Michael Wolf, President and CEO

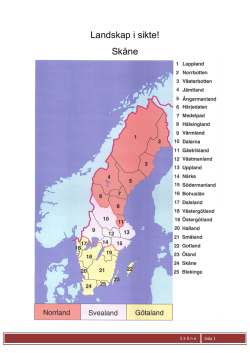

Swedbank strengthens its presence in Skåne Michael Wolf, CEO Göran Bronner, CFO Transaction highlights • Consolidating Skåne’s banking landscape • Swedbank strengthens its position in the growing Skåne region – Acquires 100 per cent of Sparbanken Öresund – Sells 8 of Sparbanken Öresund branches and acquires 1 branch from Sparbanken Skåne • Creation of the largest savings bank in Sweden: Sparbanken Skåne – Merger of Färs & Frosta, Sparbanken 1826 and parts of Sparbanken Öresund – Sweden’s largest savings bank – Swedbank will own 22 per cent of Sparbanken Skåne 2 Saving banks’ presence today • Skåne – a dynamic region – High population density; 1.3 million – Malmö, Lund, Helsingborg – Strong growth area with direct connection to Copenhagen 2 1 3 1 1 2 1 1 3 1 1 2 3 4 1 1 1 1 1 1 1 9 1 1 1 No of branches Swedbank: 27 2 1 1 Sparbanken Öresund: 24 9 3 Sparbanken 1826: 20 Färs & Frosta: 18 1 2 2 2 5 4 1 1 1 1 1 1 1 2 2 1 3 Consolidated savings bank landscape 2 1 3 1 1 2 1 1 3 1 1 2 3 4 1 1 1 1 1 1 1 9 1 1 1 No of branches Swedbank: 27 + 16 + 1 = 44 1 2 2 2 2 1 1 Färs & Frosta: 18 + 20 + 8 – 1 = 45 9 3 5 4 1 1 1 1 1 1 1 2 2 1 4 Business rationale • Strengthens Swedbank in important growth region • Significant financial upside for Swedbank and Sparbanken Skåne – Cost synergies (overlapping operations) – Capital synergies • Swedbank bears transaction risk and integration risk 5 Significant financial upside • Balance sheet impact – – – – – Purchase price for Sparbanken Öresund SEK 3bn Sale price of eight branches to Sparbanken Skåne SEK 1.8bn RWA increase SEK 16bn CET1 capital ratio impact of negative 60bp Initial upfront provisions of SEK 1.5bn • 2014 P&L statement – Income – Costs – Net profit + SEK 800m + SEK 650m + SEK 200m 6 Significant financial upside • P&L statement 2016-2017 – Estimated net profit contribution of SEK 350-450m – Incremental RoE to reach group target 2016 • Long term – Estimated net profit contribution of at least SEK 500m – Incremental RoE >25 per cent 7 Next steps • Regulatory approvals – SFSA – Competition authorities • Other approvals – Boards of the sellers – the relevant savings bank foundations • Sparbankstiftelsen Öresund • Sparbanksstiftelsen Gripen • Deal expected to close in Q2 2014 • Sparbanken Öresund to be fully integrated in next 1-3 years 8 Appendix 9 Before and after Today Sparbanksstiftelsen Gripen Post transaction Sparbanksstiftelsen Öresund 22% 78% Sparbanken Öresund Swedbank Sparbanksstiftelsen 1826 Sparbanksstiftelsen Färs & Frosta Sparbanksstiftelsen Öresund Sparbanksstiftelsen Färs & Frosta 30% Swedbank 70% 26% 22% 26% 100% 26% Färs & Frosta Sparbanksstiftelsen 1826 Färs & Frosta + Sparbanken 1826 + 8 Öresund branches Sparbanken Öresund 100% Sparbanken 1826 10 Facts Swedbank Skåne (1 Split up of Sparbanken Öresund Sparbanken Öresund Swedbank Sparbanken Skåne Current Proforma Increase % 559 447(2 112 410 857(2 109 24 16 8 27 43 59 204 700 108 300 96 400 482 000 590 300 22 15 700 8 300 7 400 38 000 46 300 22 189 000 100 000 89 000 444 000 544 000 23 Lending, SEKbn 25 16 9 14 30 114 Mortgages, SEKbn* (4 33 17 16 56 73 30 Deposits, SEKbn 24 12 12 34 46 35 Other (AUM, etc), SEKbn 20 10 10 34 44 29 Employees Branches Customers o/w Corporate (3 o/w Private 1) 2) 3) 4) In addition, one branch in Lomma will be sold to Swedbank by Sparbanken Skåne Of which 61 relates to Cerdo Bankpartner Includes micro corporates Sparbanken Öresund is a distributor of SBAB mortgage loans. Volumes will gradually move to Swedbank’s balance sheet. 11 Swedbank strengthens its presence in Skåne Q&A

© Copyright 2026