications with a subject company, public appearances and trading securities held by a research analyst account as defined by FINRA but are subject to the applicable regulatory rules as mentioned in the next paragraph. All relevant disclosures required by regulatory rules (including The Investment Industry Regulatory Organization of Canada, Financial Conduct Authority and Australian Securities & Investments Commission), GMP’s recommendation statistics and research dissemination policies can be obtained at www.gmpsecurities.com or by calling the relevant GMP office’s Compliance Department. GMP Analysts are compensated competitively based on several criteria. The Analyst compensation pool is comprised of several revenue sources, including secondary trading commissions, new issue commissions, investment banking fees, and directed payments from institutional clients. GMP prohibits any director, officer or employee of GMP from holding any office in publicly traded companies or any office in private companies in the financial services industry. The GMP research recommendation structure consists of the following ratings: Buy: A Buy rating reflects 1) bullish conviction on the part of the analyst; and 2) typically a 15% or greater return to target. Speculative Buy: A Speculative Buy rating reflects 1) bullish conviction on the part of the analyst accompanied by a substantially higher than normal risk, including the possibility of a binary outcome; and 2) typically a 30% or greater return to target. Hold: A Hold rating reflects 1) a lack of bullish or bearish conviction on the part of the analyst; and 2) typically a return of 0 to 20%. Reduce: A Reduce rating reflects 1) bearish conviction on the part of the analyst; and 2) typically a 5% or lower return to target. Tender: Clients are advised to tender their shares to a takeover bid or similar offer. 5 Equity Research Country-Specific Disclaimers: Australia: GMP Securities Australia Pty Limited (“GMP Australia”). ACN 149 263 543; Australian Financial Services License No: 403684. Level 9, 190 St. Georges Tce, Perth, WA, Australia 6000 Tel + (618) 6141 6300 Fax + (618) 9226 1370. Any advice contained in this document has been prepared without taking into account your objectives, financial situation or needs. Before acting on any advice in this document, GMP Australia recommends that you consider whether the advice is appropriate for your circumstances. GMP Australia recommends that you obtain and consider the relevant “Product Disclosure Statement” or other disclosure documents before making any decision about a product including whether to acquire or to continue to hold it. Canada: GMP Securities L.P. is a member of the Investment Industry Regulatory Organization of Canada and a participant of the TSX, TSX Venture and the Montreal Exchange. It is registered with all the provincial self-regulatory authorities of Canada. 145 King Street West, Suite 300 Toronto, Ontario M5H 1J8 Tel: (416) 367-8600 Fax: (416) 943-6134. United Kingdom: GMP Securities Europe LLP is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. 5 Stratton Street, London W1S 4GA Tel 0044 20 7647 2800 Fax 0044 20 7647 2801. This information is issued for the benefit of persons who qualify as eligible counterparties or professional clients and should be made available only to such persons and is exempt from the restriction on financial promotion in s21 of the Financial Services and Markets Act 2000 in reliance on provision in the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 particularly Article 19(5) for Investment Professionals and Article 49(2) for entities of prescribed net worth. Other countries: circulation of this report may be restricted by laws and regulations in other countries and persons in receipt of this document must satisfy any relevant legal requirements in that country. © GMP. All rights reserved. Reproduction in whole or in part without permission is prohibited. 6

© Copyright 2026