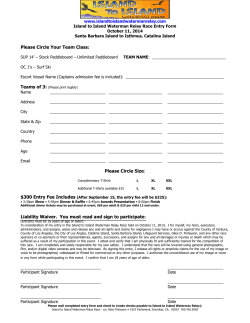

A N N U A L Middle Island MIDDLE ISLAND