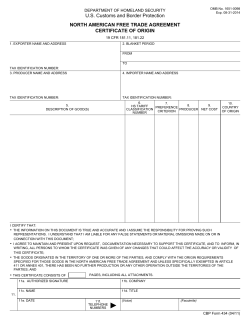

UNITED STATES – CHILE FREE TRADE AGREEMENT