EARNINGS RELEASE 3Q14

EARNINGS RELEASE

3Q14

3Q14 EARNINGS RELEASE

PARANAPANEMA DISCLOSES ITS 3Q14 EARNINGS

PARANAPANEMA S.A. (“Paranapanema” or the “Company”) – BM&FBovespa – Novo Mercado: PMAM3, the largest nonintegrated Brazilian producer of refined copper, rods, wires, laminates, bars, tubes, connections and its alloys with a 94% share

of the copper production volume in Brazil, announces its third quarter of 2014 (3Q14) earnings. The consolidated quarterly financial

information is prepared in accordance with the International Financial Reporting Standard – IFRS and is presented in Brazilian

Reais., functional currency of the Company. The financial information presented in Reais was rounded to the nearest million,

unless otherwise stated, the last number therefore has been rounded. The calculations of certain figures found in the

corresponding tables may therefore differ slightly. The comparisons presented, unless otherwise stated, refer to the second

quarter of 2014 (2Q14). It is recommended that this report be read in conjunction with the Notes to the Financial Statements.

Quarter Highlights (vs 2Q14)

Significant increase in the Company’s key figures:

o Production Volume: +1.5%, +7.2% recovery on Primary Copper

o Sales Volume: +12.4%, primarily Primary Copper export driven

o Net Revenues: +13.6%, R$ 1,238 million, due to increased sales volume

o Gross Profit: +30.7%, benefited by structural reductions in Transformation Cost per ton

o Gross Margin: 8.5% with an 8.8% Adjusted EBITDA Margin, due to sales volumes and product mix

o Adjusted EBITDA: +50.5% or R$109 million due to operational improvement

o 3Q14 Net Income: R$131 million, reversing Net Losses of the first half of 2014

o Net Debt: R$257 million; 0.8 x Adjusted EBITDA of the last twelve months

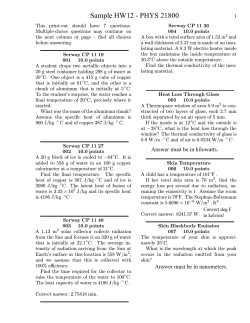

Key Indicators

3Q14

Sales Volume ('000 t)

Domestic Market

Export Market

Toll

Net Revenues (R$ million)

Domestic Market

Export Market

Toll

COGS (R$ million)

Gross Profit (R$ million)

Gross Margin (%)

Operational Expenses (R$ million)

Operational Results (R$ million)

Net Financial Income (Loss) (R$ million)

Net Income (R$ million)

Net Margin (%)

Adjusted EBITDA (R$ million)

Adjusted EBITDA Margin (%)

2

71

35

22

14

1,238

695

508

35

1,133

105

8.5%

41

64

112

131

10.6%

109

8.8%

2Q14

63

37

14

12

1,090

797

260

33

1,009

80

7.4%

45

35

-133

-72

-6.6%

73

6.7%

% Var.

3Q14/2Q14

12.4%

-5.6%

55.8%

17.8%

13.6%

-12.8%

95.3%

7.3%

12.2%

30.7%

-9.2%

82.1%

N/A

N/A

50.5%

-

1Q14

64

39

17

8

1,093

758

312

24

1,018

75

6.9%

109

-33

16

-15

-1.3%

57

5.2%

3Q13

71

45

16

10

1,302

994

279

30

1,158

144

11.1%

56

88

-130

-35

-2.7%

136

10.5%

9M14

198

112

53

33

3,421

2,250

1,080

92

3,160

261

7.6%

195

66

-5

44

1.3%

239

7.0%

3Q14 EARNINGS RELEASE

Conference Calls

Portuguese

Date: November 4, 2014

Time: 11 am (Brasília) / 8 am (US-ET)

Dial in: +55 11 3193-1001 | +55 11 2820-4001

Password: Paranapanema

English

Date: November 4, 2014

Time: 12pm (noon - Brasília) / 9 am (US-ET)

Dial in: +55 11 3193-1001

+55 11 2820-4001 | +1 786 924-6977

Password: Paranapanema

Contact

Phone: + 55 (11) 2199-7566 / 7904

E-mail: [email protected]

Press Office

FSB – Alessandra Carvalho

Phone: +55 11 3165-9585

E-mail: [email protected]

[The remainder of this page has been intentionally left blank]

3

3Q14 EARNINGS RELEASE

Message from Management to Shareholders and Capital Market Agents

Dear Sirs,

Paranapanema Management presents the Company’s Management Report and the Consolidated Quarterly

Information for the quarter ended September 30, 2014 (3Q14), including comments on the Company’s performance.

Paranapanema 2018 Project

In the beginning of the second half of the year, we kicked-off Paranapanema 2018 Project (PMA 2018 or Project)

which sets a roadmap to increase earnings in a sustainable manner, and consequently increase the Company’s

value through short and medium-term structured actions.

PMA 2018 has been created given the observed opportunities to improve processes, people and operational margin

management.

One of PMA 2018 objectives is to redesign the Company business processes to improve earnings forecast and

capital employment levels. The implementation of a strong budget driven culture and objective criteria to manage

expenditures is of fundamental importance to maximize earnings potential. We believe that by implementing a culture

of excellence in management and processes, with strong focus on execution, we are strengthening the conditions to

sustain the value creation to our shareholders.

Management strategy is to maximize shareholders value through four key drivers (i) installed capacity utilization, (ii)

cost efficiency, (iii) commercial penetration, and (iv) asset productivity.

Capacity utilization at Paranapamena is highly correlated with smelter availability at Dias d’Ávila. In this context,

preventive maintenance is a top priority to keep operations up-and-running. Thus, we are implementing a daily

scheduled maintenance system to increase confidence on critical equipment. This model is based on best-in-class

industrial players. The Primary Copper production is recovering with higher volumes.

Cost efficiency will increase the Company’s competitiveness and profitability. Implementing new cost management

processes and reducing outsourcing will allow us to reach the expected results. We are shaping our organization to

be fast and lean, eliminating low productivity operations, merging structures, and reviewing existing contracts.

In order to increase commercial penetration, the Company is reorganizing its sales processes, focusing on clients,

value adding, and simplification of product lines.

Increasing asset productivity is a target to be reached by lowering Inventories and Fixed Assets amounts. We

continue our journey towards reducing Inventories levels. In 3Q14 there was a 16% volume reduction. Another

initiative is to enhance the risk-return analysis and prioritization of Capex projects according to expected yields

criteria.

The results of these four key drivers will be perceived in better operational results and lower need for operating

assets, thus increasing the Return on Invested Capital index, which has become the key decision making driver for

our Management.

To deliver all initiatives we rely on a newly formed group of professionals, comprised of a renewed Board of Directors

and Officers, and of a technically improved team of managers.

In July/14 we hired Galeazzi & Associados (G&A), a renowned consulting firm with relevant experience in the

initiatives that we are undertaking at Paranapanema. G&A will participate in our operations for 12 months, identifying

and helping our managers to deliver the gains foreseen in PMA 2018.

In October/14 the Executive Office and G&A presented to the Board of Directors its diagnosis and action plan, to

capture the identified gains. Another important step that is starting now is the “Zero-Base Budget” process, which will

help us to reduce spending and increase productivity of operational assets by implementing a stricter budgeting

4

3Q14 EARNINGS RELEASE

culture. On 2Q15 G&A will review its diagnosis and will leave Paranapanema at the beginning of 3Q15, when a new

culture of management excellence is to be implemented in the Company.

In order to allow our shareholders and the market to follow the evolution of PMA 2018, we present the following table

with the main KPIs we will concentrate our efforts on improving:

Unit

2013

2014(E)

Baseline

2016

Review

2018

Target

kt

257

236

280

290

Transformation Cost

R$/ton

sold

2,047

2,029

1,840

1,748

Recurring SG&A

R$/ton

sold

615

554

515

489

Maintenance Capex

R$MM

Index

Cathode production

% of depreciation

Operating assets

%

Days

N/A

124

103

116

120

~90%

~100%

~100%

155

140

120

Note1: the ammounts presented in R$ will be adjusted by inflation index of the period

Note 2: (E) Estimate

[The remainder of this page has been intentionally left blank]

5

3Q14 EARNINGS RELEASE

Capex trend, maintenance plan and return thresholds for future projects to benefit value

creation process

Over the past four years, Paranapanema entered an intense Capex cycle, investing in the expansion, of (i) additional

smelting capacity from 220kton to 280kton per year, (ii) a new Tubes plant with annual capacity of 30 kton, and (iii)

wiring capacity at Dias d’Ávila from 18 kton to approximately 52 kton a year in 2011.

Note: (E) - Estimate

The main CapEx project at this moment is related to the Sulfuric Acid plant at Dias d’Ávila (BA), which has reached

the end of its operational life. This new sulfuric acid plant are being built at the same place as the existing one and is

part of our recently revised-down CapEx plan to 2014, from R$194 million to R$103million. We expect to commission

the plant in the 1H15.

Currently our installed capacity availability presents opportunity to grow our volumes without investments in new

capacity. Our focus is to maximize productivity of the Company’s existing assets by increasing production volumes

using the same level of resources, and we do not anticipate the need of major additional capacity for the coming

years. Our annual CapEx plan should be equivalent to the annual depreciation rate, currently around R$120 million,

while this capacity availability remain comfortable.

New investments are decided upon a strict decision process based on criteria such as strategic alignment and

prioritization, return on investment, Internal Rate of Return (IRR), Net present value versus weighted average cost of

capital, funding structure, and payback.

With higher capacity utilization, aligned with adequate CapEx maintenance to existing assets and capital discipline

for future projects, Paranapanema starts a new era of positive cash flow generation, while increasing its competitive

advantages. To achieve an operational level of excellence and to maximize the Company’s value is an important

step to explore complementary businesses in the future, bringing synergies and additional gains to our shareholders.

Business Environment – Copper Market

Related to the copper market, we observed global cathode demand sustained by moderate growth in Chinese market,

with attractive prices and limited supply by other smelters.

Macroeconomic data influenced the Copper price, maintaining the decline trajectory on 3Q14 (-3.1% vs. 2Q14).

6

3Q14 EARNINGS RELEASE

According with Wood Mackenzie, consumers remain tentative on the full year outlook due to on-going geopolitical

tensions, with demand expected to decelerate to 4.6% in second half of 2014, after posting strong 7.6% growth in

H1. However, moderate economic growth, more affordable copper prices, and the continued limited availability of

high grade scrap have been major factors supporting cathode demand in 2014.

At the end of 3Q14, spot TCRCs remained significantly higher than current benchmark terms for 2014 of $92/t &

9.2c/lb. LME week, held at the second half of October, marked the beginning of negotiations for next year TCRCs.

Traditionally, the spot buying demand amongst Chinese smelters is significantly lower in September. An average

TCRCs of $115/t & 11.5c/lb is believed to be the spot buying terms from Chinese smelters for clean concentrates

during the month. The mine to trader market also reported TCRCs of $110/t & 11c/lb for clean concentrate during

September.

Brazil

The macroeconomic environment in Brazil remained challenging during 3Q14. We prepared the Company to face

these market conditions in the past months by assuming at the end of 2Q14, a cautious posture when dealing with

business related to the Brazilian economy. The way we found to grow was to export the surplus of production for

which there was no demand in Brazil.

7

3Q14 EARNINGS RELEASE

Industrial Survey data released by CNI – Confederação Nacional da Indústria (National Industry Confederation) on

October 23, 2014, indicate a slight improvement in the industrial sector in September compared to previous months,

but still not enough to improve expectations for year-end.

The Brazilian Construction Sector, an important segment to Paranapanema, presented in August its worst results

since November 2005, according with the 60th Sondagem Nacional da Indústria da Construção Civil (National Civil

Construction Industry Research) published by the SindusCon-SP and Fundação Getulio Vargas on October 7, 2014.

It is a reflex of the negative perception in the sector for the coming months.

Data from the Economic Survey of ABINEE - Associação Brasileira da Indústria Elétrica e Eletrônica (Brazilian

Association of Electrical and Electronics Industry) published on October 21, 2014 show that in September the

Electronics sector posted better results than in the last three months, even though the industry has not yet retaken

significant growth.

Internal Environment

Measures taken to normalize the Company's Primary Copper production show the first results in 3Q14, when we

produced 60 thousand tons (annualized production of 240 thousand tons out of the total capacity of 280 thousand

tons), 7.2% growth when compared to last quarter. Production volumes also shows recovery to historical levels and

evolution of the utilization of installed capacity of the Dias d’Ávila plant. This recovery is due to the adoption of a new

preventive maintenance model, from which we are already benefiting from preventing unscheduled maintenance

stoppages and greater smelter availability, reflecting in greater installed capacity usage during 3Q14. The constant

evolution of industrial uptime at the Dias d’Ávila Primary Copper Unit is focus of Paranapanema’s Management, but

we cannot rule out the event of other unscheduled maintenance stoppages until the preventive maintenance program

is fully implement in all critical equipment. Management is fully committed in delivering this process by 1H15.

The Copper Products production reached 62 thousand tons in 3Q14, a 3.5% reduction to 2Q14, due to the weak

business environment in Brazil, main destination of the sales of Laminates and Wires, the main affected products.

The greater production of Primary Copper contributed to a total Sales Volume of 71 thousand tons, a 12.4% growth

over 2Q14.

We continue to make progress on Transformation Cost per ton sold, which index amounted 9.6% less when

compared to 2Q14. To achieve this performance we are increasing the Management for us on two areas: (i) capacity

usage and (ii) productivity, at the same time as creating a culture of greater operational efficiency and leaner

organization.

Transformation Cost (R$/ton)

1,999

-9.6%

1,807

2Q14

3Q14

Additionally, the Selling, General and Administrative Expenses (SG&A) were 9% lower over 2Q14. It’s important to

highlight that over the quarter there were non-recurring (one-off) events, specially labor contingency provisions,

amounting to R$16 million. When comparing SG&A excluding non-recurring items, the improvement is even better,

a reduction of 31.3% from R$36 million on 2Q14 to R$25 million on 3Q14.

8

3Q14 EARNINGS RELEASE

Throughout the year there was an important change regarding non-recurring items. On the first 9 months of 2014

non-recurring expenses negatively impacted our EBITDA on R$86 million, mainly related to the Partial Closure of

Capuava and Poland Project assets write-off. During 3Q14 significant amounts related to lawsuits were recovered,

positively impacting both Other non-recurring Revenues and Expenses (R$13 million) and Financial Income and

Expenses (R$ 54 million).

Another area of attention has been – and will continue to be – the management of invested capital, especially

Inventories and Recoverable Taxes. For the second consecutive quarter, there was a reduction on both our

Inventories and Recoverable Taxes level. Since the beginning of our Stock Short program on 4Q13, Inventories were

reduced by 28% or R$533 million (September/14 vs. September/13). Recoverable Taxes reduction reaching R$148

million (September/14 vs. March/14). We still see room for additional improvement in our operations, which will benefit

further reduction on Inventories cycle and lower Recoverable Taxes balance.

The Company Management remains focused on promoting initiatives to expand the usage of installed capacity, sales

volume and premiums, without losing sight of the goals of reducing spending and invested capital, thus aiming to

improve the return on invested capital.

Final Considerations

The Independent Auditors KPMG Auditores Independentes (KPMG), who examines the financial statements since

January 2012, only provides services to the Company related to the audit of the financial statements.

The Board of Directors declare to approve the statement of independence of the independent auditors.

Comments on the consolidated

www.paranapanema.com.br/EN/ri.

performance

of

the

Company

are

available

at

The Company is subject to arbitration on the Market Arbitration Chamber, pursuant to the Bylaws.

Dias d’Ávila, October 31, 2014.

The Management.

[The remainder of this page has been intentionally left blank]

9

the

website

3Q14 EARNINGS RELEASE

COMMENTS TO THE CONSOLIDATED FINANCIAL STATEMENTS

Comments to the Consolidated Statement of Income

Production Volume

Production Volume ('000 t)1

Primary Copper

Copper Products

Rods/Wires/other Copper Products

Bars/Profiles/Laminates/Tubes and Fittings

By-products

Production consumed by Copper Products

Total Copper

3Q14

60

62

46

15

259

44

121

2Q14

56

64

49

15

235

41

120

% Var.

3Q14/2Q14

7.2%

-3.5%

-5.5%

2.9%

10.1%

8.2%

1.5%

1Q14

60

58

45

14

248

38

118

3Q13

9M14

61

71

55

16

273

42

132

176

183

140

44

742

123

359

1

2Q14 and 3Q13 data w ere adjusted to better reflect the concept of ocupation of capacity production (w ithouth intercompay elimination) and to include all Byproducts (Sulfuric Acid, Anodic Slime, Slag, Oleum and Revert)

The Company produced 60 thousand tons of Cathode in the 3Q14; a 7.2% increase since the 2Q14. Production

volume recovery is due to the adoption of a new preventive maintenance model, focused on minimizing unscheduled

maintenance stoppage effects at the Dias d’Ávila smelter.

44 thousand tons of production were used to supply the Company’s Copper Products lines in the third quarter, with

a 3.5% (2 thousand ton) decrease in production, primarily in Laminates and Wires.

Sales Volume

Sales Volume ('000 t)1 2

Primary Copper

Domestic Market

Export Market

By-products

Copper Products

Rods/Wires/other Copper Products

Domestic Market

Export Market

Toll

Bars/Profiles/Laminates/Tubes and Fittings

Domestic Market

Export Market

Toll

Total Copper

3Q14

22

9

13

283

48

29

19

6

5

19

7

3

9

71

2Q14

16

10

6

258

47

30

21

6

3

17

6

2

9

63

% Var.

3Q14/2Q14

43.6%

-9.7%

134.2%

9.6%

2.1%

-3.5%

-11.1%

-10.1%

70.4%

12.1%

20.3%

35.4%

1.3%

12.4%

1Q14

19

11

8

258

45

30

22

6

2

15

7

2

6

64

3Q13

20

10

10

280

51

32

25

5

2

19

9

1

9

71

9M14

57

30

28

798

140

30

62

18

9

51

20

7

24

198

¹ Sales volume net of the intraoperations eliminations

2

Sales Volume of By-products on 2Q14 and 3Q13 w ere adjusted to include all By-products (Sulfuric Acid, Anodic Slime, Slag, Oleum and Revert)

Primary Copper sales volume increased by 43.6%, to 22 thousand tons, due to increased industrial availability, which

allowed greater production, as well as the execution of the finished products inventory reduction plan. Exports had

an important role in implementing this strategy, since the Brazilian market remains at a low level of activity.

Copper Product sales increased 2.5% to 48 thousand tons. This performance is primarily due to increased sales of

Tubes and growth in Toll of Rods, which offset the loss of Wires sales due to market contraction, particularly in the

civil construction, automotive and energy distribution segments.

By-products posted a 9.6% increase in sales volume, reaching 283 thousand tons, due to the sales of Sulfuric Acid

(+0.3%), Anodic Slime (+24.9%), Revert (a By-product rich in copper and of which there were no sales on 2Q14) and

Slag (+19.1%).

10

3Q14 EARNINGS RELEASE

Sales Volume per Market

The Brazilian Market (DM) absorbed 69.3% of the sales in the quarter, 49 thousand tons (including Toll) and 30.7%

or 22 thousand tons of the Company’s sales were to the Export Market (EM). Increased EM sales are attributed to

(i) the Company’s strategy to export the excess of Cathodes not absorbed at DM, (ii) sales of Anodic Slime, which is

always exported and was sold well above historical levels in the 3Q14 and (iii) export of excess inventories of Revert.

Copper and Exchange Rate Quotes

The Company’s prices are based on the Copper settlement price on the London Metal Exchange (LME) in US-Dollars

(USD).

The LME price at the end of 3Q14 was lower than the 2Q14 closing price, whilst the average LME price in 3Q14 was

3.0% greater than last quarter, reaching USD6,992/t. Over the quarter, the average USD exchange rate was BRL

2.2654/USD; 1.6% above the 2Q14 average of BRL 2.2296/t.

11

3Q14 EARNINGS RELEASE

Net Revenues

in R$ million

Net Revenues

Primary Copper

Domestic Market

Export Market

Toll

Copper Products

Rods/Wires/other Copper Products

Domestic Market

Export Market

Toll

Bars/Profiles/Laminates/Tubes and Fittings

Domestic Market

Export Market

Toll

By-products

3Q14

1,238

378

162

216

0

688

454

338

108

7

234

162

44

28

172

2Q14

1,090

252

163

89

0

770

592

489

99

4

178

117

33

29

67

% Var.

3Q14/2Q14

13.6%

49.7%

-0.8%

142.3%

-10.7%

-23.4%

-30.9%

9.5%

70.8%

31.6%

38.7%

35.1%

-1.8%

157.0%

1Q14

1,093

311

178

134

0

724

531

416

112

3

193

139

33

21

58

3Q13

1,302

345

177

168

0

791

547

458

86

2

244

192

25

27

167

9M14

3,421

941

503

438

0

2,183

1,577

1,242

320

14

606

418

111

77

297

3Q14 Net Revenues totaled R$1,238 million; a 13.6% increase over 2Q14, due an increase in Exports of Primary

Copper and By-products.

Primary Copper Revenues increased 49.7%, reaching R$378 million in the quarter, primarily due to increased export

volumes. Domestic Market represented 42.9% of the Primary Copper Revenues, below historical levels, reflecting

the deterioration of Brazilian demand due to a slowed economy. 57.1% of Primary Copper Revenues came from the

Export Market, above historical levels, due to excess production available for sale and to Brazilian economic

momentum. While not strategic, 3Q14 exports demonstrate the Company’s ability to use the EM to absorb surplus

Brazilian demand.

Copper Products Revenues reached R$688 million, posting a 10.7% retraction over 2Q14. The 31.6% (R$56 million)

increase in Bars, Profiles, Wires, Laminates, Tubes and Fittings revenues was not enough to offset the 23.4% (R$139

million) decrease in Rods and Wires Revenues. Export Revenues increased 15.1% (+R$20 million), R$9 million

arising from greater sales of Rods, Wires and other Copper Products and R$11 million from Bars, Profiles, Wires,

Laminates, Tubes and Fittings, partially offsetting the 17.5%, or R$106 million, Brazilian market retraction . Toll

Revenues, which are primarily from the Domestic Market, posted a 6.1% or R$4 million increase in the quarter.

By-products Revenues posted a 157.0% quarterly increase, totaling R$172 million, due to increased sales of Sulfuric

Acid (R$4 million, +16.4%) and Slag (R$0.2 million, +12.7%) in the Domestic Market, and greater exports of Anodic

Slime (R$ 23 million, +58.9%) and Revert (R$21 million, there were no sales of Revert in 2Q14).

12

3Q14 EARNINGS RELEASE

Cost of Goods Sold (COGS)

Cost of Goods Sold (COGS), comprised of Metal Cost, Transformation Cost and Costs allocated to Inventories totaled

R$1,133 million; a 12.2% quarterly increase, primarily due to increased sales volume. The COGS per ton totaled

R$16,022, in line when compared to 2Q14.

Metal Cost in Reais increased 13.1%, totaling R$992 million, and was impacted by increase of sales volumes

(+12.4%). The Metal Cost per ton was R$14,031; a 0.6% increase when compared to 2Q14.

in R$ million

COGS (R$ million)

Metal Cost

Transformation Cost

Costs allocated to Inventories

COGS/t

Metal Cost/t

Transformation Cost/t

3Q14

1,133

992

128

13

16.022

14.031

1.807

2Q14

1,009

877

126

6

16.045

13.944

1.999

% Var.

3Q14/2Q14

12.2%

13.1%

1.6%

105.1%

-0.1%

0.6%

-9.6%

1Q14

1,018

890

133

-5

15.917

13.918

2.072

3Q13

1,158

1,023

134

1

16.224

14.332

1.877

9M14

3,160

2,759

386

15

15.995

13.967

1.954

Transformation Cost

Gross Profit and Gross Margin

The Company’s Gross Profit increased 30.7% to R$105 million. Gross Margin also increased to 8.5%, versus 7.4%

in 2Q14.

13

3Q14 EARNINGS RELEASE

The accumulated Gross Profit in the 9M14 includes a reclassification of results that in 1Q14 and 2Q14 were classified

in the Net Financial Income (Loss) as “Metal Hedge” of +R$23 million and +R$25 million, respectively. This

reclassification relates to the improvement of Hedge Accounting adoption by the Company.

Operational Expenses

in R$ million

3Q14

Operational Expenses

Sales Expenses

General and Administrative Expenses

Other Operational Revenues and Expenses

2Q14

41

7

12

22

45

7

27

12

% Var.

3Q14/2Q14

-9.2%

7.6%

-55.1%

85.1%

1Q14

3Q13

109

8

29

72

9M14

56

8

27

22

195

22

68

106

Operational Expenses totaled R$41 million in 3Q14, 9.2% decrease when compared to 2Q14.

Sales Expenses amounted to R$7 million; a 7.6% increase due to increased third-party services related to dispatch

and personnel expenses.

General and Administrative Expenses decreased 55.1% to R$12 million. The primary reason for this decrease is the

reclassification of R$12 million in expenses from General and Administrative to “Other Operational Revenues and

Expenses”. The reclassified expenses are of non-recurring nature. Without this adjustment, General and

Administrative Expenses would have amounted to R$24 million, nevertheless a 9.6% reduction over 2Q14. This

variation is primarily due to a reduction in third-party services, travel and personnel.

Other Operational Expenses totaled R$22 million; a 85.1% increase from that of 2Q14 primarily due to the

reclassification of General and Administrative expenses of R$12 million. Isolating this effect, the variation would have

been a R$2 million reduction. The following table provides details on 3Q14 non-recurring items:

in R$ million

3Q14

Other Operational Revenues and Expenses

Partial Closure of Capuava

Poland Project assets write-off*

Provisions, gains (lossess) in lawsuits*

Other non-recurring

Total non-recurring

Other recurring

*No cash impact on the quarter

2Q14

22

3

3

11

0

16

6

12

14

0

-7

2

9

3

% Var.

3Q14/2Q14

85.1%

-80.8%

300.0%

-245.8%

-110.6%

84.1%

88.0%

1Q14

3Q13

72

44

24

-7

0

61

11

9M14

22

0

0

21

1

20

3

106

60

26

-3

2

86

20

3Q14 Operational Expenses excluding non-recurring events dropped 31.1% when compared to 2Q14. When

considering the accumulated on the first nine months of the year (9M14) Operational Expenses excluding nonrecurring events posted a 12.1% reduction when compared to the same period last year.

Net Financial Income (Loss)

in R$ million

Financial Income

Financial Expense

Foreign Exchange Variation

Other Financial Income and Expenses

Subtotal (i)

Metal Hedge

Cash Flow Hedge (income and expenses)

Total Return Swap

Subtotal (ii)

Net Financial Income (Loss)

14

3Q14

33

-38

47

43

85

34

4

-12

25

112

2Q14

31

-38

-10

0

-17

-70

-35

-11

-117

-133

% Var.

3Q14/2Q14

4.4%

-1.3%

-586.6%

82581.7%

-608.9%

-148.6%

-110.2%

11.7%

-121.8%

-184.1%

1Q14

3Q13

27

-42

-11

30

4

23

9

-20

12

16

26

-37

-3

-6

-19

-74

-39

3

-110

-130

9M14

90

-118

27

73

72

-13

-22

-43

-79

-5

3Q14 EARNINGS RELEASE

Financial Income, Financial Expenses, Foreign Exchange Variation and Other Financial Income and

Expenses

Financial income increased 4.4% in the quarter due to interest revenue over a larger cash position within this period.

Financial Expenses remained stable in the period, in line with gross debt.

Foreign Exchange Variation from accounts payable, accounts receivable and financing lines was R$47 million

positive in 3Q14, compared to R$10 million negative in 2Q14, mainly due to liquidation of debt contracts in foreign

currency.

Other Financial Income and Expenses totaled R$43 million mainly from the accrual of interest and inflation updates

over won lawsuits and bad debts recoveries by the Company within the quarter.

Metal Hedge

Metal Hedge results was R$34 million positive in 3Q14, from the mark–to-market difference between the average

future price (based on the market curve) and the month average spot prices of metals.. Management highlights that

these results are the effect of marking to market of derivatives used on Metal Hedge and which economic realization

might occur in the future.

Exchange Rate Hedge

Paranapanema uses USD Non Deliverable Forwards (NDFs) to adjust its exposure to the USD in line with the Risk

Management Policy. NDFs settled during 3Q14 generated a Hedge revenue of R$4 million.

The Other Comprehensive Income account presented a negative variation of R$340 million in 3Q14, from the

appreciation of the USD against the BRL, especially in September 2014. At the end of the quarter, the OCI balance

in Net worth was negative R$216 million, a result of the marking to market the Exchange Rate Hedge positions.

Total Return Swap

Due to the variation of PMAM3 share price and CDI over 3Q14, the result ofmarking to market the Total Return Swap

contracted in November 2012 was negative R$12 million.

EBITDA and Adjusted EBITDA Reconciliation

in R$ million

Net Income

(+) Taxes

(+) Net Financial Income (Loss)

EBIT

(+)Depreciation and Amortization

EBITDA

(+)Other non-recurring Operational Revenues and Expenses

Partial Closure of Capuava

Poland Project assets write-off*

Provisions, gains (lossess) in lawsuits*

Other non-recurring

Adjusted EBITDA

Adjusted EBITDA Margin

*No cash impact on the quarter

3Q14

131

-45

112

64

29

93

16

3

3

11

0

109

8.8%

2Q14

-72

26

-133

35

29

64

9

14

0

-7

2

73

6.7%

% Var.

3Q14/2Q14

-281.5%

-274.6%

-184.1%

82.2%

1.6%

46.0%

84.1%

-80.8%

300.0%

-245.8%

-110.6%

50.5%

-

1Q14

-15

3

16

-33

29

-4

61

44

24

-7

0

57

5.2%

3Q13

-35

7

-130

88

28

116

20

0

0

21

1

136

10.5%

9M14

44

-16

66

87

153

86

60

26

-3

2

239

7.0%

Paranapanema’s EBITDA for the 3Q14 was adjusted to isolate effects of non-recurring expenses and revenues

occurred, notably (i) wins and losses of lawsuits (R$11 million), (ii) write-off of assets from Projeto Polônia (Poland

Project R$3 million) and (iii) expenses related to the partial shutdown of Capuava plant (R$3 million). During 3Q14

15

3Q14 EARNINGS RELEASE

significant amounts related to lawsuits were recovered, positively impacting both Other non-recurring Revenues and

Expenses (R$13 million) and Financial Income and Expenses (R$ 54 million).

Adjusted EBITDA therefore increased 50.5%, totaling R$109 million. Adjusted EBITDA Margin increased by 2.1

percentage points compared to 2Q14, reaching 8.8%.

Net Income

Income Tax & Net Result

in R$ million

Earnings Before Taxes

Taxes

Net Income (Loss)

Net Margin (%)

3Q14

176

-45

131

10.6%

2Q14

-98

26

-72

-6.6%

% Var.

3Q14/2Q14

-

1Q14

-18

3

-15

-1.3%

3Q13

-42

7

-35

-2.7%

9M14

61

-16

44

1.3%

Paranapanema reported Net Income of R$130 million in 3Q14 compared to a Net Loss of R$72 million in 2Q14.The

accumulated Net Income in 2014 reached R$43 million, thus reverting the Net Losses accumulated up to 2Q14. Net

Margin was 10.5% compared to -6.6% in 2Q14.

[The remainder of this page has been intentionally left blank]

16

3Q14 EARNINGS RELEASE

Comments to the main accounts of the Consolidated Statement of Financial Position

Cash and Financial Investments

Paranapanema ended 3Q14 with high liquidity reflected by its Cash and Financial Investments position of R$988

million. This amount represents R$74 million in Cash and Cash Equivalents, and R$915 million in Financial

Investments split between 92% on the short term and 8% on the long term. In 3Q14 there was R$329 million increase

in our Cash balance, driven by a reduction in Inventories level (in R$109 million), Recoverable Taxes monetization

(R$13 million), and increasing local Trade Payables.

Working Capital

Accounts Receivable

In 3Q14 the Accounts Receivable balance totaled R$394 million; R$120 million greater than 2Q14 due to increased

export volume.

Inventories

In 3Q14 Inventories totaled R$1,386 million, 7.3% or R$109 million lower than 2Q14. The Physical inventory at the

end of the quarter totaled 96 ktons of raw materials, products in process and finished products, a 15 kton reduction.

We are working to improve further the inventory reduction process. We estimate additional opportunities to reduce

inventory volumes by 10% of the current balance.

Recoverable Taxes

In 3Q14 the Recoverable Taxes totaled R$349 million; a R$13 million reduction compared to 2Q14. The monetization

of balances of Recoverable Taxes is one of Management’s goals in order to increase cash generation and reduce

the Company’s capital invested in assets.

Trade Payables

Trade Payables totaled R$ 1,744 million; a R$283 million increase over 2Q14, due to improved terms offered by local

and international suppliers.

17

3Q14 EARNINGS RELEASE

Fixed Assets + CapEx

Fixed Assets was flat at R$1,341 million in 3Q14. Depreciation totaled R$29 million in the quarter, whilst the additions

to fixed assets amounted to R$21 million and were allocated especially on projects related to maintenance, increased

productivity and technological upgrade.

As part of the PMA-2018 Project, the Company's management reviewed the budget need for capital investment

announced for 2014 to R$103 million, a 48.4% reduction over the R$194 million originally planned.

Debt and Debt Structure

in R$ million

Loans and Financing

Short Term

Long Term

(-)Cash and Cash Equivalent

Cash and Cash Equivalent

Financial Investments

Net Debt

Adjusted EBITDA (LTM)

Net Debt/Adjusted EBITDA

3Q14

1,246

679

567

988

177

811

257

318

0.8

2Q14

1,165

547

618

659

64

596

506

345

1.5

% Var.

3Q14/2Q14

6.9%

23.9%

-8.2%

49.9%

178.4%

36.2%

-49.2%

-7.8%

-

1Q14

1,039

470

569

520

36

485

519

326

1.6

3Q13

887

514

373

390

9

381

497

182

2.7

9M14

1,246

679

567

988

177

811

257

318

0.8

At the end of the quarter, the Consolidated Financial debt totaled R$1,161 million, an increase of R$80 million or

6.9% compared to 2Q14. Net Debt totaled R$257 million, a decrease of R$249 million or 49.2% compared to 2Q14.

The Net Debt / Adjusted EBITDA ratio used to monitor the Company covenants (at 3.5x) was 0.8x, demonstrating

Adjusted EBITDA and cash position improvement.

Capital Structure

[The remainder of this page has been intentionally left blank]

18

3Q14 EARNINGS RELEASE

Appendix I – Statement of Income (R$ million)

Net Revenues (R$ MM)

Domestic Market

Export Market

Toll

COGS (R$ MM)

Gross Profit (R$ MM)

Gross Margin (%)

Operational Expenses (R$ MM)

Operating Income (R$ MM)

Financial Income (loss) (R$ MM)

Net Income (loss) (R$ MM)

Net Margin (%)

Ajusted EBITDA (R$ MM)

Adjusted EBITDA Margin (%)

3Q14

1,238

695

508

35

1,133

105

8.5%

-41

64

112

131

10.6%

109

8.8%

2Q14

1,090

797

260

33

1,009

80

7.4%

-45

35

-133

-72

-6.6%

73

6.7%

1Q14

1,093

758

312

24

1,018

75

6.9%

-109

-33

16

-15

-1.3%

57

5.2%

3Q13

1,302

994

279

30

1,158

144

11.1%

-56

88

-130

-35

-2.7%

136

10.5%

[The remainder of this page has been intentionally left blank]

19

9M14

3,421

2,250

1,080

92

3,160

261

7.6%

-195

66

-5

44

1.3%

239

7.0%

9M13

3,865

2,435

1,340

91

3,569

295

7.6%

-147

141

-149

12

0.3%

253

6.6%

3Q14 EARNINGS RELEASE

Appendix II – Statement of Financial Position (R$ million)

Assets (R$ MM)

Current assets

Cash and cash equivalents

Financial Investiments

Accounts receivable

Inventory

Recoverable taxes

Prepaid expenses

Others Current assets

Non-current assets

Long-term Financial Investments

Accounts receivable

Deferred taxes

Other non-current Assets

Investiments

Fixed Assest

Intangible Assets

Total Assets

3Q14

2,938

177

742

392

1,386

171

6

64

1,817

70

177

2

94

133

11

1,326

5

4,755

2Q14

2,651

64

528

273

1,495

183

10

99

1,816

68

179

2

140

76

11

1,336

5

4,467

1Q14

2,671

36

419

333

1,522

217

12

133

1,797

66

166

2

114

76

11

1,358

5

4,468

3Q13

2,981

9

318

388

1,920

245

5

96

1,734

63

43

3

128

78

11

1,405

5

4,715

Liabilities (R$ MM)

Current liabilities

3Q14

2,711

2Q14

2,182

1Q14

2,219

3Q13

2,723

Social and labor obligations

43

36

42

56

1,744

1,461

1,576

1,892

15

22

25

27

Loans and financing

679

547

470

514

Other liabilities

230

115

106

234

Non-current liabilities

755

787

750

544

Loans and financing

567

618

569

373

4

4

7

8

Trade Payables

Tax liabilities

Other liabilities

Provisions

184

165

174

163

Equity

1,289

1,498

1,499

1,448

Realized capital

1,383

1,383

1,383

1,383

Capital reserves

26

27

27

20

251

254

257

-

14

14

14

14

Retained Earnings/Losses

-169

-303

-234

-215

Other Comprehensive Income

-216

123

52

246

4,755

4,467

4,468

4,715

Revaluation reserve

Profit reserves

Total Liabilities

[The remainder of this page has been intentionally left blank]

20

3Q14 EARNINGS RELEASE

Appendix III – Statement of Cash Flow (R$ million)

Net cash from operating activities

Income (loss) before taxes

Residual value of written-off fixed assets

Depreciation, amortization and depletion

Provisions

Estimated loss

Long-term interest rate

Adjustment to present value - Trade accounts receivable and suppliers

Other Comprehensive Income

Changes in assets and liabilities

Trade accounts receivable

Inventories

Recoverable taxes and contributions

Prepaid expenses

Deposits for judicial claims

Derivative financial instruments Assets

Assets for sale

Other current and non-current assets

Trade Payables

Current income and social contribution taxes

Taxes and contributions payable

Additions and write-offs for lawsuits

Salaries and social security charges

Other Comprehensive Income

Derivative financial instruments Liabilities

Other liabilities

Net cash from investment activities

Financial Investiments

Additions in Property, plant and equipment, and Intangible assets

Net cash from financing activities

Additions (payments) of loans and financing lines

Dividends

Increase (decrease) in cash and cash equivalents

Opening balance of cash and cash equivalents

Closing balance of cash and cash equivalents

3Q14

532

176

2

29

32

2

-22

1

1

311

-99

106

4

4

0

-42

-7

-61

295

-5

0

-4

7

-3

24

93

-263

-242

-20

-156

-156

0

114

58

172

[The remainder of this page has been intentionally left blank]

21

2Q14

-16

-99

24

29

2

-2

9

-1

-1

22

75

32

23

2

0

95

0

8

-76

0

-3

-7

-6

-133

35

-22

-213

-178

-35

257

257

0

28

31

58

1Q14

156

-18

0

33

2

-1

3

136

-17

268

-147

-38

-8

2

-75

0

-7

7

-2

2

-7

-8

-24

21

-96

-109

13

-87

-87

0

-44

80

36

3Q13

-107

-43

1

28

22

-2

-1

0

0

-113

117

-836

-60

4

0

82

-1

52

478

0

-11

-4

8

22

65

-31

31

51

-20

29

29

0

-48

83

35

3Q14 EARNINGS RELEASE

About Paranapanema

Company Profile and Business

Paranapanema is one of the most important world-class Brazilian companies in non-ferrous metals, smelting and

refining primary copper and copper products and its alloys. The Company’s activities are divided into four industrial

units, located in Dias D'Ávila (BA), Utinga and Capuava (Santo André - SP) and Serra (ES). Paranapanema is

currently the largest Brazilian copper producer, with a market share of over 50% of the Brazilian Primary Copper

market It is also Brazil’s largest copper rod supplier with growing presence in the pipe and fittings markets.

Outstanding Shares

Outstanding shares: 319,152,437

Treasury shares: 24,505

Total shares issued: 319,176,942

Main Shareholders – as of September 30, 2014

[The remainder of this page has been intentionally left blank]

22

3Q14 EARNINGS RELEASE

Concepts and Definition

Raw Material

Copper Concentrate is primarily purchased on the international market, with Chile as the main supplier. of the Copper

Concentrate purchase price is determined by international prices of metals contained and respective yields (copper,

gold, silver, nickel, zinc, lead and other precious metals can be found in Copper Concentrate), subtracted from the

TC/RC, or Treatment Charge (TC)/Refining Charge (RC). The TC/RC is the charge paid to the transformer for the

mineral copper processing and refining into metal copper and is negotiated between suppliers and smelters, such as

Paranapanema. There may also be adjustments to Copper Concentrate price based on precious metals content as

well as those specific characteristics of Copper Concentrate offered, which ranges from mine to mine.

Copper Scrap consists of recycled copper bought both in the local and international markets used either in the raw

material mix to produce Cathode and other alloys for copper products. In 2013 the raw materials mix was 75% Copper

Concentrate and 25% Copper Scrap.

Production

Paranapanema produces Primary Copper, Copper Products and By-products from Copper Concentrate and Copper

Scrap. The Company also conducts operation of Transformation (Toll) of copper scrap received from customers into

Copper Products.

Primary Copper, also known as Copper Cathode, is the copper commodity in its metal form. Production process

consists in converting Copper Concentrate into metal Copper.

Copper Products are tubes, fittings, rods, wires, bars and others, whose main raw material are Cathodes and copper

alloys and copper alloys with other nonferrous metals such as tin, lead and zinc. In addition to the cost of copper ,

Primary Copper requires other costs to be transformed into Copper Products, such as labor, energy, etc.

By-products results from the processing of Copper Concentrate into Cathodes. The main by-products are Sulfuric

Acid and Anodic Slime (material containing precious metals such as Gold and Silver), besides Slag, Oleum and

Revert.

Toll refers to transactions where the Company receives copper scrap from its customers and transforms it into Copper

Products. Transformation costs incurred are similar to Copper Products obtained from Primary Copper.

Pricing

Paranapanema’s Net Revenues are derived from sales volumes and prices charged by Primary Copper, Copper

Products, Toll and By-Products.

The selling price of Primary Copper or Copper Cathode is established by London Metal Exchange (LME) transactions

and is converted into Reais (BRL) based on the exchange rate at the time of sale closing, as well as the Cathode

Premium, which is the remuneration charged by the Company to transform Copper Concentrate into Primary Copper.

Copper Products selling price is determined by the mix of copper, tin, lead and zinc contained in the product (in line

with those applied for Primary Copper, i.e. LME), plus Premium, value charged by Paranapanema to transform the

Primary Copper into value added products. As it occurs in Primary Copper, revenues from sales of Copper Products

are also impacted by the USD exchange rate, even if sales are booked for Brazilian customers.

By-product prices are linked to the USD. Sulfuric Acid is quoted based on FMB (Fertilizer Market Bulletin) plus

premiums or discounts, while Anodic Slime price is set based on contained precious metals.

Toll average price per ton is materially lower than those of Copper Products, which Paranapanema does not incur in

metal revenues or costs (copper received from customers is in the form of scrap). The Premium charged in Toll

23

3Q14 EARNINGS RELEASE

operations are usually priced in Reais but, in some occasions USD based contracts are adjusted by the dollar

exchange rate.

Inventories

Paranapanema Inventories are primarily comprised of commodities such as Copper, Gold, Silver, Zinc, Tin and Lead.

Commodity inventories have high liquidity and monetization values that are marked by very liquid markets.

Management dedicates special attention to adjusting inventories levels to operational needs and, since 4Q13, keeps

a program called Stock Short to monitor inventory levels, pursuing more integration and efficiency in Supply Chain,

Logistics, Industrial and Commercial on Inventories use.

Adjusted EBITDA

Paranapanema adjusts its EBIDTA of items called "non-recurring", which are amounts not related to Management

expectations that may occur in the future to the same degree as presented in the respective period.

Hedge and Hedge Accounting

The Company follows a risk management policy approved by the Board of Directors, in order to prevent unexpected

economic impacts from fluctuations in metal commodities prices, exchange rates and interest rates on profitability

and cash flow.

Paranapanema adopts various hedging strategies as a way to neutralize any (i.) disconnects between the sales price

and the purchase price of metals and raw materials, (ii.) impact of changes in exchange rates on the value of assets

and liabilities and the future value of revenues and costs, and (iii.) interest rate exposure, given by the annual payment

amount of floating interest embedded in financial contracts. The use of derivatives is limited exclusively to hedging

activities with adoption of Hedge Accounting when necessary.

Adoption of Hedge Accounting will be defined by standards specific to CPC 38 and 39, which should provide at least

the following: (a) the exchange risk on both financial and operational elements may adopt the hedge of the fair value

or cash flow with derivatives or financial instruments; (b) commodity risk may adopt hedge of the fair value or cash

flow with derivative or embedded derivatives and (c) for the interest rates risk may adopt the cash flow hedge with

derivatives.

The reading and interpretation of financial statements with the adoption of Hedge Accounting differ from those that

do not adopt Hedge Accounting and recognize all the variations on derivatives and financial instruments as Financial

Income or Losses.

With the adoption of Hedge Accounting of Cash Flows there is a need to analyze the "Other Comprehensive Income"

account presented in Net Worth. This account is used to record future gains and losses on hedges until the moment

they actually occur, when they are recognized in the Operational Result of the respective period.

In order to allocate effects of economic hedges in Gross Profit, Paranapanema has adopted Hedge Accounting of

the fair value hedging of metals (copper, zinc, lead and tin) and precious metals (gold and silver) inventories.

Management may implement new hedging strategies or modify current strategies, implemented parallel with Hedge

Accounting.

Metal Hedge

The Company seeks to neutralize metal price fluctuation on Paranapanema’s income through the fair value hedge

of the inventories program by using derivative contracts at stock exchanges, derivatives embedded in Copper

Concentrate purchasing contracts and offsetting long and short positions.

24

3Q14 EARNINGS RELEASE

The industrial cycle of the smelter causes Paranapanema to carry a "load" of physical inventory of metals and makes

use of hedging instruments to protect them, in an effort to approximate metal cost value to metal price at sale moment.

For hedging purposes, metal inventories represent a long position. Copper Concentrate sourcing process causes

purchase value to be unknown at purchase date, a metals market practice. Values are defined according to LME

parameters during months following the purchase date. This period is known as "Quotational Period" (or "QP"). This

situation specific to metal markets creates a short position for Paranapanema, until the QP is defined.

Due to amounts usually involved between long and short position of financial transactions, Paranapanema has a

long position. To balance this position, the Company sells derivatives to create an additional short, up to the amount

to neutralize the exposure. This procedure is in line with Company’s risk management policy.

Exchange Rate Hedge

The Company aims to permanently protect 70% to 100% of net foreign exchange exposure of the 6-12 months

projected cash flow through derivative transactions, and offsetting revenues and liabilities pegged to the US Dollar

(USD).

Paranapanema maintains liabilities pegged to the USD (short position), mainly with suppliers and credit facilities. As

a nature of copper business, future revenues are also pegged to the USD (long position). Net position perceived by

Paranapanema, is long. To counteract this situation, Paranapanema sells USD Non Deliverable Forwards (NDFs),

thereby reducing its USD exposure. This process is in line with the Company’s risk management policy.

Effects arising from exchange rate hedge are perceived in three accounts in Financial Statements: in Financial

Results for transactions settled during the period, in OCI, within Net Worth, where gains and losses of exchange rate

mark-to-market variations on future income and expenses awaits transfer to Operating Revenues until they are

materialized.

Total Return Swap

Paranapanema entered into an agreement in November 2012 with Deutsche Bank (DB) to exchange flows by which

DB is long on CDI (Certificados de Depósitos Interbancários – reference daily interest rate used in Brazilian market)

and short on Paranapanema’s share price, PMAM3. The Company has the opposite positions as DB.

[The remainder of this page has been intentionally left blank]

25

3Q14 EARNINGS RELEASE

Disclaimer

Management makes statements about future events that are subject to risks and uncertainties. These statements

are based on estimates and assumptions by the Management and information which the Company currently has

access. Forward-looking statements include information about their intentions, beliefs or current expectations, as

well as those of members of the Board of Directors and Executive Officers. The caveats in relation to statements and

information about the future also include information on possible or presumed operating results, as well as statements

preceded by, followed by or that include the words "believes", "may", "will", "continue", "expects", "anticipates",

"intends", "plans", "estimates" or similar expressions. The statements and information are not guarantees of future

performance. They involve risks, uncertainties and assumptions because they relate to future events and therefore

depend on circumstances that may or may not occur. Future results and value creation for the shareholder may differ

materially from those expressed in or suggested by statements about the future. Many of the factors that will

determine these results and values are beyond our ability to control or predict.

[The remainder of this page has been intentionally left blank]

26

3Q14 EARNINGS RELEASE

Board of Directors Composition

Sitting member

Alternate member

Albano Chagas Vieira (independent) – Chairman

Sergio Ricardo Lopes de Farias

Valéria Maria de Paula Rezende – Vice-Chairman

Fernanda Duclos Carisio

Dannyel Lopes de Assis

Osvaldo Bruno Brasil Cavalcante

Maria Gustava Brochado Heller Britto

César Silva do Carmo

Maria Paula Soares Aranha

Euripedes de Freitas

Maurício França Rubem

Flavia Silva Fialho Rebelo

Paulo Amador Thomaz A. Cunha Bueno (independent)

Endrigo de Pieri Perfetti

Statutory Executive Board Composition

CEO

Chief Supply Chain Officer

Christophe Malik Akli

Antônio Carlos da Rosa Pereira

Chief Copper Products Officer

CFO and IRO

Miguel Angelo de Carvalho

Thiago Alonso de Oliveira

Fiscal Council Composition

Sitting member

Alternate member

João Bosco de Oliveira Santos - Chairman

Gilda Maria dos Santos

Humberto Santamaria

Daniela Lopes de Almeida Leal

Jacy Afonso de Melo

Sergio Mesti Samorano

Susana Hanna Stiphan Jabra

Artur Carlos Das Neves

Paulo Henrique Bezerra R. Costa

Thiago Souza Silva

27

© Copyright 2026