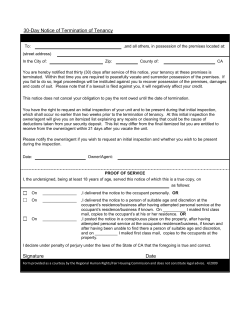

Document 40452

March 4, 2014 Translation of Japanese Original To All Concerned Parties REIT Issuer: Kenedix Residential Investment Corporation Representative: Akira Tanaka, Executive Director (Securities Code Number: 3278) Asset Management Comp any: Kenedix Real Estate Fund Management, Inc. Representative: Ryosuke Homma, President and Representative Director Contact: Akihiro Nakao, General Manager of Planning Department, Residential REIT Division TEL. +81-3-5623-8682 Notice Concerning Additional Acquisition of Asset (Silent Partnership Equity Interest) Kenedix Residential Investment Corporation (the “Investment Corporation”) announced today the decision to acquire additionally the following asset consisting of a silent partnership equity interest, which is relevant to G.K. Creek Investment II described in the press release “Notice Concerning Acquisition of Asset (Silent Partnership Equity Interest)” announced on February 18, 2014. Details are as follows. 1. Overview of the Acquisition (1) Type of Additional Acquisition Equity interest in silent partnership investing in real estate in trust beneficiary interest (the “Beneficiary Interest”) (2) Asset Name G.K. Creek Investment II (1) (3) Real Estate in Trust Regalo Minami-kusatsu Crane Mansion Tsurumi (4) Additional Investment ¥165,000 thousand (approx. 28.1% of total net assets including additional Amount(2) silent partnership equity interest) (5) Scheduled Date of Conclusion March 4, 2014 of Sales Contract (6) Scheduled Date of Acquisition March 7, 2014 (7) Funds for Acquisition Cash on hand The above acquisition shall hereinafter be referred to as the “Silent Partnership Equity Interest.” (Note 1) In addition to the above (3) Real Estate in Trust, G.K. Creek Investment II has already owned the real estate in trust of 2 properties. For more information about existing real estate in trust, please refer to the press release “Notice Concerning Acquisition of Asset (Silent Partnership Equity Interest)” announced on February 18, 2014. (Note 2) In addition to this acquisition, the Investment Corporation has invested a 400,000 thousand yen silent partnership equity interest as of February 19, 2014. For more information about existing investment amount, please refer to the press release “Notice Concerning Acquisition of Asset (Silent Partnership Equity Interest)” announced on February 18, 2014. 2. Reason for Acquisition The Silent Partnership Equity Interest is being acquired to secure opportunities for the flexible growth of the asset size in the future as well as opportunities for additional revenues, in accordance with the Investment Corporation’s fundamental investment policies and approach to investing, as set forth in its Articles of Incorporation. With the acquisition of the Silent Partnership Equity Interest, the Investment Corporation will obtain preferential negotiation rights(1) for the acquisition of the real estate in trust or its trust beneficiary interest (together to be referred to as the “Real Estate in Trust, etc.”). While the Investment Corporation is not obliged to acquire the Real Estate in Trust, etc. by obtaining these preferential negotiation rights, it believes that these will contribute to an expansion of its asset size and an increase in profitability from a mid- to long-term perspective as the execution of the preferential negotiation rights will secure opportunities for flexible acquisitions of excellent rental residences. The acquisition of the Silent Partnership Equity Interest is an investment opportunity discovered by the independent gathering of information in the real estate investment market by the Investment Corporation’s asset manager Kenedix Real Estate Fund Management, Inc. (the “Asset Management Company”). By obtaining investment opportunities from non-sponsors such as by utilizing the independent network of the Asset Management Company as well as from the sponsors’ property pipelines, the Investment Corporation will continue to steadily implement initiatives to expand the asset size and increase profitability in the future. Additionally, the Investment Corporation will receive profits in the form of dividends, backed by lease rents and other income from the real estate in trust and therefore additional investment revenues are expected. In the decision to acquire the Silent Partnership Equity Interest, the following points of the real estate in trust were evaluated. Property Name Characteristics of the Property The property is on the plaza in front of Minami-Kusatsu Station on the JR Tokaido Line. The Biwako-Kusatsu Campus of Ritsumeikan University is nearby and there are several factories and research centers of large companies in the area. As a result, this is a distinctive real estate market in which the nearby university and corporate facilities Regalo Minami-kusatsu are expected to generate steady rental demand. This property is only about 17 minutes to Kyoto Station on an express train from Minami-Kusatsu Station, adding to the convenience of this location. Furthermore, the area around the station is an excellent residential environment with many stores and a park. These characteristics point to substantial rental demand for people who work in Kyoto, too. The property gives residents access to two railway lines. Keikyu Tsurumi Station on the Keikyu Line is about an 11-minute walk away and walking distance to Tsurumi Station on the JR Keihin-Tohoku Line is about 13 minutes. From either train station, it is about 10 minutes to Yokohama Station, 19 minutes to Shinagawa Station and 29 minutes to Crane Mansion Tsurumi Tokyo Station. This allows residents to reach a number of major urban centers with ease. In addition, the property is in a highly desirable residential area that borders the Tsurumi River. The area has parks, stores and other amenities for daily activities. Steady demand for the rental units from families and smaller households is expected. 2 (Note1) The Investment Corporation already holds preferential negotiation rights for the acquisition of real estate beneficiary rights that are suitable for existing trusts. 3. Outline of the Silent Partnership Name of Operator Silent Partnership Agreement Valid Until Total Amount of Net Assets Including Silent Partnership Equity Interest Overview of the Silent Partnership Agreement G. K. Creek Investment II February 18, 2019 ¥588 million The overview of the silent partnership in which the Investment Corporation will invest is as follows: (Silent Partnership Equity Interest) G.K. Creek Investment II (Assets) (Liabilities) Trust beneficiary interest in real Limited recourse loan: estate, etc. (Note 1): ¥2,582 million ¥3,170 million (Equity) Net assets including silent partnership equity interest (Notes 2 and 3): ¥588 million (Note 1) Trust beneficiary interest in real estate, etc. includes formulation costs, reserve money, etc. The total appraisal value of the real estate (2 properties) is ¥3,340 million yen (Note 2) The Investment Corporation is scheduled to invest ¥165 million (approx. 28.1%) of the total amount of net assets, etc. of G.K. Creek Investment. (Note 3) Kenedix, Inc. (“KDX”), the shareholder of the Asset Management Company, is scheduled to conduct a 423 million yen silent partnership equity interest investment (approx. 71.9%) in G.K. Creek Investment II. KDX is an interested person, etc. as defined under the Act on Investment Trusts and Investment Corporations (the “Investment Trust Act”) and a related party as set forth in the Related-party Transaction Rules of Residential REIT Division, the Asset Management Company. (After Acquisition of Silent Partnership Equity Interest) G.K. Creek Investment II (Assets) (Liabilities) Trust beneficiary interest in real Limited recourse loan: estate, etc. (Note 4): ¥7,100million ¥9,165 million (Equity) Net assets including silent partnership equity interest (Notes 5 and 6): ¥2,065million (Note 4) Trust beneficiary interest in real estate, etc. includes formulation costs, reserve money, etc. The total appraisal value of the real estate (4 properties) is ¥9,210 million yen (Note 5) The total amount of silent partnership including existing of the Investment Corporation would be ¥565 million yen (approx. 27.4%). (Note 6) KDX has already invested a 1,077 million yen silent partnership equity interest in G.K. Creek Investment II, and the total amount of silent partnership including existing of KDX would be ¥1,500 million yen (approx. 72.6%). 3 Calculation period: For every 12 months, the three months commencing March 1 through May 31, June 1 through August 31, September 1 through November 30 and December 1 through the end of February of the following year. However, the first calculation period shall commence from February 20, 2014 through May 31, 2014 and the last date of the final calculation period shall be the termination date of the silent partnership agreement. Distribution of profit The operator will distribute profits and losses that arise and loss: from the silent partnership operation to the silent partners in each calculation period according to the division ratios of profit and loss. Furthermore, the limit of loss to be borne by the operator shall be the amount of investment of the silent partners. However, if profit has arisen from the silent partnership operation and if there is untreated cumulative loss borne by silent partners, the profits shall firstly be allotted to the cumulative loss. KDX started performing asset management services for G.K. Creek Investment II on February 18, 2014 and, even after making additional purchases, plans to continue providing asset management services for G.K. Creek Investment II. Overview of Preferential Negotiation Rights Period: From March 7, 2014 to February 28, 2017 Minimum acquisition price: ¥3,150,400 thousand (including consumption tax) The minimum acquisition price including consumption tax will remain the same even if the consumption tax rate changes in the future. Breakdown: Regalo Minami-kusatsu: ¥2,079,200 thousand (including consumption tax) Crane Mansion Tsurumi: ¥1,071,200 thousand (including consumption tax) Outline of rights: The Investment Corporation may preferentially negotiate with the operator with regard to the acquisition of the Real Estate in Trust, etc. for the price of at least the minimum acquisition price above by notifying the operator in writing that it wishes to acquire the Real Estate in Trust, etc. Between March 7, 2014 and September 30, 2015, the operator, in principle, does not conduct sales, etc. of the Real Estate in Trust to parties other than the Investment Corporation or the Asset Management Company without prior written consent. Furthermore, the operator, in principle, is obliged to notify the Investment Corporation and the Asset Management Company when it is to begin preparation of sales activities, etc. between October 1, 2015 and February 28, 2017. Other: The preferential negotiation right is held by the Investment Corporation as a right and does not bear any obligation to acquire the Real Estate in Trust in the future. Furthermore, consent of the operator will be the condition for the acquisition of the Real Estate in Trust based on the preferential negotiation right. 4. Details of the Real Estate in Trust (1) Regalo Minami-kusatsu Property Name Type of Asset Trustee Trust Term Location (Address) (Note 1) Land Type of Ownership Regalo Minami-kusatsu Trust beneficiary interest in real estate Sumitomo Mitsui Trust Bank, Limited. September 12, 2008 to the end of February 2024 1-1-8 Minami-kusatsu,Kusatsu-shi, Siga Proprietary ownership 4 Site Area Use Districts Building Coverage Ratio (Note 2) Building Floor Area Ratio (Note 2) Type of Ownership Total Floor Area Construction Completion Date Usage Type (Note 3) Structure / Number of Stories Leasable Number of Units Architect Contractor Building Permit Agency Probable Maximum Loss (Note 4) Appraisal Value (Note 5) Appraiser Details of the Tenants Total Number of Tenants Monthly Rent (Note 6) Security and Guarantee Deposit (Note 7) Total Leased Units (Note 8) Total Leased Area (Note 9) Total Leasable Area (Note 10) Occupancy Ratio (Note 11) 1,286.29 m2 Commercial districts 80% 500% Proprietary ownership 6,956.20m2 March 2008 Apartment building and Retail facilities Single Steel-reinforced concrete structure with flat-topped roof / 14-story building 170 units Archinet-Kyoto First-Class Registered Architects Matsui Kensetsu K.K. I-PEC Corporation 8.84% ¥2,120,000 thousand DAIWA REAL ESTATE APPRAISAL CO., LTD. (As of December 31, 2013) 1 ¥13,968 thousand ¥36,001 thousand 168 units 5,628.17 m2 5,735.97 m2 98.1 % (Note 1) “Location” is the indication of the residential address of the building. The same shall apply hereafter. For properties with no residential address, a building address using block numbers or a building location using information in the registration certificate (block numbers if there is more than one) are shown. (Note 2) “Building Coverage Ratio” and “Floor Area Ratio” are the maximum building-to-land ratio provided in the city plan or the maximum floor area ratio provided in the city plan. The same shall apply hereafter. (Note 3) “Type” is the classification of the principal residential units of the Real Estate in Trust, the single type, the small family type or the family type as described below (provided, however, in case the principal residential units fall under more than one type, the type to which the largest principal units based on the exclusively-owned area belong is described). The same shall apply hereafter. Family type Single type Small family type (housing mainly for single households) (housing mainly for married-couple households (housing mainly for family households of 3 persons or more) and family households with an infant) The exclusively-owned area per residential unit The exclusively owned area per residential unit The exclusively-owned area per residential unit contains at least 18m2 but less than 30m2. contains at least 30m2 but less than 60m2. contains at least 60m2. (Note 4) “Probable Maximum Loss” (PML) is the figure described in the earthquake PML valuation report prepared by Sompo Japan Nipponkoa Risk Management Inc. in January 2014. The same shall apply hereafter. (Note 5) Please refer to the reference material (1) about the appraisal date. (Note 6) “Monthly Rent” is based on the figures and information received from the current beneficiary of the Beneficiary Interest and is the sum of monthly rents based on the lease agreements with the end tenants (the sum of rent and common area maintenance charges of the residents etc., provided, however, that in case the adjunct facilities fee such as car parking space usage fees are included in the lease agreements, it includes such fees). The same shall apply hereafter. (Note 7) “Security and Guarantee Deposit” is based on the figures and information received from the current beneficiary of the Beneficiary Interest and is the sum of the security and guarantee deposit, etc. which is obliged to repay to the end tenants based on lease agreements which were actually executed with the end tenants. Furthermore, the figures are rounded down to the nearest thousand yen. The same shall apply hereafter. (Note 8) “Total Leased Units” is the number of units leased to end tenants based on the figures and information received from the current beneficiary of the Beneficiary Interest. The same shall apply hereafter. (Note 9) “Total Leased Area” is the area for which lease agreements are concluded and executed with end tenants based on the figures and information received from the current beneficiary of the Beneficiary Interest. The same shall apply hereafter. (Note 10) “Total Leasable Area” is the floor area that is leasable at the respective Real Estate in Trust (in case the respective real estate in trust contains more than one building, the sum of the leasable floor area of such buildings) and is based on the figures and information received from the current beneficiary of the Beneficiary Interest or on calculations using completion drawings of the building. The same shall apply hereafter. (Note 11) “Occupancy Ratio” is the ratio of the “Total Leased Areas” (based on the lease agreements) to the “Total Leasable Area” of the respective real estate in trust rounded to the first decimal place. The same shall apply hereafter. 5 (2) Crane Mansion Tsurumi Property Name Type of Asset Trustee Trust Term Location (Address) (Note 1) Type of Ownership Site Area Use Districts Land Building Coverage Ratio (Note 2) (Note 2) Building Floor Area Ratio Type of Ownership Total Floor Area Construction Completion Date Usage Type (Note 3) Structure / Number of Stories Leasable Number of Units Crane Mansion Tsurumi Trust beneficiary interest in real estate Sumitomo Mitsui Trust Bank, Limited. October 30, 2003to the end of February 2024 1-10 Mukai-cho, Tsurumi-ku, Yokohama-shi, Kanagawa Proprietary ownership 2,003.62 m2 Quasi-industrial districts 60% 200% Proprietary ownership 3,573.86 m2 July 1990 Retail facilities and Apartment building Small Family Steel-reinforced concrete structure with flat-topped roof / 7 story building 59 units Architect Institute of New Architecture Contractor Building Permit Agency Probable Maximum Loss (Note 4) Appraisal Value (Note 5) Appraiser Details of the Tenants Total Number of Tenants Monthly Rent (Note 6) Security and Guarantee Deposit (Note 7) Total Leased Units (Note 8) Total Leased Area (Note 9) Total Leasable Area (Note 10) Occupancy Ratio (Note 11) Siraishi Kensetsu Co., Ltd. Yokohama-shi, Kanagawa 11.05% ¥1,220,000 thousand Japan Real Estate Institute (As of December 31, 2013) 1 ¥7,284 thousand ¥14,861 thousand 54 units 3,209.76 m2 3,499.84 m2 91.7 % 5. Profile of Operator of Silent Partnership (1) Company Name (2) Location (3) Title and Name of Representative (4) Description of Business G.K. Creek Investment II 6-5 Nihombashi Kabuto-cho, Chuo-ku, Tokyo Representative: Ippan Shadan Hojin Silver Wave Office administrator: Kazumasa Izuka 1. Acquisition, holding, disposal and leasing of real estate 2. Acquisition, holding and disposal of trust beneficiary interest in real estate 3. All business incidental to the above (5) Capital ¥1 million (6) Date of Incorporation January 15, 2014 (7) Relationship with the Investment Corporation and the Operator / The Asset Management Company and the Operator There is no special capital relationship between the Asset Management Company and the operator. The Investment Corporation has invested a 400,000 million yen silent partnership equity interest in operator on February 20, 2014. KDX, the parent company of the Asset Management Company, has Capital Relationship invested a 1,077 million yen silent partnership equity interest on February 20, 2014 and is scheduled to invest additional 423 million yen silent partnership equity interest on the same day as the Investment Corporation’s silent partnership equity interest investment. After this investment, the total 6 Personnel Relationship Business Relationship Applicability as a Related Party amount of silent partnership including existing of KDX would be more than half of silent partnership equity interest. There is no special personnel relationship between the Investment Corporation and the operator or the Asset Management Company and the operator. Furthermore, there is no personnel relationship to report between related parties or associated companies of the Investment Corporation or the Asset Management Company and related parties or associated companies of the operator. There is no special business relationship between the Asset Management Company and the operator, but the Investment Corporation has invested a 400,000 thousand yen silent partnership equity interest in operator on February 20,2014. Furthermore, there is no business relationship to report between related parties or associated companies of the Investment Corporation Company and related parties or associated companies of the operator, but KDX, the shareholder of the Asset Management Company, has invested a 1,077 million yen silent partnership equity interest in operator on February 20, 2014 . The operator is not a related party of the Investment Corporation but is a related party of the Asset Management Company. This is because KDX, which is the shareholder (100%) of the Asset Management Company is an interested person, etc. as defined under the Act on Investment Trusts and Investment Corporations, and has invested silent partnership equity interest in more than half of the operator and also because asset management has been entrusted to KDX, which is an interested person, etc. as defined under the Act on Investment Trusts and Investment Corporations. 6. Related-party Transactions G.K. Creek Investment II is an interested person, etc. as defined under the Act on Investment Trusts and Investment Corporations. Furthermore, G.K. Creek Investment II is a related party as set forth in the Related-party Transaction Rules of Residential REIT Division, the Asset Management Company, since KDX, which is the shareholder (100%) of the Asset Management Company and is an interested person, etc. as defined under the Act on Investment Trusts and Investment Corporations, has conducted silent partnership equity interest investment in more than half of G.K. Creek Investment II, and since G.K. Creek Investment II has entrusted the advisory business concerning asset management to KDX, which is an interested person, etc. as defined under the Act on Investment Trusts and Investment Corporations. 7. Settlement Method, etc. As stated in “8. Date of Acquisition” below. 8. Date of Acquisition Date of decision of acquisition Scheduled date of silent partnership equity interest investment Delivery of trust beneficiary interest in real estate to operator of silent partnership March 4, 2014 March 6, 2014 March 7, 2014 9. Forecast The impact of the acquisition of the Silent Partnership Equity Interest on the period ending July 2014 (February 1, 2014 to July 31, 2014) is minimal. Therefore, the forecast of financial results for the period remains unchanged. 7 Attached Materials Reference Material (1) Outline of Real Estate in Trust Appraisals Reference Material (2) List of Minimum Acquisition Price Reference Material (3) Exterior and Map of Real Estate in Trust Reference Material (4) List of Property Portfolio after the Acquisition of the Silent Partnership Equity Interest * The original Japanese version of this material is distributed today to the Kabuto Club (press club of the Tokyo Stock Exchange), the Ministry of Land, Infrastructure, Transport and Tourism Press Club and the Ministry of Land, Infrastructure, Transport and Tourism Press Club for Papers in the Construction Industry. * Website URL of the Investment Corporation: http://www.kdr-reit.com/english/ [Provisional Translation Only] English translation of the original Japanese document is provided solely for information purposes. Should there be any discrepancies between this translation and the Japanese original, the latter shall prevail. 8 Reference Material (1) Outline of Real Estate in Trust Appraisals Unit: Thousands of yen Real estate in trust Appraiser Appraisal value Appraisal date Direct capitalization method (1) Gross operating revenue Regalo Minami-kusatsu DAIWA REAL ESTATE APPRAISAL CO., LTD. 2,120,000 February 1, 2014 Maximum gross operating revenue Shortfall attributed to vacancies (2) Operating expenses Administrative and maintenance expense Taxes and dues Other expenses (3) Net operating income (NOI) (1) – (2) (4) Capital expenditure (5) Gain on guarantee deposit investment (6) Net cash flow (NCF) (3) + (5) – (4) (7) Overall capitalization rate (NCF) (8) Value calculated using the direct capitalization method Value calculated using the discounted cash flow method Discount rate Terminal capitalization rate Value calculated using the cost method Land Building 9 Crane Mansion Tsurumi Japan Real Estate Institute 1,220,000 January 1, 2014 184,597 198,228 13,631 46,415 29,606 10,664 6,145 93,196 103,022 9,826 19,927 14,959 4,936 32 138,182 8,687 444 73,269 3,640 319 129,939 69,948 6.1% 2,130,000 2,120,000 5.9% 6.3% 1,850,000 30.7% 69.3% 5.7% 1,230,000 1,210,000 5.5% 5.9% 1,170,000 74.7% 25.3% Reference Material (2) List of Minimum Acquisition Price Minimum acquisition price of real estate in trust (2 properties) are as follows: Property Name Minimum Acquisition Price including Tax (thousand yen) Assumption of consumption tax rate 8% Minimum Acquisition Price before Tax (thousand yen) Appraisal NOI Cap Rate Assumption of consumption tax rate 10% Minimum Acquisition Price before Tax (thousand yen) Appraisal NOI Cap Rate Regalo Minami-kusatsu 2,079,200 1,970,000 7.0% 1,945,000 7.1% Crane Mansion Tsurumi 1,071,200 1,050,000 7.0% 1,045,000 7.0% (Note 1) The divisions between prices of the land and building in the minimum acquisition price (before tax) is based on the land and building prices using the values determined by the cost method as listed in the most recent property appraisal. (Less than one million yen are rounded off) (Note 2) Calculations assume that the consumption tax rate and regional consumption tax rate will be raised in steps as stipulated in the amended Consumption Tax Act. (Note 3) Appraisal NOI Cap Rate are calculated by dividing yearly NOI described in the most recent property appraisals by Minimum Acquisition Price before tax. 10 Reference Material (3) Exterior and Map of Real Estate in Trust (1) Regalo Minami-kusatsu 11 (2) Crane Mansion Tsurumi 12 Reference Material (4) List of Property Portfolio (Including the Silent Partnership Equity Interest) Area Property Name Acquisition Price (Note) (Thousands of yen) 4.7 May 1, 2012 KDX Yoyogi Residence 1,320,000 1.3 May 1, 2012 KDX Odemma Residence 1,775,000 1.8 May 1, 2012 822,000 0.8 May 1, 2012 1,488,000 1.5 May 1, 2012 650,000 0.7 May 1, 2012 2,830,000 2.9 May 1, 2012 KDX Azumabashi Residence KDX Shimura Sakaue Residence Nichii Home Tama Plaza (Land with leasehold interest) Cosmo Heim Motosumiyoshi (Land with leasehold interest) KDX Musashi Nakahara Residence 960,000 1.0 April 26, 2012 1,750,000 1.8 April 26, 2012 637,000 0.6 May 1, 2012 1,480,000 1.5 May 1, 2012 1,150,000 1.2 May 1, 2012 KDX Residence Shirokane I 3,000,000 3.0 August 7, 2013 KDX Residence Shirokane III 2,900,000 2.9 August 7, 2013 KDX Residence Shirokane II 2,800,000 2.8 August 7, 2013 KDX Residence Minami-aoyama 2,230,000 2.3 August 7, 2013 KDX Residence Minami-azabu 2,080,000 2.1 August 7, 2013 KDX Residence Shiba Koen 1,781,000 1.8 August 7, 2013 KDX Residence Azabu East 1,560,000 1.6 August 7, 2013 KDX Residence Takanawa 770,000 0.8 August 7, 2013 KDX Residence Nishihara 1,450,000 1.5 August 7, 2013 KDX Residence Daikanyama II 730,000 0.7 August 7, 2013 KDX Residence Sendagaya 650,000 0.7 August 7, 2013 KDX Chiba Chuo Residence KDX Kawaguchi Saiwai-cho Residence Area (Scheduled) 4,700,000 KDX Bunkyo Sengoku Residence Metropolitan Acquisition Date KDX Daikanyama Residence KDX Iwamoto-cho Residence Tokyo Ratio (Note) KDX Residence Nihombashi Suitengu August 7, 2013 3,240,000 3.3 Hakozaki 1,147,000 1.2 KDX Residence Higashi-shinjuku 3,270,000 3.3 August 7, 2013 KDX Residence Yotsuya 2,260,000 2.3 August 7, 2013 KDX Residence Nishi-shinjuku 1,000,000 1.0 August 7, 2013 720,000 0.7 August 7, 2013 1,250,000 1.3 August 7, 2013 920,000 0.9 August 7, 2013 KDX Residence Nihombashi August 7, 2013 KDX Residence Kagurazaka KDX Residence Futako Tamagawa KDX Residence Komazawa Koen 13 KDX Residence Mishuku 760,000 0.8 August 7, 2013 KDX Residence Yoga 700,000 0.7 August 7, 2013 KDX Residence Shimouma 600,000 0.6 August 7, 2013 Raffine Minami-magome 1,250,000 1.3 August 7, 2013 KDX Residence Yukigaya Otsuka 1,050,000 1.1 August 7, 2013 KDX Residence Denen Chofu 1,000,000 1.0 August 7, 2013 KDX Residence Tamagawa 776,000 0.8 August 7, 2013 KDX Residence Monzennakacho 773,000 0.8 August 7, 2013 Metropolitan KDX Residence Okachimachi 850,000 0.9 August 7, 2013 Area KDX Residence Moto-asakusa 800,000 0.8 August 7, 2013 KDX Residence Itabashi Honcho 620,000 0.6 August 7, 2013 KDX Residence Azusawa 550,000 0.6 August 7, 2013 KDX Residence Tobu Nerima 420,000 0.4 August 7, 2013 KDX Residence Yokohama Kannai 800,000 0.8 August 7, 2013 KDX Residence Miyamaedaira 999,000 1.0 August 7, 2013 1,800,000 1.8 August 7, 2013 Tokyo KDX Residence Machida 47 properties subtotal 67,068,000 KDX Toyohira Sanjo Residence 582,500 0.6 May 1, 2012 KDX Jozenji Dori Residence 1,015,000 1.0 May 1, 2012 KDX Izumi Residence 1,120,000 1.1 May 1, 2012 KDX Chihaya Residence 1,080,000 1.1 May 1, 2012 2,910,000 2.9 May 1, 2012 KDX Shimmachi Residence 1,015,000 1.0 May 1, 2012 KDX Takarazuka Residence 1,510,000 1.5 May 1, 2012 KDX Shimizu Residence 1,680,000 1.7 May 1, 2012 KDX Sakaisuji Hommachi Residence Other Regional Area 67.7 KDX Residence Odori Koen 765,000 0.8 August 7, 2013 KDX Residence Kikusui Yojo 830,000 0.8 August 7, 2013 KDX Residence Toyohira Koen 445,000 0.4 August 7, 2013 KDX Residence Kamisugi 700,000 0.7 August 7, 2013 KDX Residence Ichiban-cho 530,000 0.5 August 7, 2013 KDX Residence Kotodai 520,000 0.5 August 7, 2013 KDX Residence Izumi Chuo 480,000 0.5 August 7, 2013 2,350,000 2.4 August 7, 2013 KDX Residence Higashi-sakura II 900,000 0.9 August 7, 2013 KDX Residence Atsuta Jingu 840,000 0.8 August 7, 2013 KDX Residence Nishi-oji 813,000 0.8 August 7, 2013 KDX Residence Saiin 440,000 0.4 August 7, 2013 1,410,000 1.4 August 7, 2013 KDX Residence Higashi-sakura I KDX Residence Namba 14 KDX Residence Namba-minami 1,350,000 1.4 August 7, 2013 510,000 0.5 August 7, 2013 1,275,000 1.3 August 7, 2013 KDX Residence Toyonaka-minami 740,000 0.7 August 7, 2013 KDX Residence Moriguchi 551,000 0.6 August 7, 2013 KDX Residence Sannomiya 1,080,000 1.1 August 7, 2013 Ashiya Royal Homes 1,360,000 1.4 August 7, 2013 KDX Residence Funairi Saiwai-cho 588,000 0.6 August 7, 2013 KDX Residence Tenjin-higashi II 680,000 0.7 August 7, 2013 KDX Residence Tenjin-higashi I 370,000 0.4 August 7, 2013 KDX Residence Nishi Koen 763,000 0.8 August 7, 2013 KDX Residence Hirao Josui-machi 760,000 0.8 August 7, 2013 KDX Residence Shin-osaka KDX Residence Ibaraki I ・II Other Regional Area 33 properties subtotal 31,962,500 32.3 80 properties total 99,030,500 100.0 Silent partnership equity interest in 400,000 G.K. Creek Investment - July 5, 2013 Investment securities I: 400,000 Silent partnership equity interest in II: 165,000 G.K. Creek Investment II - Total: 565,000 2 properties subtotal 965,000 I: February 20, 2014 II: March 7, 2014 - (Note) Any fraction of the acquisition price less than one thousand yen is rounded down, and the ratios are rounded off to the first decimal place. 15

© Copyright 2026