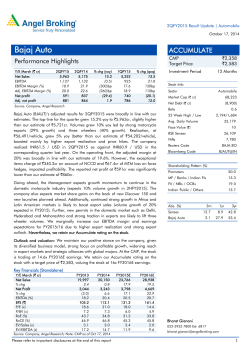

Document 366598

2QFY2015 Result Update | Auto Ancillary October 22, 2014 Exide Industries ACCUMULATE Performance Highlights CMP Target Price Y/E March (` cr) Net Sales 2QFY15 2QFY14 % chg (yoy) 1QFY15 % chg (qoq) 1,763 1,432 23.1 1,912 (7.8) EBITDA 208 201 3.2 291 (28.7) EBITDA Margin (%) 11.8 14.1 (230)bp 15.2 (340)bp Adj. PAT 126 119 6.0 185 (32.1) Source: Company, Angel Research 2QFY2015 results disappoint; operating margin below estimates: Exide Industries Ltd (EIL)’s 2QFY2015 results have come in below our estimates, as the company disappointed on the margin front despite double digit revenue growth. EIL’s top-line grew strongly by 23% yoy to `1,763cr (slightly ahead of our estimate of `1,697cr). The top-line growth was driven by strong volume growth on back of strong double digit growth in both the automotive and the industrial segment and improved product mix with a higher proportion of automotive replacement batteries. EIL did not affect any price increases during the quarter. On the operating front, the EBIDTA margin declined by 230bp yoy to 11.8% (lower than our estimate of 13.5%). Increased lead prices and higher freight and power expenses impacted the profitability. Also, EIL could not hike prices given the intense competition which impacted the operating performance. Given the poor operating performance, the net profit grew 6% yoy to `125.8cr and the same was lower than our estimate of `138.8 cr. Outlook and Valuation: EIL is likely to register a double digit top-line growth over FY2014-16, driven by robust automotive replacement demand, strong industrial segment due to improved economic outlook and recovery in the automotive OEM demand. Further, EIL is focusing on margin improvement by undertaking price hikes in the inverter segment, reducing dealer incentives and raw material cost control by improving the product quality. We have broadly retained our earnings assumptions for FY2015/16. We maintain our Accumulate rating on the stock with a price target of `170 (based on 18x FY2016 core business EPS of `8.5 and `17/share stake in the life insurance business). `156 `170 Investment Period 12 Months Stock Info Auto Ancillary Sector Market Cap (` cr) 13,243 Net Debt (` cr) (1,715) Beta 0.9 52 Week High / Low 183/99 Avg. Daily Volume 3,30,750 Face Value (`) 1 BSE Sensex 26,787 Nifty 7,996 Reuters Code EXID.BO Bloomberg Code EXID@IN Shareholding Pattern (%) Promoters 46.0 MF / Banks / Indian Fls 26.8 FII / NRIs / OCBs 17.0 Indian Public / Others 10.2 Abs. (%) 3m 1yr 3yr Sensex 2.9 28.4 59.6 Exide Industries (5.5) 20.9 31.1 Key financials (Standalone) Y/E March (` cr) FY2013 FY2014 FY2015E FY2016E 6,071 5,964 7,289 8,383 % chg 18.8 (1.8) 22.2 15.0 Net Profit 523 487 607 725 % chg 13.4 (6.8) 24.6 19.4 EBITDA (%) 12.9 13.7 13.5 14.0 Net Sales EPS (`) 6.2 5.7 7.1 8.5 P/E (x) 25.4 27.2 21.8 18.3 P/BV (x) 3.9 3.6 3.2 2.9 RoE (%) 15.3 13.1 14.7 15.8 RoCE (%) 21.0 18.8 20.7 22.3 2.1 2.1 1.7 1.5 16.6 15.6 12.8 10.6 EV/Sales (x) EV/EBITDA (x) Source: Company, Angel Research; Note: CMP as of October 22, 2014 Please refer to important disclosures at the end of this report Bharat Gianani 022-3935 7800 Ext: 6817 [email protected] 1 Exide Industries | 2QFY2015 Result Update Exhibit 1: Quarterly financial performance (Standalone) Y/E March (` cr) 2QFY15 2QFY14 % chg (yoy) 1QFY15 % chg (qoq) 1HFY15 1HFY14 % chg (yoy) Net Sales 1,763 1,432 23.1 1,912 (7.8) 3,676 3,060 20.1 Consumption of RM 26.2 1,267 (6.6) 2,450 1,989 23.2 66.7 65.0 8.3 208 179 5.7 5.9 3.9 518 427 1,183 937 (% of Sales) 67.1 65.5 Staff Costs 108 85 (% of Sales) Other Expenses (% of Sales) 6.1 6.0 264 208 66.3 26.7 100 27.0 254 5.2 21.3 15.0 14.5 14.1 14.0 1,556 1,231 26.4 1,621 (4.0) 3,177 2,596 22.4 Operating Profit 208 201 3.2 291 (28.7) 499 464 7.6 OPM (%) 11.8 14.1 13.6 15.2 0 0 1 1 Depreciation 33 Other Income 7 Total Expenditure Interest 13.3 16.2 15.2 (12.8) 0 31 5.0 32 1.8 65 61 6.3 4 86.9 9 (21.5) 16 10 57.9 181 173 4.6 267 (32.2) 449 411 9.0 PBT (incl. Extr. Items) 181 173 4.6 267 (32.2) 449 411 9.0 (% of Sales) 10.3 12.1 12.2 13.4 56 55 138 134 (% of PBT) 30.6 31.5 30.7 32.6 Reported PAT 126 119 6.0 185 (32.1) 311 277 12.1 Adj PAT 126 119 6.0 185 (32.1) 311 277 12.1 Adj. PATM PBT (excl. Extr. Items) 70.8 -21.7 Extr. Income/(Expense) Provision for Taxation 14.0 1.6 82 (32.3) 30.7 7.1 8.3 9.7 8.5 9.1 Equity capital (cr) 85 85 85 85 85 Reported EPS (`) 1.5 1.4 2.2 3.7 3.3 2.6 Source: Company, Angel Research Exhibit 2: 2QFY2015 – Actual vs Angel estimates Y/E March (` cr) Actual Estimates Net Sales Variation (%) 1,763 1,697 3.9 EBITDA 208 229 (9.1) EBITDA margin (%) 11.8 13.5 (170)bp Adj. PAT 126 139 (9.4) Source: Company, Angel Research Top-line marginally ahead of estimates: During 2QFY2015, revenues grew by a robust 23% yoy to `1,763 cr, slightly better than our estimate of `1,697 cr. The top-line growth was led by both the automotive and the industrial segments. On the automotive front, the four wheeler segment revenues grew 21% yoy while the two wheeler segment grew 12% yoy, led by healthy replacement sales. The industrial segment also performed well, reporting a revenue growth of 37% yoy. During the quarter, the OEM : Replacement volume ratio in the four-wheeler segment stood at 1.7:1 while the revenue ratio stood at 3.3:1. In the two wheeler segment OEM: Replacement volume ratio stood at 0.5 while the revenue ratio stood at 0.6:1. October 22, 2014 2 Exide Industries | 2QFY2015 Result Update Exhibit 3: Top-line marginally ahead of estimates 35 30 25 20 15 10 5 0 (5) (10) (15) 2,500 2,000 1,500 1,000 500 Net Sales ( `cr) 2QFY15 1QFY15 4QFY14 3QFY14 2QFY14 1QFY14 4QFY13 3QFY13 2QFY13 1QFY13 0 % yoy Growth Source: Company, Angel Research Higher material and other expenses impact operating performance: On the operating front, EBIDTA declined 230 bp yoy to 11.8% (lower than our estimate of 13.5%). Higher lead prices coupled with the inability to hike prices due to stiff competition impacted the margins. Further, EIL witnessed surge in freight costs (due to diesel price increase), increase in power and charging costs and surge in the technological expenses (some of the R&D expenses were of revenue nature) which impacted the margins. Other expenditure/sales increased 50 bp yoy to 15% However price increases of 5% from November 2014 coupled with technological improvement should lead to margin improvement going ahead. Exhibit 5: Significant deterioration in EBITDA margins 2,300 350 18 2,250 300 16 2,200 250 2,150 200 10 2,100 150 8 2,050 100 2,000 50 1,950 0 12 6 4 2 EBIDTA ( `cr) 2QFY15 1QFY15 4QFY14 3QFY14 2QFY14 1QFY14 4QFY13 3QFY13 0 2QFY13 Sep-14 Jul-14 Aug-14 Jun-14 Apr-14 May-14 Mar-14 Jan-14 Feb-14 Dec-13 Oct-13 Source: Company, Angel Research Nov-13 Sep-13 Jul-13 Aug-13 Jun-13 Apr-13 May-13 1,900 14 1QFY13 (USD/Tonne) Exhibit 4: Average lead price trend Margin (%) Source: Company, Angel Research Net profit dips on subdued operating performance: The net profit grew 6% yoy to `126cr as against double digit topline growth, and was below our estimates of `139cr led by a weak operating performance. October 22, 2014 3 Exide Industries | 2QFY2015 Result Update Exhibit 6: Bottom-line below our estimates 200 180 160 140 120 100 80 60 40 20 0 12 10 8 6 4 2 Net Profit (` cr) 2QFY15 1QFY15 4QFY14 3QFY14 2QFY14 1QFY14 4QFY13 3QFY13 2QFY13 1QFY13 0 Margin (%) Source: Company, Angel Research Conference call – Key highlights October 22, 2014 EIL saw a double-digit revenue growth in 2QFY2015. The growth was broad based with the automotive four-wheeler segment growing 21% yoy and the two-wheeler segment growing by 12% yoy. The automotive segment growth was led by the replacement segment even as OEM sales were lackluster. Further, the industrial segment also showed strong growth of 37% yoy. Capacity utilization in the automotive segment improved sequentially. Fourwheeler utilization levels improved from 76% in 1QFY2015 to 79% in 2QFY2015. Also, the utilization in the two wheeler segment improved from 78% in 1QFY2015 to 83% in 2QFY2015. The telecom segment has been performing well, with the company improving its market share from 8% in 2QFY2014 to 18% in 2QFY2015. EIL did not take any pricing action during the quarter. EIL is hiking inverter prices by 5% from November 2014 which would aid in margin improvement going forward. EIL indicated it would lower the dealer incentives in 2HFY2015, as it has been successful in regaining market share in the automotive replacement space. In 2QFY2015, the Replacement to OEM volume ratio for the four-wheeler and two-wheeler battery segments was 1.7 and 0.49 respectively. EIL expects automotive replacement sales to remain strong and estimates high double-digit growth over the next two years. The impact of slowdown in OEM sales during FY2008-2010 period is unlikely to have any major impact on replacement sales. EIL is targeting EBIDTA margins of 16% over the next two years from the current levels of ~14%. It is focusing on improving productivity, reduction in dealer incentives and reductions in raw material costs due to technological improvements to help enhance margins. 4 Exide Industries | 2QFY2015 Result Update EIL has guided for capital expenditure of `550cr over the next two years, out of which `250cr would be incurred in FY2015. The capex would also focus on technological improvements in the products. Investment arguments Demand scenario for automotive and industrial batteries to remain positive in the long run: We expect growth traction in the automotive battery segment to continue over the next two years. The Automotive OEM segment is witnessing volume recovery over the last three-four months post improvement in consumer sentiments. Further, robust automotive replacement demand is likely to maintain growth momentum. Also given the economic recovery, the industrial segment (railways, UPS and telecom) is also poised to register double-digit growth over the next two years. Captive sourcing reduces impact of lead price volatility: EIL acquired Tandon Metals (FY2008) and Leadage Alloys (51% stake in FY2009 and the rest 49% in 2QFY2011) to recycle lead and lessen the vulnerability of rising lead prices. This reduced the company's dependence on imported lead to ~25% in FY2013 from ~32% in FY2010. Total lead supplied by the captive smelters increased to 40-45% of total consumption in FY2013. EIL has benefitted from its captive sourcing strategy, as lead sourcing from captive smelters is 10-12% cheaper compared to market rates. Going forward, EIL plans to increase sourcing from its smelters to ~70% by FY2016. Our sensitivity analysis suggests that for every 10% increase in sourcing from captive smelters, the company’s EBITDA margin expands by ~50bp (assuming stable lead prices). Outlook and valuation EIL is likely to register a double digit top-line growth over FY2014-16, driven by robust automotive replacement demand, strong industrial segment due to improved economic outlook and recovery in the automotive OEM demand. Further, EIL is focusing on margin improvement by undertaking price hikes in inverter segment, reducing dealer incentives and raw material cost control by improving the product quality. We have broadly retained our earnings assumptions for FY2015/16. We maintain our Accumulate rating on the stock with a price target of `170 (based on 18x FY2016 core business EPS of `8.5 and `17/share stake in the life insurance business). Company background Exide Industries (EXID) is a leading automobile and industrial battery manufacturer in India. The company commands an ~65% and ~60% market share in the OEM and organized replacement battery segments respectively and a 40-45% share in the industrial battery segment. EXID has technological tie-ups with majors such as Shin Kobe and Furukawa Battery. The automotive and industrial battery segments accounted for ~60% and ~40% of the company's total revenue in FY2014, respectively. October 22, 2014 5 Exide Industries | 2QFY2015 Result Update Profit and loss statement (Standalone) Y/E March (` cr) Total operating income % chg FY2012 FY2013 FY2014 FY2015E FY2016E 4,547 5,110 6,072 5,964 7,289 8,383 19.9 12.4 18.8 (1.8) 22.2 15.0 Total expenditure 3,666 4,424 5,287 5,147 6,305 7,213 Net raw material costs 2,823 3,436 4,039 3,910 4,862 5,575 Other mfg costs 283 325 412 400 505 610 Employee expenses 278 286 349 356 409 471 Other 282 376 487 481 529 558 EBITDA 881 686 786 817 984 1,170 % chg (1.2) (22.1) 14.5 4.2 20.5 18.8 (% of total op. income) 19.4 13.4 12.9 13.7 13.5 14.0 Depreciation & amort. 83 101 113 126 141 159 EBIT 798 585 672 724 882 1054 % chg (1.7) (26.6) 14.8 (3.0) 21.8 19.5 (% of total op. income) 17.5 11.5 11.1 12.1 12.1 12.6 Interest and other charges 9 8 6 1 2 3 Other income 151 67 76 33 38 43 (% of PBT) 16.7 10.4 10.2 0.6 0.5 0.5 Recurring PBT 940 645 742 723 880 1,051 % chg 16.0 (31.4) 15.1 (2.6) 21.7 19.4 Extraordinary items PBT (reported) 33 (0) (0) - - - 907 645 743 723 880 1,051 Tax 274 184 220 236 273 326 (% of PBT) 30.2 28.5 29.6 32.6 31.0 31.0 PAT (reported) 666 461 523 487 607 725 ADJ. PAT 633 461 523 487 607 725 % chg 17.8 (27.1) 13.4 (6.8) 24.6 19.4 (% of total op. income) 13.9 9.0 8.6 8.2 8.3 8.6 Basic EPS (`) 7.8 5.4 6.2 5.7 7.1 8.5 Adj. EPS (`) 7.4 5.4 6.2 5.7 7.1 8.5 17.8 (27.1) 13.4 (6.8) 24.6 19.4 % chg October 22, 2014 FY2011 6 Exide Industries | 2QFY2015 Result Update Balance sheet statement (Standalone) Y/E March (` cr) FY2011 FY2012 FY2013 FY2014 FY2015E FY2016E SOURCES OF FUNDS Equity share capital 85 85 85 85 85 85 Reserves & surplus 2,657 2,972 3,339 3,646 4,041 4,512 Shareholders’ Funds 2,742 3,057 3,424 3,731 4,126 4,597 Total loans Deferred tax liability Other long term liabilities - - - - - - 68 83 98 105 105 105 3 4 7 6 6 6 46 16 21 20 20 20 2,860 3,160 3,549 3,863 4,257 4,728 1,561 1,777 1,900 2,014 2,264 2,564 Less: Acc. depreciation 725 810 906 1,016 1,157 1,316 Net Block 836 967 994 998 1,107 1,248 47 27 59 51 51 51 1,378 1,555 1,640 1,967 2,167 2,367 31 62 52 64 76 89 - 1 1 1 1 1 1,314 1,481 1,802 1,875 2,192 2,503 15 58 75 120 43 31 Long term provisions Total Liabilities APPLICATION OF FUNDS Gross block Capital work-in-progress Investments Long term loans and adv. Other noncurrent assets Current assets Cash Loans & advances Other Current liabilities Net current assets Total Assets October 22, 2014 63 51 48 53 73 84 1,236 1,372 1,679 1702 2077 2388 747 931 999 1,094 1,337 1,532 567 550 803 781 855 972 2,860 3,160 3,549 3,863 4,257 4,728 7 Exide Industries | 2QFY2015 Result Update Cash flow statement (Standalone) Y/E March (` cr) Profit before tax Depreciation Change in working capital Others 940 645 FY2014 FY2015E FY2016E 742 723 880 1,051 83 101 113 111 141 159 (238) 7 (237) 66 (151) (128) 37 9 37 (6) (12) (13) (236) (273) (326) Other income (151) (67) (76) Direct taxes paid (274) (184) (220) Cash Flow from Operations 398 510 360 658 585 743 (Inc.)/Dec. in fixed assets (234) (195) (156) (106) (250) (300) (Inc.)/Dec. in investments (43) (177) (86) (327) (200) (200) (433) (450) (500) Other income Cash Flow from Investing Issue of equity Inc./(Dec.) in loans Dividend paid (Incl. Tax) 151 67 76 (126) (304) (165) - - - - - - (90) - - - - - 95 140 145 (180) (212) (254) Others (265) (281) (290) 1.0 0.0 0.0 Cash Flow from Financing (260) (140) (145) (179) (212) (254) Inc./(Dec.) in cash October 22, 2014 FY2011 FY2012 FY2013 12 43 17 45 (77) (11) Opening Cash balances 3 15 58 75 120 43 Closing Cash balances 15 58 75 120 43 31 8 Exide Industries | 2QFY2015 Result Update Key ratios Y/E March FY2011 FY2012 FY2013 FY2014 FY2015E FY2016E Valuation Ratio (x) P/E (on FDEPS) 12.9 18.6 25.4 27.2 21.8 18.3 P/CEPS 12.0 15.3 20.8 21.6 17.7 15.0 3.2 2.8 3.9 3.6 3.2 2.9 P/BV Dividend yield (%) 1.5 1.5 1.0 1.2 1.3 1.9 EV/Sales 1.6 1.4 2.1 2.1 1.7 1.5 EV/EBITDA 8.2 10.2 16.6 15.6 12.8 10.6 EV / Total Assets 2.5 2.2 3.7 3.3 3.0 2.6 EPS (Basic) 7.8 5.4 6.2 5.7 7.1 8.5 EPS (fully diluted) 7.4 5.4 6.2 5.7 7.1 8.5 Per Share Data (`) Cash EPS 8.4 6.6 7.5 7.2 8.8 10.4 DPS 1.5 1.5 1.6 1.8 2.1 3.0 31.9 35.7 40.0 43.9 48.5 54.1 17.5 11.5 11.1 12.1 12.1 12.6 Book Value Dupont Analysis EBIT margin Tax retention ratio 0.7 0.7 0.7 0.7 0.7 0.7 Asset turnover (x) 3.7 3.5 3.6 1.6 1.7 1.8 ROIC (Post-tax) 45.6 28.3 28.4 13.0 14.4 15.5 Cost of Debt (Post Tax) 13.5 17,967 - - - - - - - - - - 45.6 28.3 - - - - 30.5 19.4 20.0 18.8 20.7 22.3 Leverage (x) Operating ROE Returns (%) ROCE (Pre-tax) Angel ROIC (Pre-tax) 55.4 38.5 37.1 19.4 20.9 22.4 ROE 25.5 15.9 16.1 13.1 14.7 15.8 3.1 3.1 3.3 3.0 3.2 3.3 Inventory / Sales (days) 59 65 64 72.6 72.6 72.6 Receivables (days) 25 27 27 31.6 31.6 31.6 Payables (days) 46 51 48 55.2 55.3 55.0 WC cycle (ex-cash) (days) 35 37 37 49.0 48.9 49.2 (0.5) (0.5) (0.5) (0.5) (0.4) (0.4) Net debt to EBITDA (1.6) (2.3) (2.2) (2.1) (1.7) (1.4) Interest Coverage (EBIT / Int.) 91.8 78 117 608.6 440.9 351.2 Turnover ratios (x) Asset Turnover (Gross Block) Solvency ratios (x) Net debt to equity October 22, 2014 9 Exide Industries | 2QFY2015 Result Update Research Team Tel: 022 - 39357800 E-mail: [email protected] Website: www.angelbroking.com DISCLAIMER This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Pvt. Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Pvt. Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Pvt. Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may have investment positions in the stocks recommended in this report. Disclosure of Interest Statement 1. Analyst ownership of the stock Exide Industries No 2. Angel and its Group companies ownership of the stock No 3. Angel and its Group companies' Directors ownership of the stock No 4. Broking relationship with company covered No Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors Ratings (Returns): October 22, 2014 Buy (> 15%) Reduce (-5% to -15%) Accumulate (5% to 15%) Sell (< -15%) Neutral (-5 to 5%) 10

© Copyright 2026