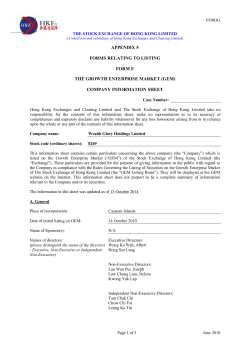

(a joint stock company established in the People’s Republic of... Stock Code : 1289