Singapore Utilities Sector Outlook remains challenging 30 October 2014 Asia Pacific/Singapore

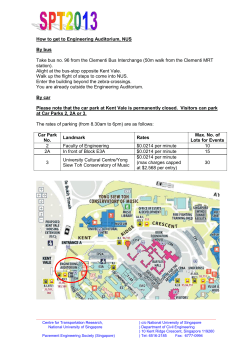

30 October 2014 Asia Pacific/Singapore Equity Research Utilities (Utilities SG (Asia)) Singapore Utilities Sector Research Analysts Gerald Wong, CFA 65 6212 3037 [email protected] Dave Dai, CFA 852 2101 7358 [email protected] Shih Haur Hwang 65 6212 3024 [email protected] SECTOR REVIEW Outlook remains challenging Figure 1: Vesting contract levels will decline to 30% in 1H15, 25% in 2H15, and 20% in 2016, which is likely to lead to a fall in blended spreads 600 70% 500 60% 400 50% 300 40% 200 30% 100 20% 0 Jan-07 10% Jan-08 Jan-09 Vesting Price ($/MWh) (LHS) Jan-10 Jan-11 Jan-12 Uniform Singapore Electricity Price ($/MWh) (LHS) Jan-13 Jan-14 Vesting Contract Level (RHS) Source: Energy Market Authority, Energy Market Company ■ Capacity growth slowing from 2015E. Following our April 2013 report "Significant capacity growth ahead", total power generation capacity in Singapore has increased 2.6GW or 26%. With only 5% further growth in capacity expected, we forecast a decline in the reserve margin from a peak of 46% in 2014 to 44% in 2015. Consequently, the Uniform Singapore Electricity Price (USEP) has stabilised at an average of S$142/MWh in 9M14 after declining 36% from S$222/MWh in 2012. ■ However, fall in vesting contract level could lead to further decline in blended spreads. With market power concerns subsiding, the Energy Market Authority (EMA) has revised down the vesting contract level from 40% to 30% in 1H15, 25% in 2H15, and 20% in 2016. With the vesting price 31% above the USEP in 3Q14, we believe the change in mix could lead to another 6% decrease in blended electricity tariffs from 3Q14 levels. ■ Remain cautious. With potential further earnings decline, we maintain our cautious view on stocks with exposure to Singapore power. We expect the weak outlook for Singapore Utilities to be a drag to Sembcorp Industries' (NEUTRAL) earnings despite increasing contribution from its overseas assets. Challenging operating conditions could also further worsen Huaneng Power’s (UNDERPERFORM) earnings outlook. DISCLOSURE APPENDIX AT THE BACK OF THIS REPORT CONTAINS IMPORTANT DISCLOSURES, ANALYST CERTIFICATIONS, AND THE STATUS OF NON-US ANALYSTS. US Disclosure: Credit Suisse does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the Firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. CREDIT SUISSE SECURITIES RESEARCH & ANALYTICS BEYOND INFORMATION® Client-Driven Solutions, Insights, and Access 30 October 2014 Focus charts and table Figure 2: Contribution of Singapore power generation Figure 3: We expect capacity growth to slow following a assets to net profit in FY13 26% increase, which will lead to decline in reserve margin 25% 23% 16000 (MW) 70% 14000 20% 60% 12000 15% 50% 10000 12% 40% 8000 10% 30% 6000 6% 5% 20% 4000 1% 10% 2000 0% YTL Power Sembcorp Industries Keppel 0 Huaneng 0% 2007 Singapore Power Generation as % of Group Net Profit (2013) 2008 2009 2010 2011 2012 2013 Total Generation Capacity - LHS 2014 2015 2016 2017 Peak demand - LHS 2018 2019 2020 Reserve Margin - RHS Source: Company data, Credit Suisse estimates Source: Energy Market Authority, Credit Suisse estimates Figure 4: Market pool prices (USEP) declined by 22% to Figure 5: Vesting price (VCHP) of S$190/MWh in 3Q14 S$173/MWh in 2013 and further to S$142/MWh in 9M14 31% above USEP 300 300 250 250 200 200 150 150 100 100 50 50 Jan-07 Apr-07 Jul-07 Oct-07 Jan-08 Apr-08 Jul-08 Oct-08 Jan-09 Apr-09 Jul-09 Oct-09 Jan-10 Apr-10 Jul-10 Oct-10 Jan-11 Apr-11 Jul-11 Oct-11 Jan-12 Apr-12 Jul-12 Oct-12 Jan-13 Apr-13 Jul-13 Oct-13 Jan-14 Apr-14 Jul-14 0 0 1Q07 3Q07 1Q08 3Q08 1Q09 3Q09 1Q10 3Q10 1Q11 3Q11 1Q12 3Q12 1Q13 3Q13 1Q14 3Q14 USEP Average ($/MWh) Uniform Singapore Electricity Price (USEP) - S$/MWh Source: Energy Market Company Source: Energy Market Company Figure 6: Sector valuation table Current Target Up/ down Mkt Cap Div yld Rating price side (%) US$ mn P/E (x) P/B (x) ROE (%) FX price Sembcorp Industries N SGD 4.83 5.40 11.8 6,752 3.5 10.9 9.8 8.8 1.5 1.4 1.2 13.8 13.9 14.1 Keppel Corporation O SGD 9.40 12.50 33.0 13,359 5.3 10.9 9.5 9.2 1.5 1.3 1.2 13.3 14.0 13.5 Hyflux Ltd N SGD 1.02 1.20 18.2 686 2.3 n.m. 27.1 15.4 1.7 1.6 1.4 Huaneng Power U HKD 9.35 7.50 -19.8 15,536 5.2 YTL Power U MYR 1.55 1.35 -12.9 Manila Electric N PHP 262.00 276.00 5.3 Average (%) 14E 15E 16E 14E 15E 16E 14E 15E 16E 8.4 0.3 5.8 9.2 9.6 9.0 1.5 1.4 1.3 18.1 14.9 14.7 3,387 1.2 12.8 14.0 NA 1.1 1.1 NA 6,580 3.9 17.3 17.1 16.3 3.6 12.1 14.5 11.7 3.7 3.4 3.2 21.2 20.1 19.5 1.8 1.7 1.7 12.6 12.7 14.2 8.8 7.5 NA Source: Company data, Credit Suisse estimates, Thomson Reuters Singapore Utilities Sector 2 30 October 2014 Outlook remains challenging Capacity growth slowing from 2015E In our report “Singapore Utilities Sector – Significant capacity growth ahead” on 11 April 2013, we noted that power generation capacity in Singapore was expected to increase by 3.0GW or 30% in 2013-14E following the completion of Singapore’s LNG terminal in 2Q13 which will increase gas supply into the country. Since then, we have seen the start of commercial operations for more than 2.6GW of capacity, with the latest addition being Sembcorp Banyan Cogen which was completed in July 2014. Figure 7: Planned installed capacity growth in 2013–14 Generation Company Keppel Merlimau Cogen Installed Expected Update Capacity (MW) commission date 800 Mid 2013 Commenced operations June 2013 ExxonMobil 220 Mid 2013 Commenced operations PacificLight Power 800 End 2013 Commenced operations in 1Q14 Tuas Power Generation 400 End 2013 Commenced operations in 2Q14 Sembcorp Cogen 400 End 2013 Commenced operations in August 2014 following delay due to lack of grid connection Source: Energy Market Authority, Company data, Credit Suisse Based on data from Energy Market Authority (EMA), capacity addition is expected to slow down in 2015-16, with only 603MW of capacity growth expected. With the exception of Hyflux’s Tuaspring plant which is likely to only commence operations in 2016 due to lack of grid connection, the remaining additions are mainly embedded generation by industrial users. Figure 8: Project commercial operating date (COD) of new capacity Company Plant Type Capacity Change (MW) Period Soxal Steam 5 4Q14 SLNG CCGT 15.6 4Q14 CGNPC CCGT 9.9 4Q14 Other 9.9 4Q14 Shell Embedded generation 67.8 Apr-15 SRC Embedded generation 42 1Q15 SRC Embedded generation 42 2Q15 CCGT 411 2Q16 Biofuel Industries Tuaspring Total 603 Source: Energy Market Authority, The Lantau Group Reserve margin likely to peak in 2014 We base the Credit Suisse power generation model on the following: ■ Historical generation capacity is based on data from Energy Market Authority, while additions are based on announced completion dates of planned expansions. We assume no further capacity changes from 2017 onwards. ■ Forecast peak demand is driven by Singapore GDP growth, which Credit Suisse expects to be 3.3% in 2014 and 5.0% in 2015. Thereafter, GDP is expected to grow by 3.5% per annum, in line with the Singapore government’s planning parameter of 3–4%. Figure 9 shows the annual installed capacity in Singapore from 2007–20. We believe that reserve margin (peak demand minus installed capacity as a percentage of installed capacity) reached a low of about 34.0% in 2011, leading to higher electricity prices during this period. However, with installed capacity growing by 19% in 2013 and 7% in 2014E, the reserve margin is expected to increase to 46%, above the 2007 level. With demand Singapore Utilities Sector 3 30 October 2014 growth expected to exceed supply growth from 2015E, we expect the reserve margin to decline to 44% in 2015E. Based on our forecasts, the reserve margin would revert to the 2010-12 levels only after 2020E. Figure 9: Credit Suisse power generation model suggests reserve margin would decline in 2015E Year-end capacity (MW) 2007 2008 2009 2010 2011 2012 2013 2014E 2015E 2016E 2017E 2018E 2019E 2020E Senoko 3300 3300 2635 2550 2550 3300 3300 3300 3300 3300 3300 3300 3300 3300 Tuas 2670 2670 2670 2670 2670 2070 2171 2609 2609 2609 2609 2609 2609 2609 Seraya 3100 2700 2700 3100 3100 3100 3100 3100 3100 3100 3100 3100 3100 3100 Sembcorp 785 785 785 785 785 785 785 1185 1185 1185 1185 1185 1185 1185 Keppel 500 500 500 500 500 500 1340 1340 1340 1340 1340 1340 1340 1340 PacificLight Power 0 0 0 0 0 0 800 800 800 800 800 800 800 800 Hyflux 0 0 0 0 0 0 0 0 0 411 411 411 411 411 Others 251.2 251.2 287 287 346 365 587 627 779 779 779 779 779 779 Total 10606 10206 9577 YOY change (%) 5% -4% -6% 9892 9951.4 10120 12083 12961 13113 13524 13524 13524 13524 13524 3% 1% 2% 19% 7% 1% 3% 0% 0% 0% 0% Peak demand 5946 6073 6041 6494 6570 6639 6814 7039 7391 7649 7917 8194 8481 8778 YoY Growth 8.0% 2.1% -0.5% 7.5% 1.2% 1.1% 3.9% 3.3% 5.0% 3.5% 3.5% 3.5% 3.5% 3.5% GDP growth 9.1% 1.8% -0.6% 15.2% 6.1% 2.5% 3.9% 3.3% 5.0% 3.5% 3.5% 3.5% 3.5% 3.5% % of total installed capacity 56% 60% 63% 66% 66% 66% 56% 54% 56% 57% 59% 61% 63% 65% Reserve Margin 44% 40% 37% 34% 34% 34% 44% 46% 44% 43% 41% 39% 37% 35% Source: Energy Market Authority, Company data, Credit Suisse estimates USEP has stabilised at around S$150/MWh The expected increase in capacity has led to a decrease in the Uniform Singapore Electricity Price (USEP) since 2013. USEP is the weighted average price in the wholesale electricity market, and is determined through the interaction of offers made by generation companies and consumer demand. The average USEP in 2013 declined 22% to S$173/MWh in 2013, and further to S$142/MWh in 9M14. Since January 2014, the monthly average USEP has been stable in the range of S$133-156/MWh, which we believe reflects the breakeven level of tariffs for certain generation companies. Figure 10: Uniform Singapore Electricity Price (USEP)—S$/MWh 300 250 200 150 100 50 Jan-07 Apr-07 Jul-07 Oct-07 Jan-08 Apr-08 Jul-08 Oct-08 Jan-09 Apr-09 Jul-09 Oct-09 Jan-10 Apr-10 Jul-10 Oct-10 Jan-11 Apr-11 Jul-11 Oct-11 Jan-12 Apr-12 Jul-12 Oct-12 Jan-13 Apr-13 Jul-13 Oct-13 Jan-14 Apr-14 Jul-14 0 USEP Average ($/MWh) Source: Energy Market Company Singapore Utilities Sector 4 30 October 2014 Reduction in vesting contract level from 1H15 Vesting contracts were implemented by the Energy Market Authority in January 2004 to control the exercise of market power by the generation companies and promote efficiency and competition in the electricity market. The vesting contracts commit the generation companies to sell a specified amount of electricity (vesting contract levels) at a specified price (the vesting contract price). As a result, it takes away incentives for the generation companies to exercise their market power by withholding their generation capacity to push up spot prices in the wholesale electricity market. Vesting contracts were allocated only to generation companies that had made their planting decisions before the decision in 2001 to introduce vesting contracts. Its allocation is made in proportion to the licensed capacity eligible for vesting contracts, as shown in Figure 11. Figure 11: Maximum capacity eligible for vesting contracts Genco Maximum Capacity (MW) Seraya 3100 Senoko 3300 Tuas 2670 Sembcorp 785 Keppel 470 PacificLight Power 800 Source: Energy Market Authority Following a biennal review, EMA has announced that the vesting contract level will be progressively reduced from 40% to 30% for 1H15, 25% for 2H15, and 20% for 2016. This was driven by the view that it can be lowered to the LNG vesting level (about 16%) for 2015-16 without market power concerns. The gradual reduction is intended to allow the respective retail arms to adjust their hedging portfolios and contract cover as the vesting contract level is reduced from 40% to 20%. In particular, it was noted that there is no intent for vesting contracts “to provide revenue certainty to the gencos nor is the sustainability of gencos' revenue a factor that should be taken into account when setting the VCL.” Figure 12: Vesting contract level to fall to 30% in 1H15, 25% in 2H15, and 20% in 2016 Period Vesting contract level 1 Jan 2011 - 31 Dec 2011 60% 1 Jan 2012 - 30 Jun 2013 55% 1 Jul 2013 - 31 Dec 2013 50% 1 Jan 2014 - 31 Dec 2014 40% 1 Jan 2015 - 30 Jun 2015 30% 1 Jul 2015 - 31 Dec 2015 25% 1 Jan 2016 - 31 Dec 2016 20% Source: Energy Market Authority Singapore Utilities Sector 5 30 October 2014 Figure 13: Vesting contract hedge price significantly above USEP 300 250 200 150 100 50 0 1Q07 3Q07 1Q08 3Q08 1Q09 3Q09 1Q10 3Q10 1Q11 3Q11 1Q12 3Q12 1Q13 3Q13 1Q14 3Q14 VCHP ($/MWh) Source: Energy Market Company Blended spreads likely to decline further With the decline in vesting contract levels, generation companies will have to sell a greater proportion of their electricity generated to the spot market or to retail customers. As shown in Figure 14, the vesting contract price of S$190/MWh is at a 31% premium to the USEP of S$145/MWh in 3Q14. While the average USEP rose above the vesting price for certain periods in 2Q09-1Q12, the average USEP has been consistently below the vesting price since 3Q12 as new generation capacity has been added to the market. Assuming electricity tariffs stay at 3Q14 levels with the USEP below the vesting price, and retail contracts have a similar tariff to the USEP, the change in mix as a result of the decrease in vesting contracts could lead to a further 6% decrease in blended electricity tariffs. Figure 14: Vesting contract levels will decline to 30% in 1H15, 25% in 2H15, and 20% in 2016, which is likely to lead to a fall in blended spreads 600 70% 500 60% 400 50% 300 40% 200 30% 100 20% 0 Jan-07 10% Jan-08 Jan-09 Vesting Price ($/MWh) (LHS) Jan-10 Jan-11 Jan-12 Uniform Singapore Electricity Price ($/MWh) (LHS) Jan-13 Jan-14 Vesting Contract Level (RHS) Source: Energy Market Authority, Energy Market Company Singapore Utilities Sector 6 30 October 2014 Asia Pacific / Singapore Conglomerates Sembcorp Industries Limited (SCIL.SI / SCI SP) Rating NEUTRAL* Price (29 Oct 14, S$) 4.83 Target price (S$) 5.40¹ Upside/downside (%) 11.8 Mkt cap (S$ mn) 8,634 (US$ 6,785) Enterprise value (S$ mn) 7,933 Number of shares (mn) 1,787.55 Free float (%) 23.8 52-week price range 5.53 - 4.78 ADTO - 6M (US$ mn) 7.5 *Stock ratings are relative to the coverage universe in each analyst's or each team's respective sector. ¹Target price is for 12 months. Research Analysts Gerald Wong, CFA 65 6212 3037 [email protected] Weak Singapore power outlook a drag ■ Maintain NEUTRAL. On our estimates, Sembcorp Cogen contributed 24% to Sembcorp Industries' underlying Utilities net profit and 12% to group net profit in 2013. We expect a further decline in blended power spreads in Singapore to be a drag to earnings in 2015-16E. ■ Market expectation for Utilities optimistic. From a peak of S$70 mn in 3Q12, Utilities' quarterly net profit from Singapore has gradually declined to S$47 mn in 2Q14. This was driven largely by Energy, which saw a 40% YoY and 21% QoQ decline in underlying net profit in 2Q14 mainly driven by lower power spreads. With the 400MW Banyan Cogen in Singapore (completed July 2014) also likely to be impacted by lower power spreads, and 1320MW TPCIL power plant in India to be completed in 1H15 unlikely to contribute significantly to profit in 2015, we believe consensus FY15 Utilities net profit forecast of about S$425 mn could be too optimistic. ■ Execution risks remain high for Marine. We expect a weak oil price environment to lead to slower new orders for Marine. In addition, margins are likely to remain under pressure due to profit recognition for new products in its orderbook, which we estimate make up about 70% of its current orderbook. ■ Utilities stub at premium to historical average. SCI's utility stub is trading at 9.5x FPE, above its historical average of 9.2x. Share price performance Price (LHS) 8 7 6 5 4 Nov-12 Mar-13 Jul-13 Rebased Rel (RHS) Nov-13 Mar-14 120 110 100 90 80 Jul-14 The price relative chart measures performance against the FTSE STRAITS TIMES IDX which closed at 3224.03 on 29/10/14 On 29/10/14 the spot exchange rate was S$1.27/US$1 Performance over Absolute (%) Relative (%) 1M 3M 12M -7.1 -11.9 -8.9 -5.1 -7.4 -9.4 — — Financial and valuation metrics Year Revenue (S$ mn) EBITDA (S$ mn) EBIT (S$ mn) Net profit (S$ mn) EPS (CS adj.) (S$) Change from previous EPS (%) Consensus EPS (S$) EPS growth (%) P/E (x) Dividend yield (%) EV/EBITDA (x) P/B (x) ROE (%) Net debt/equity (%) 12/13A 10,797.6 1,463.4 1,160.1 820.4 0.46 n.a. n.a. 8.9 10.5 3.5 5.6 1.6 16.9 net cash 12/14E 11,704.9 1,442.5 1,137.2 788.5 0.44 0 0.44 -3.9 10.9 3.5 5.5 1.5 14.4 net cash 12/15E 13,380.2 1,571.1 1,265.8 872.2 0.49 0 0.48 10.5 9.9 3.5 4.7 1.4 14.5 net cash 12/16E 14,490.4 1,729.1 1,423.8 980.7 0.55 0 0.52 12.3 8.8 3.5 3.9 1.2 14.8 net cash Source: Company data, Thomson Reuters, Credit Suisse estimates. Singapore Utilities Sector 7 30 October 2014 Weak Singapore power outlook a drag Singapore Utilities profit declined 16% YoY in 2013 Driven by lower power spreads, net profit of Sembcorp cogen declined to S$93 mn in 2013 from S$111 mn in 2012. On our estimates, Sembcorp Cogen contributed 24% to Sembcorp Industries' underlying Utilities net profit and 12% to group net profit in 2013. Figure 15: Net profit of Sembcorp Cogen declined 16% in 2013 to S$93 mn (In S$'000) 1,400,000 140,000 1,200,000 120,000 1,000,000 100,000 800,000 80,000 600,000 60,000 400,000 40,000 200,000 20,000 - 2007 2008 2009 2010 2011 Profit for the year - RHS 2012 2013 Revenue - LHS Source: Company data From a peak of S$70 mn in 3Q12, Utilities' quarterly net profit from Singapore has gradually declined to S$47 mn in 2Q14. This has been a drag to the Utilities net profit, which saw increasing contribution from China and the Middle East otherwise. Figure 16: Singapore Utilities net profit declining since 4Q12 120 112 99 100 88 76 80 60 59 58 59 23 24 21 40 62 54 16 79 34 36 35 38 39 31 89 30 38 29 104 100 81 17 92 93 39 46 43 51 76 37 25 33 21 65 20 95 40 47 46 64 50 70 64 69 52 53 52 53 47 0 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 Singapore Others Source: Company data, Credit Suisse estimates Singapore Utilities Sector 8 30 October 2014 This decline in profit was driven mainly by Energy, which continued to see a 40% YoY and 21% QoQ decline in underlying net profit in 2Q14 mainly driven by lower power spreads. Figure 17: Singapore Utilities profit decline driven by Energy In S$mn 1Q13 2Q13 1H13 1Q14 2Q14 1H14 Energy 39.2 56.6 95.8 37.1 29.3 66.4 Water 6.7 5.9 12.6 7.2 7.2 14.4 On-site logistics & Solid waste management 6.4 6.7 13.1 8.5 10.2 18.7 Total 52.3 69.2 121.5 52.8 46.7 99.5 Source: Company data Valuation SCI's utility stub is trading at 9.5x FPE, above its historical average of 9.2x. Figure 18: Sembcorp Industries—Utilities Stub valuation 25 20 15 10 5 0 Dec-02 Dec-03 Dec-04 Dec-05 P/E Dec-06 Dec-07 Average Dec-08 Dec-09 +1 std dev Dec-10 Dec-11 Dec-12 Dec-13 -1 std dev Source: Bloomberg, Company data, Credit Suisse estimates, Singapore Utilities Sector 9 30 October 2014 Companies Mentioned (Price as of 29-Oct-2014) Huaneng Power International Inc (0902.HK, HK$9.11, UNDERPERFORM, TP HK$7.5) Hyflux Ltd (HYFL.SI, S$1.02, NEUTRAL, TP S$1.2) Keppel Corporation (KPLM.SI, S$9.4, OUTPERFORM, TP S$12.5) Manila Electric (Meralco) (MER.PS, P261.6, NEUTRAL, TP P276.0) Sembcorp Industries Limited (SCIL.SI, S$4.83, NEUTRAL, TP S$5.4) YTL Power (YTLP.KL, RM1.55, UNDERPERFORM, TP RM1.35) Disclosure Appendix Important Global Disclosures I, Gerald Wong, CFA, certify that (1) the views expressed in this report accurately reflect my personal views about all of the subject companies and securities and (2) no part of my compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this report. 3-Year Price and Rating History for Huaneng Power International Inc (0902.HK) 0902.HK Date 17-Jan-12 13-Feb-12 22-Mar-12 02-Aug-12 03-Oct-12 10-Apr-13 24-Apr-13 27-Nov-13 30-Jul-14 14-Oct-14 Closing Price (HK$) 4.44 4.95 4.51 5.62 5.88 8.37 8.80 7.43 8.73 8.90 Target Price (HK$) 4.50 5.96 5.70 5.85 7.10 9.00 9.40 6.40 7.40 7.50 Rating O U* * * Asterisk signifies initiation or assumption of coverage. O U T PERFO RM U N D ERPERFO RM 3-Year Price and Rating History for Hyflux Ltd (HYFL.SI) HYFL.SI Date 04-Nov-11 02-Apr-12 03-Aug-12 01-Nov-12 10-May-13 07-Nov-13 20-Feb-14 Closing Price (S$) 1.41 1.51 1.43 1.34 1.44 1.17 1.24 Target Price (S$) 1.40 1.90 1.70 1.60 1.50 1.30 1.20 Rating N O N * Asterisk signifies initiation or assumption of coverage. N EU T RA L O U T PERFO RM Singapore Utilities Sector 10 30 October 2014 3-Year Price and Rating History for Keppel Corporation (KPLM.SI) KPLM.SI Date 26-Jan-12 13-Apr-12 18-Oct-12 18-Feb-13 18-Jul-13 07-Nov-13 23-Jan-14 25-Jul-14 21-Oct-14 Closing Price (S$) 10.39 11.07 11.00 11.29 10.80 10.93 10.88 11.03 9.70 Target Price (S$) 12.40 12.70 12.80 13.70 12.50 12.90 12.70 13.10 12.50 Rating O * Asterisk signifies initiation or assumption of coverage. O U T PERFO RM 3-Year Price and Rating History for Manila Electric (Meralco) (MER.PS) MER.PS Date 10-Feb-12 29-Feb-12 28-Jun-12 13-Dec-12 20-Dec-12 20-Dec-12 06-Jun-13 30-Sep-13 03-Jan-14 27-May-14 Closing Price (P) 273.00 263.60 251.00 260.00 262.00 262.00 380.00 286.00 254.20 262.00 Target Price (P) 198.00 247.00 262.00 339.00 339.00 276.00 Rating U N * * N * N R N U N D ERPERFO RM N EU T RA L REST RICT ED * Asterisk signifies initiation or assumption of coverage. 3-Year Price and Rating History for Sembcorp Industries Limited (SCIL.SI) SCIL.SI Date 04-Nov-11 27-Feb-12 06-Aug-12 26-Feb-13 10-Apr-13 06-Aug-13 11-Nov-13 26-Feb-14 Closing Price (S$) 4.17 5.12 5.32 5.17 5.01 5.06 5.30 5.42 Target Price (S$) 4.88 5.48 6.08 5.88 5.08 5.18 5.28 5.40 Rating O N * Asterisk signifies initiation or assumption of coverage. O U T PERFO RM N EU T RA L Singapore Utilities Sector 11 30 October 2014 3-Year Price and Rating History for YTL Power (YTLP.KL) YTLP.KL Date 07-Mar-12 10-Apr-13 10-Jul-14 11-Jul-14 Closing Price (RM) 1.74 1.46 1.50 1.49 Target Price (RM) 1.73 1.33 1.35 Rating U * * U * Asterisk signifies initiation or assumption of coverage. U N D ERPERFO RM The analyst(s) responsible for preparing this research report received Compensation that is based upon various factors including Credit Suisse's total revenues, a portion of which are generated by Credit Suisse's investment banking activities As of December 10, 2012 Analysts’ stock rating are defined as follows: Outperform (O) : The stock’s total return is expected to outperform the relevant benchmark*over the next 12 months. Neutral (N) : The stock’s total return is expected to be in line with the relevant benchmark* over the next 12 months. Underperform (U) : The stock’s total return is expected to underperform the relevant benchmark* over the next 12 months. *Relevant benchmark by region: As of 10th December 2012, Japanese ratings are based on a stock’s total return relative to the analyst's coverage universe which consists of all companies covered by the analyst within the relevant sector, with Outperforms representing the most attractiv e, Neutrals the less attractive, and Underperforms the least attractive investment opportunities. As of 2nd October 2012, U.S. and Canadian as well as European ratings are based on a stock’s total return relative to the analyst's coverage universe which consists of all companies covered by the analyst within the relevant sector, with Outperforms representing the most attractive, Neutrals the less attractive, and Underperforms the least attractive investment opportunities. For Latin American and non-Japan Asia stocks, ratings are based on a stock’s total return relative to the average total return of the relevant countr y or regional benchmark; prior to 2nd October 2012 U.S. and Canadian ratings were based on (1) a stock’s absolute total return potential to its current share price and (2) the relative attractiv eness of a stock’s total return potential within an analyst’s coverage universe. For Australian and New Zealand stocks, 12-month rolling yield is incorporated in the absolute total return calculation and a 15% and a 7.5% threshold replace the 10-15% level in the Outperform and Underperform stock rating definitions, respectively. The 15% and 7.5% thresholds replace the +1015% and -10-15% levels in the Neutral stock rating definition, respectively. Prior to 10th December 2012, Japanese ratings were based on a stock’s total return relative to the average total return of the relevant country or regional benchmark. Restricted (R) : In certain circumstances, Credit Suisse policy and/or applicable law and regulations preclude certain types of communications, including an investment recommendation, during the course of Credit Suisse's engagement in an investment banking transaction and in certain other circumstances. Volatility Indicator [V] : A stock is defined as volatile if the stock price has moved up or down by 20% or more in a month in at least 8 of the past 24 months or the analyst expects significant volatility going forward. Analysts’ sector weightings are distinct from analysts’ stock ratings and are based on the analyst’s expectations for the fundamentals and/or valuation of the sector* relative to the group’s historic fundamentals and/or valuation: Overweight : The analyst’s expectation for the sector’s fundamentals and/or valuation is favorable over the next 12 months. Market Weight : The analyst’s expectation for the sector’s fundamentals and/or valuation is neutral over the next 12 months. Underweight : The analyst’s expectation for the sector’s fundamentals and/or valuation is cautious over the next 12 months. *An analyst’s coverage sector consists of all companies covered by the analyst within the relevant secto r. An analyst may cover multiple sectors. Credit Suisse's distribution of stock ratings (and banking clients) is: Global Ratings Distribution Rating Versus universe (%) Of which banking clients (%) Outperform/Buy* 46% (54% banking clients) Neutral/Hold* 38% (51% banking clients) Underperform/Sell* 13% (43% banking clients) Restricted 3% *For purposes of the NYSE and NASD ratings distribution disclosure requirements, our stock ratings of Outperform, Neutral, an d Underperform most closely correspond to Buy, Hold, and Sell, respectively; however, the meanings are not the same, as our stock ratings are determined on a relative basis. (Please refer to definitions above.) An investor's decision to buy or sell a security should be based on investment objecti ves, current holdings, and other individual factors. Singapore Utilities Sector 12 30 October 2014 Credit Suisse’s policy is to update research reports as it deems appropriate, based on developments with the subject company, the sector or the market that may have a material impact on the research views or opinions stated herein. Credit Suisse's policy is only to publish investment research that is impartial, independent, clear, fair and not misleading. For more detail please refer to Credit Suisse's Policies for Managing Conflicts of Interest in connection with Investment Research: http://www.csfb.com/research and analytics/disclaimer/managing_conflicts_disclaimer.html Credit Suisse does not provide any tax advice. Any statement herein regarding any US federal tax is not intended or written to be used, and cannot be used, by any taxpayer for the purposes of avoiding any penalties. Price Target: (12 months) for Sembcorp Industries Limited (SCIL.SI) Method: Our S$5.40 target price for Sembcorp Industries is based on 1) sum-of-the-parts analysis with SembCorp Marine (SCMN.SI) valued at its Credit Suisse target price, 2) Gallant Venture marked to market and 3) the balance of SCI is valued at 10x FY14E earnings. Risk: The key risks to our target price of S$5.40 for SembCorp Industries (SCI) include: 1) a potential slowdown in rig demand for SMM which constitutes a significant portion of our value of SCI, 2) asset impairment in the financial assets held by SCI, 3) the risk that there is poor take-up in the additional space in Jurong Island by petrochemical companies and not meeting our growth forecasts and 4) limited sucess in its overseas joint venture. Price Target: (12 months) for Huaneng Power International Inc (0902.HK) Method: We use P/B (price-to-book) valuation to get to our target price of HK$7.50 for Huaneng Power International Inc (H). We assume a longterm ROE (return on equity) of 14%, and then get an implied FY14 PB of 1.2x, which makes us come up with the target price. Risk: Investment risks for our HK$7.50 target price for Huaneng Power International Inc (H) include: 1) faster-than-expected capacity growth. 2) lower-than-expected coal prices. 3) better-than expected utilization hours. Price Target: (12 months) for Hyflux Ltd (HYFL.SI) Method: Our 12-month target price of S$1.20 for Hyflux is based on sum-of-the-parts (SOTP) analysis encompassing: 1) a discounted cash flow (DCF) value of existing businesses at 9.2% WACC, zero terminal value, 2) value contribution from associates; 3) EPC business value at 7x normalised earnings and 4) new businesses discounted at 13.4% cost of equity. Risk: Risks to our S$1.20 target price for Hyflux includes delays in project commencement and execution would affect financials and recurring income recognition schedule, ability to pass through costs in rising materials cost environment, opex costs containment, unexpected costs relating to operational and maintenance aspects, changes in relevant government's initiatives and regulations, political risks in the countries where Hyflux operates, rising competition, lack of visibility in individual projects, reliance on key management. Price Target: (12 months) for Keppel Corporation (KPLM.SI) Method: Our S$12.50 target price for Keppel Corporation is based on an SOTP (sum of the parts) methodolgy, valuing: (1) 14x P/E multiple for the O&M business, (2) Credit Suisse's target prices for Keppel Land (S$3.80) and Mobile One S$3.73), (3) the marked-to-market value of other listed entities and (4) the asset value estimates for Keppel Bay and the infrastructure business. Risk: Risks to our target price of S$12.50 for Keppel Corp include the following: (1) slower than expected recovery in the offshore & marine or property cycles; (2) limited earnings visibility on infrastructure business; and (3) limited disclosure on individual businesses. Price Target: (12 months) for Manila Electric (Meralco) (MER.PS) Method: Our P276 target price for Manila Electric (Meralco) is based on an SOTP (sum-of-the-parts) methodology: 81% from the existing distribution business and 19% from the forthcoming generation business. We used DCF (discounted cash flow) analysis to estimate the value of both the distribution and generation businesses. Our WACC (weighted average cost of capital) assumption is 9.3%. Risk: Upside (downside) risks to our P276 target price for Manila Electric (Meralco) include: for the distribution business, higher (lower) electricity sales volume and/or regulated wheeling tariff; for its forthcoming generation business, higher (lower) attributable capacity assumptions. Price Target: (12 months) for YTL Power (YTLP.KL) Method: YTL Power's target price of RM1.35 is based on (1) The water assets are valued based on 0% premium to the FY14 RAB (regulated asset base) due to regulatory tightening in the water sector in the UK. We have assumed a forex exchange of RM5.5 to every Pound Sterling. (2) The Malaysian power assets will see their IPP expire in Sep 2015 and are valued based on a Discounted cash flow method, with a discount rate of 10% (weighted average cost of capital) (3) The Indonesian power assets are valued based on the Discounted Cashflow method with a discount rate of 10%. (4) Power Seraya power plants are valued based on a discounted cashflow method with a discount rate of 10%. Singapore Utilities Sector 13 30 October 2014 Risk: Upside risks to YTL Power's RM1.35 target price include: (1) A lucrative overseas utility project is injected into the company (2) if YTLP wins a major new domestic project. Downside to YTLPower's target price: (1) UK water regulatory change results in a worse than expected allowable rate of return. (2) A stronger Ringgit or a weaker Pound Sterling will mean less Ringgit revenue from Wessex (3) More political uncertainties. Please refer to the firm's disclosure website at https://rave.credit-suisse.com/disclosures for the definitions of abbreviations typically used in the target price method and risk sections. See the Companies Mentioned section for full company names The subject company (0902.HK, HYFL.SI) currently is, or was during the 12-month period preceding the date of distribution of this report, a client of Credit Suisse. Credit Suisse provided investment banking services to the subject company (0902.HK, HYFL.SI) within the past 12 months. Credit Suisse has managed or co-managed a public offering of securities for the subject company (0902.HK, HYFL.SI) within the past 12 months. Credit Suisse has received investment banking related compensation from the subject company (0902.HK, HYFL.SI) within the past 12 months Credit Suisse expects to receive or intends to seek investment banking related compensation from the subject company (0902.HK, HYFL.SI) within the next 3 months. Credit Suisse may have interest in (YTLP.KL) As of the end of the preceding month, Credit Suisse beneficially own 1% or more of a class of common equity securities of (0902.HK). Credit Suisse has a material conflict of interest with the subject company (MER.PS) . Credit Suisse is acting as a financial advisor to San Miguel Corporation regarding the proposed sale of its 27% stake in Manila Electric Company (Meralco) to JG Summit Holdings. Important Regional Disclosures Singapore recipients should contact Credit Suisse AG, Singapore Branch for any matters arising from this research report. The analyst(s) involved in the preparation of this report have not visited the material operations of the subject company (SCIL.SI, 0902.HK, HYFL.SI, KPLM.SI, MER.PS, YTLP.KL) within the past 12 months Restrictions on certain Canadian securities are indicated by the following abbreviations: NVS--Non-Voting shares; RVS--Restricted Voting Shares; SVS--Subordinate Voting Shares. Individuals receiving this report from a Canadian investment dealer that is not affiliated with Credit Suisse should be advised that this report may not contain regulatory disclosures the non-affiliated Canadian investment dealer would be required to make if this were its own report. For Credit Suisse Securities (Canada), Inc.'s policies and procedures regarding the dissemination of equity research, please visit http://www.csfb.com/legal_terms/canada_research_policy.shtml. Credit Suisse has acted as lead manager or syndicate member in a public offering of securities for the subject company (0902.HK, HYFL.SI, KPLM.SI) within the past 3 years. As of the date of this report, Credit Suisse acts as a market maker or liquidity provider in the equities securities that are the subject of this report. Principal is not guaranteed in the case of equities because equity prices are variable. Commission is the commission rate or the amount agreed with a customer when setting up an account or at any time after that. To the extent this is a report authored in whole or in part by a non-U.S. analyst and is made available in the U.S., the following are important disclosures regarding any non-U.S. analyst contributors: The non-U.S. research analysts listed below (if any) are not registered/qualified as research analysts with FINRA. The non-U.S. research analysts listed below may not be associated persons of CSSU and therefore may not be subject to the NASD Rule 2711 and NYSE Rule 472 restrictions on communications with a subject company, public appearances and trading securities held by a research analyst account. Credit Suisse (Hong Kong) Limited ................................................................................................................................................... Dave Dai, CFA Credit Suisse AG, Singapore Branch .......................................................................................................... Gerald Wong, CFA ; Shih Haur Hwang For Credit Suisse disclosure information on other companies mentioned in this report, please visit the website at https://rave.creditsuisse.com/disclosures or call +1 (877) 291-2683. Singapore Utilities Sector 14 30 October 2014 References in this report to Credit Suisse include all of the subsidiaries and affiliates of Credit Suisse operating under its investment banking division. For more information on our structure, please use the following link: https://www.credit-suisse.com/who_we_are/en/This report may contain material that is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or which would subject Credit Suisse AG or its affiliates ("CS") to any registration or licensing requirement within such jurisdiction. All material presented in this report, unless specifically indicated otherwise, is under copyright to CS. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of CS. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of CS or its affiliates. The information, tools and material presented in this report are provided to you for information purposes only and are not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. CS may not have taken any steps to ensure that the securities referred to in this report are suitable for any particular investor. CS will not treat recipients of this report as its customers by virtue of their receiving this report. The investments and services contained or referred to in this report may not be suitable for you and it is recommended that you consult an independent investment advisor if you are in doubt about such investments or investment services. Nothing in this report constitutes investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate to your individual circumstances, or otherwise constitutes a personal recommendation to you. CS does not advise on the tax consequences of investments and you are advised to contact an independent tax adviser. Please note in particular that the bases and levels of taxation may change. Information and opinions presented in this report have been obtained or derived from sources believed by CS to be reliable, but CS makes no representation as to their accuracy or completeness. CS accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that such liability arises under specific statutes or regulations applicable to CS. This report is not to be relied upon in substitution for the exercise of independent judgment. CS may have issued, and may in the future issue, other communications that are inconsistent with, and reach different conclusions from, the information presented in this report. Those communications reflect the different assumptions, views and analytical methods of the analysts who prepared them and CS is under no obligation to ensure that such other communications are brought to the attention of any recipient of this report. Some investments referred to in this report will be offered solely by a single entity and in the case of some investments solely by CS, or an associate of CS or CS may be the only market maker in such investments. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a judgment at its original date of publication by CS and are subject to change without notice. The price, value of and income from any of the securities or financial instruments mentioned in this report can fall as well as rise. The value of securities and financial instruments is subject to exchange rate fluctuation that may have a positive or adverse effect on the price or income of such securities or financial instruments. Investors in securities such as ADR's, the values of which are influenced by currency volatility, effectively assume this risk. Structured securities are complex instruments, typically involve a high degree of risk and are intended for sale only to sophisticated investors who are capable of understanding and assuming the risks involved. The market value of any structured security may be affected by changes in economic, financial and political factors (including, but not limited to, spot and forward interest and exchange rates), time to maturity, market conditions and volatility, and the credit quality of any issuer or reference issuer. Any investor interested in purchasing a structured product should conduct their own investigation and analysis of the product and consult with their own professional advisers as to the risks involved in making such a purchase. Some investments discussed in this report may have a high level of volatility. High volatility investments may experience sudden and large falls in their value causing losses when that investment is realised. Those losses may equal your original investment. Indeed, in the case of some investments the potential losses may exceed the amount of initial investment and, in such circumstances, you may be required to pay more money to support those losses. Income yields from investments may fluctuate and, in consequence, initial capital paid to make the investment may be used as part of that income yield. Some investments may not be readily realisable and it may be difficult to sell or realise those investments, similarly it may prove difficult for you to obtain reliable information about the value, or risks, to which such an investment is exposed. This report may provide the addresses of, or contain hyperlinks to, websites. Except to the extent to which the report refers to website material of CS, CS has not reviewed any such site and takes no responsibility for the content contained therein. Such address or hyperlink (including addresses or hyperlinks to CS's own website material) is provided solely for your convenience and information and the content of any such website does not in any way form part of this document. Accessing such website or following such link through this report or CS's website shall be at your own risk. This report is issued and distributed in Europe (except Switzerland) by Credit Suisse Securities (Europe) Limited, One Cabot Square, London E14 4QJ, England, which is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. This report is being distributed in Germany by Credit Suisse Securities (Europe) Limited Niederlassung Frankfurt am Main regulated by the Bundesanstalt fuer Finanzdienstleistungsaufsicht ("BaFin"). This report is being distributed in the United States and Canada by Credit Suisse Securities (USA) LLC; in Switzerland by Credit Suisse AG; in Brazil by Banco de Investimentos Credit Suisse (Brasil) S.A or its affiliates; in Mexico by Banco Credit Suisse (México), S.A. (transactions related to the securities mentioned in this report will only be effected in compliance with applicable regulation); in Japan by Credit Suisse Securities (Japan) Limited, Financial Instruments Firm, Director-General of Kanto Local Finance Bureau (Kinsho) No. 66, a member of Japan Securities Dealers Association, The Financial Futures Association of Japan, Japan Investment Advisers Association, Type II Financial Instruments Firms Association; elsewhere in Asia/ Pacific by whichever of the following is the appropriately authorised entity in the relevant jurisdiction: Credit Suisse (Hong Kong) Limited, Credit Suisse Equities (Australia) Limited, Credit Suisse Securities (Thailand) Limited, regulated by the Office of the Securities and Exchange Commission, Thailand, having registered address at 990 Abdulrahim Place, 27th Floor, Unit 2701, Rama IV Road, Silom, Bangrak, Bangkok 10500, Thailand, Tel. +66 2614 6000, Credit Suisse Securities (Malaysia) Sdn Bhd, Credit Suisse AG, Singapore Branch, Credit Suisse Securities (India) Private Limited (CIN no. U67120MH1996PTC104392) regulated by the Securities and Exchange Board of India (registration Nos. INB230970637; INF230970637; INB010970631; INF010970631), having registered address at 9th Floor, Ceejay House, Dr.A.B. Road, Worli, Mumbai - 18, India, T- +91-22 6777 3777, Credit Suisse Securities (Europe) Limited, Seoul Branch, Credit Suisse AG, Taipei Securities Branch, PT Credit Suisse Securities Indonesia, Credit Suisse Securities (Philippines ) Inc., and elsewhere in the world by the relevant authorised affiliate of the above. Research on Taiwanese securities produced by Credit Suisse AG, Taipei Securities Branch has been prepared by a registered Senior Business Person. Research provided to residents of Malaysia is authorised by the Head of Research for Credit Suisse Securities (Malaysia) Sdn Bhd, to whom they should direct any queries on +603 2723 2020. This report has been prepared and issued for distribution in Singapore to institutional investors, accredited investors and expert investors (each as defined under the Financial Advisers Regulations) only, and is also distributed by Credit Suisse AG, Singapore branch to overseas investors (as defined under the Financial Advisers Regulations). By virtue of your status as an institutional investor, accredited investor, expert investor or overseas investor, Credit Suisse AG, Singapore branch is exempted from complying with certain compliance requirements under the Financial Advisers Act, Chapter 110 of Singapore (the "FAA"), the Financial Advisers Regulations and the relevant Notices and Guidelines issued thereunder, in respect of any financial advisory service which Credit Suisse AG, Singapore branch may provide to you. This research may not conform to Canadian disclosure requirements. In jurisdictions where CS is not already registered or licensed to trade in securities, transactions will only be effected in accordance with applicable securities legislation, which will vary from jurisdiction to jurisdiction and may require that the trade be made in accordance with applicable exemptions from registration or licensing requirements. Non-U.S. customers wishing to effect a transaction should contact a CS entity in their local jurisdiction unless governing law permits otherwise. U.S. customers wishing to effect a transaction should do so only by contacting a representative at Credit Suisse Securities (USA) LLC in the U.S. Please note that this research was originally prepared and issued by CS for distribution to their market professional and institutional investor customers. Recipients who are not market professional or institutional investor customers of CS should seek the advice of their independent financial advisor prior to taking any investment decision based on this report or for any necessary explanation of its contents. This research may relate to investments or services of a person outside of the UK or to other matters which are not authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority or in respect of which the protections of the Prudential Regulation Authority and Financial Conduct Authority for private customers and/or the UK compensation scheme may not be available, and further details as to where this may be the case are available upon request in respect of this report. CS may provide various services to US municipal entities or obligated persons ("municipalities"), including suggesting individual transactions or trades and entering into such transactions. Any services CS provides to municipalities are not viewed as "advice" within the meaning of Section 975 of the Dodd-Frank Wall Street Reform and Consumer Protection Act. CS is providing any such services and related information solely on an arm's length basis and not as an advisor or fiduciary to the municipality. In connection with the provision of the any such services, there is no agreement, direct or indirect, between any municipality (including the officials, management, employees or agents thereof) and CS for CS to provide advice to the municipality. Municipalities should consult with their financial, accounting and legal advisors regarding any such services provided by CS. In addition, CS is not acting for direct or indirect compensation to solicit the municipality on behalf of an unaffiliated broker, dealer, municipal securities dealer, municipal advisor, or investment adviser for the purpose of obtaining or retaining an engagement by the municipality for or in connection with Municipal Financial Products, the issuance of municipal securities, or of an investment adviser to provide investment advisory services to or on behalf of the municipality. If this report is being distributed by a financial institution other than Credit Suisse AG, or its affiliates, that financial institution is solely responsible for distribution. Clients of that institution should contact that institution to effect a transaction in the securities mentioned in this report or require further information. This report does not constitute investment advice by Credit Suisse to the clients of the distributing financial institution, and neither Credit Suisse AG, its affiliates, and their respective officers, directors and employees accept any liability whatsoever for any direct or consequential loss arising from their use of this report or its content. Principal is not guaranteed. Commission is the commission rate or the amount agreed with a customer when setting up an account or at any time after that. Copyright © 2014 CREDIT SUISSE AG and/or its affiliates. All rights reserved. Investment principal on bonds can be eroded depending on sale price or market price. In addition, there are bonds on which investment principal can be eroded due to changes in redemption amounts. Care is required when investing in such instruments. When you purchase non-listed Japanese fixed income securities (Japanese government bonds, Japanese municipal bonds, Japanese government guaranteed bonds, Japanese corporate bonds) from CS as a seller, you will be requested to pay the purchase price only. UT0383.doc Singapore Utilities Sector 15

© Copyright 2026