Document 409552

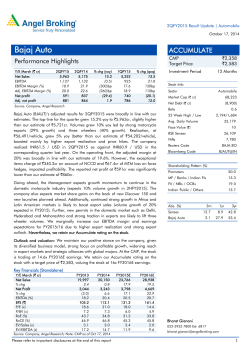

2QFY2015 Result Update | Automobile November 5, 2014 Mahindra & Mahindra ACCUMULATE Performance Highlights CMP Target Price Y/E March (` cr) Net Sales EBITDA EBITDA Margin (%) Adj. PAT 2QFY15 9,178 1,100 12.0 974 2QFY14 8,660 1,254 14.5 1,028 % chg (yoy) 6.0 (12.3) (250 bp) (5.2) 1QFY15 9,907 1,419 14.3 896 % chg (qoq) (7.4) (22.5) (230 bp) 8.7 Source: Company, Angel Research Operating performance lags estimates; higher other income and lower taxation boost profitability: Mahindra & Mahindra (M&M)’s 2QFY2015 results were in line with our estimates, primarily due to higher other income and lower taxation even as the operating performance lagged estimates. Revenues grew 6% yoy to `9,178cr, led by 5% growth in realization each in the automotive and the farm equipment segment. Volumes remained flat on a yoy basis. EBIDTA margin, at 12%, declined 250bp yoy and was significantly lower than our estimate of 14.1%. Higher employee expenses due to new wage regulations by Maharashtra government, higher discounting and product launch expenses impacted the company’s operating performance. However, higher other income at `490.6cr (35% yoy growth) due to increased dividend from subsidiaries and lower taxation (tax/PBT at 21.5%) boosted the profitability. Net Profit, at `974cr, declined 5% yoy and was in line with our estimate. Outlook and valuation: M&M’s volumes are likely to remain under pressure in 2HFY2015 given the weakness in both the automotive (due to lack of products in the compact UV space and due to subdued LCV sales) and the farm equipment space (due to poor sentiments on back of lower sowing). M&M is however likely to witness volume recovery over the next two years (FY2016 & FY2017) in both the automotive and the tractor industry. In the automotive segment, M&M aims to introduce two new utility vehicles over the next one year in the compact space (where so far it has very limited presence) enabling it to regain market share. Further, other automotive segments, ie LCV and three-wheelers, are likely to witness recovery in FY2016 on back of improvement in the economy. We also believe that the tractor industry growth would revive in FY2016 on back of increased non-agri usage of tractors and higher MSPs. Further, M&M’s margins are likely to improve in FY2016 on back of operating leverage and reduction in discounts. We have reduced our FY2015/16 estimates marginally given the volume and margin pressure in the near term. However, given the improved outlook FY2016 onwards, we maintain our positive view on the company and retain our Accumulate rating with a revised SOTP based target price of `1,428. `1,258 `1,428 Investment Period 12 Months Stock Info Automobile Sector Market Cap (` cr) 78,102 Net Debt (` cr) (9,298) Beta 0.9 52 Week High / Low 1,421/847 Avg. Daily Volume 65,485 Face Value (`) 5 BSE Sensex 27,916 Nifty 8,338 Reuters Code MAHM.BO Bloomberg Code MM@IN Shareholding Pattern (%) Promoters 25.7 MF / Banks / Indian Fls 20.5 FII / NRIs / OCBs 40.3 Indian Public / Others 13.5 Abs. (%) 3m 1yr 3yr Sensex 7.8 33.1 58.9 MM 2.3 38.7 50.7 Key financials (Standalone) Y/E March (` cr) Net Sales % chg Net Profit % chg EBITDA (%) EPS (`) P/E (x) P/BV (x) RoE (%) RoCE (%) EV/Sales (x) EV/EBITDA (x) FY2013 38,357 22.3 3,544 22.7 13.9 57.7 21.8 5.2 23.7 24.4 2.0 14.7 FY2014 38,937 1.5 3,802 7.3 13.4 61.7 20.4 4.5 22.0 20.5 2.0 14.8 FY2015E 39,758 2.1 3,440 (9.5) 12.9 55.9 22.5 3.9 17.4 18.5 2.0 15.3 FY2016E 44,615 12.2 4,017 16.8 13.1 65.2 19.3 3.4 17.7 19.2 1.8 13.4 Source: Company, Angel Research; Note: CMP as of November 5, 2014; P/E not adjusted for the value of subsidiaries Please refer to important disclosures at the end of this report Bharat Gianani 022-3935 7800 Ext: 6817 [email protected] 1 Mahindra & Mahindra | 2QFY2015 Result Update Exhibit 1: Quarterly financial performance (MM+MVML) Y/E March (` cr) 2QFY15 2QFY14 % chg (yoy) 1QFY15 % chg (qoq) 1HFY15 1HFY14 % chg (yoy) Net Sales 9,178 8,660 6.0 9,907 (7.4) 19,085 18,481 3.3 Consumption of RM 6.3 6,794 (7.2) 13,101 12,853 1.9 68.6 69.5 (2.3) 1,233 1,088 6.5 5.9 8.5 2,231 1,932 6,307 5,936 (% of Sales) 68.7 68.5 Staff Costs 609 536 (% of Sales) Other Expenses (% of Sales) 6.6 6.2 1,161 934 68.6 13.6 624 24.3 1,070 6.3 15.5 12.6 10.8 11.7 10.5 Total Expenditure 8,077 7,406 9.1 8,488 (4.8) 16,565 15,874 4.4 Operating Profit 1,100 1,254 (12.3) 1,419 (22.5) 2,520 2,607 (3.3) 12.0 14.5 73 89 (18.5) 82 OPM (%) Interest 10.8 13.3 14.3 13.2 14.1 (11.0) 154 172 (10.4) Depreciation 278 224 24.0 280 (0.7) 559 453 23.3 Other Income 491 363 35.2 145 239.1 635 460 38.0 1,240 1,304 (4.9) 1,202 3.2 2,442 2,442 0.0 1,240 1,304 (4.9) 1,202 3.2 2,442 2,442 0.0 (% of Sales) 13.5 15.1 12.8 13.2 Provision for Taxation 266 276 572 555 (% of PBT) 21.5 21.2 23.4 22.7 Reported PAT 974 1,028 (5.2) 896 8.7 1,870 1,887 (0.9) Adj PAT 974 1,028 (5.2) 896 8.7 1,870 1,887 (0.9) PBT (excl. Extr. Items) Extr. Income/(Expense) PBT (incl. Extr. Items) Adj. PATM 12.1 (3.6) 306 (13.0) 25.4 10.6 11.9 9.0 9.8 10.2 Equity capital (cr) 295.2 295.2 295.2 295.2 295.2 Adjusted EPS (`) 15.8 16.7 30.4 30.6 (5.2) 14.6 8.7 3.1 -0.9 Source: Company, Angel Research Exhibit 2: 2QFY2015 – Actual vs Angel estimates Y/E March (` cr) Actual Estimates Variation (%) Net Sales 9,178 8,983 2.2 EBITDA 1,100 1,266 (13.0) EBITDA margin (%) 12.0 14.1 (210 bps) Adj. PAT 974 965 0.9 Source: Company, Angel Research November 5, 2014 2 Mahindra & Mahindra | 2QFY2015 Result Update Exhibit 3: Quarterly volume performance Volume (units) 2QFY15 2QFY14 % chg (yoy) 1QFY15 % chg (qoq) 1HFY15 1HFY14 % chg (yoy) Total volumes 176,800 177,546 (0.4) 187,183 (5.5) 363,983 375,107 (3.0) Auto Sales - Domestic 108,595 110,223 (1.5) 106,063 2.4 214,658 228,436 (6.0) 7,053 8,059 (12.5) 6,565 7.4 13,618 12,830 6.1 115,648 118,282 (2.2) 112,628 2.7 228,276 241,266 (5.4) 57,433 57,236 0.3 71,920 (20.1) 129,353 128,626 0.6 3,719 2,028 83.4 2,635 41.1 6,354 5,215 21.8 61,152 59,264 3.2 74,555 (18.0) 135,707 133,841 1.4 Auto Sales - Exports Total Auto Sales Tractor Sales - Domestic Tractor Sales - Exports Total Tractor Sales Source: Company, Angel Research M&M’s volumes remained flat yoy. Automotive segment volumes declined 2% yoy due to decline in the utility vehicle and the LCV segment. Tractor volumes grew marginally by 3% yoy on back of poor sentiments due to deficient rainfall. Realisation/vehicle grew 5% yoy to `519,109. Price hikes in both the automotive and the farm equipment segment enhanced the realisation. Contribution/vehicle grew 5% yoy to `162,365 on back of improved realizations and benign commodity prices. Exhibit 5: Realisation and contribution per vehicle Volumes Source: Company, Angel Research November 5, 2014 Growth (%) 2QFY15 1QFY15 4QFY14 3QFY14 2QFY14 1QFY14 4QFY13 3QFY13 (10) 2QFY13 1,50,000 1QFY13 1,60,000 (5) 1,30,000 4,90,000 1,20,000 4,80,000 4,70,000 1,10,000 4,60,000 1,00,000 Realisation/vehicle 2QFY15 0 1,70,000 1QFY15 1,80,000 1,40,000 5,00,000 4QFY14 5 1,50,000 5,10,000 3QFY14 10 1,90,000 1,60,000 5,20,000 2QFY14 2,00,000 1,70,000 5,30,000 1QFY14 15 5,40,000 4QFY13 2,10,000 3QFY13 20 2QFY13 2,20,000 1QFY13 Exhibit 4: Volumes remain flat yoy Contribution/vehicle Source: Company, Angel Research 3 Mahindra & Mahindra | 2QFY2015 Result Update Exhibit 6: Segmental performance Y/E March (` cr) 2QFY15 2QFY14 % chg (yoy) 1QFY15 % chg (qoq) 1HFY15 1HFY14 % chg (yoy) 9,206 8,708 5.7 9,928 (7.3) 19,134 18,596 2.9 Total Net Sales Auto segment 5,793 5,555 4.3 5,989 (3.3) 11,782 11,535 2.1 Farm segment 3,407 3,148 8.2 3,933 (13.4) 7,340 7,047 4.1 6 6 7.7 7 (1.8) 13 13 (3.4) Other segments Total PBIT 986 1,159 (14.9) 1,291 (23.6) 2,277 2,399 (5.1) Auto segment 460 624 (26.3) 624 (26.3) 1,085 1,210 (10.3) Farm segment 523 534 (2.1) 666 (21.5) 1,189 1,187 0.2 Other segments 3.0 0.1 2425.0 0.4 621.4 3.5 2.7 25.9 PBIT/ Sales (%) 10.7 13.3 (260)bp 13.0 (230)bp 11.9 12.9 (100)bp Auto segment 7.9 11.2 (330)bp 10.4 (250)bp 9.2 10.5 (130)bp Farm segment 15.4 17.0 (160)bp 16.9 (150)bp 16.2 16.8 (60)bp Other segments 47.3 2.0 26.7 20.5 6.4 Source: Company, Angel Research EBIDTA margins, at 12%, declined sharply by 250bp yoy. Higher employee expenses due to change in Maharashtra government regulations and higher discounting and product launch expenses impacted the margins. Higher other income at `491cr (35% yoy growth) and lower taxation however offset the impact of poor operating performance. The net profit for the quarter at `974cr was in line with our estimates. Exhibit 7: EBITDA margins below estimates Exhibit 8: Net profit boosted by higher other income 1,800 16 1,600 15 1,400 14 13 800 12 600 11 EBIDTA (`cr) Source: Company, Angel Research November 5, 2014 Margin % 8 6 400 4 Net Profit (`cr) 2QFY15 1QFY15 0 4QFY14 0 3QFY14 2 8 2QFY14 9 200 1QFY14 2QFY15 1QFY15 4QFY14 3QFY14 2QFY14 1QFY14 4QFY13 0 3QFY13 200 2QFY13 10 1QFY13 400 10 4QFY13 600 12 3QFY13 800 1,000 2QFY13 1,000 14 1QFY13 1,200 1,200 Margin % Source: Company, Angel Research 4 Mahindra & Mahindra | 2QFY2015 Result Update Conference Call – Key highlights November 5, 2014 M&M expects the utility vehicle industry demand to moderate in 2HFY2015. However, it expects the industry to register a volume growth of 10% in FY2015, implying a volume growth of 8% in 2HFY2015. M&M is continuing to lose market share in the utility vehicle segment due to relatively lesser presence in the compact UV space which has been outperforming the UV industry. M&M aims to launch two new compact UVs over the next one year to regain market share. M&M received an encouraging response to the new Scorpio with 10,000 dispatches in the first five weeks of the launch. M&M has been outperforming the pick-up LCV space with market share increasing from 60% in 2QFY2014 to 72.4% in 2QFY2015. Deficient rainfall has impacted crop sowing and consequently tractor demand has been subdued. The tractor industry remained flat during 1HFY2015. M&M is likely to lower its earlier forecast of 5-7% industry growth for FY2015. The company however managed to marginally gain market share by 50bp in the tractor industry during 1HFY2015. M&M undertook tractor production cut for five days in October 2014 to correct inventory. Inventory has now normalized post the production curtailment. M&M undertook price increases of about 1-1.25% both in the automotive and the tractor segment during 1HFY2015. Powerol segment revenues grew 24% yoy to `212cr during the quarter. M&M has signed a MoU with the Maharashtra government to set up a new plant at Chakan at an investment of `4,000cr. The company has maintained its overall capex guidance of `7,500cr over the next three years. M&M expects raw material prices to remain benign in the near term. However, discounting and product launch expenses would remain higher in the near term. As per the company, the NPA levels in the pick-up segment (where it has significant market share) are low while the proportion is higher in the SCV segment (where it has relatively less presence). Therefore the impact of financing on its LCV portfolio is limited. 5 Mahindra & Mahindra | 2QFY2015 Result Update Investment arguments Volume uptrend expected over the next two years: M&M is likely to witness volume uptrend over the next two years (FY2016-17) and we expect double digit volume CAGR over the next two years. M&M would launch two new products in the compact UV space beginning FY2016 (M&M has limited presence in compact UV which account for 40% of UV industry) enabling it to regain market share. Further, the other two key automotive segments LCV and three-wheelers are likely to recover given the improved economic scenario. The tractor segment is also expected to recover in FY2016 on back of improved sentiments and increase in the MSPs. Further, with an improvement in the economy, the non-agri usage of tractors is also likely to increase which would boost demand for tractors. Investments constitute ~45% of total assets: MM has presence in various sectors through majority stakes in various listed companies, ie in sectors like technology, hospitality, real estate and finance. The high growth potential of MM's subsidiaries has supported its valuation in the past and may continue to do so in the long term as well. Investments constitute ~45% of MM’s total assets as of March 2014. Outlook and valuation M&M’s volumes are likely to remain under pressure in 2HFY2015 given the weakness in both the automotive (due to lack of products in the compact UV space and due to subdued LCV sales) and the farm equipment space (due to poor sentiments on back of lower sowing). M&M is likely to witness volume recovery over the next two years (FY2016 & FY2017) in both the automotive and the tractor industry. In the automotive segment, M&M aims to introduce two new utility vehicles over the next one year in the compact space (where so far it has very limited presence) enabling it to regain market share. Further, other automotive segments, ie LCV and three-wheelers, are likely to witness recovery in FY2016 on back of economic improvement. We also believe that the tractor industry growth would revive in FY2016 on back of increased non-agri usage of tractors and higher MSPs. Further, M&M’s margins are likely to improve in FY2016 on back of operating leverage and reduction in discounts. We have reduced our FY2015/16 estimates marginally given the volume and margin pressure in the near term. However, given the improved outlook FY2016 onwards, we maintain our positive view on the company and retain our Accumulate rating with a revised SOTP based target price of `1,428. November 5, 2014 6 Mahindra & Mahindra | 2QFY2015 Result Update Exhibit 9: SOTP valuation Particulars Value/share Core business (MM+MVML) 1,044 Remarks At 16x FY16 earnings Key Subsidiaries Tech Mahindra 264 Bloomberg Consensus target price M&MFSL 147 2.5x its FY2016 Book value Mahindra Lifespace 17 Market cap Mahindra Holiday Resort 30 Market cap Mahindra CIE 25 Market cap Ssangyong 66 Market cap Value of subsidiaries before discount After holdings 30% discount 549 385 Target Price 1,428 Source: Company, Angel Research Exhibit 10: Key assumptions Y/E March (units) FY2011 FY2012 FY2013 FY2014 FY2015E FY2016E Passenger Vehicles (UV+Verito) 179,214 220,115 279,270 229,155 218,843 247,293 4-wheeler pick-up 105,588 152,691 174,233 177,587 164,268 177,409 62,142 67,440 65,510 62,614 63,866 68,976 Three wheelers Truck & Bus 11,077 13,823 11,902 8,161 8,732 10,479 Exports 19,042 29,177 32,458 29,659 31,142 34,256 Total Automotive Sales 377,063 483,246 563,373 507,176 486,852 538,412 Domestic Tractor Sales 201,785 221,730 211,596 257,270 259,843 284,528 11,868 13,722 12,289 10,364 12,955 15,546 Total Tractor Sales 213,653 235,452 223,885 267,634 272,798 300,074 Total Volume 590,716 718,698 787,257 774,810 759,649 838,486 Exports Tractor Sales Source: Company, Angel Research Company background Mahindra and Mahindra, the flagship company of the Mahindra Group, is the largest manufacturer of UVs and tractors in India with an ~37% and ~42% market share in these segments, respectively. The company is also the second largest player in the light commercial vehicle (LCV) space, with an ~37% market share. MM is also the only company in India that is present across all the automotive segments. It has an installed capacity of 6lakh and 2.3lakh units/year in the automotive and farm equipment segments respectively. In FY2011, MM acquired a 70% stake in Ssangyong Motor Co (SYMC), transforming itself into a global UV player. Apart from the core auto business, the company has subsidiaries/associates in various businesses such as IT, NBFC, auto ancillaries, hospitality and infrastructure. November 5, 2014 7 Mahindra & Mahindra | 2QFY2015 Result Update Profit and loss statement Y/E March (` cr) FY2011 FY2012 FY2013* FY2014* FY2015E* FY2016E* Total operating income 23,460 31,847 38,357 38,937 39,758 44,615 % chg 27.8 35.7 22.3 1.5 2.1 12.2 Total expenditure 20,006 28,083 33,027 33,737 34,620 38,772 Net raw material costs 16,264 23,500 27,439 27,030 27,303 30,672 444 553 553 624 715 805 Employee expenses 1,432 1,702 1,998 2,330 2,590 2,901 Other 1,866 2,328 3,037 3,753 4,011 4,394 EBITDA 3,454 3,764 5,329 5,200 5,138 5,843 Other mfg costs % chg 27.2 9.0 28.4 (2.4) (1.2) 13.7 (% of total op. income) 14.7 11.8 13.9 13.4 12.9 13.1 Depreciation & amortization 414 576 818 997 1,129 1,235 3,040 3,188 5,081 4,869 4,874 5,628 % chg EBIT 29.6 4.9 28.2 (4.2) 0.1 15.5 (% of total op. income) 13.0 10.0 13.2 12.5 12.3 12.6 72 163 296 368 339 343 Other income 552 580 570 665 865 1,020 Recurring PBT 3,520 3,606 4,785 4,500 4,535 5,286 23.6 2.5 30.1 (5.9) 0.8 16.5 Interest and other charges % chg Extraordinary income/ (exp.) (113) (134) 91 53 0 0 PBT 3,407 3,472 4,875 4,553 4,535 5,286 Tax 858 727 1,241 698 1,095 1,269 (% of PBT) 25.2 20.9 25.5 15.3 24.1 24.0 PAT (reported) 2,662 2,879 3,634 3,855 3,440 4,017 ADJ. PAT 2,550 2,745 3,544 3,802 3,440 4,017 % chg 25.7 7.7 22.7 7.3 (9.5) 16.8 (% of total op. income) 10.9 8.6 9.2 9.8 8.7 9.0 Basic EPS (`) 45.3 48.9 59.2 62.6 55.9 65.2 Adj. EPS (`) 43.4 46.6 57.7 61.7 55.9 65.2 % chg 21.1 7.3 22.7 7.0 (9.5) 16.8 Note: * (MM + MVML) November 5, 2014 8 Mahindra & Mahindra | 2QFY2015 Result Update Balance sheet statement Y/E March (` cr) FY2011 FY2012 FY2013* FY2014* FY2015E* FY2016E* SOURCES OF FUNDS Equity share capital 294 295 295 295 295 295 Reserves & surplus 10,020 11,810 14,686 16,969 19,444 22,357 Shareholders’ Funds 10,313 12,105 14,981 17,265 19,739 22,652 2,321 3,174 4,152 4,308 4,308 4,308 354 527 756 1,051 1,051 1,051 Total loans Deferred tax liability Other long term liabilities 187 275 415 586 586 586 Long term provisions 421 363 478 557 600 670 13,598 16,444 20,782 23,767 26,284 29,268 Gross block 5,971 7,865 11,152 13,110 15,610 17,910 Less: Acc. depreciation 2,838 3,572 4,325 5,308 6,437 7,672 Net Block 3,133 4,293 6,827 7,801 9,173 10,238 774 795 919 1,254 919 919 Investments 8,926 10,297 10,894 10,464 11,664 12,864 Long term loans and adv. 1,868 1,477 2,087 3,018 3,500 4,000 117 36 504 416 416 416 4,722 6,871 8,782 10,595 10,627 12,069 615 1,188 1,823 3,141 2,802 3,285 Total Liabilities APPLICATION OF FUNDS Capital work-in-progress Other noncurrent assets Current assets Cash Loans & advances 1,153 1,396 827 1,031 1,034 1,160 Other 2,955 4,287 6,132 6,422 6,792 7,625 Current liabilities 5,942 7,326 9,232 9,782 10,016 11,239 Net current assets (1,220) (454) (450) 813 612 830 - - - - - - 13,598 16,444 20,782 23,767 26,284 29,268 Misc. exp. not written off Total Assets Note: * (MM + MVML) November 5, 2014 9 Mahindra & Mahindra | 2QFY2015 Result Update Cash flow statement Y/E March (` cr) FY2011 Profit before tax 3,407 FY2012 FY2013* FY2014* FY2015E* FY2016E* 3,472 4,785 4,500 4,535 5,286 Depreciation 414 576 583 984 1,129 1,235 Change in working capital 938 (484) 1,747 55 (138) 264 Others (370) 479 (121) (593) (439) (430) Other income (552) (580) - - - - Direct taxes paid (858) (727) (1,241) (698) (1,095) (1,269) Cash Flow from Operations 2,980 2,735 5,753 4,249 3,991 5,086 (Inc.)/Dec. in fixed assets (505) (1,915) (1,441) (2,292) (2,165) (2,300) (Inc.)/Dec. in investments (2,528) (1,372) (1,420) 430 (1,200) (1,200) 552 580 - - - - (2,480) (2,707) (2,861) (1,863) (3,365) (3,500) Other income Cash Flow from Investing Issue of equity Inc./(Dec.) in loans Dividend paid (Incl. Tax) 1,006 24 - - - - (559) 853 67 156 - - 624 803 (894) (966) (966) (1,104) Others (2,698) (1,135) (1,533) - - - Cash Flow from Financing (1,628) 545 (2,360) (810) (966) (1,104) Inc./(Dec.) in cash (1,129) 574 532 1,576 (339) 483 1,743 615 1,291 1,823 3,141 2,802 615 1,188 1,823 3,141 2,802 3,285 Opening Cash balances Closing Cash balances Note: * (MM + MVML) November 5, 2014 10 Mahindra & Mahindra | 2QFY2015 Result Update Key ratios Y/E March FY2011 FY2012 FY2013* FY2014* FY2015E* FY2016E* Valuation Ratio (x) P/E (on FDEPS) 29.0 27.0 21.8 20.4 22.5 19.3 P/CEPS 24.9 22.3 17.7 16.1 17.0 14.8 P/BV 7.2 6.1 5.2 4.5 3.9 3.4 Dividend yield (%) 1.0 1.0 1.0 1.1 1.1 1.3 EV/Sales 3.0 2.2 2.0 2.0 2.0 1.8 20.5 18.5 14.7 14.8 15.3 13.4 5.2 4.2 3.8 3.2 3.0 2.7 EPS (Basic) 45.3 48.9 57.7 61.7 55.9 65.2 EPS (fully diluted) 43.4 46.6 57.7 61.7 55.9 65.2 Cash EPS 50.5 56.4 71.0 77.9 74.2 85.3 DPS 12.0 13.0 13.0 14.0 14.0 16.0 175.4 205.3 244.0 280.3 320.5 367.8 13.0 10.0 13.2 12.5 12.3 12.6 EV/EBITDA EV / Total Assets Per Share Data (`) Book Value Dupont Analysis EBIT margin Tax retention ratio 0.7 0.8 0.7 0.8 0.8 0.8 Asset turnover (x) 2.1 2.3 2.0 1.9 1.7 1.7 20.5 17.9 20.0 20.0 15.7 16.5 2.1 4.7 5.3 7.2 6.0 6.0 (0.6) (0.6) (0.6) (0.5) (0.5) (0.5) 9.4 9.4 11.6 13.1 10.7 11.0 ROCE (Pre-tax) 24.8 21.2 24.4 20.5 18.5 19.2 Angel ROIC (Pre-tax) 17.7 16.7 26.8 23.6 20.8 21.7 ROE 28.1 24.5 23.7 22.0 17.4 17.7 4.2 4.6 3.4 3.0 2.5 2.5 Inventory / Sales (days) 22 23 29 30 30 30 Receivables (days) 20 18 21 24 23 23 Payables (days) 63 61 79 81 81 81 (21) (20) (28) (28) (28) (28) ROIC (Post-tax) Cost of Debt (Post Tax) Leverage (x) Operating ROE Returns (%) Turnover ratios (x) Asset Turnover (Gross Block) WC cycle (ex-cash) (days) Solvency ratios (x) Net debt to equity (0.7) (0.7) (0.6) (0.5) (0.5) (0.5) Net debt to EBITDA (2.1) (2.2) (1.6) (1.8) (2.0) (2.0) Interest Coverage (EBIT / Int.) 41.9 19.6 17.1 13.2 14.4 16.4 Note: * (MM + MVML) November 5, 2014 11 Mahindra & Mahindra | 2QFY2015 Result Update Research Team Tel: 022 - 39357800 E-mail: [email protected] Website: www.angelbroking.com DISCLAIMER This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Pvt. Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Pvt. Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Pvt. Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may have investment positions in the stocks recommended in this report. Disclosure of Interest Statement 1. Analyst ownership of the stock Mahindra and Mahindra No 2. Angel and its Group companies ownership of the stock No 3. Angel and its Group companies' Directors ownership of the stock No 4. Broking relationship with company covered No Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors Ratings (Returns): November 5, 2014 Buy (> 15%) Reduce (-5% to -15%) Accumulate (5% to 15%) Sell (< -15%) Neutral (-5 to 5%) 12

© Copyright 2026