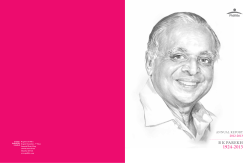

Voltas Limited Audit Report 2013 Financial Disclosures