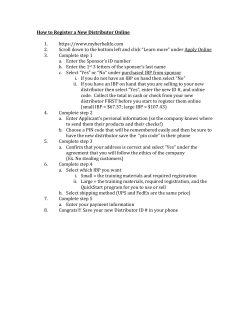

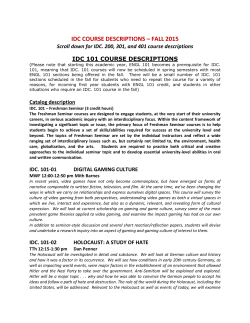

s a l e s a n d

sa le s and mar k e t i ng 2014 r e por t tit le s po ns o r : s t u dy sp onsors: A Supplement To Consumer Goods Technology New research provides a progress update for initiatives in: • Trade Promotion Management • Downstream Data • Consumer Engagement • S&OP pr es ented b y: 6663 Full page ad 3 5/1/14 May 1, 2014 11:33 AM Page 1 AT&T offers a comprehensive portfolio of innovative solutions for global CPG firms. Visit www.att.com/retailbusiness © 2014 AT&T Intellectual Property. All rights reserved. AT&T and the AT&T logo are trademarks of AT&T Intellectual Property. RIS_CGT_Temp.indd 1 5/6/14 2:08 PM sa le s and mar k e t i ng 2014 r e por t publisher Albert Guffanti [email protected] editorial Executive Editor: Kara Romanow [email protected] edit note At IDC Manufacturing Insights, we know that sales and marketing organizations are working hard to serve their retail customers and engage with consumers. Join us in a conversation about some of the most discussed challenges in the industry — trade promotions, downstream data, consumer engagement and keeping products on the shelf with sales and operations planning. Our report shows that sometimes change is slow, but we believe 2014 is going to be the year many organizations start to see even more progress from their investments in sales and marketing efforts, making technology, market visibility and expertise work together. —ki m kn i ckl e, IDC Manufact uring Ins igh ts Editor: Ali Ackerman Orr [email protected] Assistant Editor: Alarice Padilla [email protected] sales Associate Publisher: Diana Masurack Mann [email protected] Senior Account Manager: Bill Little [email protected] Assistant to Publisher: Jen Johnson [email protected] art and production Creative Director: Colette Magliaro [email protected] Art Director: Pamela C. Ravetier [email protected] Production Manager: Pat Wisser [email protected] contents sm 6 The State of Things 10 sm Online Project Manager: Whitney Ryerson [email protected] marketing/events/circulation Director, Event Planning: Patricia Benkner [email protected] Trade Promotion Management Circulation Manager: Jeffrey Zabe [email protected] Downstream Data Manufacturers and retailers are challenged to leverage new forms of data, while not losing sight of progress still needed around more traditional forms of downstream data. 18 sm Web Development Manager: Scott Ernst [email protected] Director, Event Content: John Hall [email protected] Subscriptions: 978-671-0449 Reprints: [email protected], 212-221-9595 14 sm Director of Lead Generation & Audience Development: Jason Ward [email protected] An overview of where sales and marketing initiatives fit in among a consumer goods company’s top business priorities and complex challenges. Despite persistent impediments, manufacturers report progress and ponder TPO’s contribution to Integrated Business Planning. sm online media Vice President of Media Integration: Rob Keenan [email protected] Direct to Consumer 22 Survey results indicate that a marketing relationship is favored over a direct commercial one, but smart companies will explore the mechanisms to facilitate direct-to-consumer sales. S&OP IDC explores the interesting notion of Integrated Business Planning and its interrelationship with S&OP. corporate CEO/Chairman: Gabriele A. Edgell [email protected] President: Gerald C. Ryerson [email protected] Vice President: John Chiego [email protected] Founder: Douglas C. Edgell, 1951-1998 corporate office Edgell Communications 4 Middlebury Boulevard Randolph, NJ 07869-1111 (973) 607-1300 • Fax (973) 607-1395 www.consumergoods.com member TECHNOLOGY GROUP printed in the u.s.a. member SM4 | c g t | 2 0 1 4 s a l e s a n d m a r k e t i n g r e p o rt www. ed g el l c o m m u n i c a t i o n s. c o m 2014 sa le s and m a r k e t i n g r e por t The State of Things Sales and marketing plays fundamental role in meeting business prioritie s and serving the “5 I” consumer • BY KI M KNI CKLE onsumer goods (CG) manufacturers tell us that their top three business initiatives are expanding their geographic reach, improving customer acquisition and retention, and introducing new products and services (Figure 1). In each of these initiatives, sales and marketing plays a fundamental role in serving the “5 I” consumer — instrumented with mobile devices, informed with access to the Internet on their devices, interconnected in social communities, in place in stores or wherever else they might be, and finally, immediate in their ability to take action. This is the first time we’ve seen expanding regions at the top of the list, and we think it’s exactly because consumers now possess all of these 5 I attributes. We know that increasing the effectiveness and productivity of sales and marketing in today’s market is the result of continued investments in people, process and technology. Our IDC research finds that application spend and customer relationship management (CRM) spend show healthy growth from 2013 to 2016 (Figure 2). Within the CRM segment, the strongest growth is in marketing automation (Figure 3). These investments should ultimately bring greater automation, more consistent processes and easier access to relevant information. Over the last few years, we’ve witnessed an increasing use of new technologies such as big data and analytics, cloud, mobile and social in how CG companies engage with their customers and consumers. While all of these technologies are important to sales and marketing, we can’t get around the fact that social, in the form of social tools, social media and social networks, has fundamentally changed the way CG manufacturers can work with and connect with the consumer and the retail customer. We can see that connection in the fact that integrating social and CRM is more common than any other type of integration (Figure 4). Adding social interactions with consumers and among consumers to more traditional data SM6 | c g t | 2 0 1 4 s a l e s a n d m a r k e t i n g r e p o rt Top Business Initiatives in Consumer Products Q. In 2013, which of the following initiatives will be significant in driving IT investments at your organization? Multiple responses allowed f i g u r e 1: I N I T I AT I V E 42.6% Expand into new geographic regions/countries 37.4% Improve customer acquisition and retention 35.2% Introduce new and/or improved products and services Source: 2013 IDC Global Technology and Industry Research Organization IT Survey U.S. Consumer Packaged Goods IT Spending, 2013–2016 ($M) f i g u r e 2: T Y PE O F S PEND 2013 2014 2015 2016 2013- 2016 C AGR % Application Spend 5,001.67 5,277.21 5,575.00 5,900.11 5.7% CRM Applications 574.38 604.91 637.00 668.06 5.2% Share of CRM applications in application IT spend (%) 11.5% 11.5% 11.4% 11.3% Source: IDC Manufacturing Insights IT Spending Guide MI243424, 2013 This is the first time that expanding regions ranks as a top business priority, perhaps because consumers now possess all of the “5 I” attributes. 2014 sa le s m a r k e t i n g r e por t and The State of Things sources, like transactional (downstream) data and promotion data, is definitely making sales and marketing processes and decisions both more complex and more data rich. That’s why we’ll also share some of our thoughts on how important it is to use new tools to analyze that data. But we all know that technology is just an enabler, and it’s how companies apply the technology in their organizations for business value that really matters. For the rest of this report, we explore how CG manufacturers are finding opportunities for improved sales and marketing across business functions and technologies in four key areas: 1 The progress CG manufacturers are making in Trade Promotion Management and its contribution to Integrated Business Planning; 2 How complementing Downstream Data with other data and big data analytics can improve demand visibility to better manage volatility and drive customer service improvements; 3 How Direct-to-Consumer initiatives continue to evolve by leveraging social and mobile, to strengthen brand marketing and sales with personalization and consumer experience benefits; 4 How Sales & Operations Planning still faces orchestration challenges, but as it evolves, will better represent the perspectives of sales and supply chain as one approach. As in years past, we’ve based our analysis in this report on ongoing conversations and research with IDC Manufacturing Insights clients, IT and vertical industry business priority and spending data, and our 2014 Sales & Marketing Survey results. We expect to see continuing progress in all of these areas as they are among the key initiatives that we believe will enable future sales growth and continued expansion into new markets, improved customer service performance, and greater productivity through sales and marketing. SM8 | c g t | 2 0 1 4 s a l e s a n d m a r k e t i n g r e p o rt Americas CRM Applications Revenue by Segment, 2013–2016 ($M) f i g u r e 3: APP LI C ATI O N 2013 2014 2015 2016 2013- 2016 C AGR % Marketing Automation 3,177.50 3,486.50 3,794.20 4,119.50 9% Sales Automation 3,708.00 4,005.60 4,287.80 4,579.40 7.3% Customer Service 2,141.00 2,311.80 2,494.00 2,684.80 7.8% Contact Center 4,225.80 4,413.50 4,601.30 4,805.20 4.4% Source: IDC Manufacturing Insights and IDC 241293, 2013 Connecting Customer Details Q. Which internal systems do you currently integrate with your social software tools? Multiple responses allowed f i g u r e 4: SYSTEM CRM 34% ERP 33.2% Analytics Customer support 25.3% 21.9% Source: 2013 IDC Global Technology and Industry Research Organization IT Survey While technologies are important to sales and marketing, social has fundamentally changed the way consumer goods manufacturers connect with the consumer and the retail customer. 2014 sa le s and m a r k e t i n g r e por t Trade Promotion Management Plenty of Improvement Opportunities Exist Despite Impediments he practice of using trade promotion funds to temporarily “buy down” the selling price of a consumer product has been and continues to be a major vehicle for CG companies to drive sales volume. Indeed, the use of promotional funds is so pervasive that for some product categories, the majority of sales are driven by promotions and the underlying baseline volume can be difficult to assess. Given the contribution trade promotion funds make to CG companies’ performance and the large expense this approach places on the P&L, manufacturers are working to improve and increase their insights into their performance (transform the process; guarantee outcomes; targeted results). The availability of purposebuilt tools, the massive amount of data now captured and a desire to better integrate promotional planning into the broader notion of S&OP have resulted in many businesses looking to truly optimize rather than just manage the process. In last year’s discussion of trade promotions, we proposed a maturity progression from basic spend management to truly collaborative promotion optimization. As with all maturity models, most companies sit in the middle; with only a few having moved up into the most advanced stages. Impediments to effective promotional assessment still exist, with the barriers indicated in Figure 5. This year’s survey data is a bit of a mixed bag. Forecasting baseline and access to promotions data continue to decline as an impediment, which is certainly good news; yet more companies this year indicated they don’t have an effective tool in place versus last. We do have a larger number of smaller company responses in this year’s data, which may explain the difference. We also hear, anecdotally, that many companies are rethinking internally-developed TPM systems in favor of commercially available alternatives from the major software vendors, which could also help to explain the difference. In terms of improving trade promotions per- SM10 | c g t | 2 0 1 4 s a l e s a n d m a r k e t i n g r e p o rt • By Sim on Ellis Impediments to Effective Promotional Assessment Q: What impediments at your company, if any, do you see preventing better assessment of trade promotions? Multiple responses allowed f i g u r e 5: Im p e d i m e n t 2014 2013 2012 The forecast baseline is difficult to define, so promotional lift is debatable. 35.2% 36.8% 58% The data from promotions is either difficult to access or inaccurate. 35.2% 42.1% 39% No impediments; this process is a core competency for us. 14.8% 26.3% 21% We do not have an effective tool in place. 46.3% 36.8% 13% TPM is a sales activity. 14.8% 15.8% 4% Source: IDC Manufacturing Insights and CGT, 2014 Improving the Performance of Trade Promotions Q. How are you improving your trade promotion performance? f i g u r e 6: Multiple responses allowed I MPRO VE ME N T TA CT I C 2013 2014 We are collaborating internally to design better promotions. 50% We are working with our retail customers to design better promotions. 44.4% We have improved the way we analyze the results so we can design better promotions. 42.6% We are using new technologies for our trade promotions management and optimization. We are using new channels for our trade promotions. Source: IDC Manufacturing Insights and CGT, 2014 81.6% 73.7% 68.4% 52.6% 40.7% 21.1% 20.4% 2014 sa le s and m a r k e t i n g r e por t Trade Promotion Management formance, we see similarly ranked responses as prior years, even though the absolute rankings are down across the board (Figure 6). Again, this could be skewed by a higher number of smaller companies, but it may also be that many companies have worked through these improvements already and taken the “low hanging fruit” such that further improvements are now more difficult to get. We would tend to dismiss that at IDC Manufacturing Insights, as our view is that there are plenty of improvement opportunities remaining. One such opportunity is to better leverage the value of big data and analytics. Technology plays a key role in delivering true collaborative trade promotion optimization, particularly in the abil- figur e 8 : Business Value of Big Data Q. For these technologies that your company is researching, piloting or currently using, what is the business value you expect to gain for your organization? Multiple responses allowed f i g u r e 7: VA L U E 44.8% Generate new revenue streams 40.3% Enhance products and/or services 28.4% Increase operational efficiencies Source: 2013 IDC Global Technology and Industry Research Organization IT Survey Integrated Business Planning SC Pl a n Supply Chain Poor Forecast Accuracy, TPM sa les Plan Trade Promotion Planning Master Data Accuracy, Design-for-Supply Chain, Flexibility S&OP Sales Product Plan, Promotional Plan, Account Plan, Share-of-Voice R&D Budget, Innovation Funnel, COGS Challenges Marketing m k Tg .Pl a n SM12 R&D | c g t | 2 0 1 4 s a l e s a n d m a r k e t i n g r e p o rt Finance Innovation Performance and Churn f i n . Pl a n NPDI Pl a n 2014 sa le s Trade Promotion Management ity to manage these large amounts of data, and to manage them quickly — often in real time. While an optimized process will use historical performance data to generate an improved “forecast” for all promotions, it is still critical to have real-time visibility into the performance to ensure that sales data is quickly analyzed to ensure that additional inventory is available as required. Certainly looking at the responses to the value from big data in Figure 7, we see direct linkages to the trade promotion process — whether using advanced analytics to drive increased promotion-related sales or the ability to better manage promotions for greater efficiency and lift. When considering the future of the trade promotion process, the end game will always be a moving target. As soon as a CG company arrives at the point of collaborative promotional optimization, the most mature stage, there will be new opportunities to seize. Three things immediately spring to mind. First, with the growing power of technology to analyze data quickly and provide usable insights in real time, there are more ways to engage consumers in the promotional process and more forms for promotions to take. Second, the omnichannel shopper is going to expect to see promotions across channels in which they shop, whether in store, online or some hybrid of the two. Third, as CG companies take a broader view of planning, trade promotion optimization will be increasingly viewed as a key part of the Integrated Business Planning (IBP) process. This last point is particularly interesting (Figure 8). and m a r k e t i n g r e por t Downstream Data New Developments Make This A Hot Topic Once Again • By Si mon Elli s e’ve been talking about the use of downstream data for what seems like an eternity — when it’s only actually been a decade! Long enough to have debated its merits and shortcomings, but also long enough to recognize that the ability to “see” farther down into consumer demand is transformative. Yet, I think most of us still consider downstream data to be in the early stages of maturity. Two recent developments in the CG supply chain reinforce the fact that the use of downstream data is incredibly critical: • First, demand is more unpredictable than ever, and many companies have seen a decline in forecasting accuracy. Better algorithms and clever math can certainly help, but we’d argue those only do marginally. • Second, more and more companies are realizing that customer/consumer-centricity ought to be the “first principle” of their supply chains. But to make better use of downstream data, one has to actually be able to get downstream data, and frankly, the methods of disbursement haven’t really moved much for years (Figure 9). When we rank the various ways in which consumer products companies get this data, we can see that the sources of data have not really changed much, and fewer companies are noting receipt from, for example, the retailer (Figure 10). Receiving data from a third party continues to be the major source; however, the realities of how most third-party providers manage the data and the fact that it’s not typically usable in real time minimizes the value for service performance. The fact of the matter is that by 2014, we really Methods for Receiving Downstream Data Q. How do you receive downstream data for your products? f i g u r e 9: Multiple responses allowed The end game of trade promotion processes will always be a moving target. Once consumer goods companies arrive at the point of collaborative promotional optimization, there will be new opportunities to seize. SM14 | c g t | 2 0 1 4 s a l e s a n d m a r k e t i n g r e p o rt METHOD We receive the data we need from retailer portals. We receive data directly from retailers. We receive data from a third-party provider. Source: IDC Manufacturing Insights and CGT, 2014 2013 2014 78% 60.7% 89% 67.9% 73.2% 100% 2014 sa le s and m a r k e t i n g r e por t Downstream Data would have expected a predominant amount of this data to come directly from the retailer. There is an 80:20 rule in play here — most CG companies simply aren’t going to bother with downstream data much below their top 20 retail customers. Yet, our results clearly suggest that even amongst the top 20, there is significant progress still to be made in direct-sourcing downstream data. I’m not one to spend a lot of time assigning blame, but the reality is that both manufacturers and retailers bear responsibility. Many retailers have not invested in the technical capabilities to enable portals or efficient direct sharing; manufacturers have not adequately demonstrated the benefits inherent to downstream data to facilitate these investments. Before “throwing the baby out with the bath water”, it is clear that things are improving, just perhaps not to the degree that we might have expected five years ago. Among the downstream data received by the various sources, data from the retailer has increased, whether provided directly or via portal access (up in total from about 50 percent in 2013 to 68 percent in 2014) and that is clearly good news, but it should be higher. In my days in the industry, it was my view that downstream data really needed to be at or around 75 percent to provide the maximum impact — I thought we’d have been there by now. I don’t have much doubt that the industry will get there, particularly as data management and analytics capabilities get so much better — “all dressed up and nowhere to go” is not a particularly good refrain! Enough criticism, though, let’s take a look to the future. While traditional transactional data still has a ways to go, and remains the single most analyzed forms of data (Figure 11), CG companies are looking at some of the more interesting emerging forms of downstream data. Some of these are new forms of quantifiable data, things like machine or mobile device generated, which can be used to directly affect quantitative demand forecasts and supply plans. But most are unstructured forms of data that cannot so easily be used to adjust forecasts. In some cases, we are seeing these forms of data used to “attenuate” a forecast. In other cases, they are used more for marketing and product refinement purposes. As we move into this brave new world of social media data, it is incumbent on both manufacturers and retailers to leverage these new forms of data as best they can, but also to not sight of progress still needing to be made around more traditional forms of downstream data. f i g u r e 10: Methods for Receiving Majority of Downstream Data Q. How do you receive the majority of the downstream data for your products? METHOD 2013 2014 We receive data from a third-party provider. We receive data directly from retailers. We receive the data we need from retailer portals. 69.4% 54.2% 22.2% 18.8% 2.8% 14.6% Source: IDC Manufacturing Insights and CGT, 2014 f i g u r e 11: Top Data Types Captured and Analyzed in Consumer Products Q. What types of data are or will be captured and analyzed today or in the next 12 months? Multiple responses allowed T Y P E O F D ATA 15.7% Transactional data Text from non-social network sources 11% Machine or device generated sensor data 9.5% 8.4% Web logs Video GPS data from mobile devices Audio Chatter on social networks (unstructured data) 6.6% 5.4% 4.2% 3.4% Source: 2013 IDC Global Technology and Industry Research Organization IT Survey SM16 | c g t | 2 0 1 4 s a l e s a n d m a r k e t i n g r e p o rt 2014 sa le s and m a r k e t i n g r e por t Direct to Consumer The Continuing Evolution of Consumer Engagement his is a fascinating topic for continuing discussion, as it tends to inflame passions — from both retailers and from CG manufacturers. As we have noted in past years, technological progress and retailer focus on private label/brand products has conspired to force manufacturers to explore direct to consumer. Yet, the approach has been changing — from direct commercial relationships (selling direct) to one characterized more by a marketing relationship than a direct commercial one. That hasn’t stopped leading companies, like Procter & Gamble, from exploring potential approaches, and partnerships (efforts recently announced with Amazon), to facilitate direct to consumer. But for most companies, the preferred future appears to be to engage with consumers on a brand and marketing level, but leave the actual selling to traditional channels. This approach, if proven true through the passage of time, seems visionary and foolish, paradoxically both at the same time. CG companies are not retailers, and while an increasing number of them are actually looking at opening their own stores (note the percent doubling since 2012), this is neither a trivial undertaking nor one that necessarily leverages core competencies. So, engaging with the consumer through direct marketing and sales efforts does make sense and is underpinned with core competencies in those disciplines. Yet, consumers have clearly shown that they want choice, and this choice is reflected in a de- figur e 1 2 : Direct-to-Consumer Sales Q. Are you currently selling products directly to consumers? STATU S 2012 2014 60% 58% 53.7% Selling D2C today 33% 28% 40.7% No plans for D2C Planning to sell D2C in next two years 2013 7% 14% 5.6% Source: IDC Manufacturing Insights and CGT, 2014 • By Si mon Elli s Technological progress and the retailer’s focus on private label brands have forced manufacturers to explore direct to consumer. sire to purchase their products across a broad range of channels — the ubiquitous omnichannel. The eventual reality may end up being both: The majority of direct to consumer is about brand marketing and sales, but the ability to actually buy the product directly is there for consumers who really want it! Asking CG companies about their direct-to-consumer efforts “shouts” indecision — companies appear to be unclear about what really to do. As summarized in Figure 12, we have seen a gradual decline in companies selling direct to consumer since 2012, and an increase in companies saying they have no plans to do so. To be fair, though, 40 percent who say they have “no plans” also means that 60 percent do. We also see a decline in the number of companies planning to sell direct to consumer within the next two years. f i g u r e 13: Direct-to-Consumer Sales Channels Q. How are you currently selling products directly to consumers? 2012 APPROACH 60 sites. 58 Yes, through third-party Internet 33 28 Yes, through our own web site. 7 own Yes, through our physical retail outlets. 14 2013 | c g t | 2 0 1 4 s a l e s a n d m a r k e t i n g r e p o rt 41% 42% 53.7 22.2% 33% 39% 33.3% 40.7 11% 5.6 19% 20.4% Source: IDC Manufacturing Insights and CGT, 2014 0 SM18 2014 10 20 30 40 50 60 2014 sa le s and m a r k e t i n g r e por t Direct to Consumer If we look at the mechanisms through which companies would sell their products, we again see a decline in two of the three alternatives (Figure 13). Selling “directly through third-party sites” has declined the most, but so has selling “through our own web site”. The only approach that has grown slightly, as we noted previously, is selling “through our own physical retail outlets”. We are dealing with a modest sample size in this survey, so the results must be tempered by that fact, but the results from the questions do support what we are hearing anecdotally in the industry — that a marketing relationship is favored over a direct commercial one. The smart companies will explore the mechanisms to facilitate direct consumer sales, just in case and even if they also believe that a direct marketing relationship is the more likely course. This begs the question of the inherent value of a marketing relationship — and its linkage to social customer experiences. We asked two questions, the results of which are summarized in Figures 14 and 15, about the linkage between business value and “social customer experience” and between business value and “social innovation management”. The former is essentially the role that social interactions play in the overall brand relationship; the latter is the role social interactions play in the brand innovation process. The top responses are similar. The overall relationship with the consumer is about generating greater levels of customer loyalty first, while also enhancing products and services. The role of social innovation management is, as one would expect, more about the role and performance of the actual products in enhancing and improving the user experience. As CG companies continue to explore the right approach for direct to consumer, it seems reasonable to think that social business technologies and engagements will play a huge role in facilitating success. It also seems wise to at least explore the available options for selling directly to the consumer, should such capability end being important to the future performance of the business. SM20 | c g t | 2 0 1 4 s a l e s a n d m a r k e t i n g r e p o rt f i g u r e 14: Top Business Values of Social Customer Experience Q. What is the business value you expect to gain for your organization for social customer experience initiatives? Multiple responses allowed B U S I N E S S VA L U E 45.6% Garner greater customer loyalty 44.1% Enhance products and/or services 38.2% Generate new revenue streams More effectively manage suppliers 22.1% Source: 2013 IDC Global Technology and Industry Research Organization IT Survey Asking consumer goods companies about their direct-to-consumer efforts “shouts” indecision. Companies appear to be unclear about their approach. f i g u r e 15: Top Business Values of Social Innovation Management Q. What is the business value you expect to gain for your organization for social innovation management initiatives? Multiple responses allowed B U S I N E S S VA L U E 47.8% Enhance products and/or services 38.8% Garner greater customer loyalty 35.8% Generate new revenue streams Improve human capital management 22.4% Source: 2013 IDC Global Technology and Industry Research Organization IT Survey 2014 sa le s and m a r k e t i n g r e por t S&OP The Journey Toward Integrated Business Planning Sales & Operations Planning (S&OP) has suffered from an extreme case of “alphabet soup” over its long lifetime. Perhaps this is to justify repetitive implementations (“we are re-implementing S&OP as SI&OP because of the key role of inventory”) or a desire to engage at a broader level. We have seen, in no particular order S&OP, SI&OP, SM&OP (where M = Marketing) and Integrated Business Planning (IBP). While we here at IDC Manufacturing Insights find this pursuit of the perfect acronym generally a bit silly, the notion of IBP and its interrelationship with S&OP is actually quite interesting, and we would like to explore it here. One of the core challenges that we see in CG organizations is the tension between the supply and demand sides of the supply chain. Demand is becoming more and more volatile and forecast accuracy is declining; at the same time global supply is becoming more complex and long lead times are commonplace. Volatile demand and extending supply are actually working against each other — particularly where the delivery of service obligations are concerned. This is illustrated in Figure 16. figur e 1 6 : • By Si mon Elli s The broader notion of IBP, as distinct from S&OP, is at the head of the list in terms of ways to bridge gaps between supply and demand. At the core, it is about managing the forecast, but also about managing the ability of the business to respond rapidly to changes in either the internal or external environment — across multiple functions. IBP (illustrated previously in Figure 8) is the holistic business process that connects all the various planning functions across an entire organization to enable the alignment of operational and financial performance goals. In the context of IBP, S&OP is the key orchestrating capability that sits on top of, and spans across, the demand, supply and fulfillment capabilities of the business to ensure that a consensus plan is reached and that all constituents in the business are operating against a common set of targets. S&OP is a critical component of IBP, just like demand or supply planning: • S&OP – Key orchestrating capability; “Are we all working to the same targets?” • Demand Sensing & Planning – Used synonymously, but a key capability to manage demand volatility and forecast- Disconnects Between Demand and Supply Sides of Supply Chain IBP - Balance Forecasting and Responsiveness (Agility) Complexity Management Agile Inventory Supply Complexity Cost Control Service Centricity Risk Management Technology Pillars: Cloud, Big Data/Analytics, Mobility, Social Business Product and Service Proliferation SM22 | c g t | 2 0 1 4 s a l e s a n d m a r k e t i n g r e p o rt Demand Volatility 2014 sa le s and m a r k e t i n g r e por t S&OP ing improvements; “Are we capturing the best demand signal possible?” • Supply Planning – MRP and constraint analysis; “What are our supply limitations, and can we support the proposed business plans?” • Production Planning – Factory scheduling and line planning; “What and when do we make on which lines?” At the same time, fulfillment, inventory management and network optimization are all part of the integrated planning process. Our objection to adding inventory to the acronym (thus SI&OP) is that it has always been part of the operational process, just as network design and supply management are — it is unnecessarily redundant. S&OP is, by its very nature, a supply-chain-centric process, with critical input from other functions, yes, but ultimately owned by the supply chain. It essentially tries to solve the lack of coordination between business functions. Yet, as we stated earlier, IBP is much more than that, it is the holistic business process that connects all the various planning figur e 1 7 : functions across an entire organization to enable the alignment of operational and financial performance goals. It is not just supply chain planning, but how far does it go? Is it also product planning, customer planning and financial planning? At IDC Manufacturing Insights, we’d argue that it is all of these things (Figure 17). The overall ability for a consumer products company to plan the business, whether at a strategic, tactical or operational level, depends upon the timely delivery of a marketing plan, a sales plan, a supply chain plan and a financial plan. All are required, but they must all be done in the context of each other and be strategically aligned. For example, the process of setting working capital targets cannot be done in a vacuum. It must take into account factory capacity and desired service levels. Very often we see companies whose capacity and working capital targets are incompatible with their service aspirations — and then they wonder why they missed. S&OP manages the operational side of the business, but it does not address the broader, cross-functional decisions that are managed by the IBP process. Holistic Integrated Business Planning c u s t om e r pl a n n i n g Analytics Sales & Operations Planning p r od u c t p la nning de m an d supply fulf i llmen t •Demand Sensing •Supply Planning •Production Planning •Order Management •Demand Forecasting •Fast Planning/MRP •Factory Scheduling •Warehousing •Transportation Inventory Management & Optimization Network Optimization SM24 | c g t | 2 0 1 4 s a l e s a n d m a r k e t i n g r e p o rt f i na nci a l pl anni ng

© Copyright 2026